Market Brief 09/07/2024

VIETNAM STOCK MARKET

1,293.71

1D 0.79%

YTD 14.31%

245.66

1D 1.03%

YTD 6.81%

1,321.78

1D 0.45%

YTD 16.80%

99.25

1D 0.68%

YTD 13.32%

-449.71

1D 0.00%

YTD 0.00%

24,742.92

1D 9.31%

YTD 30.94%

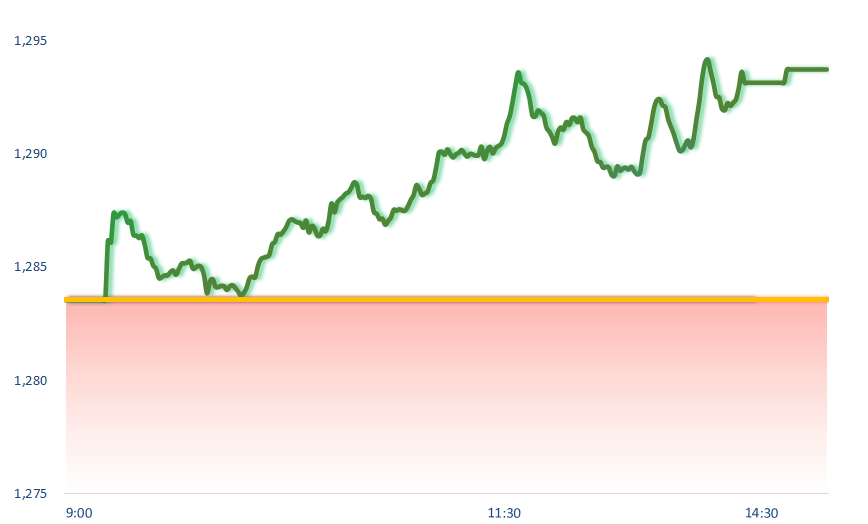

The stock market had an upbeat trading session with total volume reaching nearly USD1 billion, inwhich chemicals, insurance, and banking were the most positive industries.

ETF & DERIVATIVES

23,010

1D 0.31%

YTD 17.82%

15,820

1D 0.38%

YTD 17.62%

16,390

1D 0.55%

YTD 18.25%

20,000

1D 0.81%

YTD 17.79%

20,980

1D 0.43%

YTD 14.02%

33,500

1D 1.03%

YTD 28.70%

18,010

1D 0.95%

YTD 17.94%

1,321

1D 0.49%

YTD 0.00%

1,321

1D 0.46%

YTD 0.00%

1,323

1D 0.92%

YTD 0.00%

1,325

1D 0.62%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

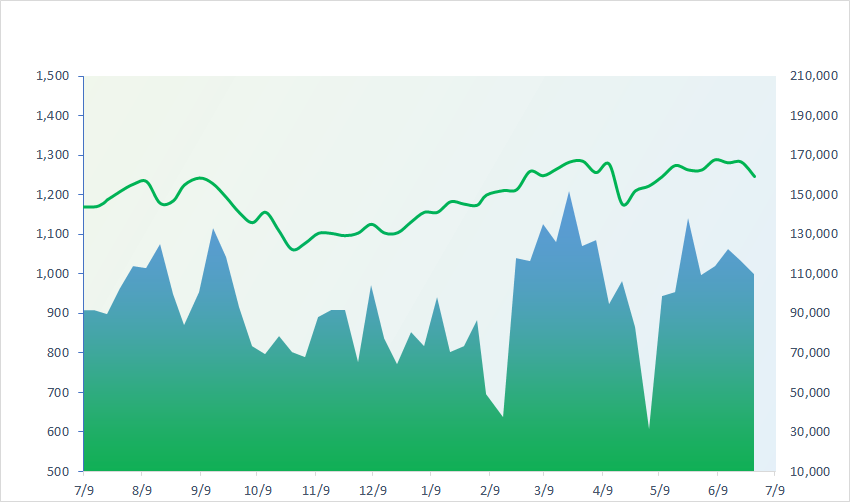

VNINDEX (12M)

GLOBAL MARKET

41,580.17

1D 1.96%

YTD 24.25%

2,959.37

1D 1.26%

YTD -0.10%

17,523.23

1D 0.00%

YTD 4.38%

2,867.38

1D 0.34%

YTD 7.40%

80,351.64

1D 0.49%

YTD 11.77%

3,426.09

1D 0.64%

YTD 6.07%

1,319.92

1D -0.20%

YTD -7.92%

85.47

1D -0.45%

YTD 10.96%

2,362.64

1D -0.47%

YTD 13.77%

Asian stocks mostly gained today as investors bet that Fed will cut interest rates soon. Japan's Nikkei 225 index continued to hit new highs, driven by the strong performance of technology stocks, especially semiconductor manufacturers.

VIETNAM ECONOMY

4.99%

1D (bps) 9

YTD (bps) 139

4.60%

YTD (bps) -20

2.30%

1D (bps) -5

YTD (bps) 42

2.71%

1D (bps) 2

YTD (bps) 53

2544500.00%

1D (%) 0.00%

YTD (%) 3.81%

2814400.00%

1D (%) -0.07%

YTD (%) 2.81%

356500.00%

1D (%) -0.03%

YTD (%) 2.56%

On July 9th, domestic gold bar prices remained stable, while gold ring prices continued to adjust downwards by VND300,000/tael. In contrast, global gold prices edged up slightly compared to the morning trading session.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Three banks simultaneously raised deposit rates from July;

- Revising the land price framework in Ho Chi Minh City;

- Legal progress at the Novaland's Aqua City project;

- Gold prices plummeted as investors rushed to take profits;

- The US services sector showed visible signs of weakening;

- Nvidia may "earn big" by selling a new chip type to China.

VN30

BANK

88,100

1D 1.03%

5D -0.11%

Buy Vol. 2,702,748

Sell Vol. 2,739,805

47,500

1D 1.06%

5D 3.83%

Buy Vol. 4,428,412

Sell Vol. 5,884,898

32,700

1D 0.31%

5D 1.24%

Buy Vol. 8,735,908

Sell Vol. 11,957,431

23,350

1D -0.43%

5D 1.97%

Buy Vol. 20,140,626

Sell Vol. 18,644,233

19,400

1D 1.84%

5D 2.37%

Buy Vol. 74,578,514

Sell Vol. 65,713,038

23,150

1D 1.98%

5D 1.98%

Buy Vol. 32,996,361

Sell Vol. 26,603,745

25,250

1D 3.48%

5D 4.77%

Buy Vol. 26,181,000

Sell Vol. 23,300,997

17,900

1D 0.85%

5D 2.58%

Buy Vol. 12,772,774

Sell Vol. 14,983,657

30,350

1D 0.66%

5D 2.53%

Buy Vol. 17,696,437

Sell Vol. 21,776,057

21,400

1D 0.47%

5D 0.00%

Buy Vol. 9,449,445

Sell Vol. 6,936,427

24,300

1D 0.21%

5D 1.04%

Buy Vol. 17,956,616

Sell Vol. 17,514,353

11,800

1D 0.85%

5D 0.43%

Buy Vol. 51,071,963

Sell Vol. 63,764,432

20,900

1D 0.24%

5D 0.00%

Buy Vol. 4,424,157

Sell Vol. 5,272,278

CTG: VietinBank planned to offer 80 million bonds to raise VND8,000 billion, all of which are non-convertible bonds, without warrants, and without collateral. HDB: HDBank announced a 2023 dividend payout ratio of 30%, including 10% in cash and 20% in stock.

OIL & GAS

79,000

1D 0.38%

5D 5.52%

Buy Vol. 2,633,071

Sell Vol. 2,522,811

15,300

1D 1.66%

5D 11.25%

Buy Vol. 44,132,430

Sell Vol. 50,200,059

46,000

1D -1.08%

5D -1.92%

Buy Vol. 3,469,263

Sell Vol. 4,172,627

POW: POW stock once again tested the VND15,300 peak level after briefly rising over 4.2% in the session.

VINGROUP

40,800

1D 0.99%

5D 0.39%

Buy Vol. 4,529,101

Sell Vol. 4,143,132

38,300

1D 0.79%

5D -5.53%

Buy Vol. 12,927,359

Sell Vol. 15,734,304

20,500

1D 0.99%

5D 1.96%

Buy Vol. 34,668,798

Sell Vol. 19,567,370

VHM: Vinhomes announced the establishment of a branch in Bac Giang, where the company previously proposed a VND6,300 billion project.

FOOD & BEVERAGE

67,500

1D -0.15%

5D 0.26%

Buy Vol. 9,233,307

Sell Vol. 10,294,564

76,500

1D 0.39%

5D -3.20%

Buy Vol. 9,859,792

Sell Vol. 9,974,481

57,300

1D 1.60%

5D 4.55%

Buy Vol. 2,868,517

Sell Vol. 2,082,160

VNM: Vinamilk's Vinabeef Tam Dao cattle farming and beef processing complex is set to launch products in Q4/2024, expected to generate annual revenue of VND2,550 billion.

OTHERS

66,700

1D 3.25%

5D -0.21%

Buy Vol. 3,494,857

Sell Vol. 3,236,438

47,500

1D 2.59%

5D 0.40%

Buy Vol. 2,335,201

Sell Vol. 2,267,255

101,400

1D 0.10%

5D 7.42%

Buy Vol. 1,444,623

Sell Vol. 1,268,940

137,500

1D -1.50%

5D 1.21%

Buy Vol. 15,500,145

Sell Vol. 14,541,697

66,800

1D -0.30%

5D 9.83%

Buy Vol. 14,864,067

Sell Vol. 12,494,597

38,000

1D 4.11%

5D 0.87%

Buy Vol. 15,856,003

Sell Vol. 16,373,802

34,650

1D 0.29%

5D 1.05%

Buy Vol. 17,376,226

Sell Vol. 23,056,465

29,000

1D 0.69%

5D 0.00%

Buy Vol. 39,034,227

Sell Vol. 48,641,781

GVR: The association of natural rubber producing countries has just raised its forecast for the global rubber supply deficit. Profits of rubber companies are expected to see positive growth in the second half of this year.

Market by numbers

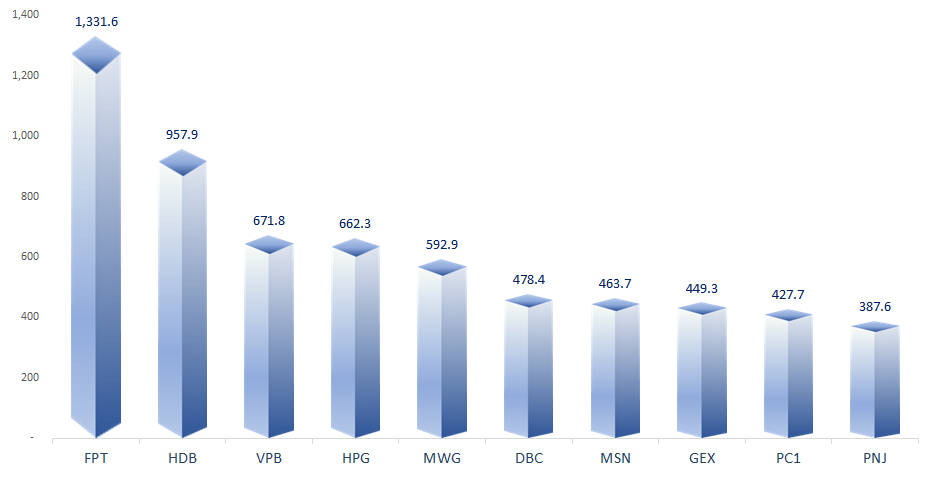

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

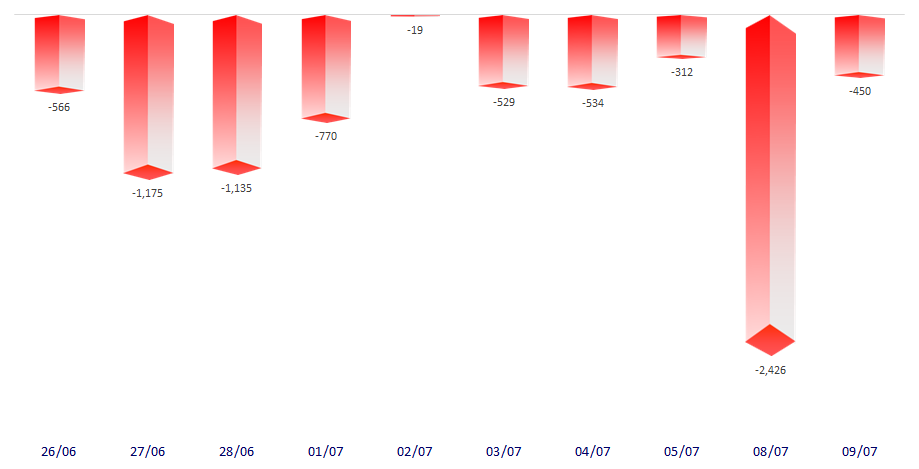

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

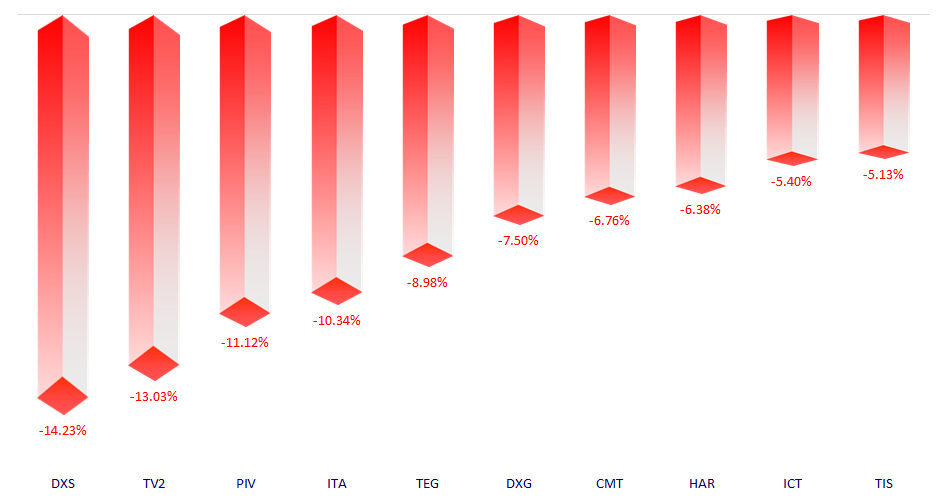

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.