Market Brief 03/07/2024

VIETNAM STOCK MARKET

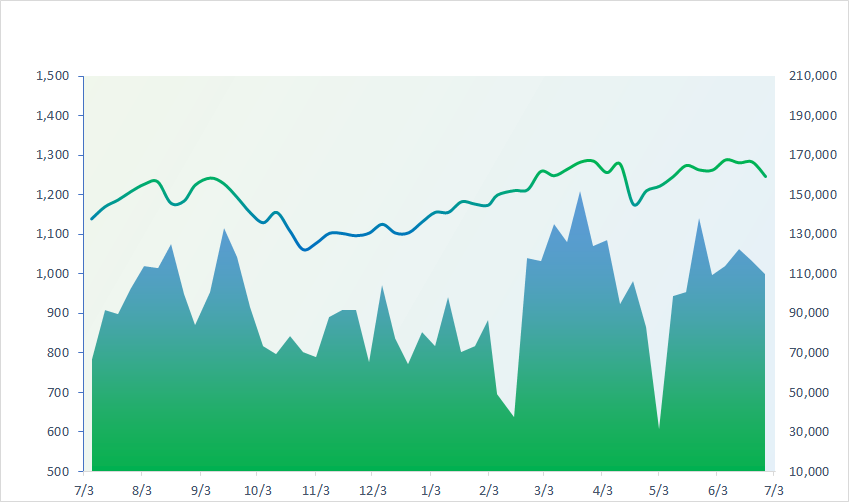

1,276.85

1D 0.56%

YTD 12.82%

241.43

1D 0.26%

YTD 4.97%

1,305.50

1D 0.73%

YTD 15.36%

97.90

1D 0.33%

YTD 11.78%

-529.05

1D 0.00%

YTD 0.00%

17,745.86

1D 13.09%

YTD -6.09%

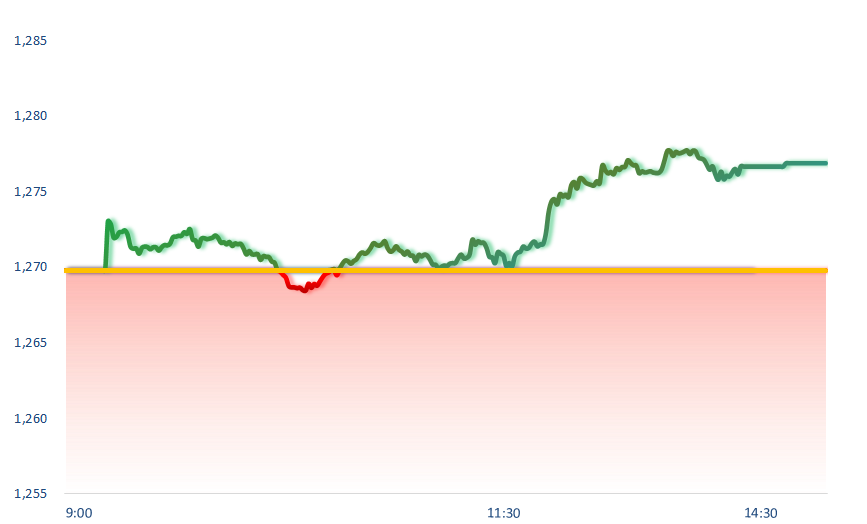

Cash flow poured into large-cap stocks, mainly banking stocks, pushing VNIndex to surge in the afternoon session. BID and FPT were the two stocks with the most positive influence on VNIndex today.

ETF & DERIVATIVES

22,810

1D 0.93%

YTD 16.79%

15,660

1D 0.51%

YTD 16.43%

16,210

1D 0.68%

YTD 16.96%

19,770

1D 1.44%

YTD 16.43%

20,800

1D 1.02%

YTD 13.04%

32,700

1D 0.28%

YTD 25.62%

17,750

1D 1.25%

YTD 16.24%

1,307

1D 0.91%

YTD 0.00%

1,308

1D 0.85%

YTD 0.00%

1,310

1D 0.72%

YTD 0.00%

1,313

1D 0.91%

YTD 0.00%

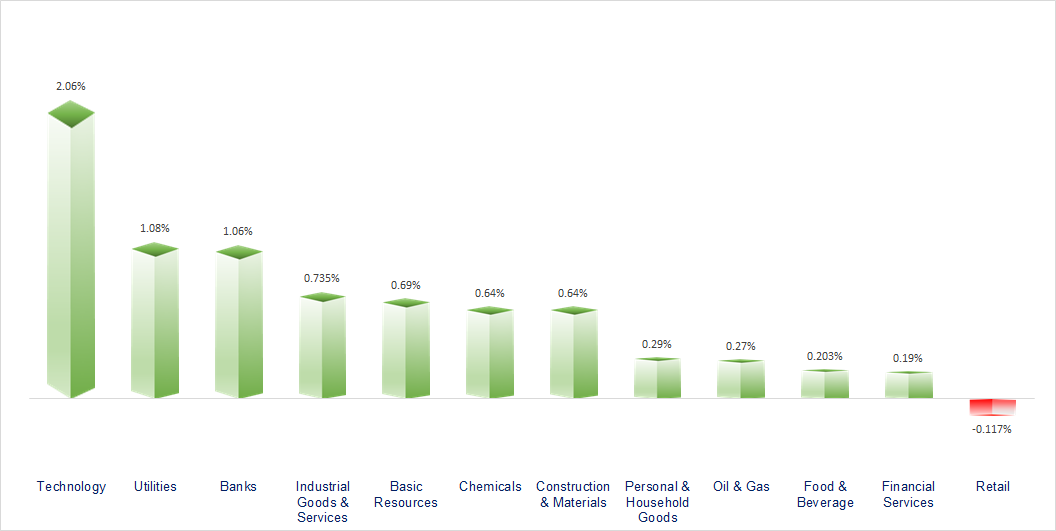

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

40,580.76

1D 1.26%

YTD 21.27%

2,982.37

1D -0.49%

YTD 0.68%

17,978.57

1D 1.18%

YTD 7.09%

2,794.01

1D 0.47%

YTD 4.65%

79,987.90

1D 0.69%

YTD 11.26%

3,415.51

1D 1.41%

YTD 5.74%

1,293.62

1D 0.39%

YTD -9.75%

86.38

1D -0.23%

YTD 12.14%

2,343.34

1D 0.60%

YTD 12.84%

Asia-Pacific markets mostly rose Wednesday as investors assessed a slew of data from the region. Hong Kong’s Hang Seng index was up 1.18% in the final hour of trade, boosted by property stocks. India’s BSE Sensex briefly crossed the 80,000 mark, reaching an all-time high. HSBC reported that India’s private sector activity expanded much faster last month, with the composite PMI coming in at 60.9 in June, up from a five-month low of 60.5 in May.

VIETNAM ECONOMY

4.48%

1D (bps) -3

YTD (bps) 88

4.60%

YTD (bps) -20

2.41%

1D (bps) 3

YTD (bps) 53

2.76%

1D (bps) 3

YTD (bps) 58

25,470

1D (%) 0.02%

YTD (%) 3.92%

28,090

1D (%) 0.11%

YTD (%) 2.61%

3,572

1D (%) -0.09%

YTD (%) 2.76%

Although the exchange rate on the black market has decreased slightly in recent days, it is still anchored at a high level. Currently, the buying rate on the black market is 25,830 VND/USD and selling rate is 25,910 VND/USD. In just the last two days, the State Bank continued to sell about USD343 million. From the beginning of the year until now, the State Bank sold about USD6.6 billion.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The State Bank issued a series of new Circulars;

- Promoting exports through cross-border e-commerce;

- Total import-export turnover of the country reached 336.48 billion USD;

- CNN: Mr. Trump won in the first presidential debate;

- IMF slightly adjusted the US economic growth forecast to 2.6%;

- Chinese automakers are expected to account for 33% of the global market share by 2030.

- Hanoi adjusted to increase land prices in districts;

- There are 6 leading Korean corporations that want to expand investment in Vietnam;

- White House aggressively shot down reports on the president’s age and any possible limitations on his ability;

- Boeing agrees to buy Spirit AeroSystems, a longtime supplier;

- Oil prices up 2% to two-month high on summer demand hopes, supply worries.

VN30

BANK

88,500

1D 0.34%

5D 3.87%

Buy Vol. 4,300,156

Sell Vol. 4,195,653

47,200

1D 3.17%

5D 6.07%

Buy Vol. 6,666,594

Sell Vol. 8,348,598

32,350

1D 0.15%

5D 3.35%

Buy Vol. 7,913,403

Sell Vol. 9,026,312

23,500

1D 2.62%

5D -2.08%

Buy Vol. 17,557,103

Sell Vol. 17,202,707

19,000

1D 0.26%

5D 0.00%

Buy Vol. 35,476,624

Sell Vol. 41,934,486

22,900

1D 0.88%

5D 1.78%

Buy Vol. 14,323,284

Sell Vol. 17,477,568

24,500

1D 1.66%

5D 7.93%

Buy Vol. 19,333,657

Sell Vol. 17,806,551

17,550

1D 0.57%

5D 0.00%

Buy Vol. 8,328,189

Sell Vol. 8,337,843

29,900

1D 1.01%

5D 1.36%

Buy Vol. 12,186,593

Sell Vol. 16,117,226

21,350

1D -0.23%

5D 0.47%

Buy Vol. 4,343,214

Sell Vol. 5,206,275

24,250

1D 0.83%

5D 0.62%

Buy Vol. 12,066,351

Sell Vol. 12,872,705

11,750

1D 0.00%

5D 3.52%

Buy Vol. 34,089,494

Sell Vol. 57,247,564

20,950

1D 0.24%

5D -0.95%

Buy Vol. 5,545,187

Sell Vol. 3,872,831

SSB: Asian Infrastructure Investment Bank (AIIB) invested USD75 million in green bonds issued by SeABank.

OIL & GAS

78,200

1D 0.00%

5D -1.31%

Buy Vol. 1,365,872

Sell Vol. 37,393,426

15,100

1D 4.14%

5D -1.30%

Buy Vol. 40,471,389

Sell Vol. 3,100,270

41,850

1D 1.21%

5D 0.36%

Buy Vol. 3,147,891

Sell Vol. 2,377,864

VPI forecasts that gasoline prices will increase by 1.9% on July 4.

VINGROUP

41,350

1D -0.60%

5D 1.60%

Buy Vol. 2,116,557

Sell Vol. 10,600,704

38,100

1D -0.13%

5D 2.40%

Buy Vol. 8,602,844

Sell Vol. 59,916,396

21,300

1D -1.84%

5D 1.53%

Buy Vol. 79,649,079

Sell Vol. 4,513,544

VRE: In just one month, Vincom Retail has had 3 shopping centers in operation.

FOOD & BEVERAGE

66,200

1D 0.00%

5D 3.38%

Buy Vol. 2,813,263

Sell Vol. 7,162,694

76,500

1D 0.26%

5D 2.50%

Buy Vol. 4,772,378

Sell Vol. 1,058,832

61,500

1D 0.49%

5D -3.18%

Buy Vol. 903,767

Sell Vol. 1,292,241

VinFast officially launched the right-hand drive version of the VF 5 in Indonesia on July 1.

OTHERS

63,900

1D 0.16%

5D 5.03%

Buy Vol. 1,133,361

Sell Vol. 1,717,651

47,000

1D -1.26%

5D 5.03%

Buy Vol. 1,361,967

Sell Vol. 1,717,651

101,200

1D 0.20%

5D -0.39%

Buy Vol. 1,184,435

Sell Vol. 926,375

131,000

1D 2.34%

5D -0.61%

Buy Vol. 14,909,887

Sell Vol. 12,280,128

65,500

1D -0.76%

5D 5.47%

Buy Vol. 13,032,535

Sell Vol. 13,126,386

34,600

1D 0.00%

5D -3.76%

Buy Vol. 5,079,747

Sell Vol. 7,534,717

34,450

1D 0.29%

5D 0.15%

Buy Vol. 11,919,863

Sell Vol. 16,158,883

28,750

1D 0.17%

5D -0.52%

Buy Vol. 35,760,222

Sell Vol. 45,226,672

MWG: At the end of June, the Board of Directors approved a plan to buy back treasury shares to increase existing shareholders’ ownership ratio. Accordingly, Mobile World plans to spend a maximum of VND100 billion to buy back a maximum of 2 million treasury shares.

Market by numbers

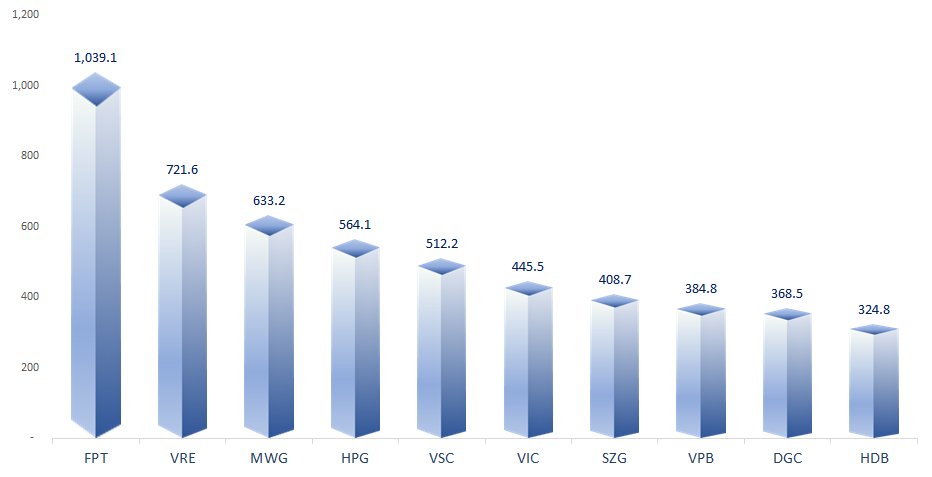

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

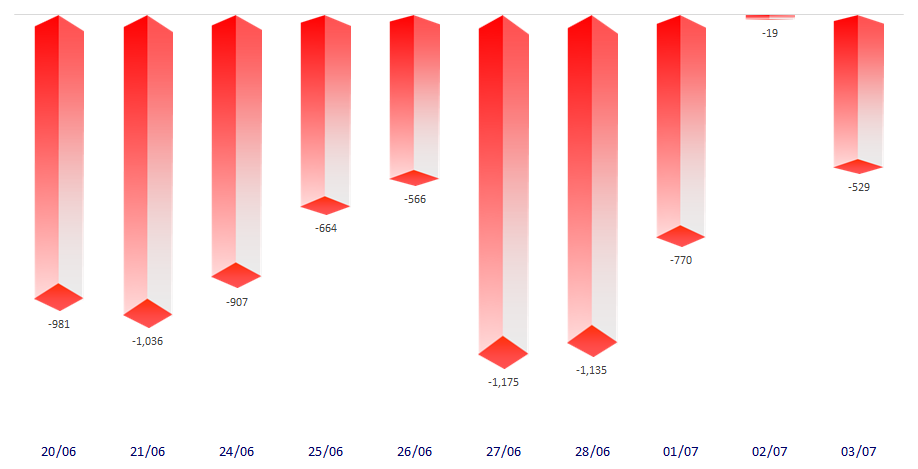

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

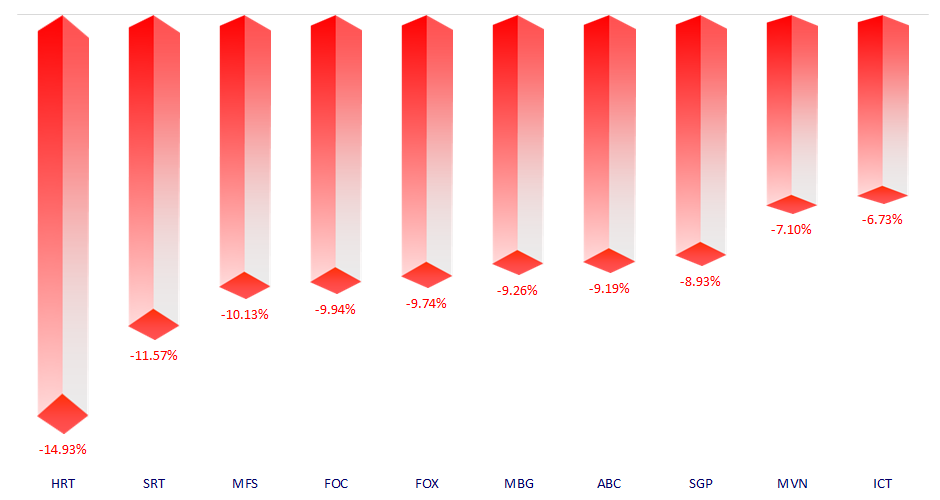

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.