Market Brief 13/08/2021

VIETNAM STOCK MARKET

1,357.05

1D 0.30%

YTD 23.43%

1,484.25

1D 0.49%

YTD 40.24%

336.96

1D 0.79%

YTD 70.96%

92.17

1D 0.21%

YTD 24.84%

-830.56

1D 0.00%

YTD 0.00%

30,620.97

1D 10.98%

YTD 78.52%

- Foreign investors boosted a net selling of 830b dong on August 12. SSI and VHM were strongly net sold by foreign investors with a value of VND 490 billion and VND 250 billion, respectively. After that, VIC was also net sold 82 billion dong. On the other side, PLX was bought the most with 98 billion dong. MBB and STB were net bought 69 billion dong and 42 billion dong respectively.

ETF & DERIVATIVES

24,820

1D -0.04%

YTD 32.02%

17,400

1D -0.80%

YTD 38.87%

18,300

1D 2.75%

YTD 37.59%

21,500

1D -1.78%

YTD 36.08%

21,580

1D 0.37%

YTD 58.10%

25,760

1D -0.54%

YTD 49.77%

18,310

1D -1.24%

YTD 31.25%

1,479

1D 0.56%

YTD 0.00%

1,480

1D 0.24%

YTD 0.00%

1,481

1D 0.34%

YTD 0.00%

1,485

1D 0.53%

YTD 0.00%

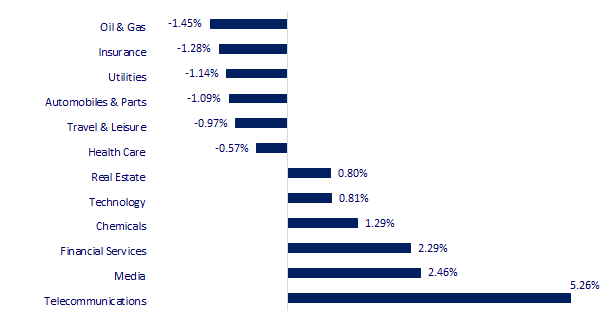

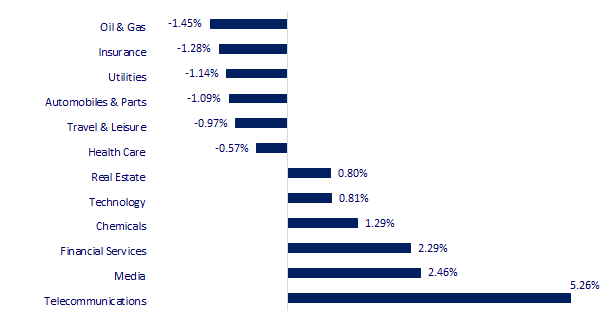

CHANGE IN PRICE BY SECTOR

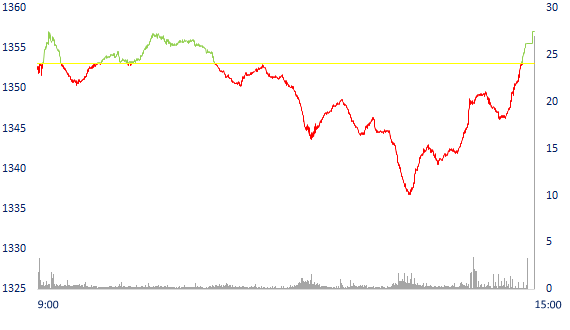

INTRADAY VNINDEX

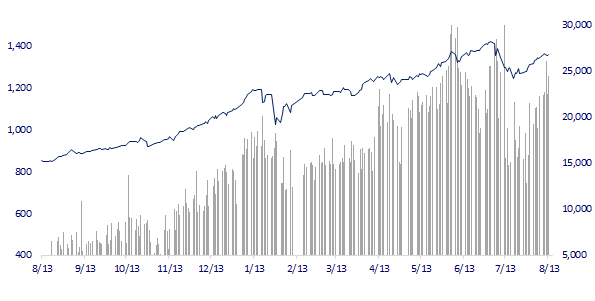

VNINDEX (12M)

GLOBAL MARKET

27,977.15

1D -0.04%

YTD 1.94%

3,516.30

1D -0.24%

YTD 2.98%

3,171.29

1D -1.16%

YTD 10.36%

26,391.62

1D 0.51%

YTD -2.78%

3,165.49

1D -0.54%

YTD 10.33%

1,528.32

1D -0.29%

YTD 5.45%

68.97

1D 0.41%

YTD 42.80%

1,762.45

1D 0.38%

YTD -7.42%

- Asian stocks mixed, Korean market fell the most. In Japan, the Nikkei 225 fell 0.04%. The Chinese market fell with Shanghai Composite down 0.24%, Shenzhen Component down 0.691%. Hong Kong's Hang Seng rose 0.51%. South Korea's Kospi index fell 1.16%.

VIETNAM ECONOMY

0.79%

1D (bps) -4

YTD (bps) 66

5.60%

YTD (bps) -20

1.16%

1D (bps) 13

YTD (bps) -6

1.87%

1D (bps) -9

YTD (bps) -16

22,925

1D (%) 0.09%

YTD (%) -1.09%

27,437

1D (%) 0.20%

YTD (%) -5.72%

3,592

1D (%) 0.06%

YTD (%) 0.53%

- Before the information about the State Bank (SBV) offering a support package of VND 20,500 billion, Deputy Governor of the State Bank (SBV) Dao Minh Tu corrected that there was no such package. Mainly commercial banks announced that interest rates will be reduced and by different methods of reduction, depending on the size and conditions of each bank.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The State Bank denied the information that there is a support package of VND 20,500 billion

- More than 9,800 businesses in Can Tho closed

- Hanoi plans to support 10 more groups of difficult workers outside of the Government's Resolution 68

- The shipping industry faces huge risks from delta mutations

- China hinted that it will tighten control of industries for many years to come

- USD increases for the 2nd week, anchors at the highest level in 4 months

VN30

BANK

99,600

1D -0.30%

5D 1.53%

Buy Vol. 2,339,300

Sell Vol. 2,125,500

42,550

1D -0.58%

5D -0.82%

Buy Vol. 4,148,400

Sell Vol. 4,095,300

34,300

1D -0.29%

5D 0.44%

Buy Vol. 22,674,400

Sell Vol. 24,101,100

52,200

1D 0.38%

5D 0.77%

Buy Vol. 28,834,900

Sell Vol. 28,197,600

63,600

1D 2.75%

5D 4.95%

Buy Vol. 30,624,500

Sell Vol. 23,269,500

29,600

1D 0.34%

5D -0.17%

Buy Vol. 21,001,200

Sell Vol. 20,700,200

34,750

1D -0.86%

5D -0.71%

Buy Vol. 5,273,300

Sell Vol. 4,921,000

36,400

1D 0.00%

5D 2.54%

Buy Vol. 5,923,700

Sell Vol. 6,969,900

29,700

1D 0.34%

5D -1.98%

Buy Vol. 45,013,200

Sell Vol. 39,715,000

35,350

1D 0.14%

5D -0.56%

Buy Vol. 26,065,500

Sell Vol. 25,034,300

- VPB: 6 months' pre-tax profit reached more than 9,000 billion dong, up 37% over the same period last year, equivalent to 54% of the plan. Profits of individual banks accounted for 88%. The proportion of CASA reached nearly 19% at the end of June, higher than 15.5% in 2020. The bank will issue shares to increase charter capital to VND 75,000 billion, the highest among Vietnamese systems.

REAL ESTATE

103,500

1D 156.19%

5D 150.00%

Buy Vol. 6,903,900

Sell Vol. 6,113,300

91,600

1D 126.73%

5D 121.26%

Buy Vol. 6,903,900

Sell Vol. 6,113,300

91,600

1D -0.97%

5D -2.03%

Buy Vol. 4,133,200

Sell Vol. 4,509,100

- PDR: 6M.2021, PDR profit before tax is 637 billion dong, up 82% HoH, rising to join the Top 5 listed real estate companies with the highest profit in the first half of 2021

OIL & GAS

93,000

1D -1.59%

5D 0.65%

Buy Vol. 2,213,600

Sell Vol. 1,930,600

11,300

1D -0.44%

5D 2.73%

Buy Vol. 18,924,100

Sell Vol. 23,547,500

52,900

1D -0.19%

5D 0.00%

Buy Vol. 4,196,700

Sell Vol. 5,529,000

- PLX was the focus of foreign investors' net buying in today's session with a value of 97.8 billion dong.

VINGROUP

110,900

1D -0.18%

5D -2.12%

Buy Vol. 3,642,500

Sell Vol. 3,453,600

120,000

1D 2.56%

5D 5.36%

Buy Vol. 17,581,900

Sell Vol. 15,768,500

28,000

1D 0.00%

5D 0.18%

Buy Vol. 8,520,600

Sell Vol. 7,782,500

- VRE: bought back 2,550 billion dong of bonds before maturity. These bonds are part of a bond batch of VND 3,000 billion with a term of 5 years, issued in March 2017.

FOOD & BEVERAGE

89,900

1D -0.66%

5D 3.10%

Buy Vol. 7,276,600

Sell Vol. 7,193,600

133,500

1D -0.37%

5D -0.74%

Buy Vol. 2,523,700

Sell Vol. 1,976,100

151,800

1D -0.85%

5D -2.19%

Buy Vol. 280,000

Sell Vol. 337,800

- VNM: PLATINUM VICTORY PTE. LTD. continue to register to buy nearly 21 million VNM shares. Trading time from August 18, 2021 to September 16, 2021

OTHERS

118,000

1D -0.59%

5D 0.51%

Buy Vol. 725,700

Sell Vol. 887,900

118,000

1D -0.59%

5D 0.51%

Buy Vol. 725,700

Sell Vol. 887,900

95,000

1D 1.28%

5D -1.66%

Buy Vol. 7,465,400

Sell Vol. 6,027,700

171,000

1D 0.59%

5D -0.29%

Buy Vol. 2,014,000

Sell Vol. 1,772,600

94,500

1D 0.00%

5D -1.77%

Buy Vol. 1,014,500

Sell Vol. 1,229,600

34,800

1D 1.46%

5D 1.75%

Buy Vol. 9,115,500

Sell Vol. 9,126,800

59,000

1D 2.25%

5D 4.61%

Buy Vol. 36,912,500

Sell Vol. 34,072,400

48,650

1D 0.52%

5D 0.52%

Buy Vol. 45,847,200

Sell Vol. 43,198,700

- VJC: Vietjet has just offered to sell 1,000 billion dong of bonds for the third time this year. In May and June, the airline also issued individual bonds worth VND1,000 billion each. As of June 30, the airline has 11,766 billion dong of financial debt, of which bond debt is nearly 3,210 billion dong.

Market by numbers

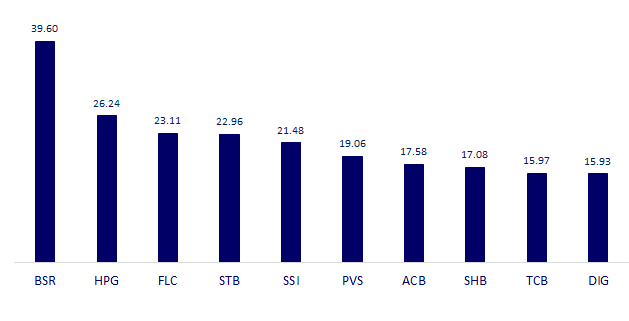

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

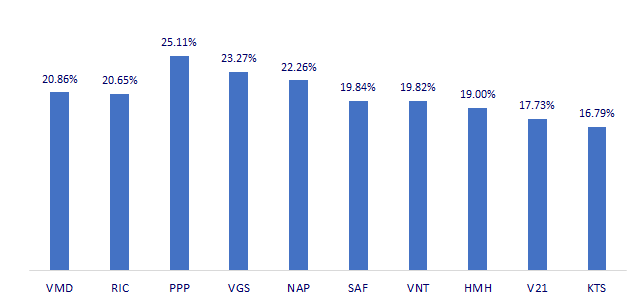

TOP INCREASES 3 CONSECUTIVE SESSIONS

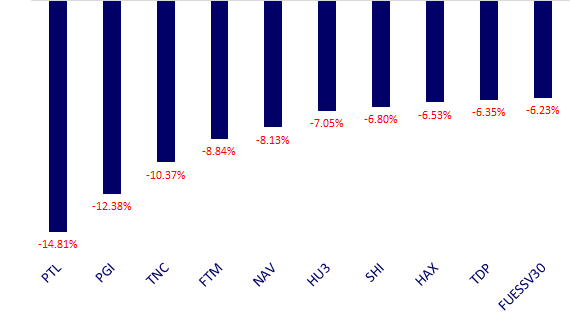

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.