Market Brief 27/05/2024

VIETNAM STOCK MARKET

1,267.68

1D 0.46%

YTD 12.01%

242.83

1D 0.46%

YTD 5.58%

1,284.88

1D 0.11%

YTD 13.54%

94.87

1D 0.50%

YTD 8.32%

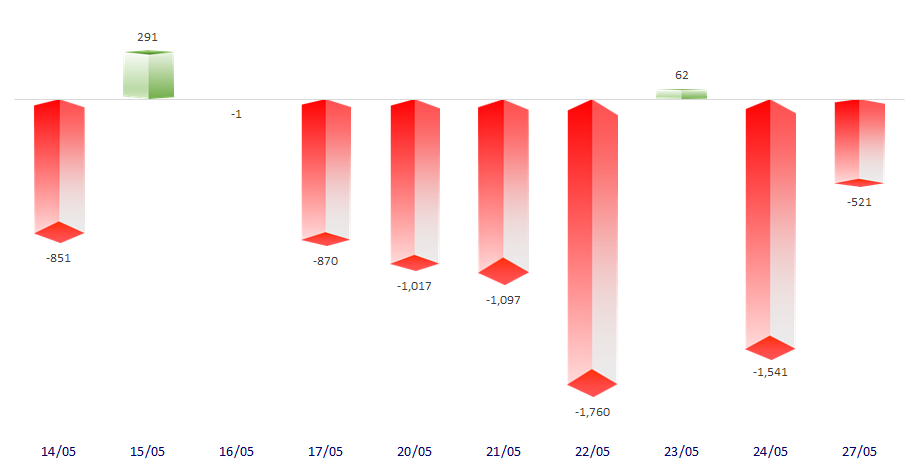

-521.30

1D 0.00%

YTD 0.00%

19,871.04

1D -50.75%

YTD 5.16%

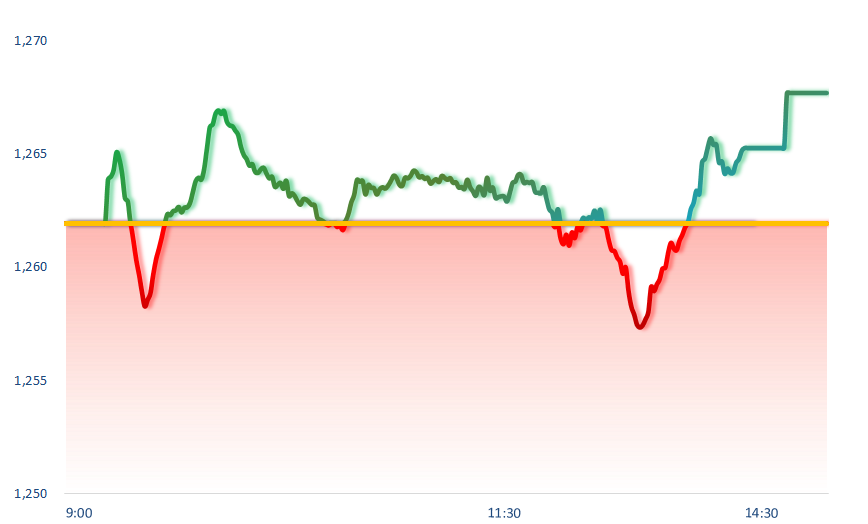

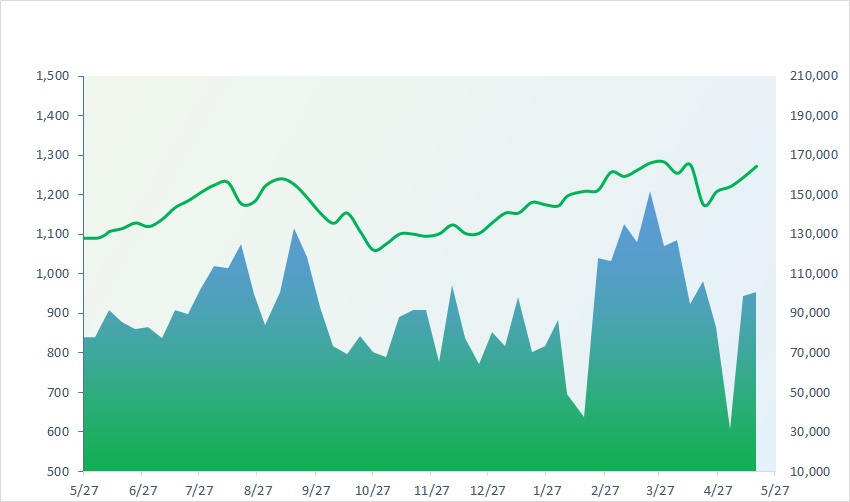

The stock market fluctuated around the reference level after the sharp decline at the end of last week. Insurance, chemicals, and oil and gas continued to be positive. GAS contributed the most to the VNIndex today with an increase of 2.5%.

ETF & DERIVATIVES

22,390

1D -0.49%

YTD 14.64%

15,310

1D 0.13%

YTD 13.83%

15,890

1D -0.19%

YTD 14.65%

19,100

1D -1.65%

YTD 12.49%

20,520

1D -0.19%

YTD 11.52%

31,650

1D -0.41%

YTD 21.59%

17,490

1D 0.00%

YTD 14.54%

1,276

1D -0.12%

YTD 0.00%

1,278

1D -0.31%

YTD 0.00%

1,278

1D -0.27%

YTD 0.00%

1,278

1D -0.05%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

38,900.02

1D 0.66%

YTD 16.24%

3,124.04

1D 1.14%

YTD 5.46%

18,827.35

1D 1.17%

YTD 12.14%

2,722.99

1D 1.32%

YTD 1.99%

75,390.50

1D -0.03%

YTD 4.87%

3,318.45

1D 0.06%

YTD 2.74%

1,366.37

1D 0.14%

YTD -4.67%

82.57

1D 0.54%

YTD 7.20%

2,345.26

1D 0.28%

YTD 12.93%

Asian stock markets saw a recovery on Monday after the downward trend at the end of last week. Chinese stocks rose strongly as data showed the country's industrial profits in April increased compared to the previous month. Japanese and Korean stocks also gained with the contribution of the technology stocks.

VIETNAM ECONOMY

5.10%

YTD (bps) 150

4.60%

YTD (bps) -20

2.44%

1D (bps) -5

YTD (bps) 56

2.81%

1D (bps) -3

YTD (bps) 63

25,481

1D (%) 0.00%

YTD (%) 3.96%

28,263

1D (%) -0.70%

YTD (%) 3.24%

3,583

1D (%) -0.08%

YTD (%) 3.08%

The central exchange rate announced by SBV on May 27 is VND24,268/USD, increased VND4 compared to last week's closing rate. USD exchange rate at commercial banks followed different patterns. While all banks have increased the selling price of USD to the ceiling rate allowed by SBV, some have reduced the buying price of USD by VND22-26, such as VietinBank, Techcombank, and Sacombank.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- New registered FDI in the first 5 months increased by more than 50% compared to the same period last year;

- Approval of the LNG electricity price framework, up to nearly 2,591 VND/kWh;

- Import-export enterprises are seeking support from banks;

- Fed may not cut interest rates this summer;

- The global economy has a higher potential for recovery than expected;

- China's steel exports continue to increase strongly.

VN30

BANK

90,200

1D 0.00%

5D -1.85%

Buy Vol. 2,358,834

Sell Vol. 2,229,511

48,900

1D -0.61%

5D -1.41%

Buy Vol. 1,444,209

Sell Vol. 1,946,432

32,400

1D -0.31%

5D -2.85%

Buy Vol. 14,560,412

Sell Vol. 14,162,945

46,500

1D 0.22%

5D -3.53%

Buy Vol. 10,464,840

Sell Vol. 8,271,955

18,000

1D 0.00%

5D -4.26%

Buy Vol. 14,021,232

Sell Vol. 17,442,403

22,450

1D 0.00%

5D -2.15%

Buy Vol. 17,783,718

Sell Vol. 20,194,217

23,800

1D -1.65%

5D -4.23%

Buy Vol. 8,545,556

Sell Vol. 8,976,416

17,700

1D -0.28%

5D -4.07%

Buy Vol. 11,689,812

Sell Vol. 9,396,048

28,700

1D 0.00%

5D 1.41%

Buy Vol. 11,295,510

Sell Vol. 16,399,970

22,000

1D 0.00%

5D -2.22%

Buy Vol. 7,913,735

Sell Vol. 10,644,184

29,450

1D 0.68%

5D 4.25%

Buy Vol. 14,587,571

Sell Vol. 15,514,972

11,600

1D 0.43%

5D -2.11%

Buy Vol. 33,499,398

Sell Vol. 40,070,880

21,650

1D -0.92%

5D -1.59%

Buy Vol. 2,347,101

Sell Vol. 2,924,864

MBB: MBB announced the organization of the 2024-2029 term shareholders' general meeting to re-elect the board of directors and supervisory board.

OIL & GAS

81,000

1D 2.53%

5D 6.61%

Buy Vol. 3,882,888

Sell Vol. 52,285,811

12,100

1D 6.61%

5D 8.68%

Buy Vol. 102,121,170

Sell Vol. 6,024,964

41,300

1D 0.73%

5D -3.53%

Buy Vol. 6,215,618

Sell Vol. 3,583,823

POW: PV Power announced its business results for the first 5 months of 2024, recording revenue and pre-tax profit at 41% and 67% of the annual plan, respectively.

VINGROUP

45,050

1D 0.22%

5D -1.61%

Buy Vol. 2,741,690

Sell Vol. 9,742,974

39,800

1D 0.00%

5D -2.41%

Buy Vol. 9,026,463

Sell Vol. 8,208,992

22,300

1D 0.00%

5D -0.45%

Buy Vol. 8,482,505

Sell Vol. 5,179,337

VIC: The Korea Tourism Organization and Vingroup signed a memorandum of understanding to promote Vietnam-Korea cultural and tourism exchanges.

FOOD & BEVERAGE

66,100

1D 0.15%

5D -3.80%

Buy Vol. 4,656,629

Sell Vol. 7,019,941

73,500

1D 0.00%

5D 1.21%

Buy Vol. 7,421,908

Sell Vol. 1,589,234

58,500

1D 0.86%

5D -1.27%

Buy Vol. 1,397,375

Sell Vol. 1,664,590

VNM: Moc Chau Dairy Cattle Breeding JSC (stock code MCM), a subsidiary of VNM, has been approved for listing on the Ho Chi Minh Stock Exchange.

OTHERS

62,100

1D 0.98%

5D 9.56%

Buy Vol. 1,670,058

Sell Vol. 4,240,903

46,400

1D 4.04%

5D 9.56%

Buy Vol. 4,340,777

Sell Vol. 4,240,903

109,000

1D 0.93%

5D -4.89%

Buy Vol. 1,004,688

Sell Vol. 952,499

132,800

1D 0.68%

5D -0.15%

Buy Vol. 9,174,023

Sell Vol. 8,606,593

60,000

1D -0.83%

5D 0.00%

Buy Vol. 12,734,515

Sell Vol. 9,710,823

35,250

1D 2.92%

5D 4.91%

Buy Vol. 14,325,927

Sell Vol. 16,003,042

35,100

1D -0.43%

5D -4.23%

Buy Vol. 30,026,715

Sell Vol. 40,970,897

28,900

1D 0.00%

5D -0.66%

Buy Vol. 31,790,551

Sell Vol. 38,493,431

FPT: FPTS Securities, a subsidiary of FPT, has just completed a stock issuance to increase equity capitalto more than VND3,000 billion.

Market by numbers

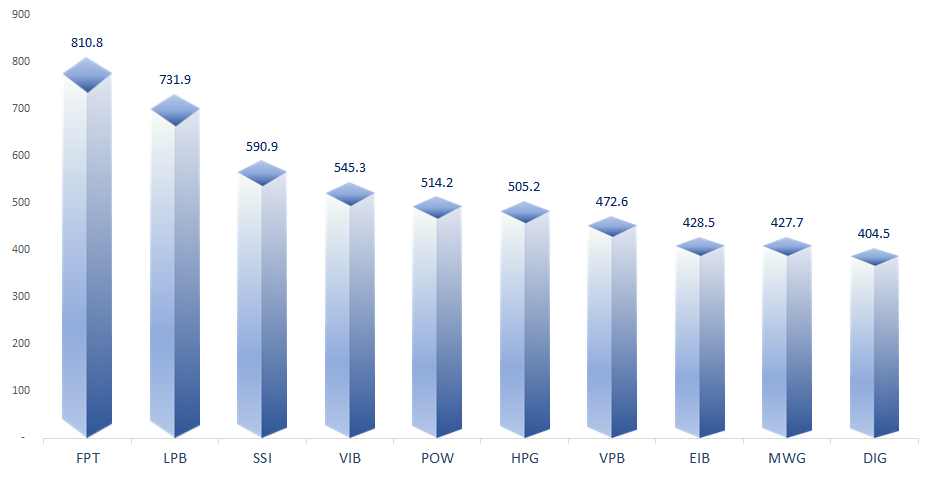

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

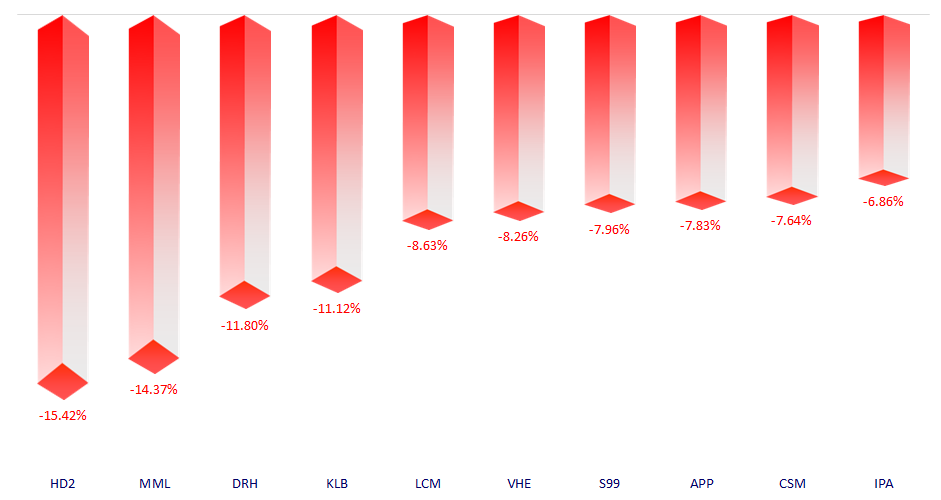

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.