Market Brief 18/06/2021

VIETNAM STOCK MARKET

1,377.77

1D 1.31%

YTD 25.31%

1,481.30

1D 1.33%

YTD 39.96%

318.73

1D 0.52%

YTD 61.71%

90.22

1D 0.75%

YTD 22.20%

333.33

1D 0.00%

YTD 0.00%

28,910.81

1D 6.34%

YTD 68.55%

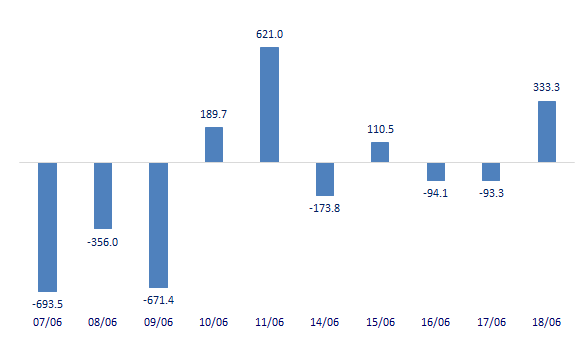

- Foreign investors' transactions were strongly affected because today is the trading session for two foreign ETFs, V.N.M and FTSE, to complete the portfolio structure of Q2.2021. Accordingly, foreign capital inflows bought 53.4m shares, worth 2,583.9b dong, while selling out more than 56m shares, 2,266b dong. In terms of value, this capital flow was a net purchase of 333b dong.

ETF & DERIVATIVES

24,900

1D 0.52%

YTD 32.45%

17,500

1D 0.98%

YTD 39.66%

21,500

1D 2.38%

YTD 36.08%

22,160

1D -0.63%

YTD 62.34%

24,770

1D 1.31%

YTD 44.01%

18,680

1D 0.97%

YTD 33.91%

1,470

1D 0.46%

YTD 0.00%

1,464

1D -0.06%

YTD 0.00%

1,484

1D 1.12%

YTD 0.00%

1,485

1D 1.44%

YTD 0.00%

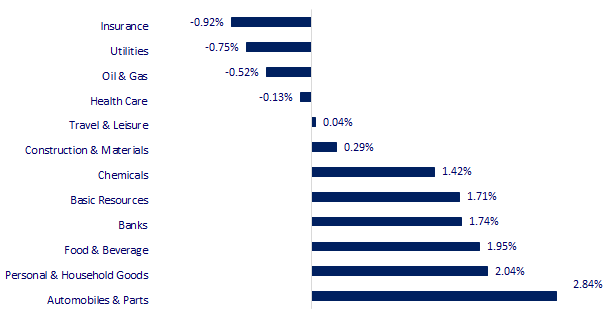

CHANGE IN PRICE BY SECTOR

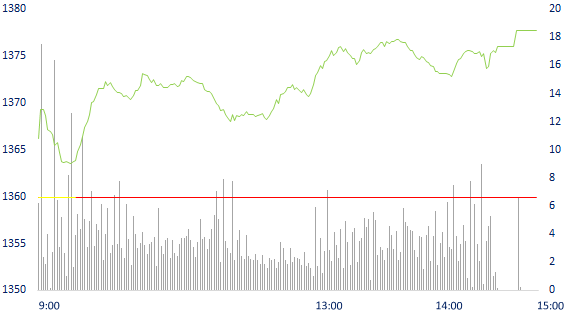

INTRADAY VNINDEX

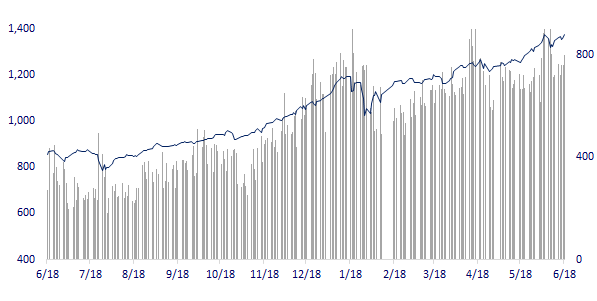

VNINDEX (12M)

GLOBAL MARKET

28,964.08

1D -0.45%

YTD 5.54%

3,525.10

1D -0.01%

YTD 3.24%

3,267.93

1D 0.09%

YTD 13.73%

28,753.00

1D -0.03%

YTD 5.92%

3,153.47

1D 0.00%

YTD 9.91%

1,612.98

1D -0.29%

YTD 11.29%

70.77

1D 0.01%

YTD 46.52%

1,793.15

1D 0.43%

YTD -5.80%

- Asian stocks mixed, commodities sector in focus. In Japan, the Nikkei 225 fell 0.45%. The Bank of Japan (BOJ) today kept its monetary policy unchanged and expanded its pandemic support program. The Chinese market was mixed with Shanghai Composite down 0.01%, Shenzhen Component up 0.769%. Hong Kong's Hang Seng fell 0.03%. South Korea's Kospi index rose 0.09%.

VIETNAM ECONOMY

0.95%

1D (bps) -2

YTD (bps) 82

5.60%

YTD (bps) -20

1.16%

1D (bps) -13

YTD (bps) -6

2.13%

1D (bps) 5

YTD (bps) 10

23,100

1D (%) 0.13%

YTD (%) -0.34%

28,216

1D (%) 0.21%

YTD (%) -3.05%

3,643

1D (%) 0.30%

YTD (%) 1.96%

- According to newly released data from the State Bank, by the end of April, people's deposits increased by 2.34% compared to the beginning of the year, at nearly 5.3m billion VND. This figure is lower than the same period in 2020, which was 3.37%. This is the fourth year in a row that deposit growth has slowed. The above trend is similar to the figure for the whole year, in the period 2016-2020.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Residential deposit growth slows down

- Korean corporation proposed 3 projects over 1,800 hectares in Thua Thien Hue

- Risk of rising inflation again

- Bloomberg: US raises interest rates, Asia will be the worst hit place

- Australia extended the issuance of the conclusion of the anti-dumping investigation on colored steel belts

- China makes iron ore the most volatile commodity in the world

VN30

BANK

108,500

1D 4.13%

5D 5.54%

Buy Vol. 4,732,900

Sell Vol. 4,547,000

46,150

1D 0.54%

5D 2.10%

Buy Vol. 4,672,400

Sell Vol. 6,212,800

51,200

1D 1.39%

5D -3.21%

Buy Vol. 21,710,200

Sell Vol. 21,901,100

51,000

1D 1.59%

5D -3.04%

Buy Vol. 15,247,800

Sell Vol. 15,790,800

66,500

1D 0.76%

5D -7.25%

Buy Vol. 21,417,000

Sell Vol. 24,276,600

40,550

1D 1.63%

5D 2.92%

Buy Vol. 39,763,500

Sell Vol. 46,693,000

34,250

1D 1.93%

5D -0.58%

Buy Vol. 6,196,600

Sell Vol. 7,057,800

35,500

1D 0.28%

5D -3.01%

Buy Vol. 3,816,300

Sell Vol. 5,357,200

29,650

1D 0.85%

5D -2.79%

Buy Vol. 25,578,900

Sell Vol. 34,207,700

- STB: Sacombank said that from June 18, 2021, this bank will deploy a preferential capital of up to VND 10,000 billion with an interest rate of 4%/year and a maximum loan term of 6 months to accompany the export enterprises and support enterprises to overcome difficulties in production and business activities when the Covid-19 epidemic is complicated.

REAL ESTATE

103,000

1D 0.78%

5D -1.81%

Buy Vol. 13,783,700

Sell Vol. 3,386,400

23,500

1D 5.86%

5D 7.31%

Buy Vol. 29,447,700

Sell Vol. 30,395,400

37,350

1D 1.22%

5D 1.49%

Buy Vol. 4,431,200

Sell Vol. 4,623,500

92,100

1D 0.44%

5D 5.38%

Buy Vol. 7,300,100

Sell Vol. 7,502,800

- PDR: accelerate the restructuring of capital sources and continuously pay off loans. It is estimated that short-term and long-term debt by the end of July 2021 will only be 1,018.9 billion dong.

OIL & GAS

92,700

1D -1.28%

5D 6.55%

Buy Vol. 1,168,400

Sell Vol. 2,397,200

12,300

1D -0.81%

5D 2.07%

Buy Vol. 17,893,500

Sell Vol. 28,450,600

56,500

1D -0.35%

5D 4.63%

Buy Vol. 7,429,800

Sell Vol. 4,361,000

- POW: In May, most of POW's factories did not complete the monthly output plan except for Dakđrinh and Vung Ang 1, and the remaining plants were not mobilized.

VINGROUP

117,400

1D 0.34%

5D -0.51%

Buy Vol. 2,718,700

Sell Vol. 3,517,300

112,500

1D 3.21%

5D 6.13%

Buy Vol. 7,500,100

Sell Vol. 6,675,200

32,500

1D -1.07%

5D 3.17%

Buy Vol. 6,074,800

Sell Vol. 9,788,300

- VRE: Merged its subsidiary, Ha Thanh Real Estate Development and Investment Co., Ltd. into Vincom Reatail Northern Co., Ltd.

FOOD & BEVERAGE

92,100

1D 1.21%

5D 0.11%

Buy Vol. 4,693,700

Sell Vol. 7,024,300

106,500

1D 3.40%

5D 0.47%

Buy Vol. 2,909,500

Sell Vol. 2,559,700

22,800

1D 1.11%

5D 7.04%

Buy Vol. 10,486,600

Sell Vol. 17,466,700

- MSN: Changed the listing of 5,851,446 shares due to ESOP issuance, bringing the total number of shares to 1,180,534,692 shares.

OTHERS

116,000

1D -0.43%

5D 0.43%

Buy Vol. 829,000

Sell Vol. 571,400

116,000

1D -0.43%

5D 0.43%

Buy Vol. 829,000

Sell Vol. 571,400

83,800

1D 1.45%

5D 0.36%

Buy Vol. 2,866,700

Sell Vol. 3,305,000

141,000

1D 1.44%

5D 2.92%

Buy Vol. 865,500

Sell Vol. 860,000

98,000

1D 2.62%

5D 1.14%

Buy Vol. 636,200

Sell Vol. 863,700

59,700

1D -0.50%

5D 8.74%

Buy Vol. 1,692,100

Sell Vol. 2,268,400

50,500

1D 0.00%

5D 2.74%

Buy Vol. 12,724,100

Sell Vol. 14,830,100

52,100

1D 1.36%

5D -1.88%

Buy Vol. 52,142,900

Sell Vol. 46,637,800

- HPG: Foreign investors on HoSE were the strongest net sellers of HPG with a value of 306 billion dong. It is worth noting that the transaction of foreign investors buying and selling HPG was partially done through the order matching method, but the priceboard of securities companies did not display buying and selling data of this stock. HPG is a stock that has been heavily weighted by two foreign ETFs in this restructuring period.

Market by numbers

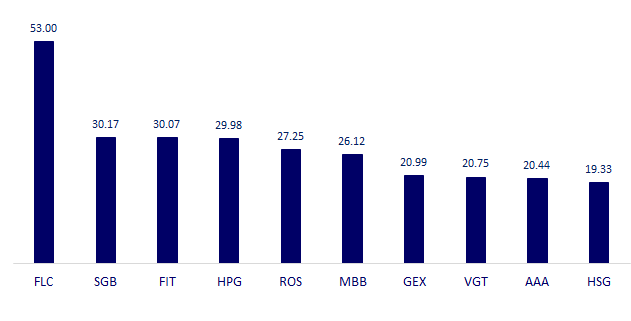

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

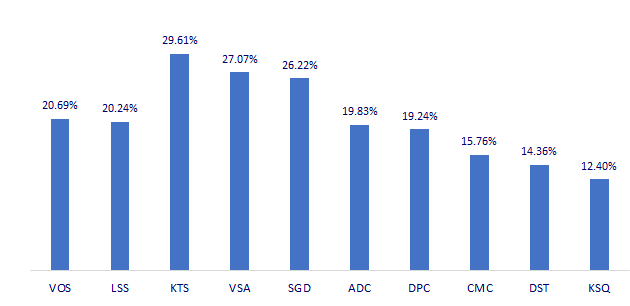

TOP INCREASES 3 CONSECUTIVE SESSIONS

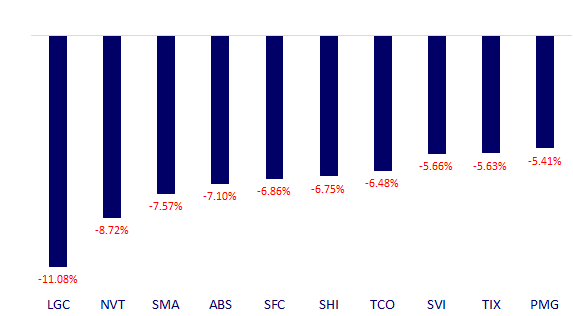

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.