Morning Brief 06/11/2024

GLOBAL MARKET

42,221.88

1D 1.02%

YTD 11.95%

5,782.76

1D 1.23%

YTD 21.93%

18,439.17

1D 1.43%

YTD 24.88%

20.49

1D -6.78%

8,172.39

1D -0.14%

YTD 5.84%

19,256.27

1D 0.57%

YTD 14.83%

7,407.15

1D 0.48%

YTD -1.64%

73.94

1D 0.27%

YTD -2.42%

2,728.90

1D 0.23%

YTD 31.94%

U.S. stocks closed sharply higher in a broad rally on Tuesday after data signaled a solid economy. The Institute for Supply Management said its non-manufacturing purchasing managers index, a gauge of the services sector, accelerated to 56.0 last month, its highest since August 2022, from 54.9 the prior month and above the 53.8 expected by economists polled by Reuters.

VIETNAM ECONOMY

5.65%

1D (bps) -55

YTD (bps) 205

4.60%

YTD (bps) -20

2.24%

1D (bps) 5

YTD (bps) 36

2.63%

1D (bps) 6

YTD (bps) 45

2546000.00%

1D (%) -0.02%

YTD (%) 3.88%

2829609.00%

1D (%) -0.01%

YTD (%) 3.36%

362362.00%

1D (%) 0.39%

YTD (%) 4.25%

Oil prices edged up about 1% on Tuesday with a storm expected to cut U.S. output in the Gulf of Mexico and as the U.S. dollar weakened on Election Day with polls showing America's presidential race exceptionally close.

VIETNAM STOCK MARKET

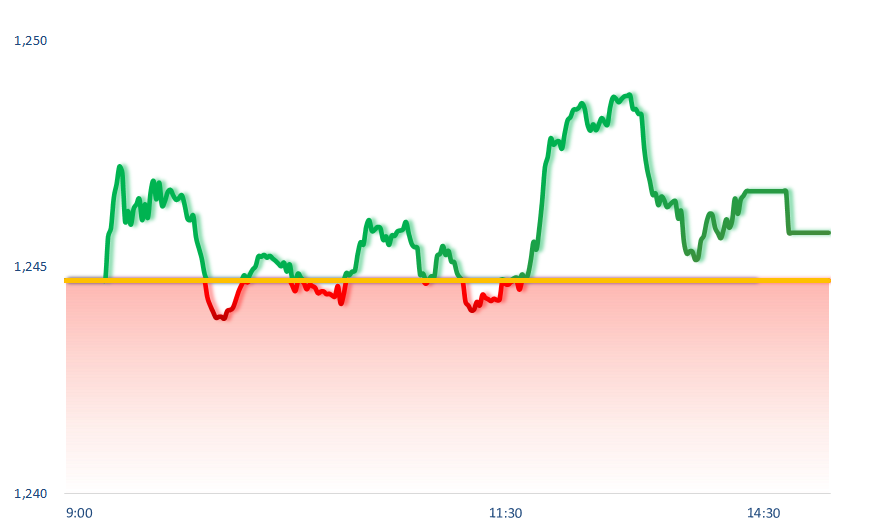

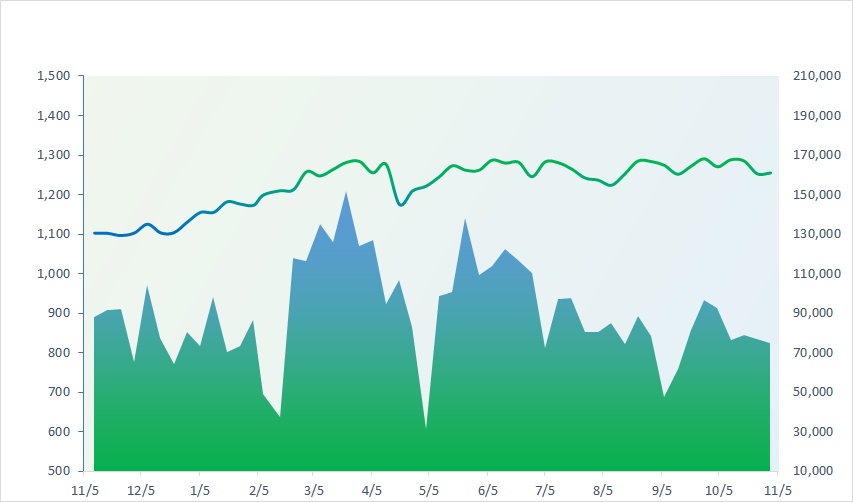

1,245.76

1D 0.08%

YTD 10.08%

224.86

1D 0.18%

YTD -2.23%

1,313.35

1D 0.05%

YTD 16.06%

91.90

1D 0.32%

YTD 4.93%

-869.78

12,021.67

1D -29.32%

YTD -36.38%

The market has been struggling to wait for the US election results. The financial services, oil and gas sectors were the most negative. Proprietary traders net sold VND515 billion, mainly including MWG VND123 billion, NLG VND120billion.

INTRADAY

VN30 (12M)

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.