Market Brief 08/07/2024

VIETNAM STOCK MARKET

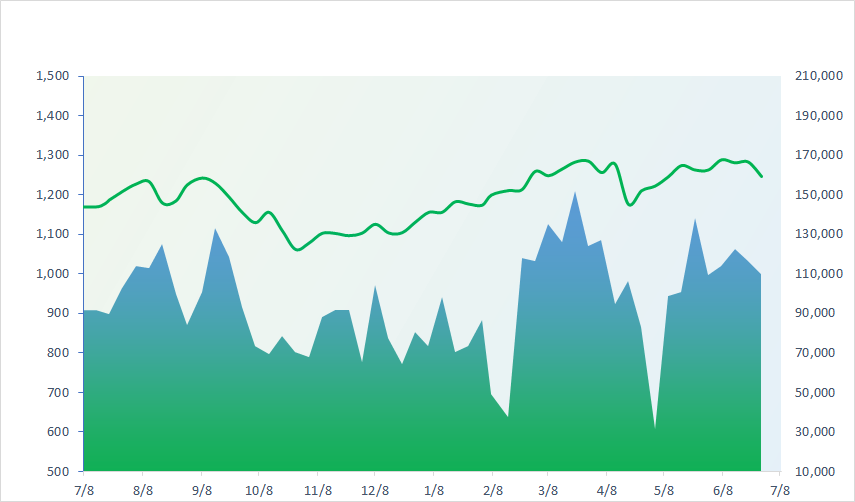

1,283.56

1D 0.04%

YTD 13.42%

243.15

1D 0.35%

YTD 5.72%

1,315.83

1D -0.03%

YTD 16.28%

98.58

1D 0.33%

YTD 12.56%

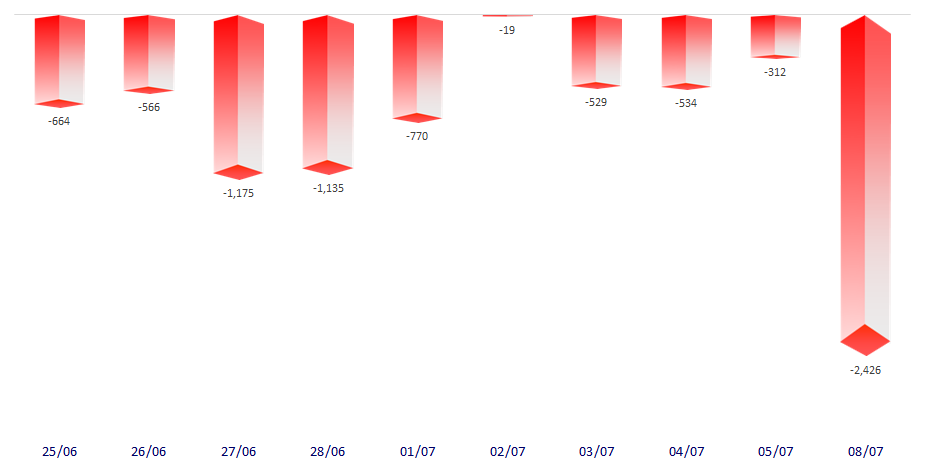

-2,426.31

1D 0.00%

YTD 0.00%

22,636.21

1D 24.71%

YTD 19.79%

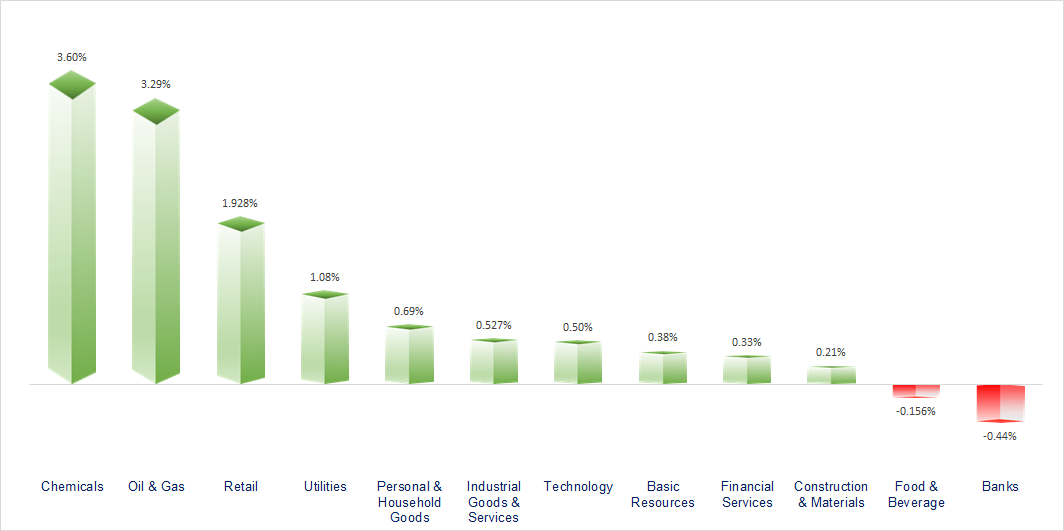

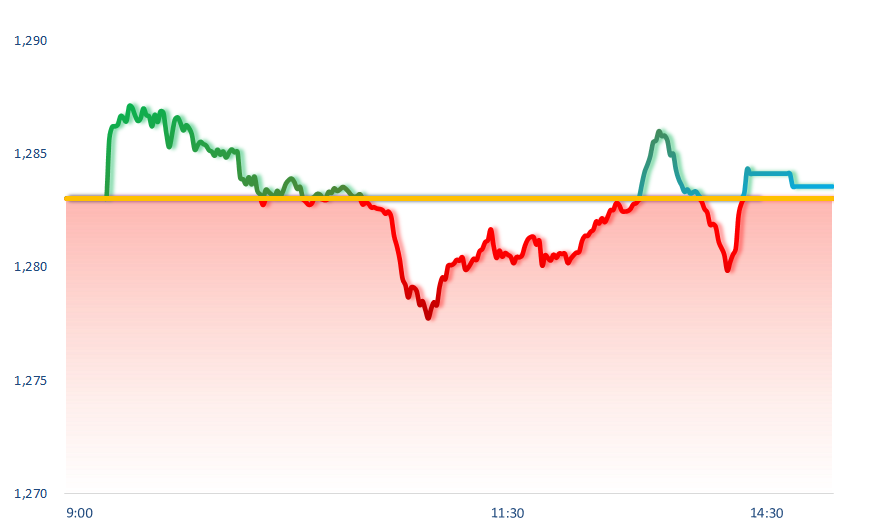

The stock market fluctuated strongly around the reference level on the first trading day of the week. Chemical was the most positive group as Vietnam chemical group - Vinachem said revenue in the first 6 months of the year was estimated to reach 55% of the annual plan, many subsidiaries had significant profit growth.

ETF & DERIVATIVES

22,940

1D -0.17%

YTD 17.46%

15,760

1D -0.06%

YTD 17.17%

16,300

1D 0.06%

YTD 17.60%

19,840

1D 0.15%

YTD 16.84%

20,890

1D -0.43%

YTD 13.53%

33,160

1D 0.36%

YTD 27.39%

17,840

1D 0.45%

YTD 16.83%

1,314

1D -0.17%

YTD 0.00%

1,315

1D -0.24%

YTD 0.00%

1,311

1D -0.63%

YTD 0.00%

1,317

1D -0.27%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

40,780.70

1D -0.32%

YTD 21.86%

2,922.45

1D -0.93%

YTD -1.34%

17,524.06

1D -1.55%

YTD 4.38%

2,857.76

1D -0.16%

YTD 7.04%

79,960.38

1D -0.05%

YTD 11.22%

3,404.47

1D -0.19%

YTD 5.40%

1,322.50

1D 0.80%

YTD -7.74%

85.86

1D -0.63%

YTD 11.47%

2,373.89

1D -0.90%

YTD 14.31%

Asia markets mostly slipped on Monday, inwhich Hong Kong and China markets were the most negative as investors worries about EU's high taxes on Chinese imported electric vehicles. Nikkei 225 also dropped 0.32% as Japan real wages fell for 26th straight month.

VIETNAM ECONOMY

4.90%

1D (bps) 10

YTD (bps) 130

4.60%

YTD (bps) -20

2.35%

1D (bps) 4

YTD (bps) 47

2.69%

1D (bps) -3

YTD (bps) 51

2544500.00%

1D (%) -0.05%

YTD (%) 3.81%

2816400.00%

1D (%) 0.12%

YTD (%) 2.88%

356600.00%

1D (%) 0.03%

YTD (%) 2.59%

SBV announced the central exchange rate at 24,243 VND/USD on July 8, decrease VND3 compared to last weekend. Applying a margin of 5%, the current USD exchange rate commercial banks are allowed to trade is from 23,031 - 25,455 VND/USD.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Non-performing loan situation in Q2 did not meet the expectations of credit institutions;

- Relieve inflationary pressure after salary increase;

- Expert: Exchange rates are still under great pressure, SBV may increase policy rates;

- China announced notable data on foreign exchange reserves;

- Russia and Iran signed a currency agreement to counter Western sanctions;

- The Prime Minister of France announces his resignation.

VN30

BANK

87,200

1D -0.91%

5D 1.28%

Buy Vol. 1,751,245

Sell Vol. 2,651,184

47,000

1D -0.63%

5D 7.06%

Buy Vol. 3,755,754

Sell Vol. 4,643,149

32,600

1D -0.31%

5D 1.88%

Buy Vol. 7,570,727

Sell Vol. 9,969,189

23,450

1D -0.21%

5D 3.53%

Buy Vol. 12,761,893

Sell Vol. 12,455,026

19,050

1D -0.52%

5D 0.26%

Buy Vol. 33,721,822

Sell Vol. 43,195,680

22,700

1D -0.44%

5D 1.11%

Buy Vol. 11,803,897

Sell Vol. 16,427,898

24,400

1D 0.00%

5D 5.63%

Buy Vol. 11,093,483

Sell Vol. 15,269,564

17,750

1D 0.28%

5D 2.31%

Buy Vol. 20,013,667

Sell Vol. 34,510,049

30,150

1D 0.17%

5D 2.90%

Buy Vol. 17,348,358

Sell Vol. 20,961,250

21,300

1D 0.47%

5D 0.47%

Buy Vol. 4,539,640

Sell Vol. 5,185,505

24,250

1D -0.21%

5D 1.89%

Buy Vol. 9,826,931

Sell Vol. 10,787,698

11,700

1D -0.43%

5D 0.86%

Buy Vol. 36,220,213

Sell Vol. 41,948,958

20,850

1D -0.24%

5D 0.00%

Buy Vol. 3,885,872

Sell Vol. 4,780,139

Foreign investors witnessed a record net selling session since the beginning of 2023, with two bank stocks among the top net selling - HDB at VND499.9 billion and STB at VND246.3 billion.

OIL & GAS

78,700

1D 0.13%

5D 3.44%

Buy Vol. 1,497,813

Sell Vol. 1,687,485

15,050

1D 3.08%

5D 13.97%

Buy Vol. 36,725,175

Sell Vol. 33,916,629

46,500

1D 5.80%

5D -2.30%

Buy Vol. 10,376,602

Sell Vol. 8,553,382

PLX: PLX stock continued to surge 5.8% after the Ministry of Industry and Trade released the draft Decree on petroleum policy.

VINGROUP

40,400

1D -2.42%

5D 0.80%

Buy Vol. 5,108,341

Sell Vol. 6,345,988

38,000

1D -1.17%

5D -7.09%

Buy Vol. 10,881,264

Sell Vol. 16,966,967

20,300

1D -2.40%

5D 2.42%

Buy Vol. 30,208,133

Sell Vol. 42,642,097

VHM: A subsidiary of Vinhomes - Thai Son JSC - was approved as the investor for the My Lam - Tuyen Quang resort urban development project with a total investment of over VND18.2 trillion.

FOOD & BEVERAGE

67,600

1D 0.60%

5D 0.26%

Buy Vol. 9,648,737

Sell Vol. 9,341,392

76,200

1D -0.65%

5D -4.25%

Buy Vol. 8,944,041

Sell Vol. 8,943,715

56,400

1D -2.76%

5D 2.38%

Buy Vol. 2,502,420

Sell Vol. 2,219,521

MSN: WinCommerce has opened 91 new stores since the beginning of 2024, and announced a target of reaching 4,000 sales points by the end of 2024.

OTHERS

64,600

1D 0.94%

5D -0.22%

Buy Vol. 1,876,075

Sell Vol. 2,491,614

46,300

1D -0.22%

5D 0.60%

Buy Vol. 2,168,786

Sell Vol. 1,653,459

101,300

1D -0.30%

5D 8.55%

Buy Vol. 1,170,722

Sell Vol. 1,205,426

139,600

1D 0.65%

5D 1.82%

Buy Vol. 10,446,065

Sell Vol. 8,690,727

67,000

1D 2.13%

5D 6.41%

Buy Vol. 18,861,792

Sell Vol. 15,738,194

36,500

1D 3.99%

5D 1.92%

Buy Vol. 11,146,713

Sell Vol. 11,515,536

34,550

1D -0.29%

5D 1.59%

Buy Vol. 12,649,943

Sell Vol. 18,419,731

28,800

1D 0.52%

5D 0.00%

Buy Vol. 32,572,672

Sell Vol. 49,253,814

MWG: MWG's Q2/2024 profits are expected to see a significant increase as Bach Hoa Xanh reported reaching an average revenue of VND2 billion/store threshold in May 2024.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

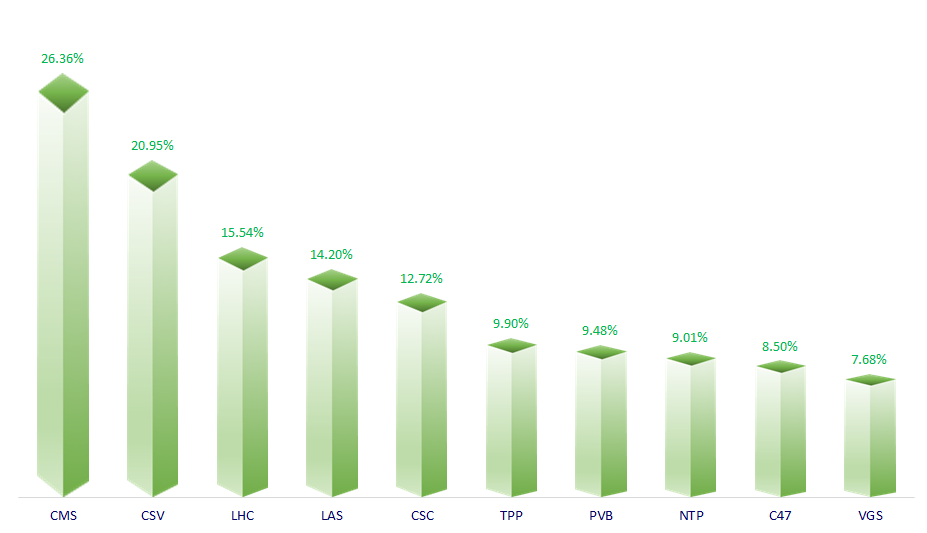

TOP INCREASES 3 CONSECUTIVE SESSIONS

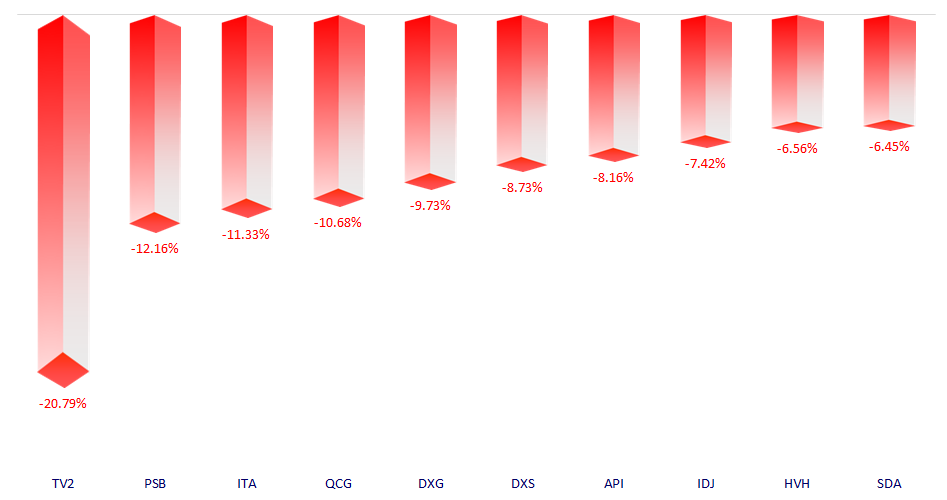

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.