Market brief 10/01/2025

VIETNAM STOCK MARKET

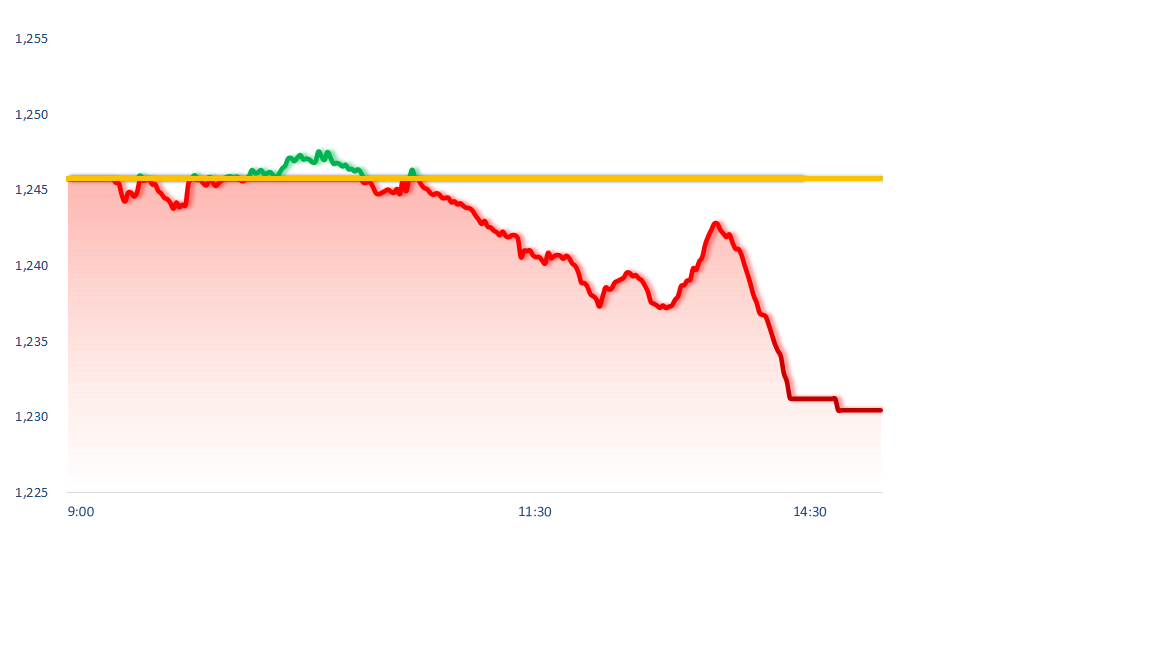

1,230.48

1D -1.23%

YTD -2.87%

219.49

1D -1.10%

YTD -3.49%

1,293.23

1D -1.34%

YTD -3.83%

92.15

1D -1.01%

YTD -3.06%

-286.27

1D 0.00%

YTD 0.00%

12,694.41

1D -29.98%

YTD -29.98%

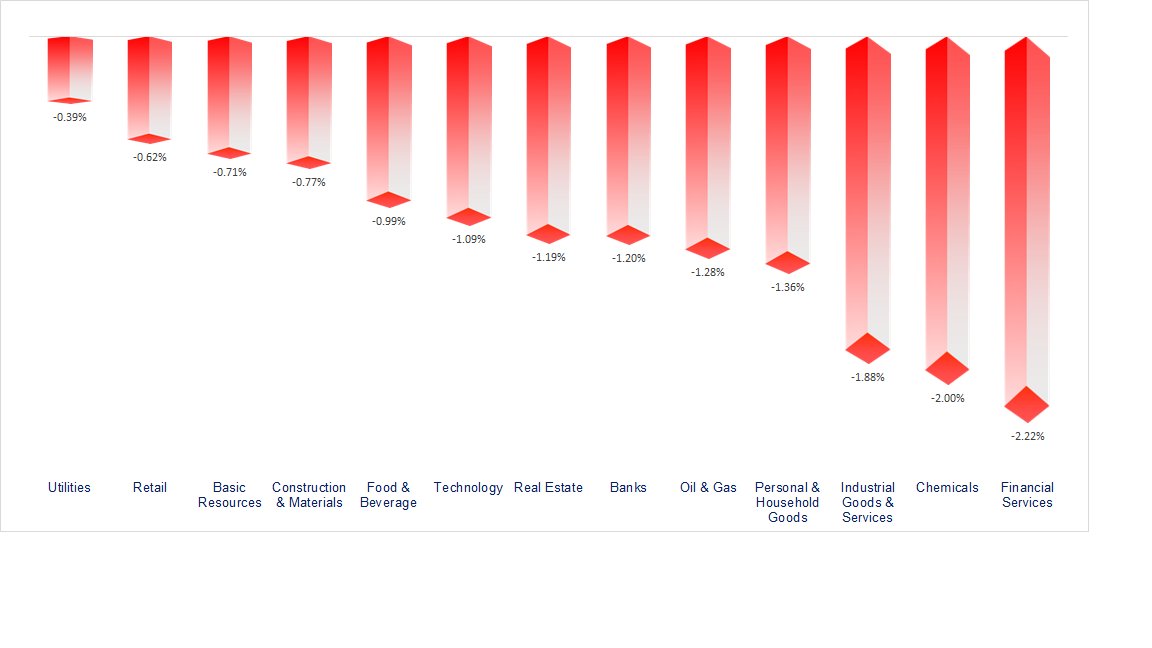

VNIndex plunged on a day when most of the global stock markets were sold off. The most negative sectors in the market were telecommunications, financial services and chemicals.

ETF & DERIVATIVES

22,680

1D -1.39%

YTD -3.41%

15,660

1D -0.89%

YTD -3.81%

16,200

1D -0.61%

YTD -2.99%

19,640

1D 0.41%

YTD -2.29%

21,300

1D 0.38%

YTD -3.62%

32,250

1D -0.92%

YTD -3.79%

17,420

1D -0.46%

YTD -2.79%

1,296

1D -1.08%

YTD 0.00%

1,301

1D -1.17%

YTD 0.00%

1,310

1D -0.87%

YTD 0.00%

1,312

1D -1.05%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

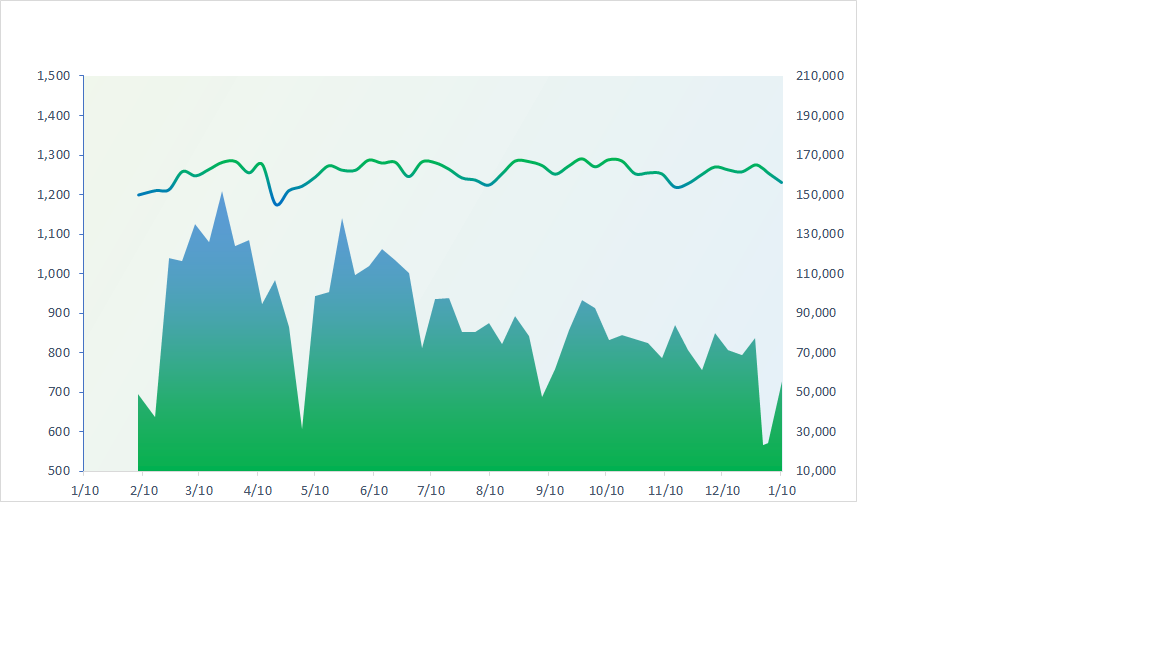

VNINDEX (12M)

GLOBAL MARKET

39,190.40

1D -1.05%

YTD -1.77%

3,168.52

1D -1.33%

YTD -5.47%

19,064.29

1D -0.92%

YTD -4.96%

2,515.78

1D -0.24%

YTD 4.85%

77,378.91

1D -0.38%

YTD -1.52%

3,801.56

1D -1.58%

YTD 0.37%

1,367.99

1D 0.37%

YTD -2.30%

78.73

1D 1.98%

YTD 4.90%

2,682.34

1D 0.44%

YTD 1.79%

Asian stocks were mostly in the red, led by the Nikkei 225, which lost more than 1%. Japanese household spending fell for a fourth straight month in April, which economists said could affect the Bank of Japan's interest rate target.

VIETNAM ECONOMY

4.76%

1D (bps) 41

YTD (bps) 79

4.60%

2.46%

1D (bps) 1

YTD (bps) -2

2.83%

1D (bps) 1

YTD (bps) -1

2554800.00%

1D (%) -0.02%

YTD (%) -0.01%

2688400.00%

1D (%) -0.06%

YTD (%) -1.40%

353000.00%

1D (%) 0.36%

YTD (%) -0.87%

The US dollar continued to rise as Treasury yields, despite adjusting, remained high on concerns about upcoming tariffs.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Ha Nam's GRDP growth highest in 5 years;

- 75% of European enterprises consider Vietnam an ideal investment destination;

- Son La races against time to disburse more than VND 4,300 billion in public investment capital;

- China is on the verge of deflation;

- Many Fed officials signal that interest rates will remain unchanged for a long time;

- Canada considers imposing retaliatory tariffs on the US after Donald Trump's remarks.

VN30

BANK

91,400

1D -0.54%

5D -0.65%

Buy Vol. 1,828,470

Sell Vol. 1,856,912

39,100

1D -2.13%

5D 2.36%

Buy Vol. 5,524,343

Sell Vol. 6,546,689

37,500

1D 0.27%

5D 0.81%

Buy Vol. 11,754,015

Sell Vol. 14,860,144

23,400

1D -2.30%

5D -0.85%

Buy Vol. 8,978,563

Sell Vol. 17,729,358

18,500

1D -1.07%

5D -1.33%

Buy Vol. 12,752,686

Sell Vol. 14,890,692

21,150

1D -1.63%

5D -1.53%

Buy Vol. 14,300,955

Sell Vol. 15,871,585

21,600

1D -3.36%

5D -11.66%

Buy Vol. 29,190,446

Sell Vol. 21,078,509

15,900

1D -1.24%

5D -1.85%

Buy Vol. 12,649,068

Sell Vol. 16,390,038

35,200

1D -3.30%

5D -2.49%

Buy Vol. 23,782,378

Sell Vol. 25,901,267

19,300

1D -0.77%

5D 0.78%

Buy Vol. 26,304,573

Sell Vol. 15,960,321

24,700

1D -1.00%

5D -1.59%

Buy Vol. 8,317,671

Sell Vol. 9,428,071

10,150

1D -0.98%

5D -0.98%

Buy Vol. 21,726,854

Sell Vol. 30,537,527

17,400

1D 2.05%

5D 3.57%

Buy Vol. 3,123,562

Sell Vol. 4,160,586

MBB: Sharing at the investor conference this afternoon (January 10), MBB Bank's board of directors announced preliminary business results for 2024. According to estimates from the bank, the parent bank's profit reached VND27,600 billion, up 12% over the previous year, consolidated profit reached VND28,800 billion, up nearly 10%.

OIL & GAS

66,700

1D -0.45%

5D -1.91%

Buy Vol. 950,951

Sell Vol. 1,017,571

11,650

1D -0.43%

5D -1.27%

Buy Vol. 9,004,223

Sell Vol. 13,511,670

38,100

1D -2.31%

5D -0.91%

Buy Vol. 1,334,720

Sell Vol. 2,206,845

POW: PV Power is about to receive over a hundred billion in dividends from Nhon Trach 2 Oil and Gas Power.

VINGROUP

40,500

1D -0.61%

5D 0.00%

Buy Vol. 3,296,574

Sell Vol. 2,995,028

40,000

1D -0.99%

5D 0.00%

Buy Vol. 3,722,565

Sell Vol. 6,374,174

16,850

1D -0.88%

5D -2.03%

Buy Vol. 13,813,028

Sell Vol. 16,979,063

VIC: VCCI cooperated with Vingroup, calling on 200,000 member businesses to prioritize using VinFast cars.

FOOD & BEVERAGE

61,300

1D -0.81%

5D -2.70%

Buy Vol. 2,672,637

Sell Vol. 2,783,770

65,500

1D -2.67%

5D -6.03%

Buy Vol. 4,271,862

Sell Vol. 5,155,726

53,600

1D 0.00%

5D -2.55%

Buy Vol. 724,682

Sell Vol. 904,229

SAB: SABECO has officially opened the SABECO Beer Research and Development Center (SRC).

OTHERS

70,000

1D -2.10%

5D -0.71%

Buy Vol. 782,899

Sell Vol. 959,648

49,500

1D 1.02%

5D -0.50%

Buy Vol. 1,705,479

Sell Vol. 1,561,101

98,600

1D -0.70%

5D -0.90%

Buy Vol. 615,217

Sell Vol. 869,941

147,300

1D -1.01%

5D -1.14%

Buy Vol. 3,653,773

Sell Vol. 5,077,494

57,500

1D -0.35%

5D -1.88%

Buy Vol. 5,296,676

Sell Vol. 6,468,000

28,000

1D -2.10%

5D -7.59%

Buy Vol. 2,350,005

Sell Vol. 2,625,176

23,700

1D -2.87%

5D -6.51%

Buy Vol. 30,928,114

Sell Vol. 33,758,076

25,550

1D -1.73%

5D -3.95%

Buy Vol. 21,321,518

Sell Vol. 28,355,721

SSI: SSI still held the 2nd position in brokerage market share in 2024 on the HoSE floor with a proportion of 9.18%, but significantly lower than in 2023 (10.44%). This is the largest market share decrease in this top 10.

Market by numbers

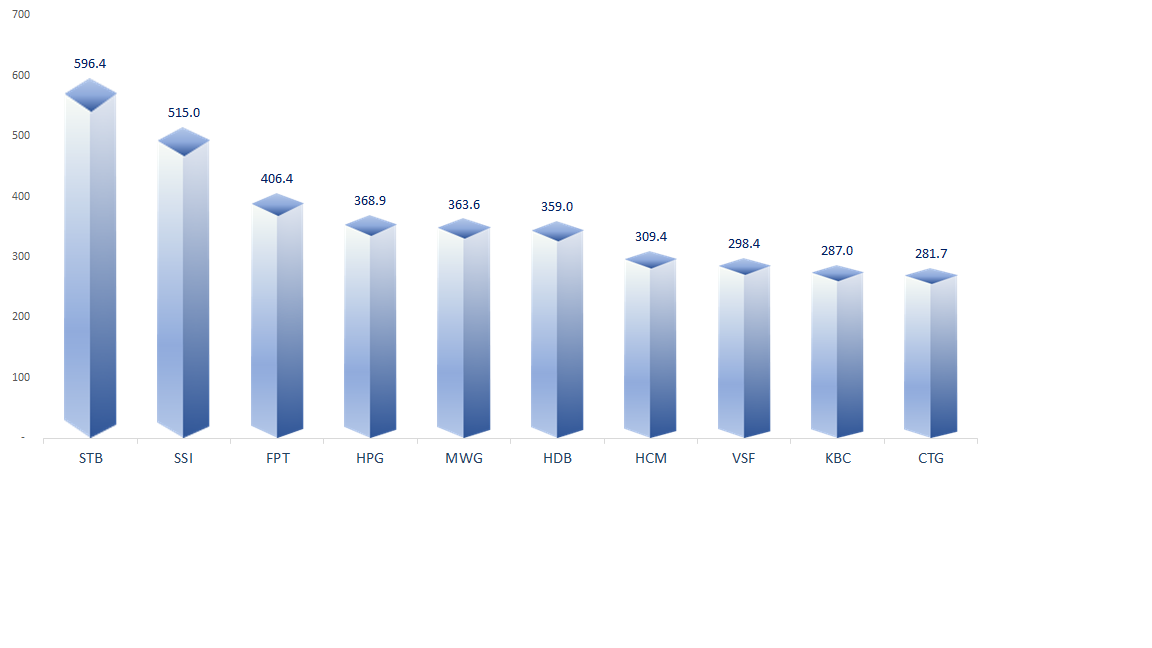

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

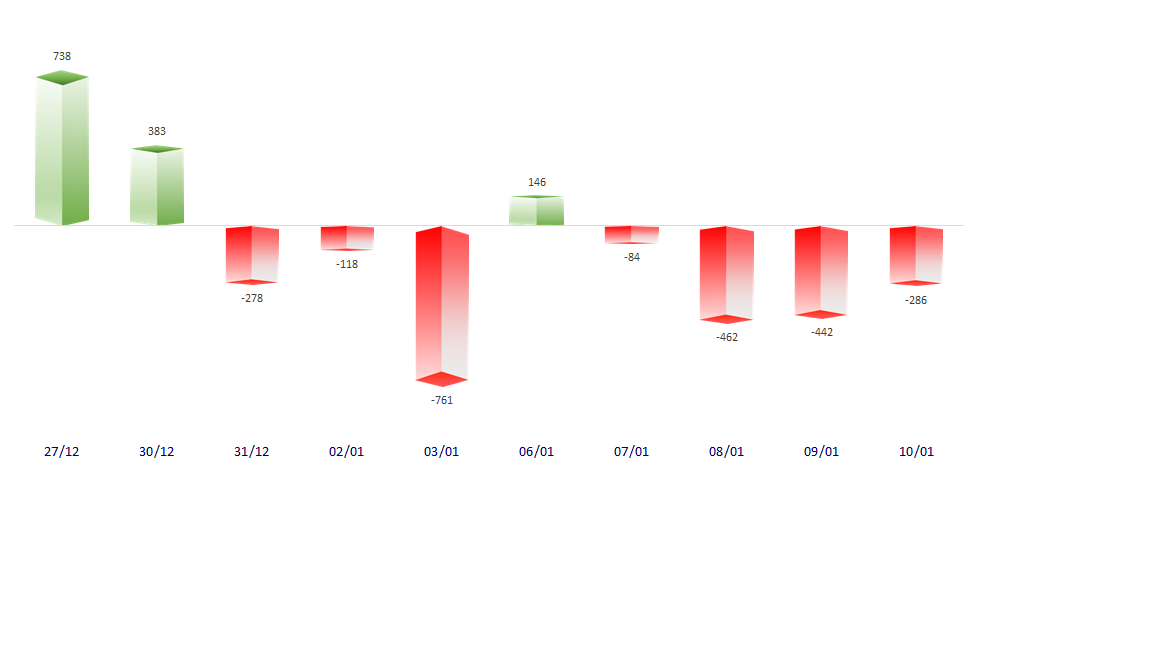

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

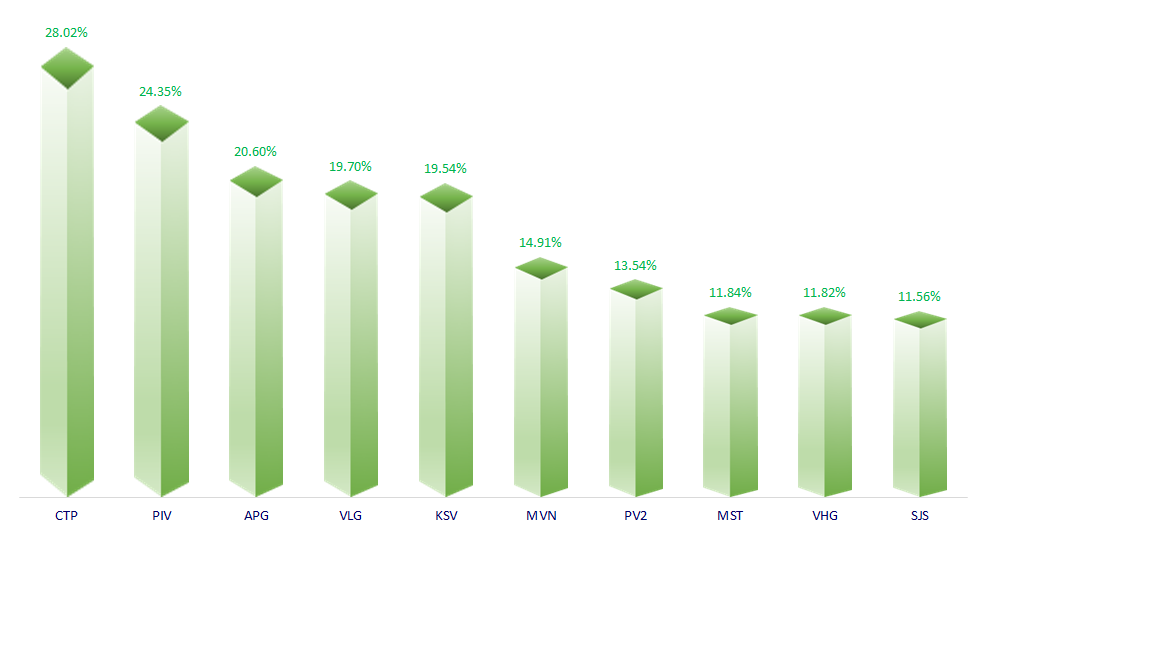

TOP INCREASES 3 CONSECUTIVE SESSIONS

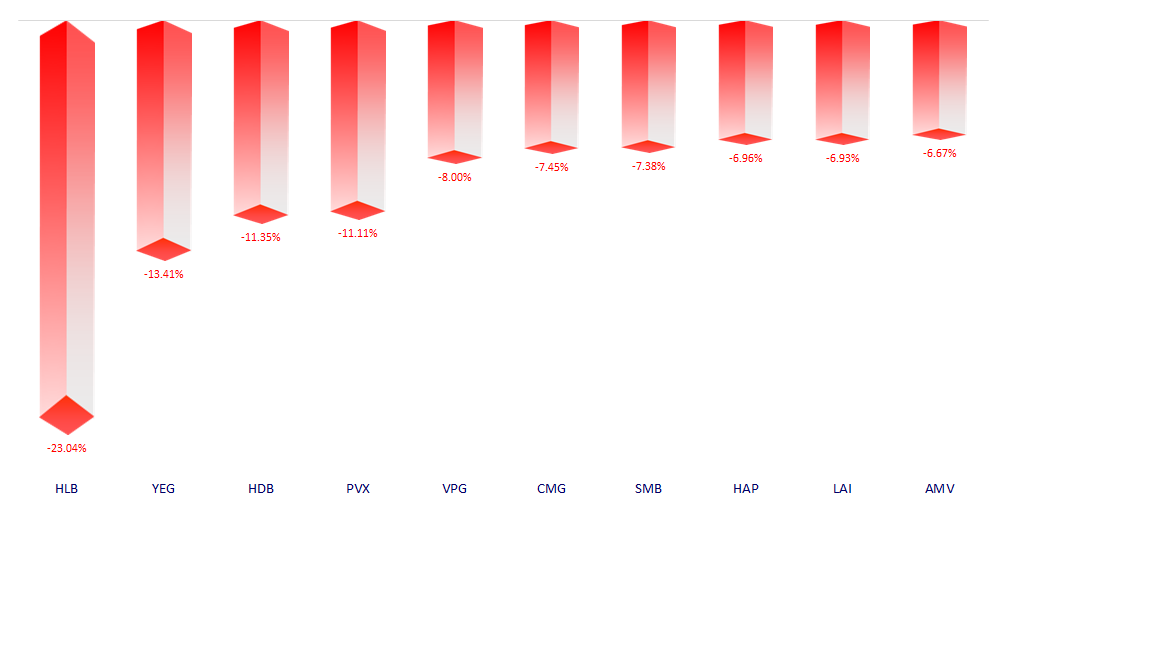

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.