Market Brief 03/06/2024

VIETNAM STOCK MARKET

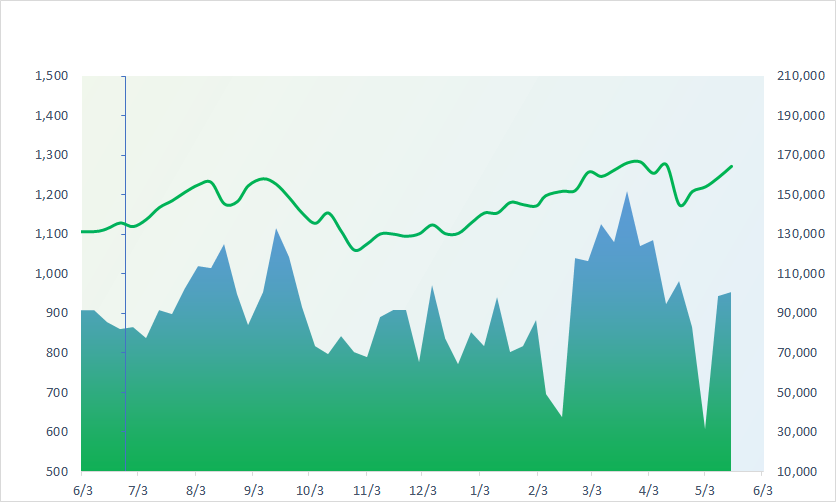

1,280.00

1D 1.45%

YTD 13.10%

244.72

1D 0.67%

YTD 6.40%

1,297.78

1D 1.71%

YTD 14.68%

96.93

1D 1.10%

YTD 10.68%

-225.01

1D 0.00%

YTD 0.00%

28,839.98

1D 36.07%

YTD 52.62%

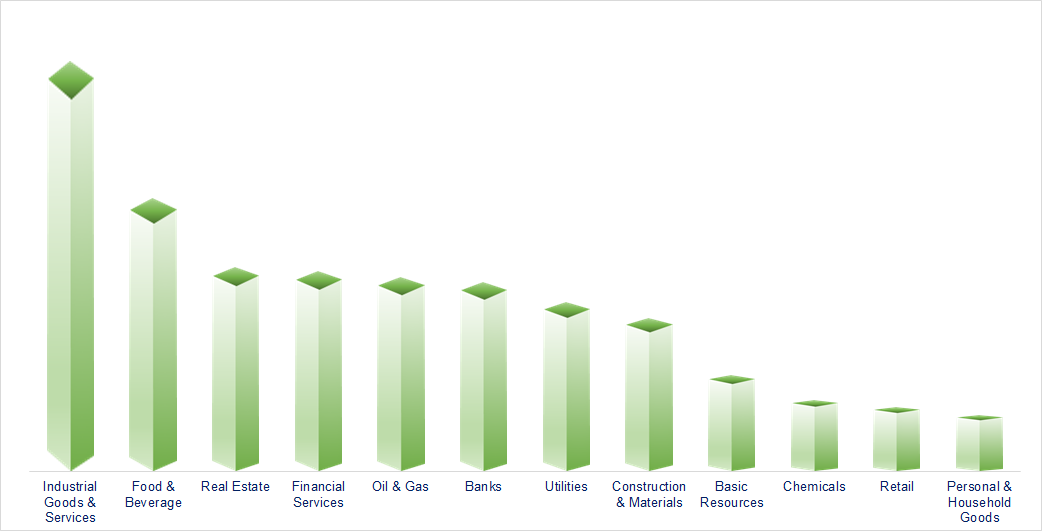

The market started the first session of June positively. VNIndex opened with a gap up of 10 points and maintained the increasing momentum until the session closed. All industry groups ended in green, with food & beverage and industrial services sectors leading the gains.

ETF & DERIVATIVES

22,630

1D 0.58%

YTD 15.87%

15,470

1D 1.24%

YTD 15.02%

16,100

1D 1.51%

YTD 16.16%

19,630

1D 1.55%

YTD 15.61%

20,870

1D 2.35%

YTD 13.42%

32,140

1D 1.39%

YTD 23.47%

17,600

1D 0.92%

YTD 15.26%

1,292

1D 1.69%

YTD 0.00%

1,361

1D 6.96%

YTD 0.00%

1,293

1D 1.72%

YTD 0.00%

1,293

1D 1.50%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

38,923.03

1D 1.13%

YTD 16.31%

3,078.49

1D -0.27%

YTD 3.92%

18,403.04

1D 1.79%

YTD 9.62%

2,682.52

1D 1.74%

YTD 0.48%

76,468.78

1D 3.39%

YTD 6.37%

3,348.87

1D 0.37%

YTD 3.68%

1,345.66

1D 0.00%

YTD -6.12%

80.77

1D -0.55%

YTD 4.86%

2,330.70

1D 0.07%

YTD 12.23%

Most Asian markets closed in the green in the first trading session of the week. The Hang Seng index led gains after news that China's PMI index is expected to rise to 51.7 points, higher than the Reuters survey of 51.5.

VIETNAM ECONOMY

3.90%

1D (bps) 50

YTD (bps) 30

4.60%

YTD (bps) -20

2.38%

1D (bps) -10

YTD (bps) 50

2.82%

YTD (bps) 64

25,458

1D (%) -0.02%

YTD (%) 3.87%

28,197

1D (%) -0.17%

YTD (%) 3.00%

3,581

1D (%) -0.08%

YTD (%) 3.02%

SJC gold prices plummeted, breaking through VND80 million/tael after the Big 4 banks started selling SJC gold to the public from 14:30 PM on June 3rd. Other gold enterprises also adjusted SJC gold prices down below the VND80 million/tael level.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Decoding the 'surge' of fertilizer stocks;

- Terminating outdated mining and natural resources processing projects;

- Extending the VAT reduction policy: A necessary move to drive economic recovery;

- Nvidia continued to heat up the global market with new AI chips;

- India withdrew 100 tons of gold stored in the UK;

- Reasons why the US is cautious about Chinese electric vehicles.

VN30

BANK

88,200

1D 1.15%

5D -2.22%

Buy Vol. 3,538,651

Sell Vol. 3,385,750

47,300

1D 0.42%

5D -3.27%

Buy Vol. 3,047,030

Sell Vol. 3,359,468

32,600

1D 2.19%

5D 0.62%

Buy Vol. 20,134,730

Sell Vol. 21,849,192

47,150

1D 0.32%

5D 1.40%

Buy Vol. 13,400,396

Sell Vol. 19,183,940

18,300

1D 1.67%

5D 1.67%

Buy Vol. 25,569,890

Sell Vol. 32,493,824

22,600

1D 3.91%

5D 0.67%

Buy Vol. 45,044,838

Sell Vol. 43,006,755

24,000

1D 3.23%

5D 0.84%

Buy Vol. 10,254,748

Sell Vol. 11,736,192

18,050

1D 2.27%

5D 1.98%

Buy Vol. 27,362,352

Sell Vol. 24,545,339

29,750

1D 6.82%

5D 3.66%

Buy Vol. 72,496,931

Sell Vol. 34,072,914

22,300

1D 2.53%

5D 1.36%

Buy Vol. 9,370,404

Sell Vol. 9,953,501

24,800

1D 0.61%

5D 0.25%

Buy Vol. 22,893,444

Sell Vol. 22,398,025

11,650

1D 2.19%

5D 0.43%

Buy Vol. 53,529,801

Sell Vol. 57,965,431

21,600

1D 0.47%

5D -0.23%

Buy Vol. 2,759,022

Sell Vol. 2,099,402

STB: Sacombank expects to record a non-current income of VND1,336 billion from the sale of Phong Phu Industrial Park in 2024, which could increase its EBT by 43% compared to 2023, reaching over VND13,700 billion. SSB: SeaBank has completed the increase of its charter capital to VND24,957 billion through the issuance of 42 million ESOP shares.

OIL & GAS

80,400

1D 0.37%

5D 11.16%

Buy Vol. 2,753,293

Sell Vol. 60,936,813

13,450

1D 6.75%

5D 0.48%

Buy Vol. 78,498,639

Sell Vol. 5,884,683

41,500

1D 1.22%

5D -2.44%

Buy Vol. 4,016,340

Sell Vol. 3,323,103

POW: POW stock continued to hit the ceiling limit due to the positive impact of the VND1,000 billion insurance compensation for the Vung Ang 1 power plant and expectations of increased power consumption in the summer.

VINGROUP

43,950

1D 0.92%

5D -1.26%

Buy Vol. 2,789,018

Sell Vol. 10,374,732

39,300

1D 1.16%

5D 0.00%

Buy Vol. 9,616,469

Sell Vol. 13,212,995

22,300

1D 2.53%

5D 0.00%

Buy Vol. 13,427,976

Sell Vol. 6,507,059

VIC: VinFast officially signed a cooperation contract with 4 distribution agents in the Philippines, expected to start delivering vehicles to customers in this country from Q3/2024.

FOOD & BEVERAGE

66,100

1D 1.07%

5D 5.71%

Buy Vol. 5,843,071

Sell Vol. 12,776,596

77,700

1D 1.44%

5D 1.54%

Buy Vol. 9,566,459

Sell Vol. 2,258,055

59,400

1D 1.89%

5D 1.45%

Buy Vol. 2,165,937

Sell Vol. 2,493,695

MSN: Masan Consumer's MCH shares continued to hit a new all-time-high, with a market capitalization surpassing its parent company MSN as well as major food companies like VNM and SAB.

OTHERS

63,000

1D 3.62%

5D -2.26%

Buy Vol. 1,711,788

Sell Vol. 1,620,316

45,350

1D 1.11%

5D -2.26%

Buy Vol. 1,671,788

Sell Vol. 1,620,316

108,700

1D 1.49%

5D -0.28%

Buy Vol. 1,264,318

Sell Vol. 1,380,270

136,900

1D 1.71%

5D 3.09%

Buy Vol. 11,317,314

Sell Vol. 14,142,069

64,000

1D 0.63%

5D 6.67%

Buy Vol. 12,096,838

Sell Vol. 13,032,884

35,000

1D -0.43%

5D -0.71%

Buy Vol. 6,829,189

Sell Vol. 8,237,013

35,400

1D 2.02%

5D 0.85%

Buy Vol. 25,940,997

Sell Vol. 25,615,740

29,000

1D 1.40%

5D 0.35%

Buy Vol. 31,156,324

Sell Vol. 43,950,259

FPT: FRT shares continued to surpass the historic high, with the Long Chau pharmacy chain having expanded strongly and reached the milestone of 60 vaccination centers as of the end of May 2024.

Market by numbers

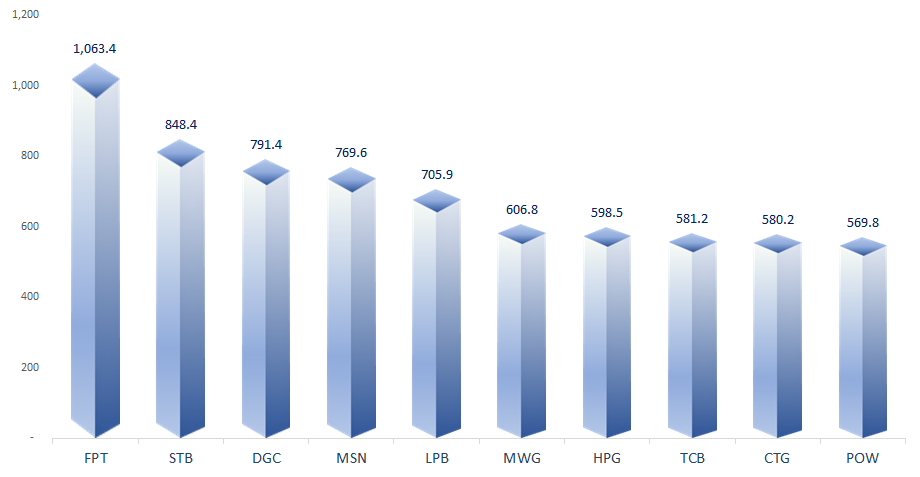

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

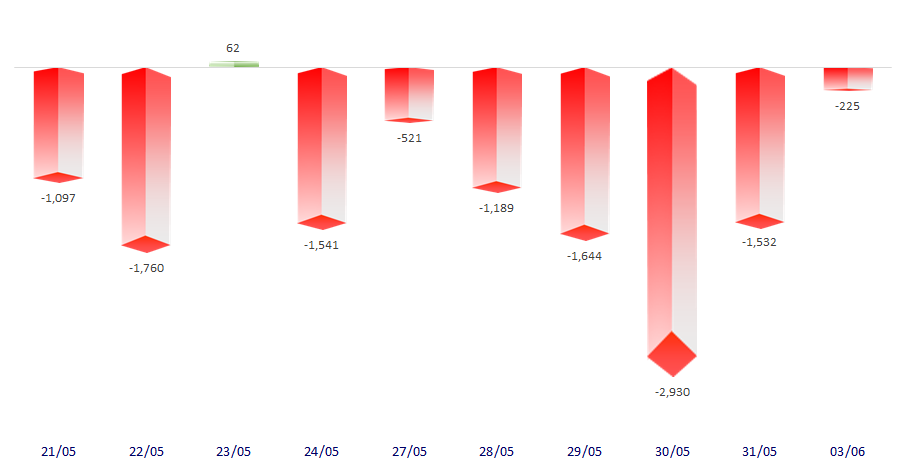

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

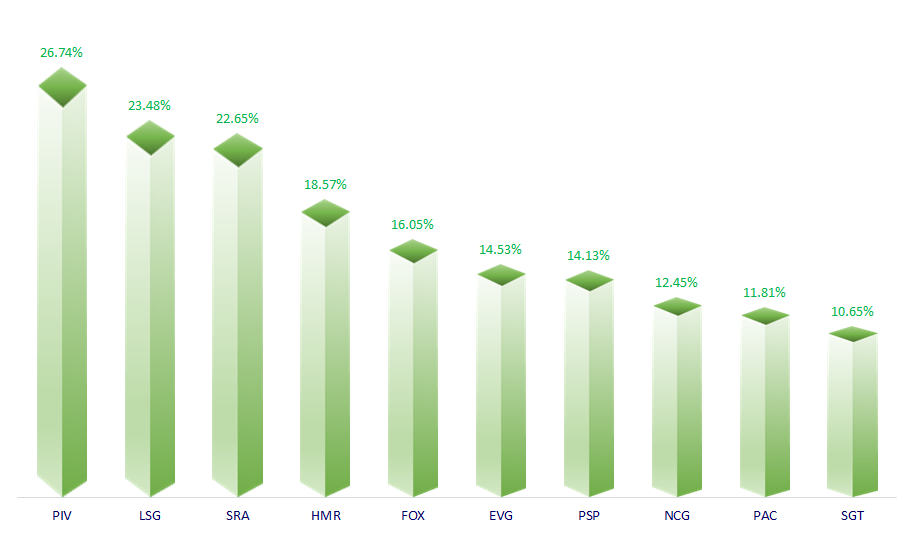

TOP INCREASES 3 CONSECUTIVE SESSIONS

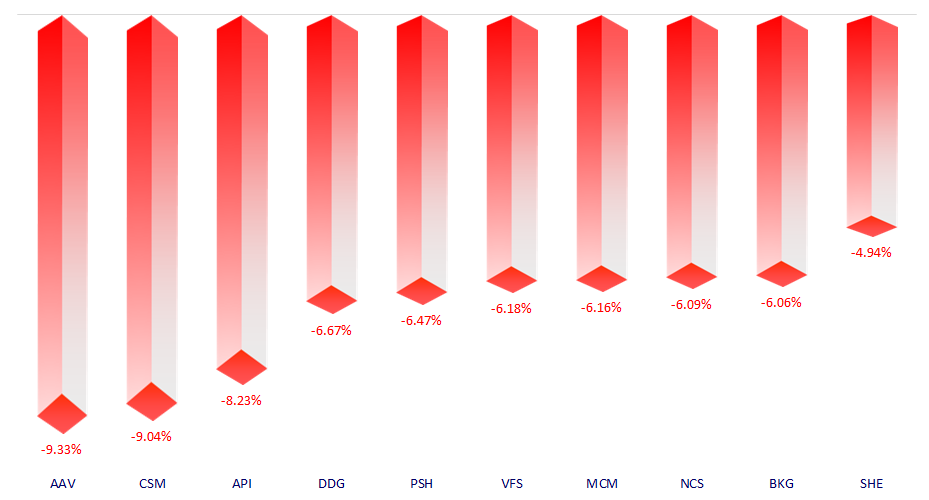

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.