Market Brief 04/06/2024

VIETNAM STOCK MARKET

1,283.52

1D 0.27%

YTD 13.41%

244.32

1D -0.16%

YTD 6.23%

1,300.99

1D 0.25%

YTD 14.97%

97.00

1D 0.07%

YTD 10.76%

-159.10

1D 0.00%

YTD 0.00%

26,711.77

1D -7.38%

YTD 41.36%

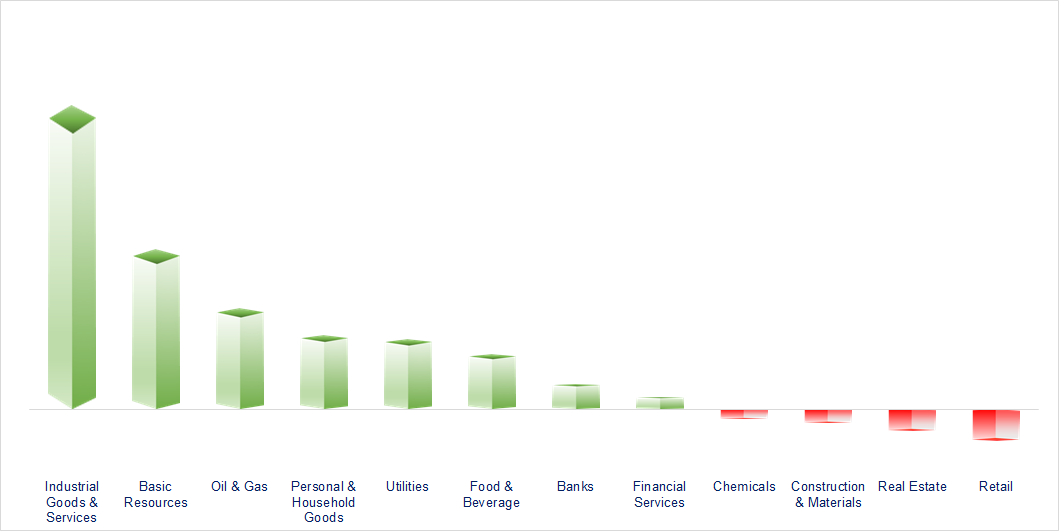

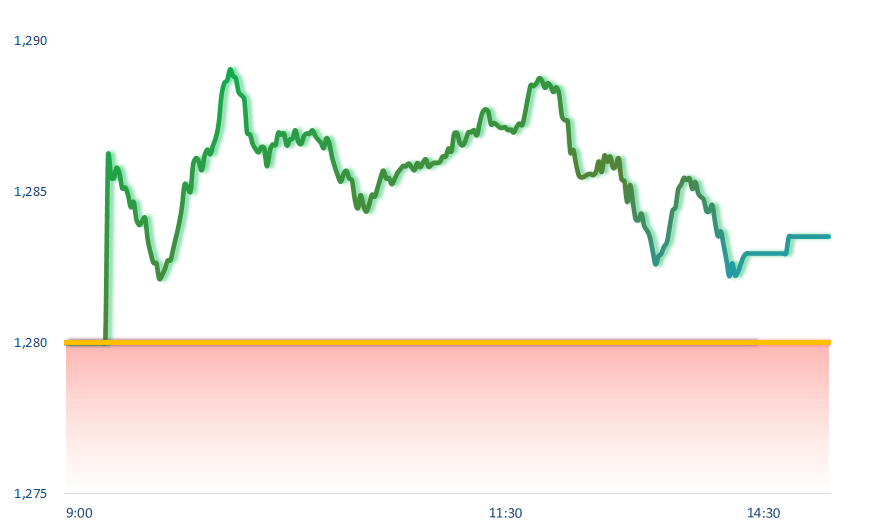

The stock market sidewayed as it approached the 21-month high level. Diverging performance occurred across most sectors, with technology, industrial services, and steel sectors seeing relatively positive increases. On the other side, retail and real estate sectors declined but not significantly.

ETF & DERIVATIVES

22,620

1D -0.04%

YTD 15.82%

15,540

1D 0.45%

YTD 15.54%

16,120

1D 0.12%

YTD 16.31%

19,630

1D 0.00%

YTD 15.61%

20,830

1D -0.19%

YTD 13.21%

32,270

1D 0.40%

YTD 23.97%

17,610

1D 0.06%

YTD 15.32%

1,295

1D 0.27%

YTD 0.00%

1,293

1D -4.94%

YTD 0.00%

1,293

1D 0.01%

YTD 0.00%

1,294

1D 0.09%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

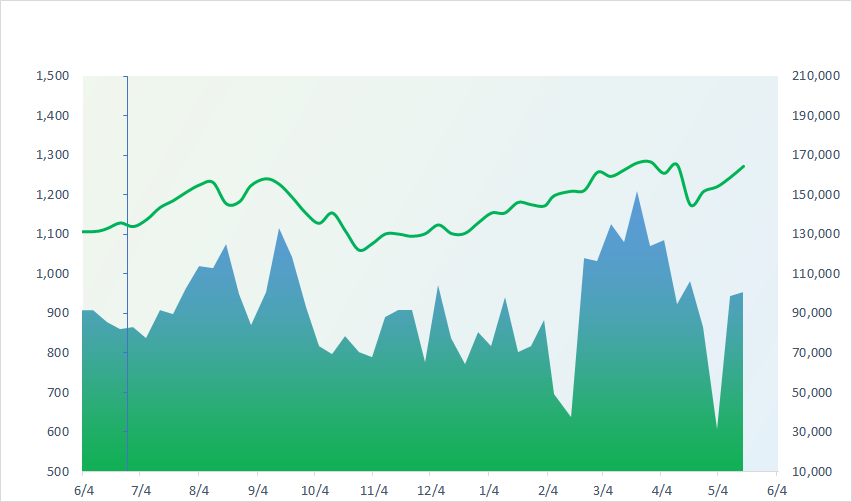

VNINDEX (12M)

GLOBAL MARKET

38,837.46

1D -0.22%

YTD 16.06%

3,091.20

1D 0.41%

YTD 4.35%

18,444.11

1D 0.22%

YTD 9.86%

2,662.10

1D -0.76%

YTD -0.29%

72,079.05

1D -5.74%

YTD 0.26%

3,338.94

1D -0.30%

YTD 3.37%

1,337.32

1D -0.62%

YTD -6.70%

76.98

1D -1.33%

YTD -0.06%

2,331.38

1D -0.69%

YTD 12.26%

Asian markets had mixed performance during June 4th trading session. Indian stocks led the fall as the country continued vote counting for the 2024 general elections. Following the decline was the South Korea's Kospi as the country's consumer inflation data slowed in May, rising at a lower pace than expected.

VIETNAM ECONOMY

4.09%

1D (bps) 19

YTD (bps) 49

4.60%

YTD (bps) -20

2.46%

1D (bps) 8

YTD (bps) 58

2.81%

1D (bps) -1

YTD (bps) 63

25,458

1D (%) 0.00%

YTD (%) 3.87%

28,541

1D (%) 1.22%

YTD (%) 4.26%

3,578

1D (%) -0.08%

YTD (%) 2.93%

SJC gold price continued to decline sharply to VND78.98 million/tael, which is only about VND7 million/tael higher than global gold price. However, information from various sales points was inconsistent as many stores and banks ran out of stock very early.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Foreign investors decreased their selling momentum on HOSE;

- Vietnam Post hit by a malware attack;

- Utilizing nearly 30 million tons of rare earth resource for the semiconductor industry in Vietnam;

- Fed is facing a tough decision on interest rates: Balancing inflation and economic growth;

- Concerns over the surge of Chinese goods in the US and Europe;

- Disruption in aircraft supply chain may persist until 2026.

VN30

BANK

88,700

1D 0.57%

5D -2.21%

Buy Vol. 3,180,056

Sell Vol. 3,257,661

47,600

1D 0.63%

5D -3.05%

Buy Vol. 2,352,168

Sell Vol. 3,046,593

32,800

1D 0.61%

5D 1.86%

Buy Vol. 17,227,862

Sell Vol. 19,182,624

47,600

1D 0.95%

5D 1.49%

Buy Vol. 15,101,860

Sell Vol. 19,036,444

18,200

1D -0.55%

5D 0.83%

Buy Vol. 19,204,672

Sell Vol. 23,893,203

22,500

1D -0.44%

5D -0.44%

Buy Vol. 18,320,154

Sell Vol. 27,137,501

23,950

1D -0.21%

5D -0.83%

Buy Vol. 6,539,480

Sell Vol. 12,440,174

18,050

1D 0.00%

5D 1.12%

Buy Vol. 9,003,710

Sell Vol. 11,304,007

29,950

1D 0.67%

5D 3.81%

Buy Vol. 29,805,951

Sell Vol. 46,688,380

22,400

1D 0.45%

5D 0.45%

Buy Vol. 7,175,816

Sell Vol. 7,757,038

24,500

1D -1.21%

5D -1.63%

Buy Vol. 16,010,026

Sell Vol. 17,359,788

11,550

1D -0.86%

5D -1.28%

Buy Vol. 41,566,737

Sell Vol. 54,227,844

21,600

1D 0.00%

5D -0.23%

Buy Vol. 3,113,260

Sell Vol. 2,411,553

VCB, CTG: Vietcombank and Vietinbank are among 5 banks that have not yet resolved conclusions and recommendations of the State Audit. TCB: Techcombank successfully issued VND1,500 billion worth of bond with 3-year maturity and coupon rate of 4.5% per annum.

OIL & GAS

80,800

1D 0.50%

5D 12.45%

Buy Vol. 2,982,440

Sell Vol. 70,272,955

14,000

1D 4.09%

5D 0.36%

Buy Vol. 71,404,596

Sell Vol. 4,890,813

41,700

1D 0.48%

5D -2.11%

Buy Vol. 3,552,968

Sell Vol. 3,626,291

POW: The Nhon Trach 3&4 project have been delayed by more than 100 days due to issues with land lease and infrastructure fees.

VINGROUP

44,100

1D 0.34%

5D -1.38%

Buy Vol. 2,895,710

Sell Vol. 16,824,008

39,400

1D 0.25%

5D -1.56%

Buy Vol. 13,152,581

Sell Vol. 12,773,086

22,100

1D -0.90%

5D -1.20%

Buy Vol. 9,981,142

Sell Vol. 6,736,375

VHM: Foreign investors continued to net sell VHM VND66.5 billion on June 4th after net selling this stock by over VND4,700 billion in May.

FOOD & BEVERAGE

66,000

1D -0.15%

5D 2.65%

Buy Vol. 4,954,867

Sell Vol. 9,627,578

77,500

1D -0.26%

5D 0.66%

Buy Vol. 6,701,364

Sell Vol. 4,160,588

61,400

1D 3.37%

5D -0.64%

Buy Vol. 4,281,141

Sell Vol. 1,320,723

MSN: The Norwegian Seafood Council and WinCommerce signed a cooperation agreement, granting an official license to use the "Seafood from Norway" brand for Norwegian seafood at the WinMart system.

OTHERS

62,300

1D -1.11%

5D -2.45%

Buy Vol. 874,485

Sell Vol. 2,623,059

45,850

1D 1.10%

5D -2.45%

Buy Vol. 2,067,100

Sell Vol. 2,623,059

108,400

1D -0.28%

5D -1.09%

Buy Vol. 901,408

Sell Vol. 1,192,070

139,100

1D 1.61%

5D 1.53%

Buy Vol. 10,312,230

Sell Vol. 11,070,492

63,800

1D -0.31%

5D 3.74%

Buy Vol. 9,785,538

Sell Vol. 12,435,736

35,100

1D 0.29%

5D -1.40%

Buy Vol. 6,868,233

Sell Vol. 7,638,796

35,400

1D 0.00%

5D -0.56%

Buy Vol. 19,811,883

Sell Vol. 27,570,624

29,300

1D 1.03%

5D 0.51%

Buy Vol. 62,389,232

Sell Vol. 83,196,824

FPT: FPT shares continued to hit new highs; the company is going to pay a 10% cash dividend and raise additional equity capital by issuing 190.5 million new shares.

Market by numbers

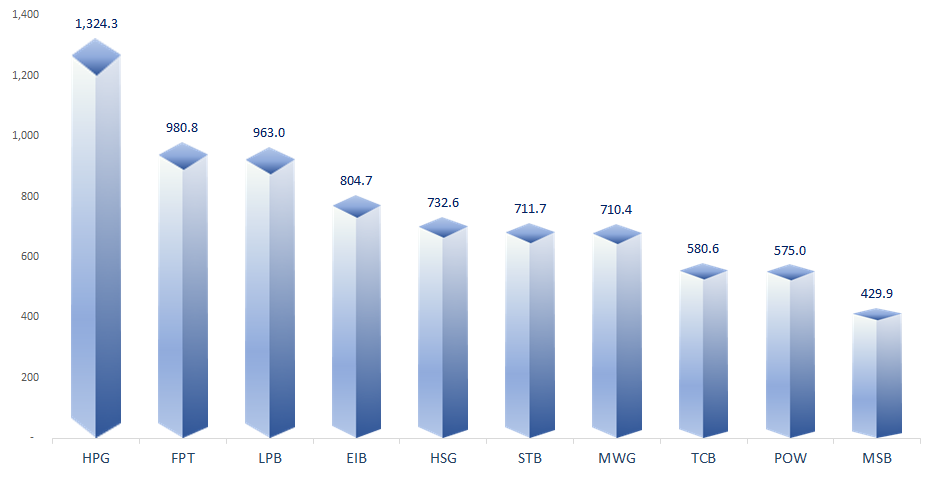

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

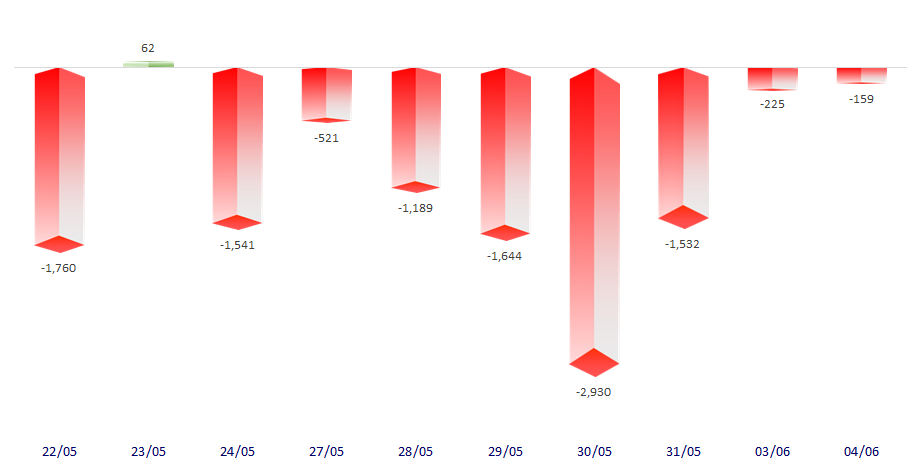

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

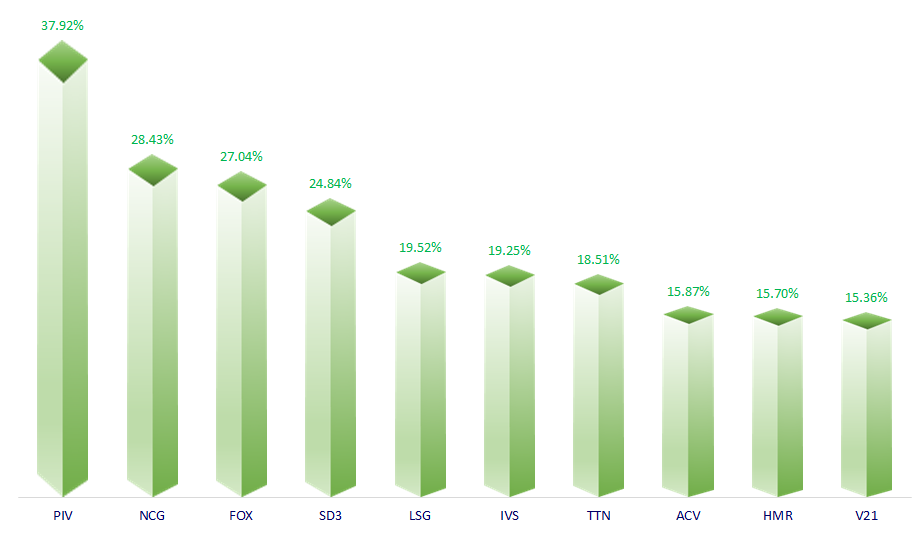

TOP INCREASES 3 CONSECUTIVE SESSIONS

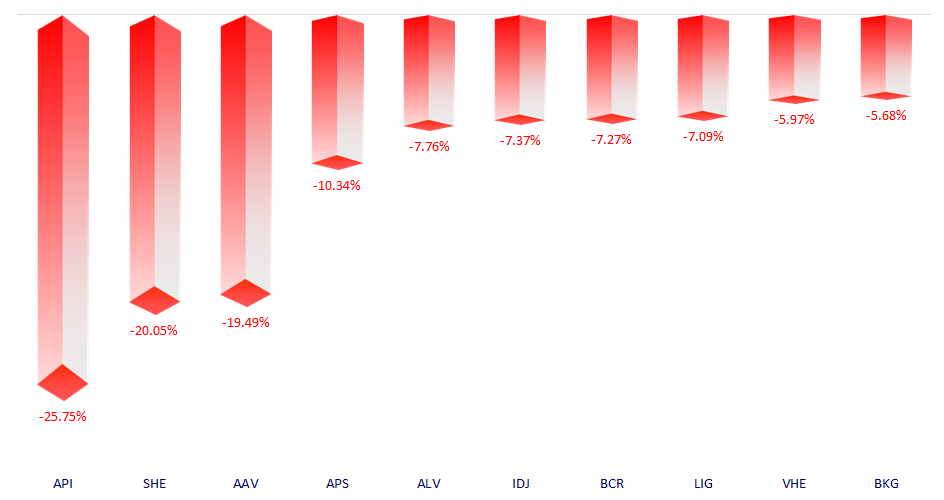

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.