Market brief 17/09/2024

VIETNAM STOCK MARKET

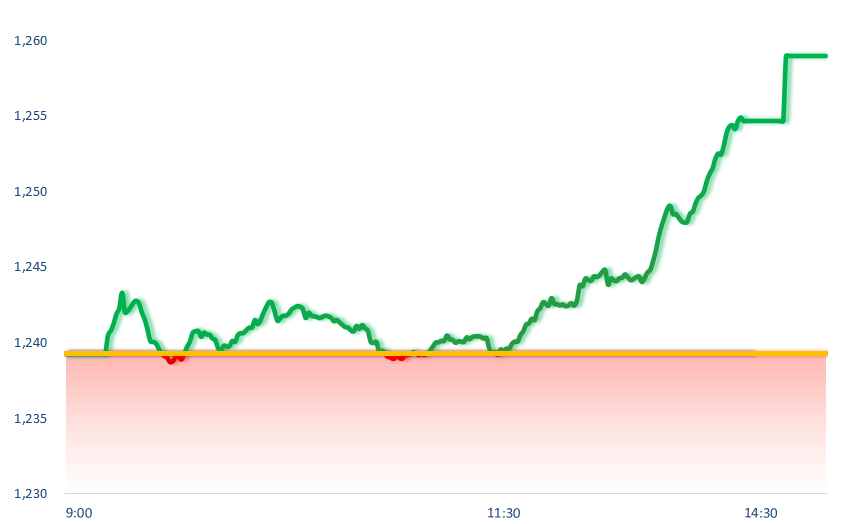

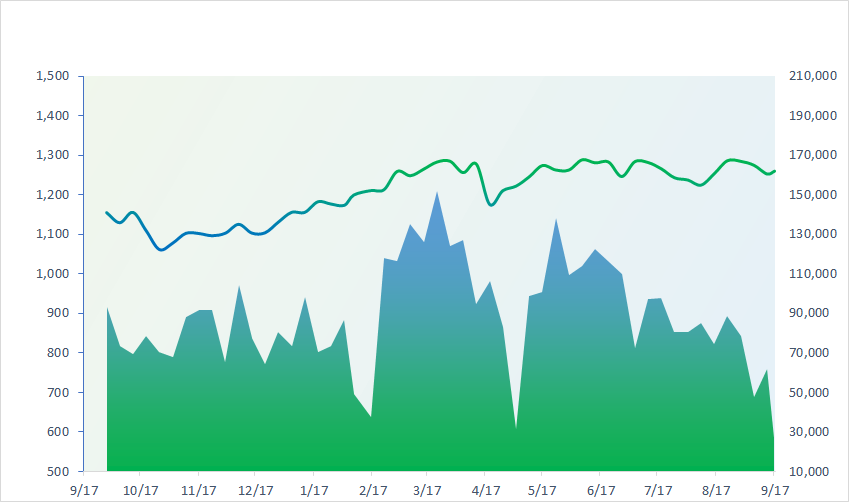

1,258.95

1D 1.59%

YTD 11.24%

232.30

1D 0.63%

YTD 1.00%

1,303.65

1D 1.74%

YTD 15.20%

93.12

1D 0.59%

YTD 6.33%

522.54

1D 0.00%

YTD 0.00%

15,091.63

1D 2.39%

YTD -20.14%

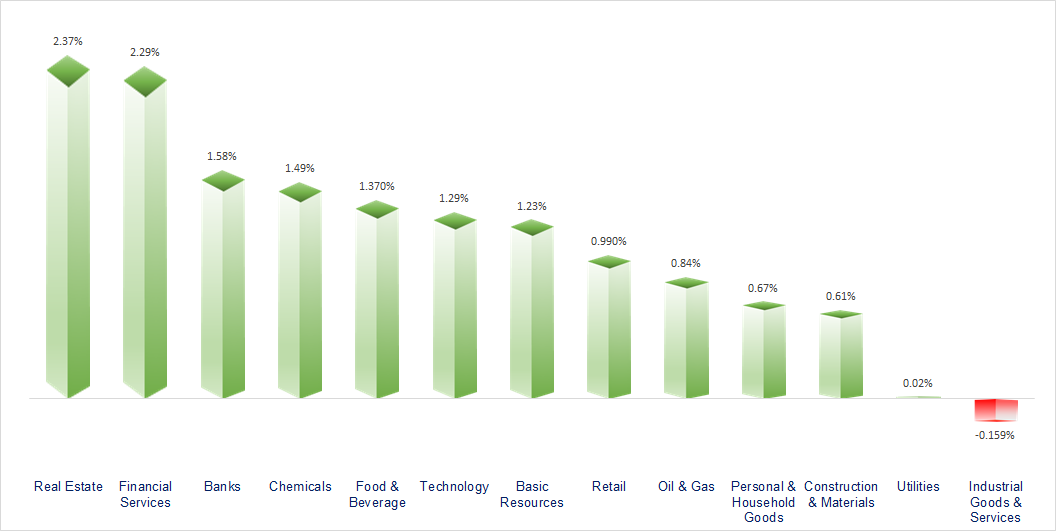

VNIndex recovered strongly thanks to foreign net buying. Almost all sectors increased today, in which real estate, financial services and banking were the most positive.

ETF & DERIVATIVES

22,820

1D 1.24%

YTD 16.85%

15,680

1D 0.84%

YTD 16.58%

16,200

1D 0.31%

YTD 16.88%

19,500

1D 1.19%

YTD 14.84%

20,500

1D 0.99%

YTD 11.41%

32,990

1D 1.57%

YTD 26.74%

17,410

1D 0.06%

YTD 14.01%

1,306

1D 1.86%

YTD 0.00%

1,307

1D 1.82%

YTD 0.00%

1,302

1D 1.85%

YTD 0.00%

1,302

1D 1.29%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

36,203.22

1D -1.03%

YTD 8.19%

2,704.09

1D 0.00%

YTD -8.72%

17,660.02

1D 1.37%

YTD 5.19%

2,575.41

1D 0.00%

YTD -3.54%

83,079.66

1D 0.09%

YTD 15.56%

3,592.45

1D 0.76%

YTD 11.22%

1,436.60

1D 0.07%

YTD 0.22%

72.50

1D -0.66%

YTD -5.88%

2,572.82

1D -0.34%

YTD 23.89%

Asian stocks were mixed ahead of a key Fed meeting, while markets in South Korea and China remained closed for the Mid-Autumn Festival.

VIETNAM ECONOMY

3.23%

1D (bps) -21

YTD (bps) -37

4.60%

YTD (bps) -20

2.29%

1D (bps) -7

YTD (bps) 41

2.63%

1D (bps) -6

YTD (bps) 45

2479800.00%

1D (%) 0.32%

YTD (%) 1.18%

2818400.00%

1D (%) 0.82%

YTD (%) 2.95%

354200.00%

1D (%) 0.31%

YTD (%) 1.90%

The price of SJC gold bars in the context of world gold reaching a new record because investors are expecting a 50 basis point interest rate cut by the Fed at this week's meeting.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Quang Ninh determined to spend VND1,000 billion to overcome the damage after storm YAGI;

- Dong Nai set the time to announce the provincial planning and promote investment;

- The wave of increasing savings interest rates is spreading;

- Thailand approved a plan to distribute USD4.4 billion in cash to people;

- Microsoft spent USD60 billion to buy treasury stocks, increased dividends to 10%;

- Shipping rates plummeted as China's exports slowed down.

VN30

BANK

90,500

1D 1.80%

5D 1.69%

Buy Vol. 1,985,119

Sell Vol. 1,463,678

48,700

1D 1.99%

5D 0.41%

Buy Vol. 3,870,112

Sell Vol. 2,631,209

34,950

1D 0.87%

5D 0.00%

Buy Vol. 10,745,443

Sell Vol. 10,861,860

22,750

1D 2.48%

5D 2.25%

Buy Vol. 14,307,374

Sell Vol. 14,657,713

18,650

1D 1.63%

5D 2.75%

Buy Vol. 23,069,358

Sell Vol. 18,239,573

24,250

1D 1.46%

5D 2.11%

Buy Vol. 17,509,975

Sell Vol. 17,332,366

26,600

1D 1.53%

5D 1.14%

Buy Vol. 6,819,413

Sell Vol. 5,698,597

18,150

1D 0.83%

5D 1.97%

Buy Vol. 12,610,887

Sell Vol. 12,534,893

29,850

1D 1.02%

5D 2.23%

Buy Vol. 11,994,188

Sell Vol. 11,636,478

18,150

1D 0.83%

5D 1.40%

Buy Vol. 3,839,473

Sell Vol. 3,591,647

24,500

1D 1.45%

5D 1.03%

Buy Vol. 7,663,962

Sell Vol. 8,505,321

10,400

1D 1.46%

5D 0.97%

Buy Vol. 27,191,541

Sell Vol. 21,243,943

15,450

1D 1.31%

5D -9.12%

Buy Vol. 4,386,933

Sell Vol. 3,199,879

At the end of the trading session on September 17, all bank stocks listed on HoSE and HNX increased in price. Among them, many stocks had good increases such as TCB, VCB, BID,…

OIL & GAS

72,700

1D 0.14%

5D -5.01%

Buy Vol. 1,799,005

Sell Vol. 1,329,052

12,550

1D 2.03%

5D -3.46%

Buy Vol. 12,059,069

Sell Vol. 8,691,362

45,000

1D 0.00%

5D -3.02%

Buy Vol. 2,269,642

Sell Vol. 2,182,630

VPI forecasts that retail gasoline prices in the September 19 management period may remain the same or only decrease slightly.

VINGROUP

42,900

1D 2.02%

5D -0.23%

Buy Vol. 4,128,345

Sell Vol. 5,121,820

44,000

1D 5.39%

5D 2.80%

Buy Vol. 37,610,672

Sell Vol. 27,986,309

19,400

1D 2.65%

5D 1.04%

Buy Vol. 14,032,120

Sell Vol. 13,030,770

VIC: VinFast Auto officially accepts deposits for VF 3 cars in the Philippines.

FOOD & BEVERAGE

73,400

1D 2.09%

5D -2.00%

Buy Vol. 6,972,221

Sell Vol. 4,905,786

74,500

1D 2.19%

5D -0.93%

Buy Vol. 6,204,078

Sell Vol. 5,335,824

56,500

1D 1.25%

5D 2.17%

Buy Vol. 969,712

Sell Vol. 760,828

VNM: Vinamilk and FPT cooperate strategically to enhance comprehensive financial management with technology solutions.

OTHERS

71,400

1D 1.56%

5D -0.14%

Buy Vol. 587,778

Sell Vol. 592,363

42,850

1D 0.35%

5D -1.04%

Buy Vol. 866,851

Sell Vol. 421,249

105,000

1D 0.96%

5D 0.77%

Buy Vol. 964,133

Sell Vol. 1,299,938

132,900

1D 1.37%

5D 2.23%

Buy Vol. 4,285,123

Sell Vol. 4,802,876

66,800

1D 1.06%

5D -1.47%

Buy Vol. 15,782,187

Sell Vol. 12,121,753

35,600

1D 2.01%

5D 4.40%

Buy Vol. 6,053,013

Sell Vol. 5,857,374

32,700

1D 1.87%

5D 0.93%

Buy Vol. 18,122,921

Sell Vol. 15,884,838

25,250

1D 1.61%

5D 0.40%

Buy Vol. 24,033,873

Sell Vol. 24,880,187

HPG: According to the progress of Hoa Phat's Dung Quat 2 project, phase 1 is expected to have the first hot test product by the end of 2024 before officially operating in the first quarter of 2025.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

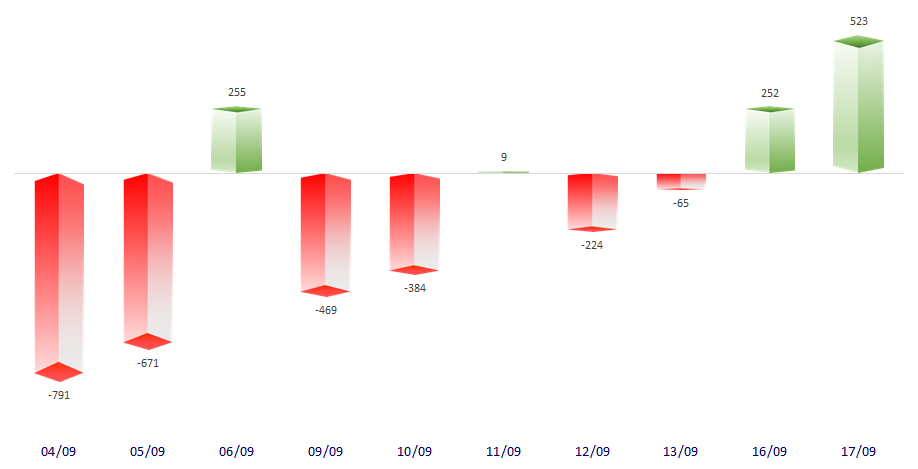

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

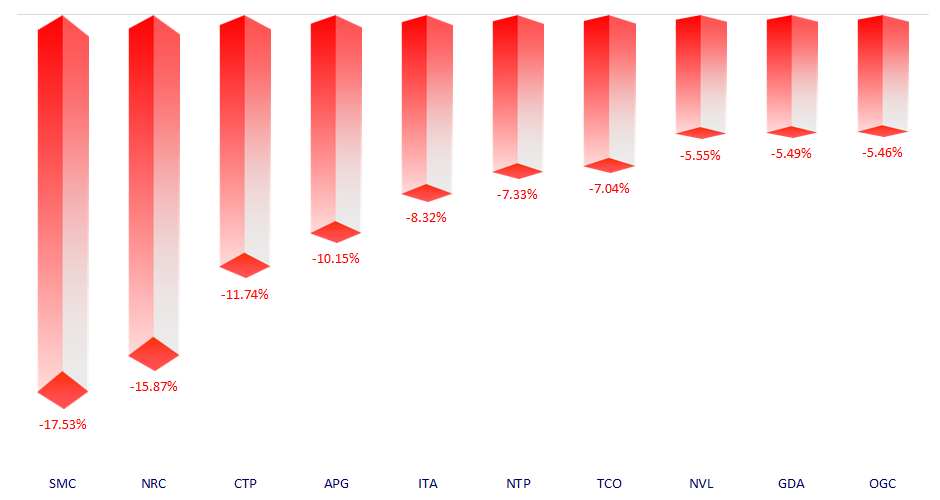

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.