Market brief 31/10/2024

VIETNAM STOCK MARKET

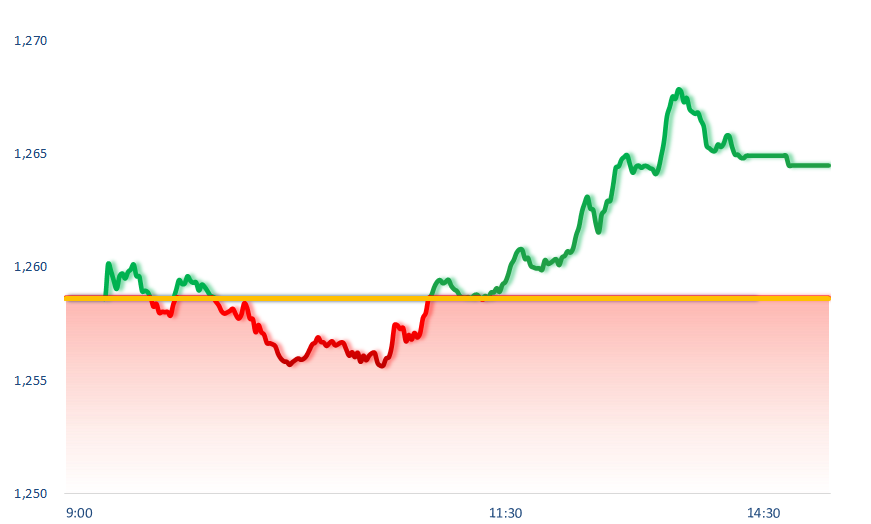

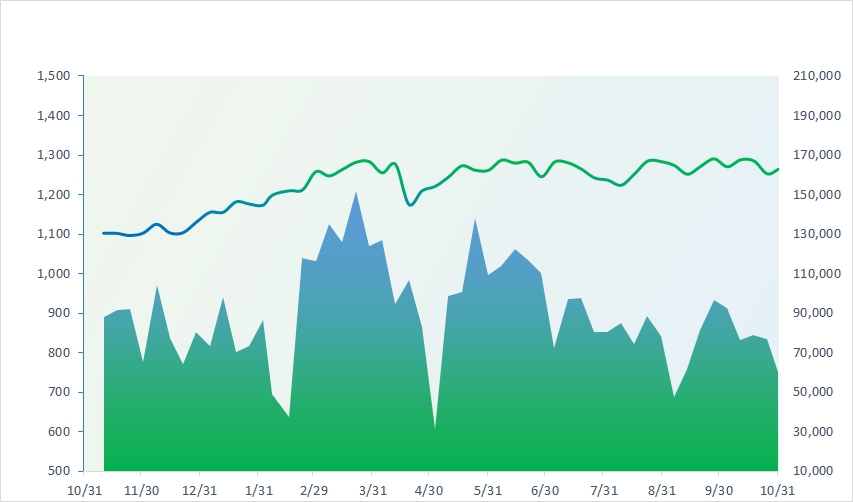

1,264.48

1D 0.46%

YTD 11.73%

226.36

1D 0.21%

YTD -1.58%

1,338.60

1D 0.36%

YTD 18.29%

92.38

1D -0.09%

YTD 5.48%

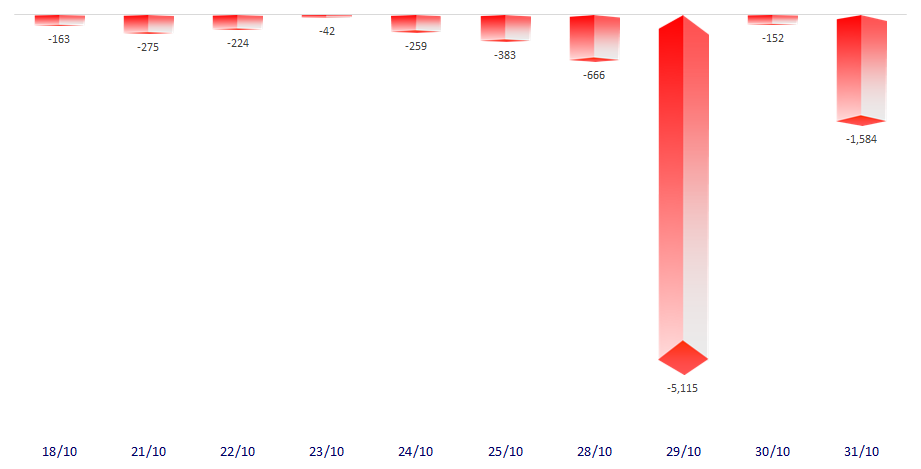

-1,584.16

1D 0.00%

YTD 0.00%

19,111.02

1D 35.30%

YTD 1.13%

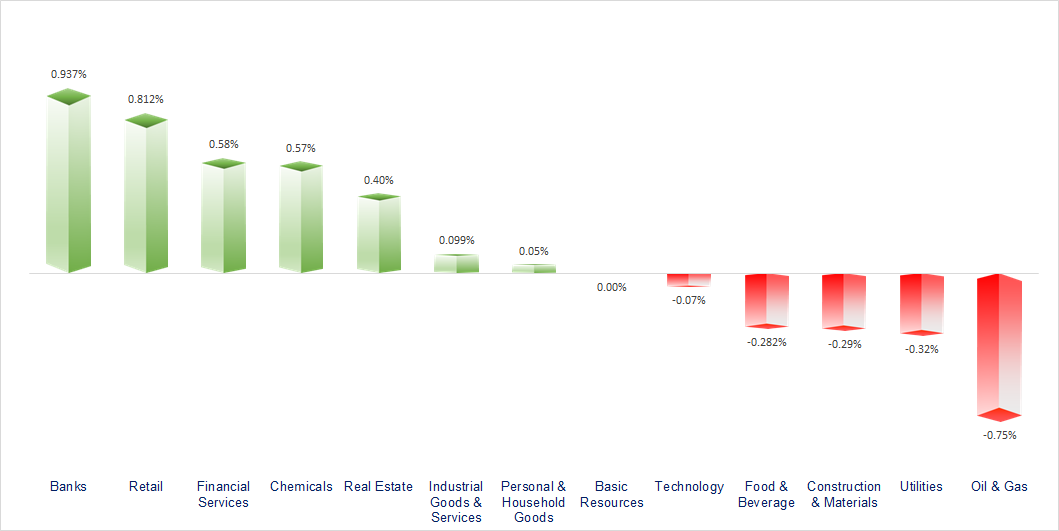

VNIndex increased when almost all enterprises announced their third quarter business results. Tourism, banking and chemicals were the most active sectors today. In contrast, oil & gas and food & beverage were quite gloomy.

ETF & DERIVATIVES

23,430

1D 0.34%

YTD 19.97%

16,140

1D 0.62%

YTD 20.00%

16,700

1D 0.78%

YTD 20.49%

19,980

1D -1.58%

YTD 17.67%

21,890

1D 0.78%

YTD 18.97%

33,300

1D 0.36%

YTD 27.93%

17,900

1D 0.73%

YTD 17.22%

1,344

1D 0.11%

YTD 0.00%

1,346

1D 0.18%

YTD 0.00%

1,347

1D 0.42%

YTD 0.00%

1,346

1D 0.10%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

39,081.25

1D -0.50%

YTD 16.79%

3,279.82

1D 0.42%

YTD 10.72%

20,317.33

1D -0.31%

YTD 21.02%

2,556.15

1D -1.45%

YTD -4.26%

79,444.98

1D -0.67%

YTD 10.51%

3,558.88

1D -0.17%

YTD 10.18%

1,466.04

1D 1.41%

YTD 2.28%

72.36

1D -0.03%

YTD -6.06%

2,776.23

1D -0.36%

YTD 33.68%

Asian stocks were mixed, with Japan's Nikkei 225 falling slightly after the Bank of Japan kept its benchmark interest rate at 0.25%, unchanged from its previous policy meeting. Chinese stocks rose as the country's manufacturing PMI rose to 50.1, beating Reuters' forecast.

VIETNAM ECONOMY

3.57%

1D (bps) -17

YTD (bps) -3

4.60%

YTD (bps) -20

2.07%

1D (bps) -18

YTD (bps) 19

2.63%

1D (bps) -1

YTD (bps) 46

2545500.00%

1D (%) -0.01%

YTD (%) 3.86%

2823200.00%

1D (%) 0.23%

YTD (%) 3.13%

362200.00%

1D (%) 0.06%

YTD (%) 4.20%

Domestic USD exchange rate this morning continued to record the fifth consecutive session of decrease at many banks. Of which, Vietcombank and VietinBank were the two banks with the most significant decrease, with 43 and 40 VND respectively in the buying direction.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Hanoi Chairman issues directive to boost public investment disbursement;

- FDI disbursement may reach record USD25 billion in 2024;

- Qatar's USD475 billion fund will expand investment in Vietnam;

- Samsung: Chip segment profits plunge 40% in Q3;

- US economy grows 2.8% in Q3, weaker than expected;

- Apple tests iPhone 17 production in India.

VN30

BANK

93,600

1D 2.07%

5D 2.07%

Buy Vol. 5,742,508

Sell Vol. 4,480,669

47,750

1D 0.10%

5D -0.52%

Buy Vol. 3,855,979

Sell Vol. 4,148,004

35,700

1D 2.73%

5D 2.44%

Buy Vol. 16,076,747

Sell Vol. 16,282,048

23,900

1D -0.42%

5D 1.06%

Buy Vol. 16,877,534

Sell Vol. 17,614,908

20,450

1D 0.99%

5D 2.25%

Buy Vol. 48,657,685

Sell Vol. 34,823,990

25,050

1D 0.20%

5D 1.42%

Buy Vol. 15,083,480

Sell Vol. 15,311,090

26,900

1D -1.10%

5D 0.00%

Buy Vol. 11,431,353

Sell Vol. 12,368,727

17,300

1D 0.29%

5D 1.47%

Buy Vol. 39,101,286

Sell Vol. 44,312,763

35,200

1D 1.15%

5D 5.39%

Buy Vol. 25,892,080

Sell Vol. 44,016,125

18,950

1D -0.26%

5D 2.43%

Buy Vol. 18,148,562

Sell Vol. 18,919,926

25,400

1D 1.20%

5D 1.60%

Buy Vol. 14,475,454

Sell Vol. 10,952,456

10,600

1D 0.95%

5D 0.47%

Buy Vol. 37,814,208

Sell Vol. 29,413,805

16,550

1D 0.30%

5D -0.60%

Buy Vol. 3,466,305

Sell Vol. 3,624,021

TPB: At the end of the third quarter, Tien Phong Commercial Joint Stock Bank (TPBank) achieved more than VND5,460 billion in profit, credit growth was healthy at 14%, entering the Top 100 of Brand Finance with a brand value of USD461 million.

OIL & GAS

70,500

1D -0.14%

5D -0.70%

Buy Vol. 1,041,354

Sell Vol. 1,128,259

11,950

1D -0.83%

5D -1.24%

Buy Vol. 9,184,064

Sell Vol. 13,814,750

41,100

1D -0.72%

5D -1.56%

Buy Vol. 1,302,546

Sell Vol. 1,362,224

PLX: In the first 9 months of 2024, Petrolimex's pre-tax profit was VND3,200 billion, exceeding the annual profit plan by 10%.

VINGROUP

41,550

1D 1.34%

5D -1.19%

Buy Vol. 4,093,391

Sell Vol. 3,759,192

41,500

1D 0.85%

5D -5.36%

Buy Vol. 58,199,240

Sell Vol. 36,920,003

17,850

1D -1.92%

5D -1.65%

Buy Vol. 12,478,641

Sell Vol. 15,361,662

VIC: Vingroup reported a 9-month profit of VND4,069 billion, a sudden increase of 160% over the same period.

FOOD & BEVERAGE

66,100

1D -0.30%

5D -3.36%

Buy Vol. 9,558,393

Sell Vol. 8,898,630

76,600

1D -1.92%

5D -2.42%

Buy Vol. 19,588,855

Sell Vol. 17,493,359

55,200

1D 0.00%

5D -1.25%

Buy Vol. 828,284

Sell Vol. 1,194,827

VNM: Vinamilk reported a profit after tax of more than VND2,400 billion in the third quarter of 2024, deposited more than USD1 billion in idle money in the bank.

OTHERS

67,100

1D 1.05%

5D 1.98%

Buy Vol. 299,863

Sell Vol. 379,267

43,000

1D 0.12%

5D -1.04%

Buy Vol. 563,847

Sell Vol. 344,528

105,000

1D 1.06%

5D 0.77%

Buy Vol. 1,023,846

Sell Vol. 937,173

135,900

1D 0.00%

5D 1.19%

Buy Vol. 2,503,335

Sell Vol. 2,598,252

66,500

1D 0.76%

5D 1.68%

Buy Vol. 10,520,177

Sell Vol. 13,647,526

32,900

1D 0.61%

5D 0.00%

Buy Vol. 3,165,409

Sell Vol. 3,711,190

26,600

1D 0.95%

5D -0.75%

Buy Vol. 20,302,265

Sell Vol. 13,816,333

26,900

1D -0.37%

5D 1.70%

Buy Vol. 23,325,712

Sell Vol. 28,298,472

HPG: By the end of the third quarter, Hoa Phat had poured more than VND52,000 billion into the Dung Quat 2 project, an increase of more than VND10,000 billion after 1 quarter.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

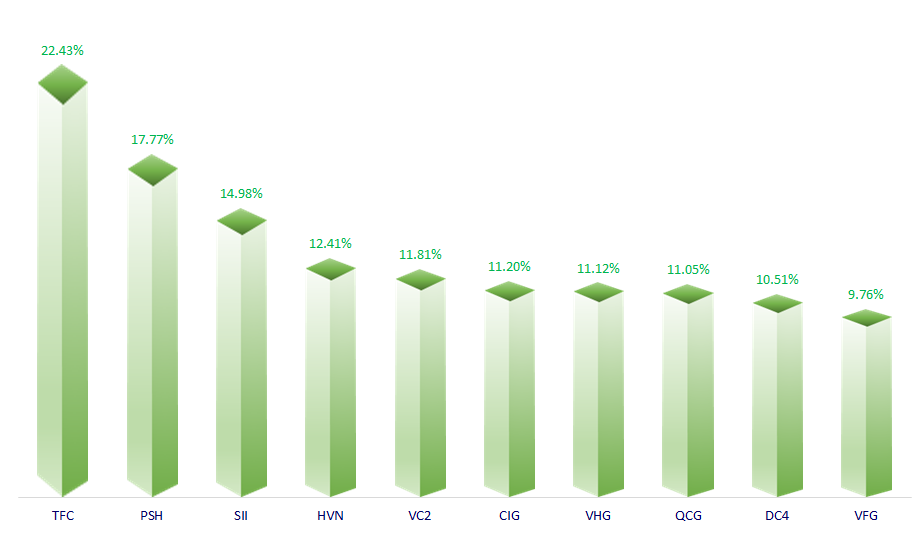

TOP INCREASES 3 CONSECUTIVE SESSIONS

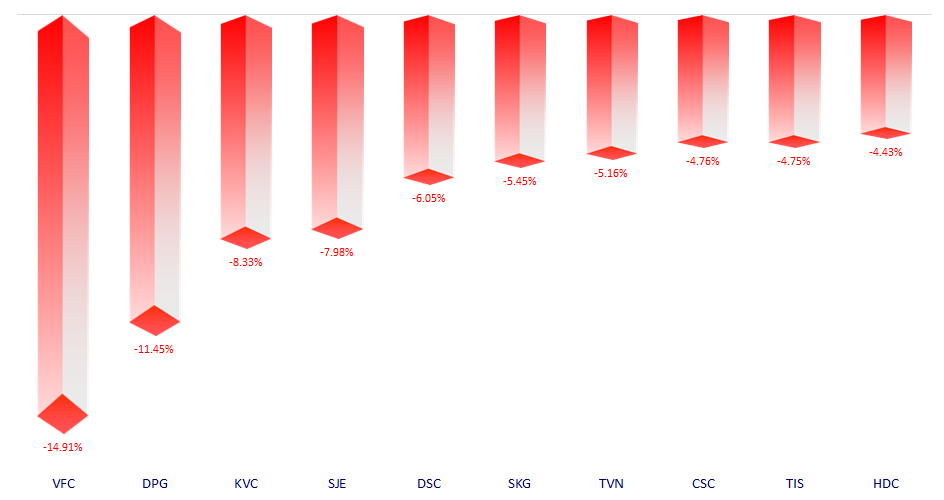

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.