Market Brief 07/05/2024

VIETNAM STOCK MARKET

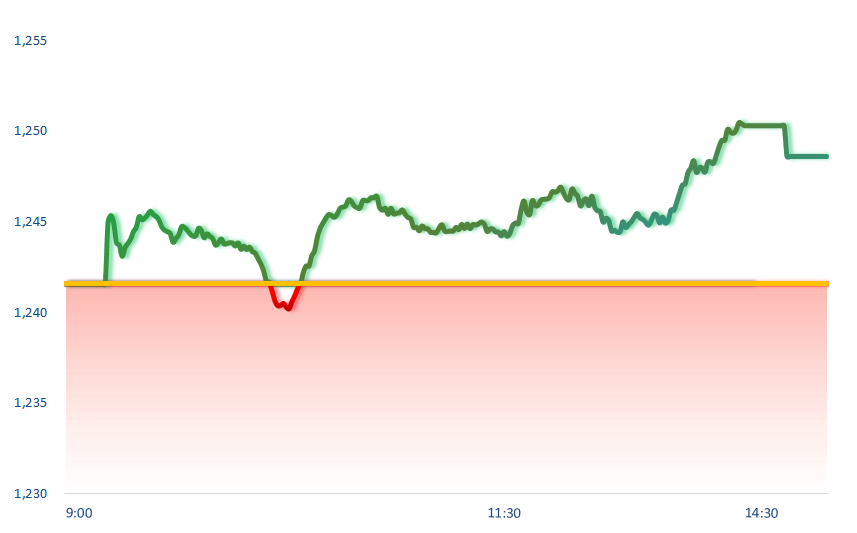

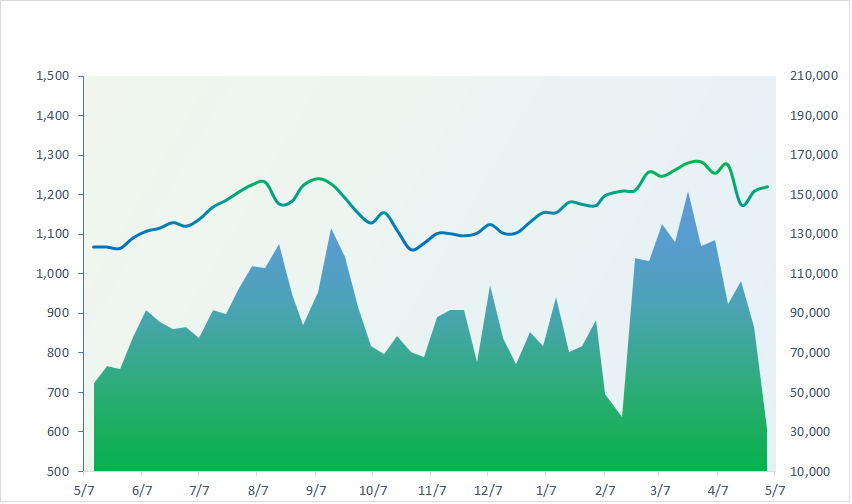

1,248.63

1D 0.57%

YTD 10.33%

232.96

1D 0.29%

YTD 1.29%

1,284.85

1D 0.80%

YTD 13.54%

91.10

1D 0.50%

YTD 4.02%

136.68

1D 0.00%

YTD 0.00%

20,522.78

1D -13.11%

YTD 8.61%

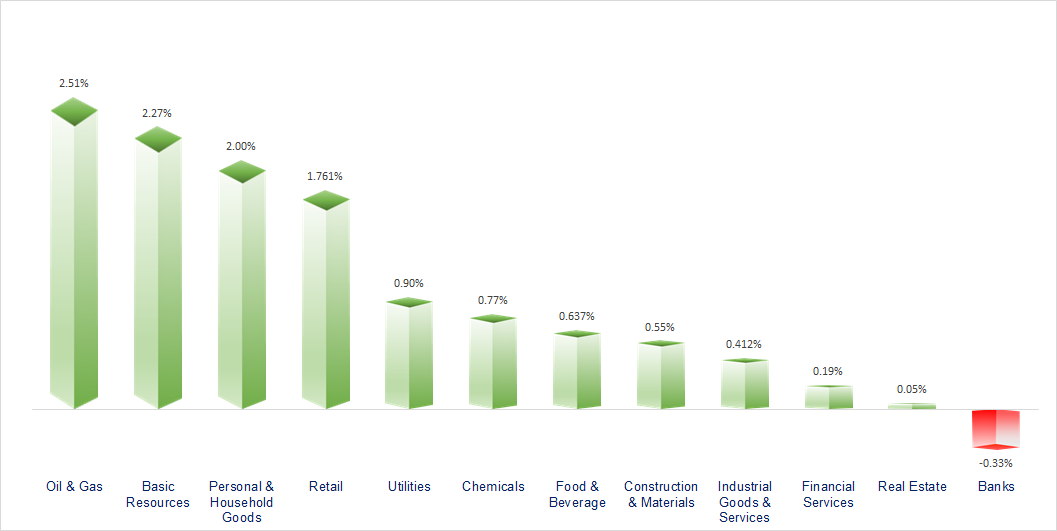

The market continues to experience a positive session driven by key pillar stocks such as HPG, FPT, VNM, GAS. With the exception of the banking sector, most industry groups are performing quite well, with the leading sectors being tourism and entertainment, technology, and basic resources.

ETF & DERIVATIVES

22,080

1D 0.64%

YTD 13.06%

15,180

1D 0.73%

YTD 12.86%

15,710

1D 0.90%

YTD 13.35%

18,760

1D 0.32%

YTD 10.48%

20,340

1D -0.15%

YTD 10.54%

31,350

1D 0.35%

YTD 20.44%

17,000

1D 0.47%

YTD 11.33%

1,276

1D 0.47%

YTD 0.00%

1,277

1D 0.28%

YTD 0.00%

1,278

1D 0.42%

YTD 0.00%

1,280

1D 0.34%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

38,835.10

1D 1.57%

YTD 16.05%

3,147.74

1D 0.22%

YTD 6.26%

18,479.37

1D -0.53%

YTD 10.07%

2,734.36

1D 2.16%

YTD 2.42%

73,511.85

1D -0.52%

YTD 2.25%

3,300.04

1D -0.10%

YTD 2.17%

1,376.37

1D 0.47%

YTD -3.98%

83.14

1D -0.54%

YTD 7.94%

2,313.71

1D -0.50%

YTD 11.41%

Asian markets are mixed amid optimism about the possibility of the FED lowering interest rates in the near future. Nikkei 225 and Kospi are the two most positive markets today, led by the technology stock group.

VIETNAM ECONOMY

4.27%

1D (bps) -7

YTD (bps) 67

4.60%

1D (bps) -10

YTD (bps) -20

2.29%

1D (bps) -10

YTD (bps) 41

2.72%

1D (bps) 4

YTD (bps) 54

25,455

1D (%) 0.00%

YTD (%) 3.86%

27,985

1D (%) -0.64%

YTD (%) 2.22%

3,590

1D (%) 0.00%

YTD (%) 3.28%

As of the afternoon of May 7, 2024, SJC gold price continues to soar, rising more than 2 million VND to 87.5 million VND/tael, reaching an unprecedented record high.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Rubber exports flourish as prices soar to a 12-year high;

- Domestic steel coating enterprises intend to file lawsuits against imported steels from China and South Korea;

- General Department of Taxation takes action to collect tax debts from online businesses and live streaming platforms;

- Cambodia says it will cut shipping through Vietnam by 70% with new China-funded Mekong canal;

- Oil edges up after Israel strikes Gaza, while truce talks continue;

- Dow posts 4-day win streak as Fed rate-cut hopes provide boost.

VN30

BANK

92,900

1D -0.11%

5D 1.86%

Buy Vol. 1,783,254

Sell Vol. 1,808,020

50,000

1D -0.99%

5D 1.63%

Buy Vol. 2,002,778

Sell Vol. 2,572,578

32,800

1D -1.20%

5D 0.00%

Buy Vol. 7,694,200

Sell Vol. 11,223,758

47,900

1D -0.93%

5D 2.79%

Buy Vol. 15,890,899

Sell Vol. 15,413,961

18,800

1D 0.27%

5D 1.35%

Buy Vol. 14,738,096

Sell Vol. 17,995,665

22,750

1D -0.66%

5D 2.25%

Buy Vol. 23,109,421

Sell Vol. 21,312,290

24,300

1D 0.00%

5D 2.97%

Buy Vol. 10,728,031

Sell Vol. 11,916,091

17,750

1D -0.28%

5D -0.84%

Buy Vol. 5,344,344

Sell Vol. 7,422,796

28,300

1D 0.71%

5D 0.35%

Buy Vol. 14,980,056

Sell Vol. 19,258,210

21,700

1D 0.00%

5D 2.84%

Buy Vol. 5,654,266

Sell Vol. 6,539,742

27,650

1D 0.18%

5D 2.98%

Buy Vol. 8,517,790

Sell Vol. 9,834,514

11,650

1D -0.85%

5D 1.75%

Buy Vol. 36,994,410

Sell Vol. 64,742,565

22,050

1D 0.23%

5D 0.23%

Buy Vol. 3,484,537

Sell Vol. 2,819,759

ACB: ACB increases the deposit interest rate by 0.2 % for 1-3 month terms on all deposit amounts. STB: Sacombank significantly raises the deposit interest rate by 0.2-0.5% across all terms. SSB: A major shareholder has sold 1 million SSB shares from April 8th to May 3rd through matching orders.

OIL & GAS

76,300

1D 2.01%

5D 5.71%

Buy Vol. 2,718,796

Sell Vol. 12,695,741

11,100

1D 0.00%

5D 8.40%

Buy Vol. 10,578,852

Sell Vol. 6,298,106

38,700

1D 5.45%

5D 1.24%

Buy Vol. 7,606,808

Sell Vol. 2,575,181

PLX: PLX stock price is positive thanks to the explosive Q1 business results, with a net revenue increase of 11% and a post-tax profit increase of 70%.

VINGROUP

45,000

1D 0.56%

5D 0.61%

Buy Vol. 1,921,724

Sell Vol. 9,624,655

41,050

1D -0.24%

5D 4.01%

Buy Vol. 8,655,142

Sell Vol. 12,754,622

23,350

1D 0.00%

5D 4.62%

Buy Vol. 13,141,492

Sell Vol. 14,126,948

VIC: VinFast shares continue their recovery streak, gaining an additional 6.57% to reach 3.08 USD/share, equivalent to a market capitalization of USD7.2 billion.

FOOD & BEVERAGE

68,000

1D 3.34%

5D 5.95%

Buy Vol. 15,741,499

Sell Vol. 6,875,131

71,200

1D 0.14%

5D 6.07%

Buy Vol. 6,469,587

Sell Vol. 2,764,106

57,700

1D 1.23%

5D 4.58%

Buy Vol. 1,711,544

Sell Vol. 1,052,784

MSN: Masan High-Tech Materials (MSR), a subsidiary of MSN, reports its fourth consecutive quarterly loss with a net loss of VND718 billion.

OTHERS

54,800

1D -0.54%

5D 4.94%

Buy Vol. 879,496

Sell Vol. 1,148,149

41,400

1D 2.10%

5D 4.94%

Buy Vol. 1,210,519

Sell Vol. 1,148,149

118,600

1D 4.59%

5D 14.04%

Buy Vol. 2,307,005

Sell Vol. 2,113,024

131,300

1D 2.90%

5D 6.57%

Buy Vol. 5,905,615

Sell Vol. 6,331,256

59,300

1D 1.72%

5D 8.01%

Buy Vol. 17,192,572

Sell Vol. 14,981,175

31,450

1D 0.80%

5D 4.83%

Buy Vol. 9,273,968

Sell Vol. 8,567,393

35,550

1D -0.28%

5D 0.99%

Buy Vol. 18,936,723

Sell Vol. 21,233,317

30,150

1D 2.90%

5D 6.16%

Buy Vol. 48,019,158

Sell Vol. 49,985,749

HPG: Hoa Phat'S sales volume reached 805,000 tons in April 2024, a 16% increase compared to March, marking the highest sales volume in the past 2 years. VJC: The Civil Aviation Authority of Vietnam enhances the review and inspection of airfare prices among airlines in response to the substantial surge in airfare prices in 2024.

Market by numbers

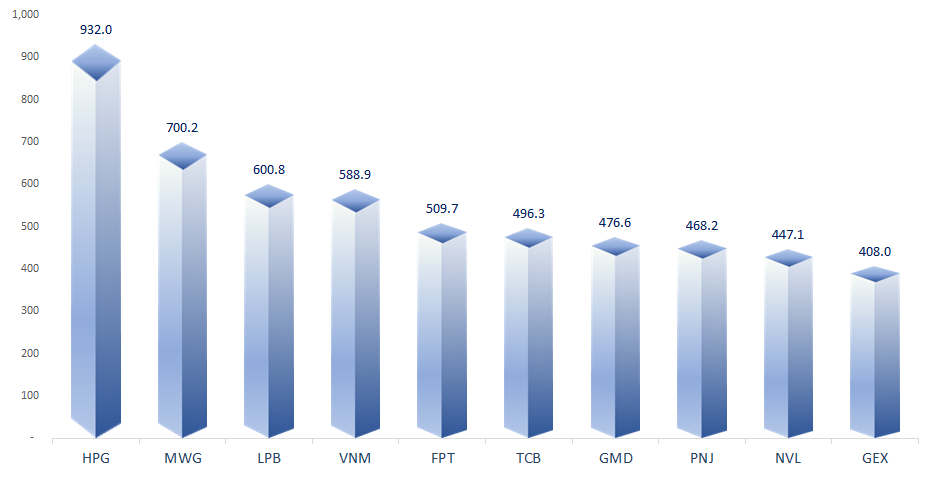

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

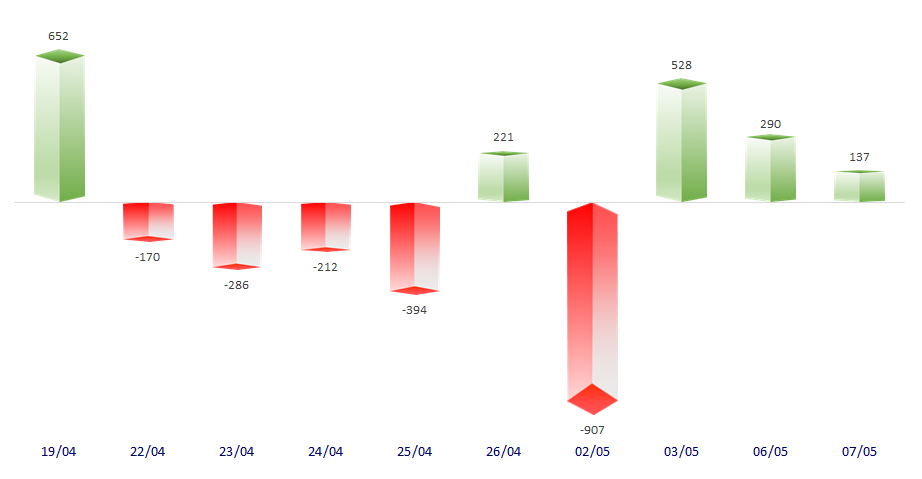

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

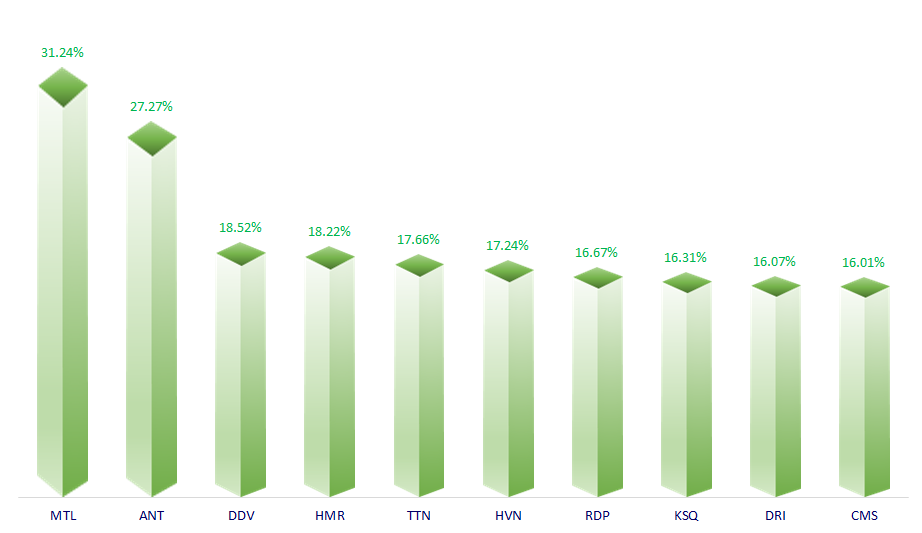

TOP INCREASES 3 CONSECUTIVE SESSIONS

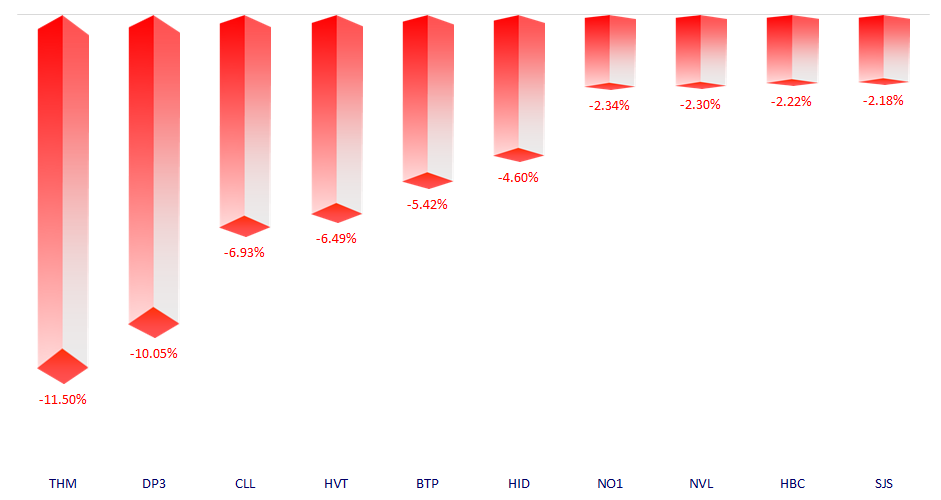

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.