Market Brief 31/07/2024

VIETNAM STOCK MARKET

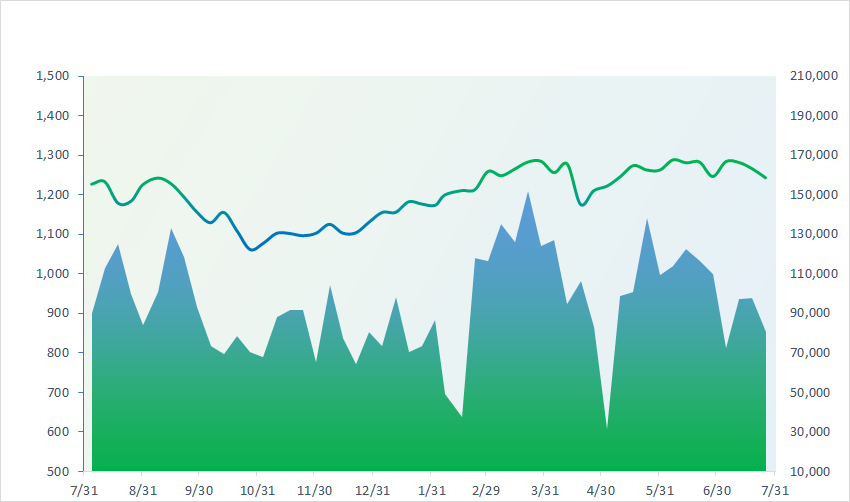

1,251.51

1D 0.52%

YTD 10.58%

235.36

1D -0.22%

YTD 2.33%

1,299.09

1D 0.88%

YTD 14.80%

95.07

1D -0.18%

YTD 8.55%

-697.59

1D 0.00%

YTD 0.00%

19,418.39

1D 25.01%

YTD 2.76%

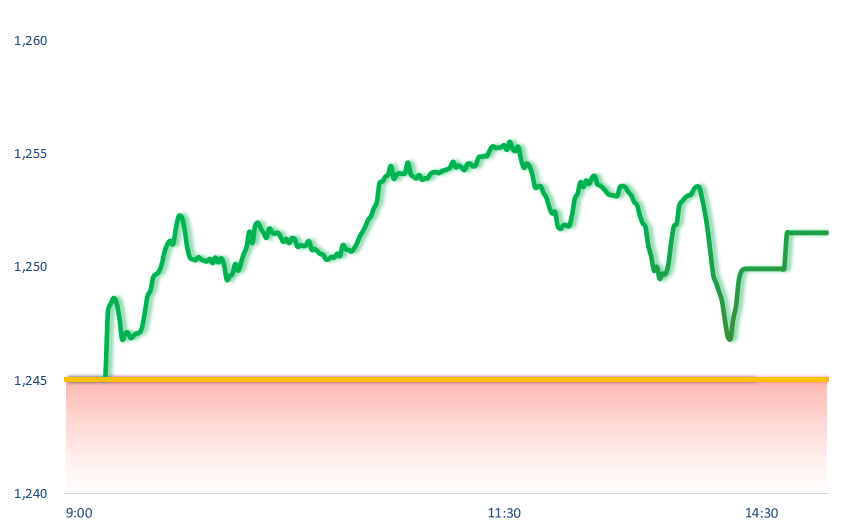

The market had a positive session as almost all enterprises have revealed Q2 business results. VN-Index increased strongly from the beginning of the session thanks to the surge of VNM and banking stocks. However, the index gradually weakened towards the end of the afternoon session when selling pressure increased in the midcap and penny groups.

ETF & DERIVATIVES

22,750

1D 0.75%

YTD 16.49%

15,630

1D 1.17%

YTD 16.21%

16,130

1D 0.44%

YTD 16.38%

19,440

1D 0.67%

YTD 14.49%

20,700

1D 1.02%

YTD 12.50%

32,880

1D 0.12%

YTD 26.32%

17,500

1D 0.40%

YTD 14.60%

1,304

1D 0.92%

YTD 0.00%

1,303

1D 0.74%

YTD 0.00%

1,303

1D 0.82%

YTD 0.00%

1,298

1D 0.49%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

39,101.82

1D 1.49%

YTD 16.85%

2,938.75

1D 2.06%

YTD -0.79%

17,344.60

1D 2.01%

YTD 3.31%

2,770.69

1D 1.19%

YTD 3.78%

81,741.34

1D 0.35%

YTD 13.70%

3,455.94

1D 0.41%

YTD 7.00%

1,320.86

1D 0.98%

YTD -7.85%

80.25

1D 1.56%

YTD 4.19%

2,419.60

1D 0.47%

YTD 16.51%

Most Asian stock markets rose on Wednesday. The Nikkei 225 index advanced 1.49% after BOJ announced a rate hike of around 0.25%. The HSI index also gained more than 2% even though China's July PMI weakened compared to the previous month, dropping to 49.4 points.

VIETNAM ECONOMY

4.47%

1D (bps) -21

YTD (bps) 87

4.60%

YTD (bps) -20

2.35%

1D (bps) 1

YTD (bps) 47

2.70%

1D (bps) 2

YTD (bps) 52

2542300.00%

1D (%) -0.05%

YTD (%) 3.73%

2809500.00%

1D (%) 0.21%

YTD (%) 2.63%

356500.00%

1D (%) 0.22%

YTD (%) 2.56%

The USD exchange rate at commercial banks this morning witnessed downward adjustments from 1 to 20 VND at most banks. USD Index (DXY), a measure of the strength of the greenback, fell to 104.45 due to the pressure of the Japanese yen's appreciation.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam is the largest trade partner of the EU in ASEAN;

- India is the gateway for Vietnamese goods to access the South Asian market;

- Bao Viet Group has invested nearly VND1,000 billion in ACB and CTG stocks, hundreds of billions in VNM, IJC;

- Japan raised interest rates for the second time since 2007;

- The 'hottest' stocks in the US market fluctuated more than Bitcoin, market capitalization 'evaporated' nearly USD200 billion;

- China's exports of ships and containers surged.

VN30

BANK

89,200

1D 1.94%

5D 1.94%

Buy Vol. 3,993,771

Sell Vol. 3,379,969

47,600

1D 1.71%

5D 3.25%

Buy Vol. 5,199,000

Sell Vol. 6,901,419

32,000

1D 0.00%

5D -0.62%

Buy Vol. 13,121,698

Sell Vol. 12,206,270

23,250

1D 1.31%

5D 1.09%

Buy Vol. 16,604,338

Sell Vol. 20,563,014

19,000

1D 2.43%

5D 2.70%

Buy Vol. 60,472,514

Sell Vol. 59,879,337

24,400

1D -0.41%

5D 1.88%

Buy Vol. 43,973,641

Sell Vol. 44,510,028

26,300

1D 3.95%

5D 4.99%

Buy Vol. 13,983,889

Sell Vol. 13,336,420

18,150

1D 0.83%

5D 1.11%

Buy Vol. 36,257,742

Sell Vol. 40,509,973

29,000

1D 0.35%

5D -0.68%

Buy Vol. 12,398,734

Sell Vol. 11,444,027

21,200

1D 2.91%

5D 0.95%

Buy Vol. 9,659,786

Sell Vol. 7,025,248

24,550

1D 1.66%

5D 1.45%

Buy Vol. 18,523,222

Sell Vol. 15,669,268

11,150

1D 0.45%

5D 0.45%

Buy Vol. 26,566,275

Sell Vol. 33,109,166

21,800

1D -0.46%

5D -0.68%

Buy Vol. 2,985,418

Sell Vol. 4,136,301

BID: In the first half of 2024, BIDV recorded an increase of VND221,000 billion in total assets, equivalent to a 10% increase from the beginning of the year to VND2.52 quadrillion, continuing to maintain the top position in terms of asset size in the commercial banking system at the present time.

OIL & GAS

79,900

1D 3.50%

5D 1.89%

Buy Vol. 6,029,143

Sell Vol. 5,053,720

13,450

1D 0.37%

5D -1.29%

Buy Vol. 11,679,904

Sell Vol. 15,913,865

45,900

1D -2.55%

5D 3.42%

Buy Vol. 5,553,885

Sell Vol. 5,453,070

GAS: In Q2, GAS recorded net revenue of over VND30,000 billion, up 25% yoy; gross profit was over VND5.7 trillion, up 23%.

VINGROUP

42,300

1D 0.24%

5D -3.04%

Buy Vol. 4,092,291

Sell Vol. 5,464,781

36,700

1D 0.00%

5D -7.69%

Buy Vol. 7,570,994

Sell Vol. 8,701,921

18,600

1D -0.80%

5D 9.15%

Buy Vol. 16,263,370

Sell Vol. 15,220,061

VIC: VEFAC, a subsidiary of Vingroup, recorded a Q2 profit of VND201 billion, down VND26 billion compared to the same period in 2023.

FOOD & BEVERAGE

71,600

1D 5.76%

5D 3.64%

Buy Vol. 51,648,906

Sell Vol. 33,083,604

74,100

1D -0.67%

5D 1.47%

Buy Vol. 5,257,160

Sell Vol. 8,353,124

55,400

1D 1.09%

5D 9.12%

Buy Vol. 1,687,941

Sell Vol. 1,856,582

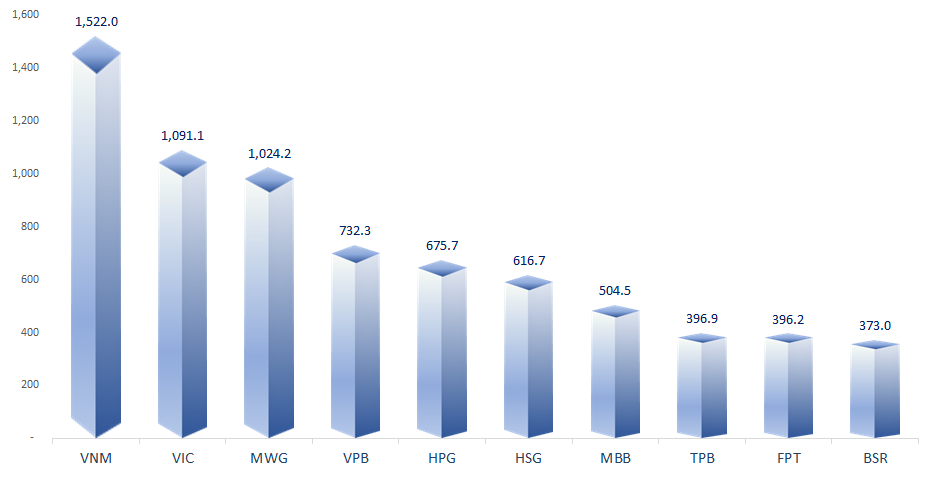

VNM: Vinamilk's consolidated revenue in Q2/2024 reached VND16,665 billion, increased 9.5% yoy and recorded the highest quarterly revenue in history.

OTHERS

73,000

1D -0.41%

5D 2.71%

Buy Vol. 1,543,023

Sell Vol. 1,991,206

43,600

1D 1.40%

5D -1.85%

Buy Vol. 1,266,156

Sell Vol. 1,351,073

105,900

1D 0.47%

5D 2.06%

Buy Vol. 624,210

Sell Vol. 626,743

128,600

1D 0.47%

5D 3.91%

Buy Vol. 5,277,697

Sell Vol. 4,552,580

63,800

1D 1.27%

5D 0.92%

Buy Vol. 14,578,802

Sell Vol. 20,495,960

33,000

1D -0.75%

5D -3.34%

Buy Vol. 4,609,178

Sell Vol. 6,463,720

31,800

1D -0.47%

5D -1.81%

Buy Vol. 12,469,931

Sell Vol. 19,549,055

27,200

1D -2.51%

5D 0.00%

Buy Vol. 41,379,089

Sell Vol. 43,804,059

HPG: The European Commission has received a complete application requesting an anti-dumping investigation on hot-rolled coil (HRC) steel products from Vietnam, with 2 companies being invloved including Hoa Phat and Formosa Ha Tinh.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

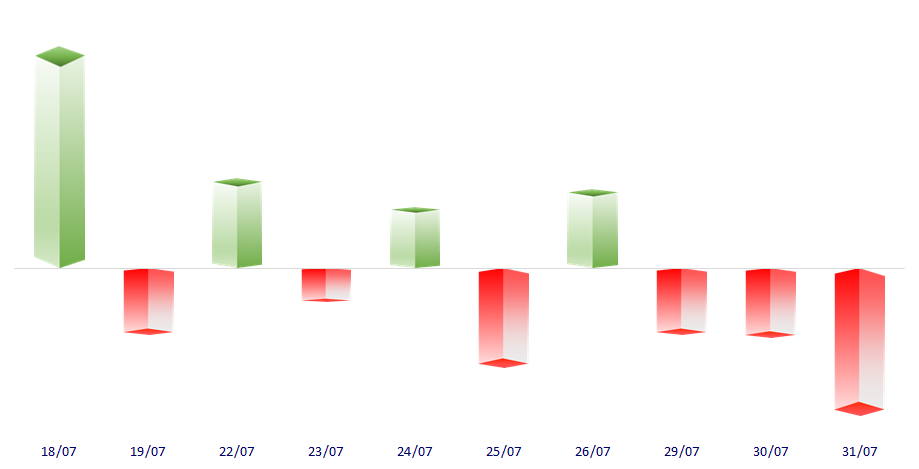

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

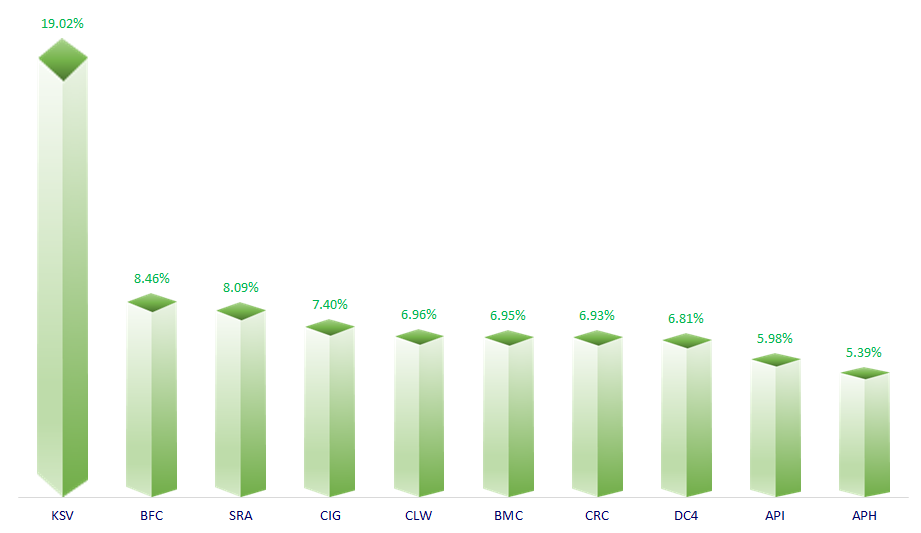

TOP INCREASES 3 CONSECUTIVE SESSIONS

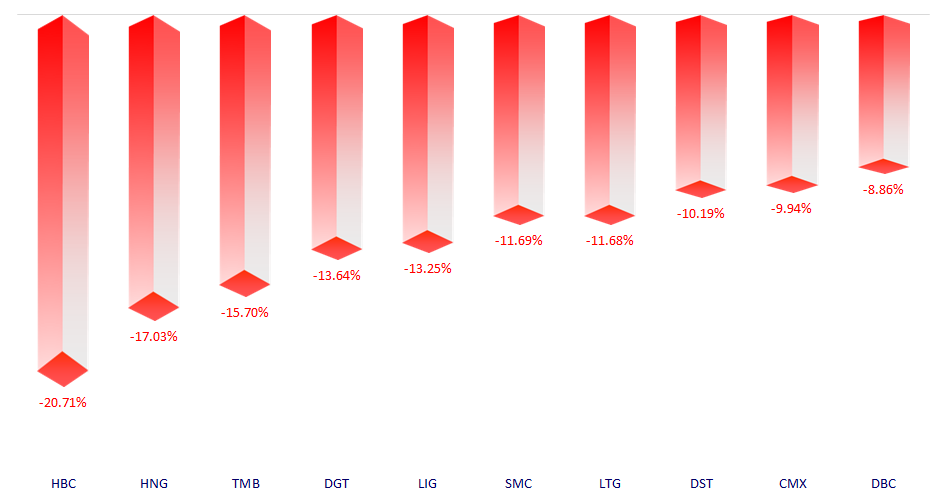

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.