Market brief 22/07/2024

VIETNAM STOCK MARKET

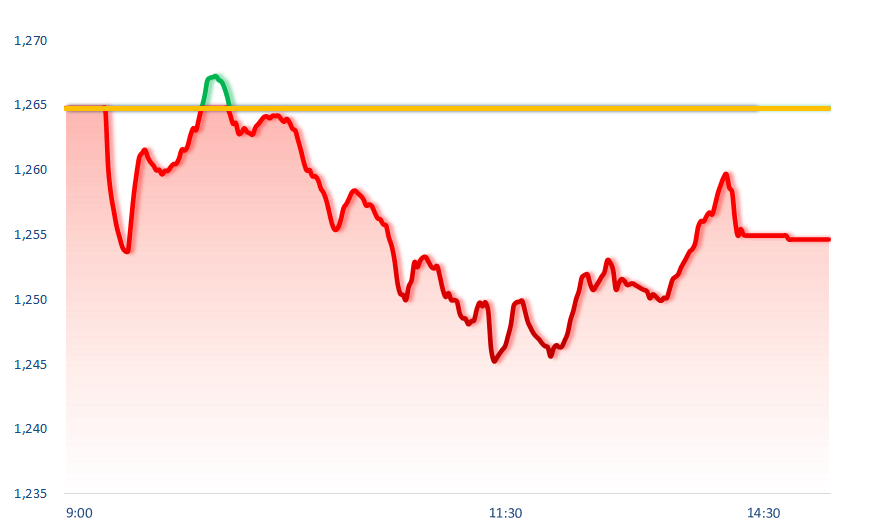

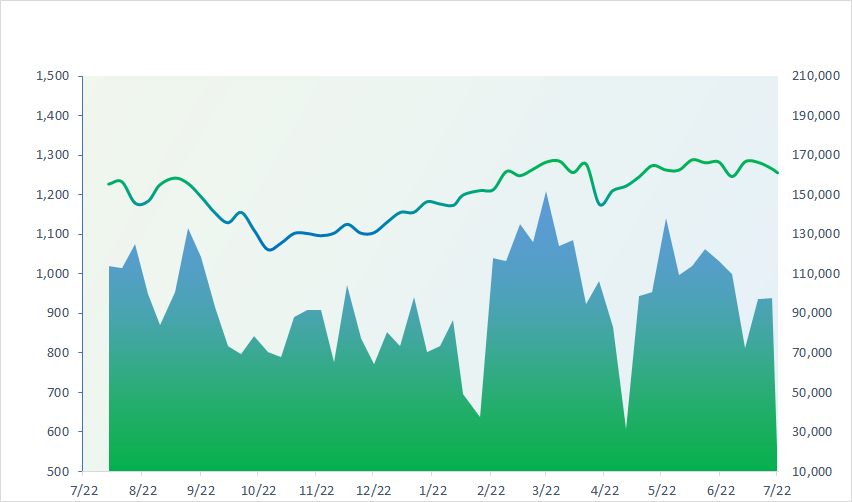

1,254.64

1D -0.80%

YTD 10.86%

238.38

1D -0.89%

YTD 3.65%

1,299.31

1D -0.23%

YTD 14.82%

95.65

1D -1.17%

YTD 9.21%

428.97

1D 0.00%

YTD 0.00%

23,870.15

1D 16.16%

YTD 26.32%

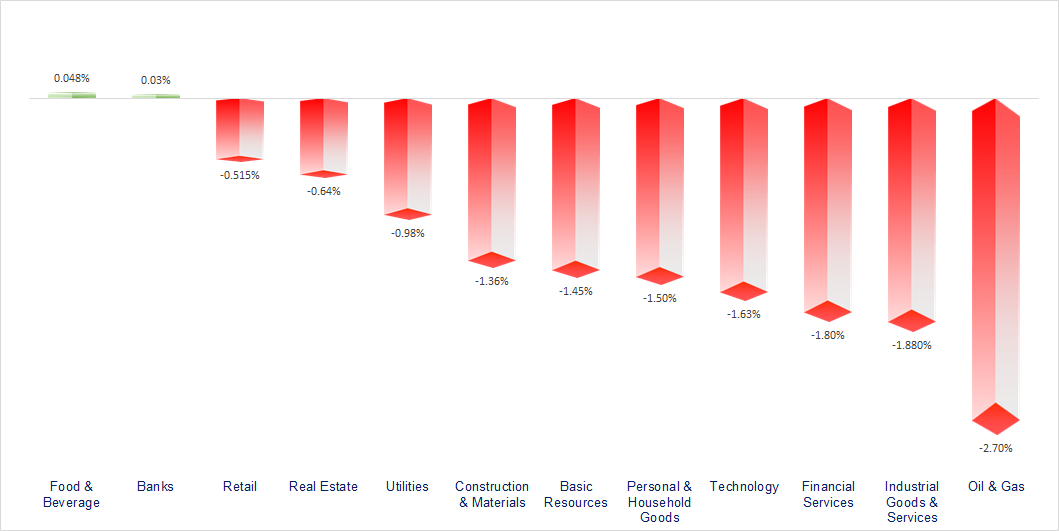

The market continued to decline as the second quarter business results of enterprises gradually emerged. Banking and food & beverage were the rare groups that increased today.

ETF & DERIVATIVES

22,720

1D -0.26%

YTD 16.33%

15,570

1D -0.45%

YTD 15.76%

16,170

1D -0.25%

YTD 16.67%

19,600

1D 0.00%

YTD 15.43%

21,090

1D -0.24%

YTD 14.62%

32,640

1D -1.30%

YTD 25.39%

17,660

1D -0.06%

YTD 15.65%

1,300

1D 0.22%

YTD 0.00%

1,301

1D 0.02%

YTD 0.00%

1,303

1D 0.00%

YTD 0.00%

1,306

1D 0.06%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

39,599.00

1D -1.16%

YTD 18.33%

2,964.22

1D -0.61%

YTD 0.07%

17,635.88

1D 1.25%

YTD 5.05%

2,763.51

1D -1.14%

YTD 3.51%

80,507.58

1D -0.12%

YTD 11.98%

3,444.75

1D -0.08%

YTD 6.65%

1,317.14

1D 0.00%

YTD -8.11%

82.47

1D -0.58%

YTD 7.07%

2,405.02

1D -0.25%

YTD 15.81%

Asian stocks also reacted negatively to the news that President Biden has dropped out of the re-election race. Among major markets, Japan's Nikkei 225 index fell the most, down 1.16%.

VIETNAM ECONOMY

4.60%

1D (bps) 8

YTD (bps) 100

4.60%

YTD (bps) -20

2.40%

1D (bps) 12

YTD (bps) 52

2.73%

1D (bps) -2

YTD (bps) 55

2547400.00%

1D (%) 0.06%

YTD (%) 3.93%

2835000.00%

1D (%) 0.06%

YTD (%) 3.56%

355400.00%

1D (%) -0.08%

YTD (%) 2.24%

At noon on July 22, the price of SJC gold bars had many unexpected fluctuations in the buying direction while the selling direction continued to remain stable at 80 million VND/tael. Meanwhile, the price of gold rings increased in the same direction as the world.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Hanoi disburses nearly VND21,000 billion in public investment;

- The Prime Minister requests the Ministry of Finance to propose car registration fees in July;

- Accelerating industrialization and modernization of the country until 2030, with a vision to 2045;

- Japan: The number of bankruptcies of 100-year-old enterprises skyrocketed by 95% in the first half of the year;

- China lowers interest rates for the first time in a year;

- US public debt reaches USD34,900 billion, reaching a historic milestone.

VN30

BANK

87,700

1D 0.23%

5D 0.23%

Buy Vol. 2,694,777

Sell Vol. 2,944,646

47,700

1D 0.00%

5D 2.47%

Buy Vol. 5,490,346

Sell Vol. 7,266,637

33,650

1D 0.75%

5D 4.83%

Buy Vol. 28,916,831

Sell Vol. 31,996,985

23,650

1D 1.07%

5D 4.42%

Buy Vol. 27,745,133

Sell Vol. 26,274,910

18,800

1D 0.00%

5D 0.00%

Buy Vol. 30,448,530

Sell Vol. 34,389,965

25,200

1D -0.79%

5D 9.33%

Buy Vol. 83,271,887

Sell Vol. 66,609,774

25,300

1D 1.40%

5D 3.69%

Buy Vol. 18,190,355

Sell Vol. 15,034,551

18,600

1D 1.09%

5D 5.38%

Buy Vol. 57,436,964

Sell Vol. 57,289,586

30,000

1D -0.99%

5D 0.84%

Buy Vol. 19,685,159

Sell Vol. 23,515,913

21,350

1D -0.47%

5D 0.23%

Buy Vol. 9,969,774

Sell Vol. 9,044,354

24,750

1D -1.39%

5D 3.34%

Buy Vol. 26,745,162

Sell Vol. 28,468,581

11,200

1D -0.88%

5D -2.15%

Buy Vol. 46,919,704

Sell Vol. 48,694,437

21,150

1D 0.48%

5D 1.68%

Buy Vol. 4,988,662

Sell Vol. 3,745,485

TCB: In the second quarter of 2024, Techcombank's total operating income and pre-tax profit continued to increase by more than 30% YoY. CASA balance continued to be at a record high of more than VND180 trillion, while the bad debt ratio was controlled below 1.3% and the capital adequacy ratio increased to 14.5%.

OIL & GAS

77,000

1D -1.03%

5D -11.51%

Buy Vol. 2,445,968

Sell Vol. 1,983,736

13,450

1D 1.13%

5D -3.44%

Buy Vol. 32,666,909

Sell Vol. 21,602,503

46,350

1D -1.17%

5D -1.45%

Buy Vol. 4,075,439

Sell Vol. 4,997,249

POW: Hua Na Hydropower JSC, a subsidiary of PV Power, ended the first 6 months of the year with business results that were not as expected, recording a loss after tax of VND14 billion.

VINGROUP

40,750

1D 0.00%

5D -0.26%

Buy Vol. 2,636,523

Sell Vol. 3,479,007

37,900

1D 0.13%

5D -1.47%

Buy Vol. 7,700,066

Sell Vol. 10,089,195

20,050

1D 0.75%

5D -1.21%

Buy Vol. 22,935,635

Sell Vol. 15,913,038

VRE: Vincom Retail profits VND1,021 billion in Q2/2024.

FOOD & BEVERAGE

65,400

1D 0.15%

5D -3.09%

Buy Vol. 5,594,802

Sell Vol. 6,166,552

72,200

1D 1.69%

5D -0.18%

Buy Vol. 7,480,170

Sell Vol. 6,394,712

55,700

1D 0.91%

5D 0.74%

Buy Vol. 1,583,961

Sell Vol. 1,916,351

SAB: For the first half of 2024, SCD, a subsidiary of Sabeco, had revenue of VND98.6 billion, 150% higher than the same period last year, but still had a loss after tax of more than VND32 billion.

OTHERS

67,700

1D -0.15%

5D -2.82%

Buy Vol. 2,374,009

Sell Vol. 2,313,982

44,750

1D -2.19%

5D 1.06%

Buy Vol. 1,575,475

Sell Vol. 1,832,833

105,300

1D -0.28%

5D -6.48%

Buy Vol. 950,564

Sell Vol. 1,271,769

124,100

1D -1.51%

5D 1.56%

Buy Vol. 11,462,733

Sell Vol. 9,500,465

65,300

1D -0.46%

5D -14.94%

Buy Vol. 10,336,114

Sell Vol. 10,550,536

32,750

1D -5.07%

5D 1.02%

Buy Vol. 11,167,050

Sell Vol. 10,344,781

34,650

1D -0.43%

5D -1.41%

Buy Vol. 20,919,449

Sell Vol. 21,857,028

28,050

1D -0.53%

5D 0.00%

Buy Vol. 35,888,345

Sell Vol. 32,179,854

GVR: GVR recently held a conference to review the first 6 months of the year with estimated consolidated revenue of VND10,092 billion and consolidated pre-tax profit of VND1,909 billion, up 6% and 4% respectively over the same period in 2023. In the second quarter, GVR estimated revenue of VND5,507 billion and pre-tax profit of about VND1,131 billion, up 29% and 27% over the same period in 2023.

Market by numbers

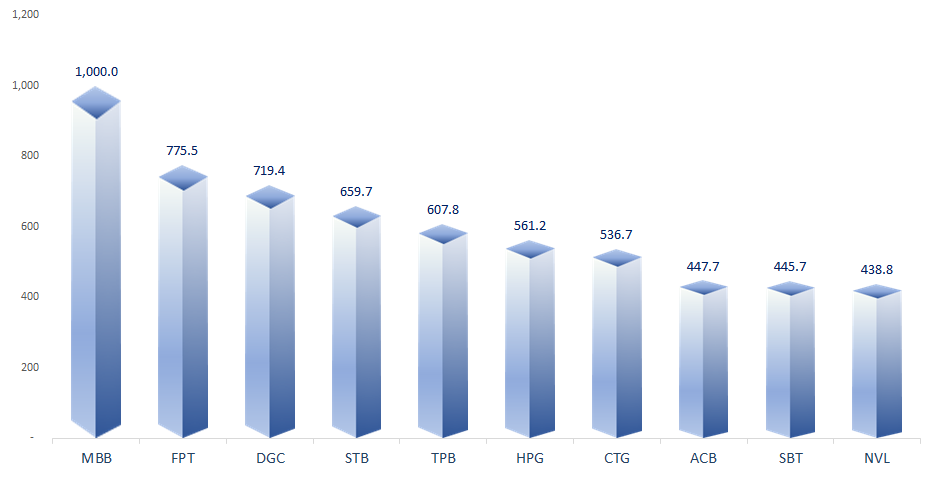

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

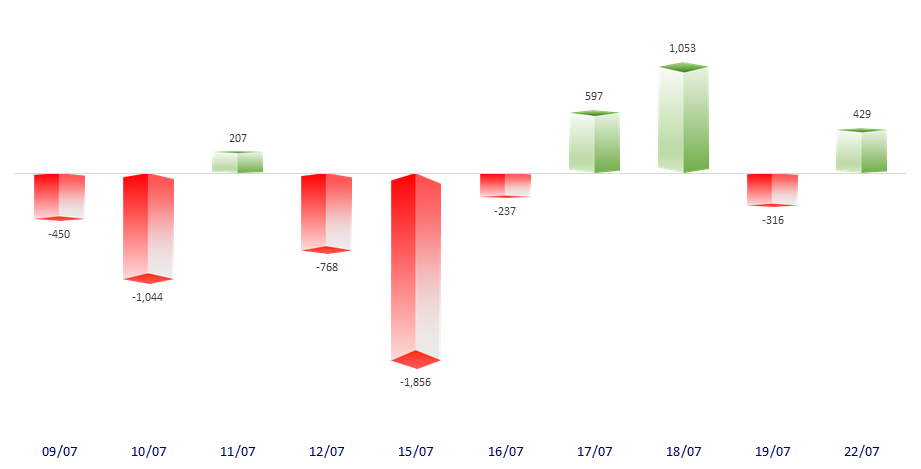

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

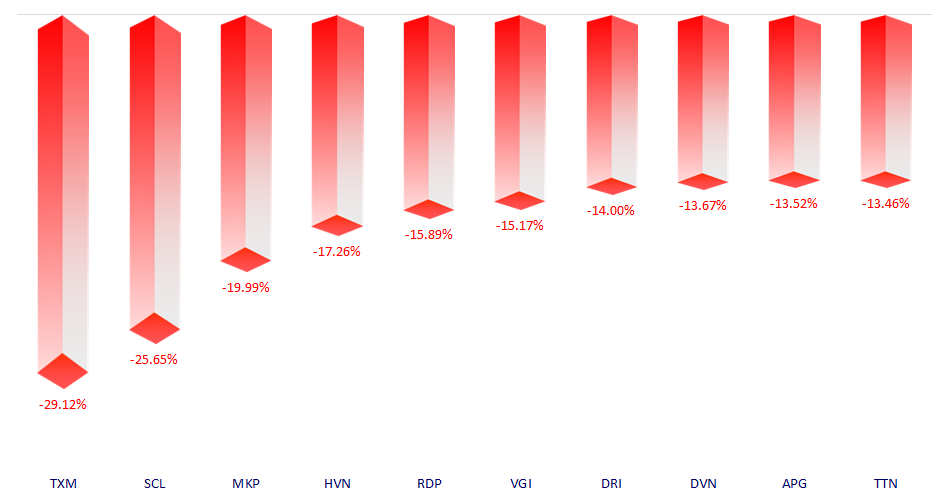

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.