Morning Brief 07/10/2024

GLOBAL MARKET

42,352.75

1D 0.81%

YTD 12.30%

5,751.07

1D 0.90%

YTD 21.26%

18,137.85

1D 1.22%

YTD 22.84%

19.21

1D -6.25%

8,280.63

1D -0.02%

YTD 7.24%

19,120.93

1D 0.55%

YTD 14.02%

7,541.36

1D 0.85%

YTD 0.14%

77.56

1D 0.00%

YTD 0.69%

2,648.70

1D -0.36%

YTD 27.54%

The DJIA posted a record closing high on Friday and the Nasdaq ended with a more than 1% gain as a stronger-than-expected jobs report reassured investors who had worried the economy may be getting too weak. U.S. job gains increased in September by the most in six months, and the unemployment rate fell to 4.1%, the report showed.

VIETNAM ECONOMY

3.72%

1D (bps) -28

YTD (bps) 12

4.60%

YTD (bps) -20

2.53%

1D (bps) -2

YTD (bps) 65

3.08%

1D (bps) -2

YTD (bps) 90

2494000.00%

1D (%) 0.06%

YTD (%) 1.75%

2795800.00%

1D (%) -0.42%

YTD (%) 2.13%

359900.00%

1D (%) 0.06%

YTD (%) 3.54%

According to data from the General Statistics Office, GDP in nine months of 2024 is estimated to increase by 6.82% over the same period last year, of which GDP in the third quarter reached 7.4%.

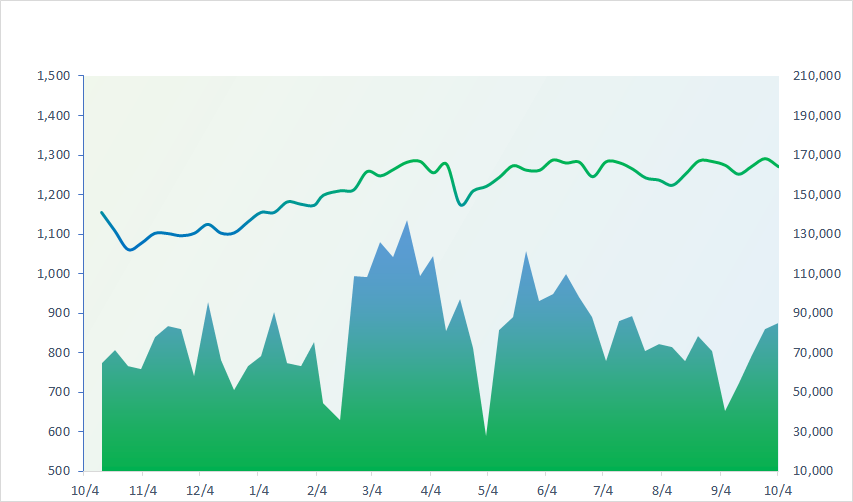

VIETNAM STOCK MARKET

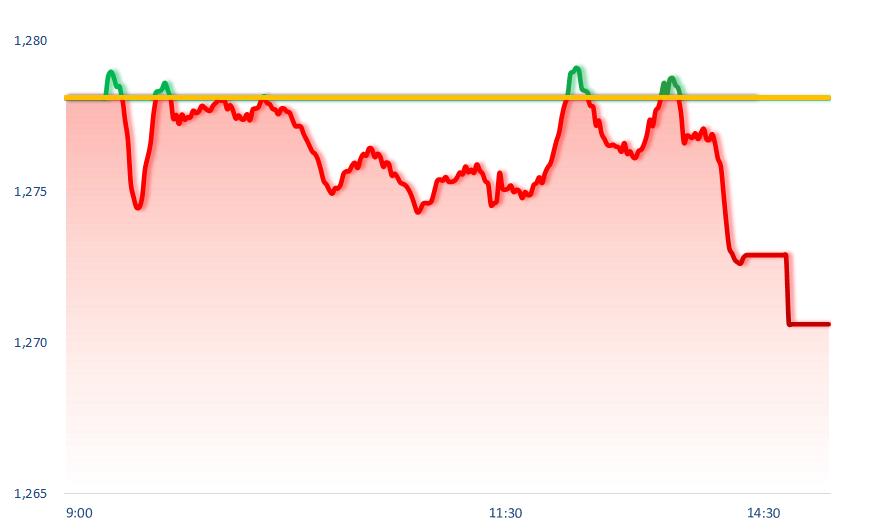

1,270.60

1D -0.59%

YTD 12.27%

232.67

1D -0.29%

YTD 1.17%

1,336.21

1D -0.76%

YTD 18.08%

92.37

1D -0.33%

YTD 5.47%

-707.73

15,413.63

1D -39.65%

YTD -18.43%

On October 4, most of the pillar stocks closed at the lowest level of the session. Strong selling pressure in the 1,300 point area caused VNIndex to fall through the MA10 and MA20 lines. Proprietary traders net bought VND484 billion, mainly including MBB VND62 billion, STB VND55 billion, VPB VND45 billion,...

INTRADAY

VN30 (12M)

SELECTED NEWS

- Credit growth as of September 27 reached 8.53%;

- Global pork production may fall in 2025;

- US initiates dual anti-dumping/anti-subsidy investigation into CORE steel imported from Vietnam;

- EU votes to impose additional tariffs on Chinese electric vehicles;

- Elon Musk joins Donald Trump at US election campaign rally;

- BMW urges Germany to oppose EU's tariff plan for Chinese electric vehicles.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.