Market brief 26/11/2024

VIETNAM STOCK MARKET

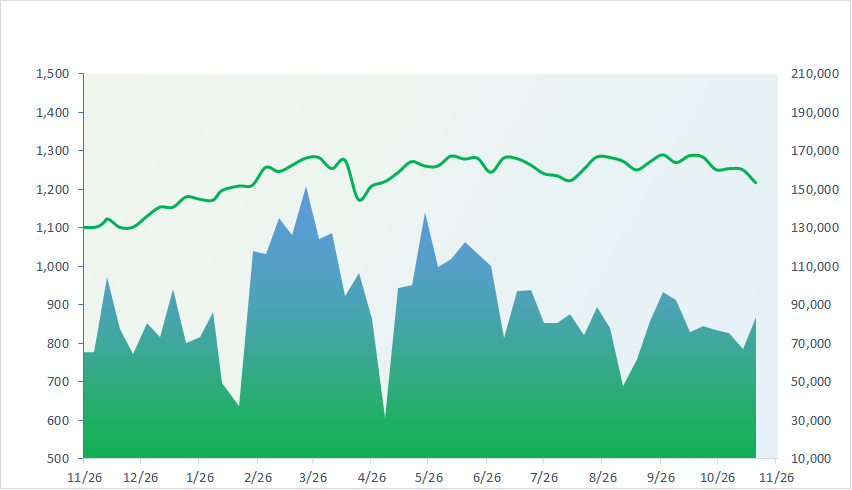

1,242.13

1D 0.60%

YTD 9.76%

223.70

1D -0.69%

YTD -2.73%

1,299.22

1D 0.56%

YTD 14.81%

92.06

1D 0.26%

YTD 5.12%

248.96

1D 0.00%

YTD 0.00%

14,830.42

1D -18.06%

YTD -21.52%

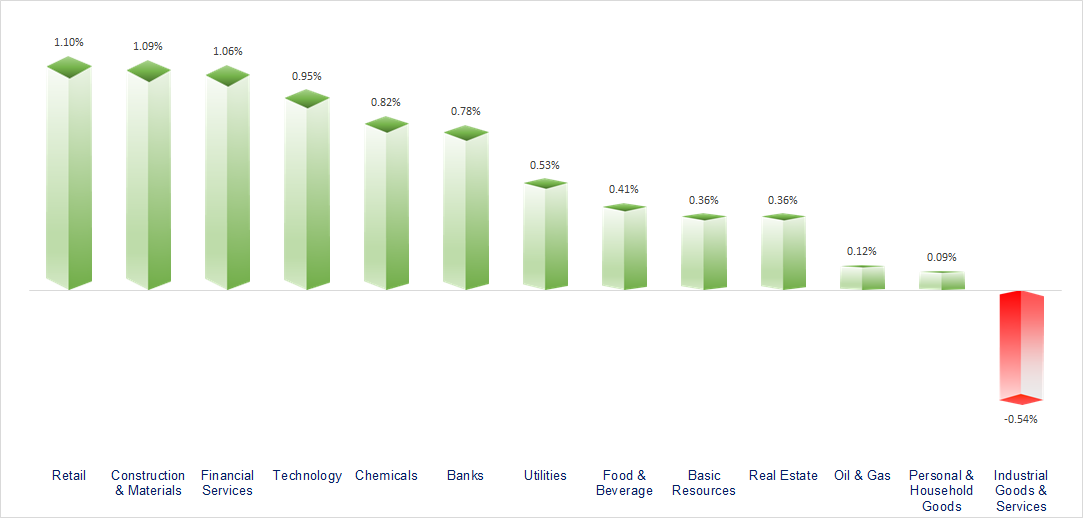

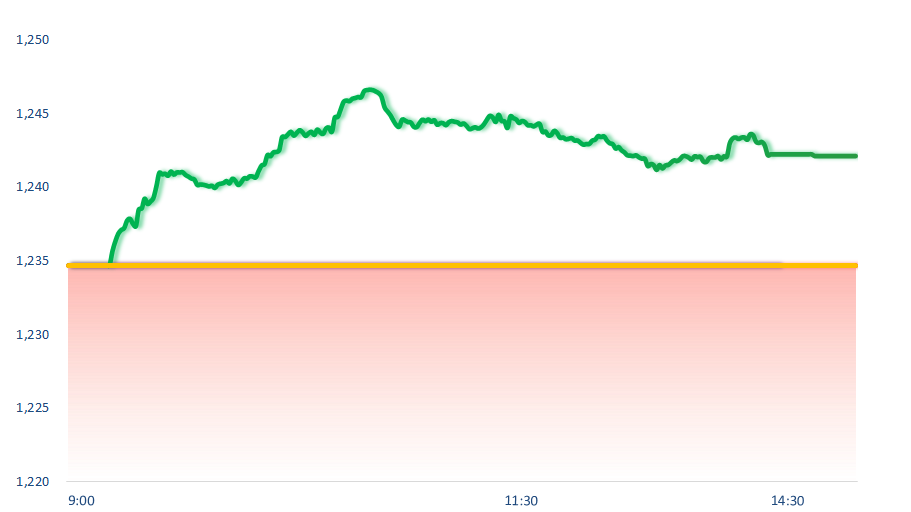

The VNINDEX showed very positive movement by breaking through the 1240 resistance level, however, it has not yet met the conditions to become a breakout session. The real estate, banking, and financial services sectors were the highlights of the market today. In contrast, the industrial goods and services sector showed weaker performance during the trading session.

ETF & DERIVATIVES

22,720

1D 0.62%

YTD 16.33%

15,770

1D 1.41%

YTD 17.25%

16,200

1D 1.00%

YTD 16.88%

19,400

1D 2.00%

YTD 14.25%

20,910

1D 0.77%

YTD 13.64%

32,090

1D 0.82%

YTD 23.28%

17,370

1D 0.64%

YTD 13.75%

1,307

1D 0.66%

YTD 0.00%

1,312

1D 0.55%

YTD 0.00%

1,313

1D 0.69%

YTD 0.00%

1,313

1D 0.56%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

38,442.00

1D -0.87%

YTD 14.88%

3,259.76

1D -0.12%

YTD 10.04%

19,159.20

1D 0.04%

YTD 14.12%

2,520.36

1D -0.55%

YTD -5.60%

79,992.63

1D -0.15%

YTD 11.27%

3,709.89

1D -0.58%

YTD 14.86%

1,437.56

1D -0.40%

YTD 0.29%

73.49

1D -1.51%

YTD -4.59%

2,622.60

1D -1.81%

YTD 26.28%

Today, the Asian stock markets were mostly in the red, with only Hong Kong maintaining a slight positive trend. According to the latest update, Japan has announced a 2.9% increase in the PPI services index compared to the same period last year, while Singapore reported a 1.2% rise in October manufacturing output, which was lower than analysts' forecasts.

VIETNAM ECONOMY

5.45%

1D (bps) -3

YTD (bps) 185

4.60%

YTD (bps) -20

2.24%

1D (bps) -4

YTD (bps) 36

2.58%

1D (bps) -7

YTD (bps) 40

2550900.00%

1D (%) 0.01%

YTD (%) 4.08%

2729736.00%

1D (%) -0.35%

YTD (%) -0.29%

356757.00%

1D (%) 0.04%

YTD (%) 2.63%

Global gold prices fell by more than 3% on November 25, ending a five-session rally that had reached the highest level in nearly three weeks as geopolitical risks eased. Similarly, domestic gold prices dropped by 2.2 million VND/tael on the buying side and VND1.7 million on the selling side. Specifically, SJC gold was trading at VND82.8 million for buying and VND85.3 million for selling.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Approval of an investment policy for a VND3,745 billion industrial park in Bac Giang;

- Nearly VND48,000 billion in budget funds expected for Metro Line 2 in Ho Chi Minh City;

- Vietnam and China promote cooperation and share information in the securities sector;

- Thailand: The automotive industry continues to see a sharp decline in production;

- The USD turns lower after Trump selects the US Treasury Secretary;

- HSBC: ASEAN will surpass Japan in economic size by 2029.

VN30

BANK

92,400

1D 1.20%

5D 2.67%

Buy Vol. 3,691,933

Sell Vol. 2,867,898

46,250

1D 1.54%

5D 3.70%

Buy Vol. 3,579,552

Sell Vol. 4,685,872

35,300

1D 0.57%

5D 5.85%

Buy Vol. 8,461,415

Sell Vol. 9,918,443

23,550

1D 0.21%

5D 5.13%

Buy Vol. 13,419,181

Sell Vol. 18,182,559

19,050

1D 0.00%

5D 2.97%

Buy Vol. 32,258,468

Sell Vol. 38,919,836

24,100

1D 0.63%

5D 4.10%

Buy Vol. 9,538,208

Sell Vol. 12,773,139

25,050

1D 1.42%

5D 1.62%

Buy Vol. 13,081,394

Sell Vol. 11,147,285

16,150

1D 0.00%

5D 2.22%

Buy Vol. 17,415,373

Sell Vol. 19,322,748

33,200

1D 1.07%

5D 3.91%

Buy Vol. 11,988,873

Sell Vol. 15,869,780

18,550

1D 0.27%

5D 2.77%

Buy Vol. 12,303,299

Sell Vol. 16,222,040

25,000

1D 0.40%

5D 2.88%

Buy Vol. 7,535,656

Sell Vol. 8,804,339

10,350

1D 0.49%

5D 2.48%

Buy Vol. 23,234,769

Sell Vol. 23,657,565

16,900

1D 0.30%

5D 0.00%

Buy Vol. 3,780,111

Sell Vol. 3,174,023

EIB: A group of shareholders holding more than 5% of Eximbank's shares has proposed the dismissal of Mr. Nguyen Ho Nam and Mrs. Luong Thi Cam Tu from their positions as members of the Board of Directors, with Mrs. Tu having previously served as the Chairman of the Board at the bank.

OIL & GAS

69,600

1D 0.43%

5D 2.50%

Buy Vol. 1,190,048

Sell Vol. 1,516,455

12,350

1D 1.65%

5D 10.27%

Buy Vol. 20,035,484

Sell Vol. 25,399,665

39,250

1D -0.38%

5D 2.48%

Buy Vol. 1,289,013

Sell Vol. 1,332,888

GAS: PV GAS and PV Power (POW) signed a contract for the first LNG shipment to supply the trial operation of the Nhon Trach 3 and Nhon Trach 4 power plants.

VINGROUP

41,050

1D 0.12%

5D 1.73%

Buy Vol. 2,076,884

Sell Vol. 3,247,977

42,400

1D -0.70%

5D 0.47%

Buy Vol. 7,707,501

Sell Vol. 12,807,694

18,300

1D 0.27%

5D 2.23%

Buy Vol. 10,807,915

Sell Vol. 12,642,339

VHM: Vinhomes has announced the results of its share buyback transaction. The company repurchased nearly 247 million of its own shares between October 23 and November 21.

FOOD & BEVERAGE

64,800

1D 0.78%

5D 2.86%

Buy Vol. 3,672,114

Sell Vol. 4,120,416

72,700

1D 0.69%

5D 3.86%

Buy Vol. 7,599,721

Sell Vol. 10,052,679

56,100

1D 1.08%

5D 2.00%

Buy Vol. 1,638,587

Sell Vol. 1,587,472

MSN: The CEO of Masan High-Tech Materials has resigned after 7 years with the company.

OTHERS

66,100

1D 0.61%

5D 3.28%

Buy Vol. 458,181

Sell Vol. 552,680

44,250

1D 0.00%

5D 1.72%

Buy Vol. 457,985

Sell Vol. 845,624

103,200

1D 0.39%

5D 1.47%

Buy Vol. 869,099

Sell Vol. 943,645

135,200

1D 0.97%

5D 4.00%

Buy Vol. 7,331,643

Sell Vol. 7,141,749

60,000

1D 1.69%

5D 4.35%

Buy Vol. 7,346,138

Sell Vol. 8,305,999

31,300

1D 1.29%

5D 2.96%

Buy Vol. 5,458,926

Sell Vol. 5,881,539

24,600

1D 0.41%

5D 3.14%

Buy Vol. 20,084,401

Sell Vol. 23,165,284

26,350

1D 0.19%

5D 3.54%

Buy Vol. 29,815,197

Sell Vol. 30,863,790

GVR: Due to a data copying error, GVR has had to revise its consolidated financial report for Q3 2024. GVR confirmed that this error does not affect the business results or any other figures on the balance sheet in the published financial report.

Market by numbers

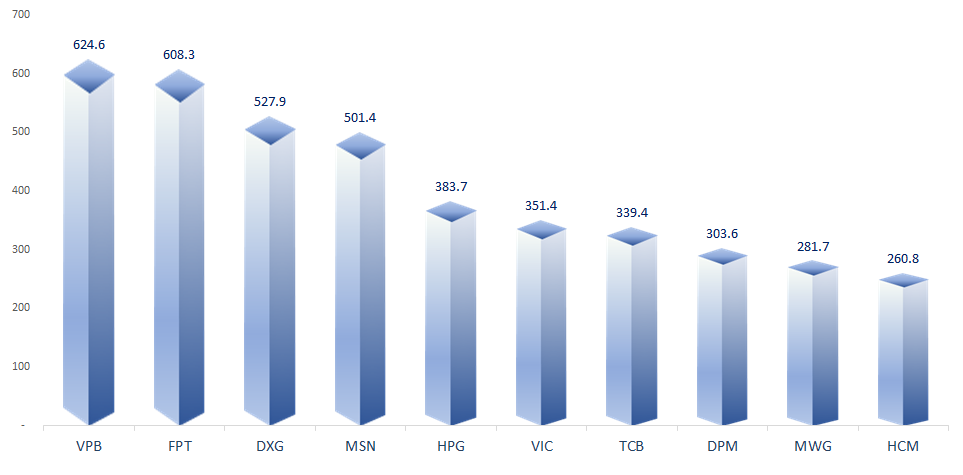

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

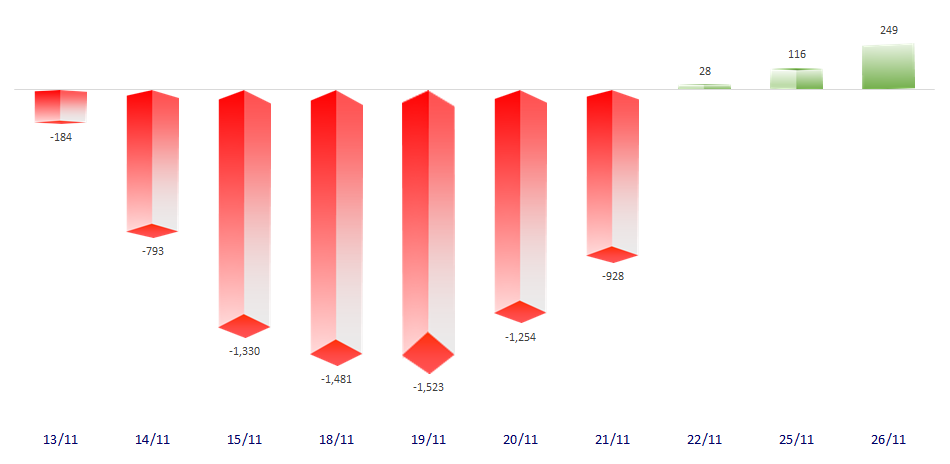

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

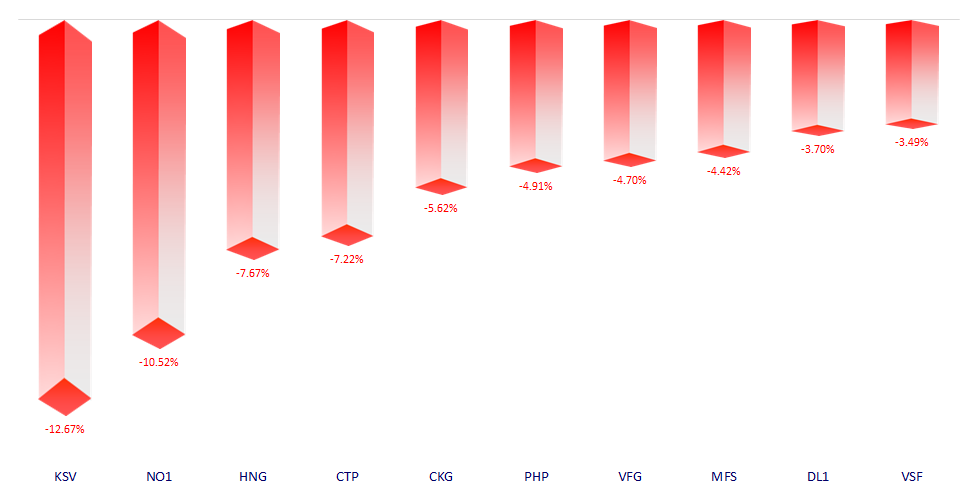

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.