Morning Brief 05/11/2024

GLOBAL MARKET

41,794.60

1D -0.61%

YTD 10.82%

5,712.69

1D -0.28%

YTD 20.45%

18,179.98

1D -0.33%

YTD 23.12%

21.98

1D 0.46%

8,184.24

1D 0.09%

YTD 5.99%

19,147.85

1D -0.56%

YTD 14.18%

7,371.71

1D -0.50%

YTD -2.11%

73.94

1D 0.92%

YTD -2.68%

2,728.90

1D -0.13%

YTD 31.64%

U.S. stocks closed slightly lower after a choppy session on Monday, as investors prepared for a crucial week in which Americans will elect a new president and the Federal Reserve will announce its policy statement. Chip heavyweight Nvidia advanced 0.48%. On Friday, S&P Dow Jones Indices said the company would replace Intel in the Dow Jones. Intel shares slipped 2.93% to weigh on the DJIA.

VIETNAM ECONOMY

6.20%

1D (bps) 223

YTD (bps) 260

4.60%

YTD (bps) -20

2.19%

1D (bps) 12

YTD (bps) 31

2.57%

1D (bps) 27

YTD (bps) 39

2546500.00%

1D (%) 0.04%

YTD (%) 3.90%

2829976.00%

1D (%) 0.31%

YTD (%) 3.37%

360963.00%

1D (%) -0.26%

YTD (%) 3.84%

The U.S. dollar softened on Monday as investors treaded carefully hours before the U.S. presidential election. Oil prices climbed on OPEC+'s decision for a month's delay in plans to increase output.

VIETNAM STOCK MARKET

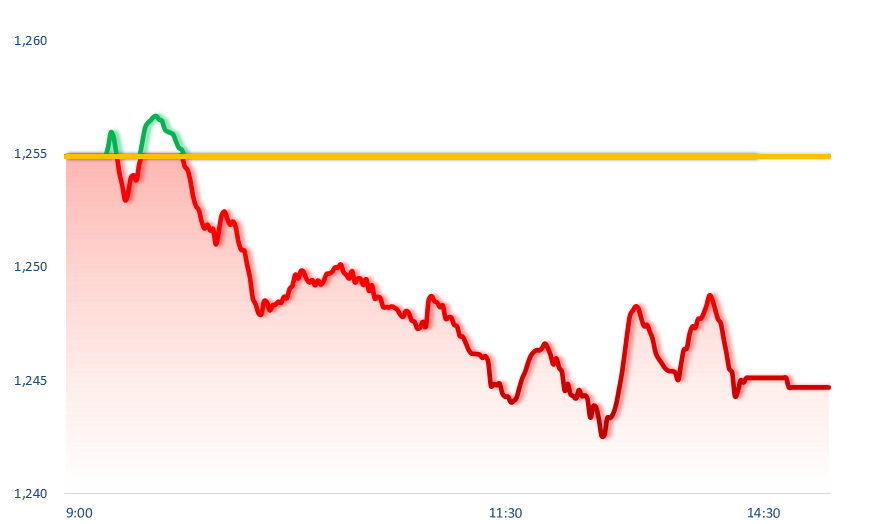

1,244.71

1D -0.81%

YTD 9.98%

224.45

1D -0.43%

YTD -2.41%

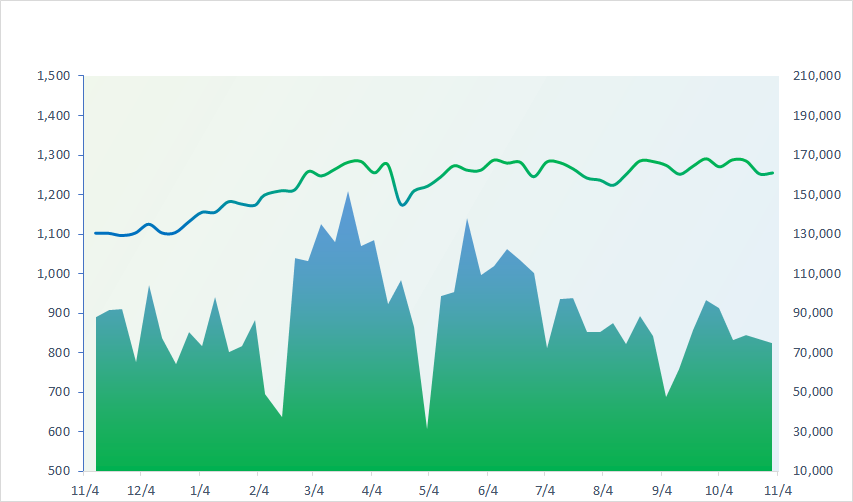

1,312.64

1D -0.98%

YTD 15.99%

91.61

1D -0.38%

YTD 4.60%

-684.63

17,009.14

1D 6.36%

YTD -9.99%

The market plunged ahead of the US Presidential election. VNIndex fell below the MA200 support level, approaching the bottom in September. Proprietary traders net sold VND34 billion, mainly including MSN VND30 billion, PNJ VND26 billion.

INTRADAY

VN30 (12M)

SELECTED NEWS

- FTSE Russell and Morgan Stanley work with the State Securities Commission on upgrading Vietnam's stock market;

- Proposal to continue reducing environmental tax on gasoline until the end of 2025;

- Continue to seek investors for the urban area in Me Linh worth VND3,200 billion;

- Europe is preparing for possible transatlantic breakdown in case of Trump's victory;

- Where the UK's wealthiest are fleeing ahead of Reeves's budget;

- 5 most important economic impacts from US presidential election results.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.