Morning brief 22/08/2025

GLOBAL MARKET

44,785.50

1D -0.34%

YTD 5.27%

6,370.16

1D -0.40%

YTD 8.31%

21,100.31

1D -0.34%

YTD 9.27%

16.60

1D 5.80%

9,309.20

1D 0.23%

YTD 13.90%

24,293.34

1D 0.07%

YTD 22.02%

7,938.29

1D -0.44%

YTD 7.55%

67.50

1D 0.85%

YTD -10.06%

3,337.92

1D -0.18%

YTD 26.67%

U.S. stocks extended losses on Thursday (August 21), with the S&P 500 marking its fifth straight decline amid mixed macroeconomic data on initial jobless claims and the Purchasing Managers’ Index (PMI). All eyes are now on Fed Chair Jerome Powell’s speech at the annual Jackson Hole Economic Symposium, where he may provide deeper insights into the interest rate path and help ease lingering inflation concerns. According to the CME FedWatch tool, markets are currently pricing in nearly a 74% probability of a Fed rate cut at the September 2025 policy meeting.

VIETNAM ECONOMY

4.56%

1D (bps) 68

YTD (bps) 59

4.60%

2.93%

1D (bps) -5

YTD (bps) 46

3.37%

1D (bps) 3

YTD (bps) 52

26,536

1D (%) 0.06%

YTD (%) 3.86%

31,606

1D (%) 0.46%

YTD (%) 15.92%

3,741

1D (%) 0.37%

YTD (%) 5.06%

In Vietnam’s domestic commodity and currency markets on the afternoon of August 21, SJC gold set a new record high at 125.4 million VND/tael. The USD/VND exchange rate continued its upward momentum, establishing a new level above VND 26,500.

VIETNAM STOCK MARKET

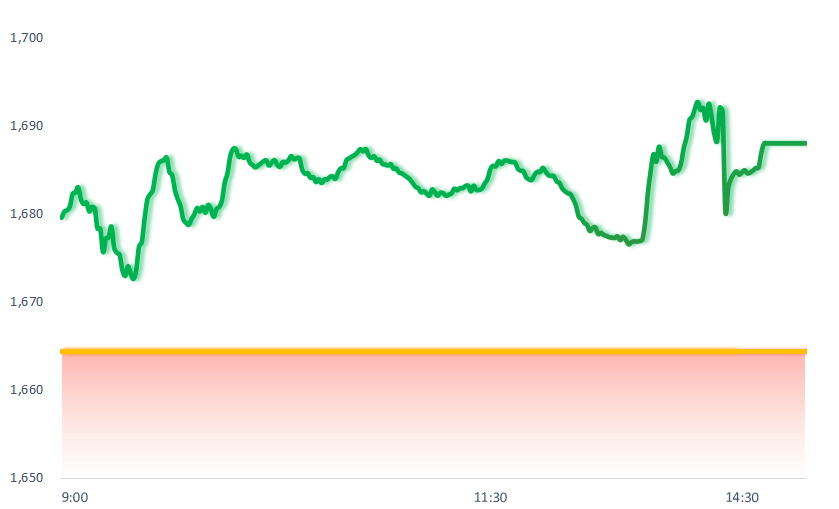

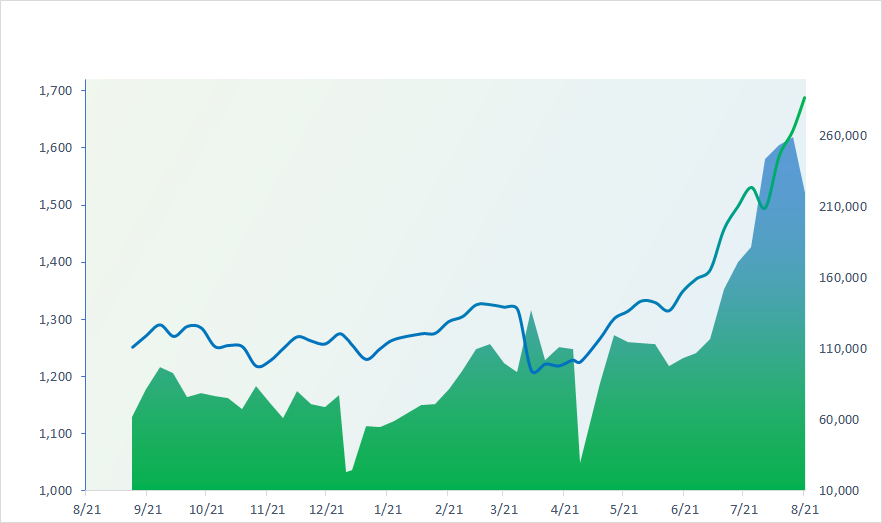

1,688.00

1D 1.42%

YTD 33.25%

284.39

1D 0.23%

YTD 25.05%

1,874.91

1D 2.54%

YTD 39.42%

110.58

1D 0.82%

YTD 16.33%

-2,503.23

56,583.82

1D -24.41%

YTD 212.09%

VN-Index surged more than 23 points, driven by a rally in Banking stocks. Proprietary trading desks of securities firms recorded their seventh consecutive net buying session on August 21, with purchases totaling VND 416 billion, led by ACB (VND 229 billion), MWG (VND 79 billion), and OCB (VND 57 billion). In contrast, they net sold SHB (VND 87 billion), MBB (VND 56 billion), and VCG (VND 53 billion).

INTRADAY

VN30 (12M)

SELECTED NEWS

- Minister of Health: 50% of medicines sold online may be counterfeit;

- Ministry of Industry and Trade launches anti-dumping investigation into ceramic and porcelain tiles from India;

- New proposal on automobile emission standards;

- Mr. Trump: U.S. will halt approval of solar and wind power projects;

- China considers developing a yuan-backed stablecoin;

- Mr. Trump sets a deadline to assess the prospects of Russia–Ukraine peace talks.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.