Market Brief 28/09/2021

VIETNAM STOCK MARKET

1,339.31

1D 1.08%

YTD 21.81%

1,451.12

1D 0.83%

YTD 37.11%

356.03

1D 0.86%

YTD 80.63%

96.01

1D 0.26%

YTD 30.04%

476.09

1D 0.00%

YTD 0.00%

23,428.06

1D -12.30%

YTD 36.58%

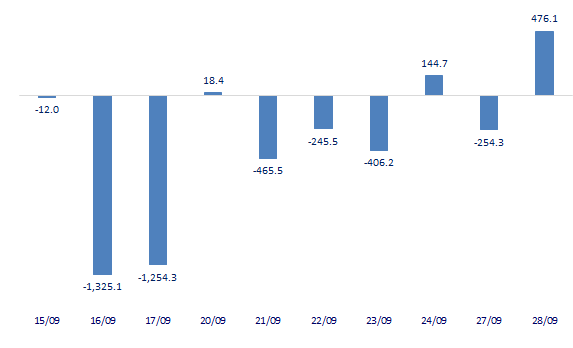

- Foreign investors were active again when they were net buyers on HoSE while selling slightly on HNX and UPCoM. In general, foreign investors bought 40.5 million shares, worth 1,593 billion VND, while selling 25.5 million shares, worth 1,123 billion VND. Total net buying volume reached 15 million shares, equivalent to a net buying value of 476 billion dong.

ETF & DERIVATIVES

24,310

1D -0.53%

YTD 29.31%

17,100

1D 0.29%

YTD 36.47%

17,970

1D 0.90%

YTD 35.11%

21,700

1D 0.93%

YTD 37.34%

20,130

1D -2.14%

YTD 47.47%

26,000

1D 0.78%

YTD 51.16%

18,210

1D -0.76%

YTD 30.54%

1,446

1D 1.13%

YTD 0.00%

1,450

1D 1.40%

YTD 0.00%

1,451

1D 1.19%

YTD 0.00%

1,454

1D 1.42%

YTD 0.00%

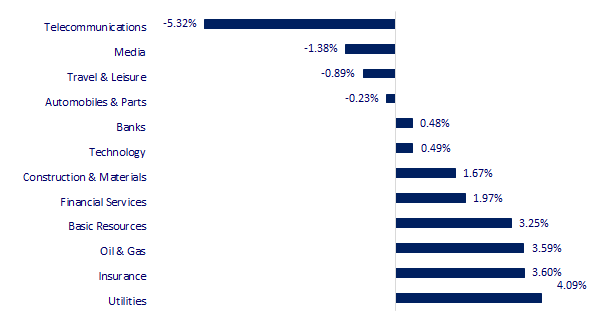

CHANGE IN PRICE BY SECTOR

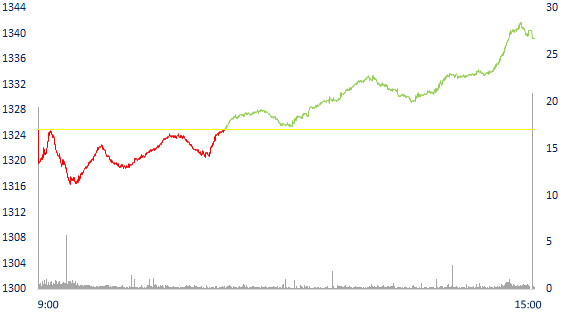

INTRADAY VNINDEX

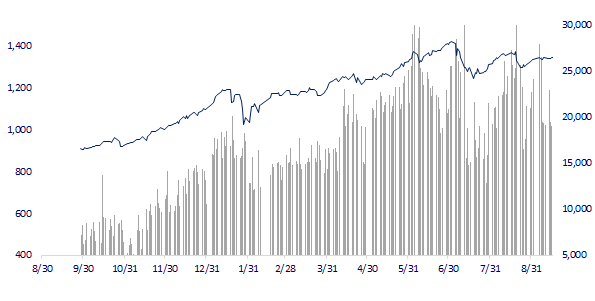

VNINDEX (12M)

GLOBAL MARKET

30,183.96

1D 0.48%

YTD 9.98%

3,602.22

1D 0.54%

YTD 5.50%

3,097.92

1D -1.14%

YTD 7.81%

24,500.39

1D 0.90%

YTD -9.75%

3,077.69

1D -0.73%

YTD 7.27%

1,616.50

1D -0.22%

YTD 11.53%

76.08

1D 0.88%

YTD 57.52%

1,733.15

1D -1.00%

YTD -8.96%

- Asian stocks mixed, Brent oil price exceeded 80 USD/barrel. In Japan, Nikkei rose 0.48%. The Chinese market was mixed with Shanghai Composite up 0.54%, Shenzhen Component down 0.212%. Hong Kong's Hang Seng rose 0.9%. South Korea's Kospi index fell 1.14%.

VIETNAM ECONOMY

0.68%

YTD (bps) 55

5.60%

YTD (bps) -20

0.98%

1D (bps) -20

YTD (bps) -24

1.94%

1D (bps) 6

YTD (bps) -9

22,860

1D (%) -0.04%

YTD (%) -1.37%

27,197

1D (%) -0.13%

YTD (%) -6.55%

3,593

1D (%) -0.08%

YTD (%) 0.56%

- The WB maintains its forecast that Vietnam's GDP will grow by 4.8% this year, much more positive than the 3.8% forecast given by ADB last week. Immunization rates are uneven among localities and risks. The increasing risk of bad debt are the challenges that Vietnam's economy has to face. The World Bank forecasts that Vietnam's GDP in 2022 will grow by 6.5-7%

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Support businesses to return to production safely soon

- The Ministry of Labor proposes to increase overtime to maintain the supply chain

- The WB maintains its forecast that Vietnam's GDP will grow by 4.8% this year

- India - Taiwan shake hands to solve the worry of lack of chips, which could make China angry

- China's central bank promises to protect consumers in China Evergrande case

- China criticizes WTO for ruling on trade dispute with US

VN30

BANK

99,200

1D 1.22%

5D 1.22%

Buy Vol. 1,060,800

Sell Vol. 972,100

40,100

1D 1.78%

5D 1.13%

Buy Vol. 3,859,000

Sell Vol. 3,434,000

30,950

1D -0.16%

5D -1.75%

Buy Vol. 12,587,600

Sell Vol. 11,730,400

49,800

1D 0.61%

5D -1.19%

Buy Vol. 11,175,900

Sell Vol. 8,989,600

66,800

1D -0.30%

5D -0.15%

Buy Vol. 9,686,400

Sell Vol. 12,554,600

28,000

1D 0.00%

5D 0.00%

Buy Vol. 14,294,100

Sell Vol. 16,041,400

25,450

1D -0.20%

5D -0.39%

Buy Vol. 4,638,600

Sell Vol. 4,469,200

40,700

1D 1.75%

5D 1.75%

Buy Vol. 10,614,900

Sell Vol. 8,776,500

26,550

1D 0.19%

5D -0.93%

Buy Vol. 14,572,600

Sell Vol. 15,912,400

31,600

1D 0.32%

5D -0.63%

Buy Vol. 5,207,500

Sell Vol. 4,937,900

- STB: announces that it will auction debt secured by shares of Ban Viet Commercial Joint Stock Bank (UPCoM: BVB) on October 7. Specifically, the debt that will be auctioned belongs to Phuong Nghi Trading and Construction Co., Ltd. arising from September 2012. As of July 19, 2021, the total liabilities of this debt is VND 1,005.4 billion, including VND 424.5 billion of principal and nearly VND 580.9 billion of interest.

REAL ESTATE

102,600

1D 0.20%

5D -0.39%

Buy Vol. 1,281,000

Sell Vol. 1,981,800

41,600

1D 0.60%

5D -0.36%

Buy Vol. 4,050,100

Sell Vol. 3,477,100

81,300

1D 1.25%

5D -0.37%

Buy Vol. 4,887,700

Sell Vol. 4,490,300

- PDR plans to issue 2,700 bonds to professional securities investors, with par value of VND 100 million/bond, with the goal of raising VND 270 billion.

OIL & GAS

95,100

1D 5.67%

5D 7.82%

Buy Vol. 7,049,900

Sell Vol. 6,584,100

11,750

1D 1.73%

5D 0.86%

Buy Vol. 15,843,100

Sell Vol. 20,134,400

51,100

1D 2.00%

5D 3.02%

Buy Vol. 3,734,800

Sell Vol. 3,873,400

- Brent oil surpassed $80 per barrel on signals that demand was outstripping supply and inventories fell sharply.

VINGROUP

86,500

1D 0.46%

5D 1.05%

Buy Vol. 3,403,900

Sell Vol. 4,216,700

78,500

1D 0.38%

5D 1.29%

Buy Vol. 10,741,200

Sell Vol. 7,926,200

28,500

1D 0.88%

5D 0.35%

Buy Vol. 7,112,400

Sell Vol. 6,134,000

- VHM: On September 27, 2021, Vinhomes Joint Stock Company officially launched Huong Duong subdivision in Vinhomes Star City urban area, Thanh Hoa.

FOOD & BEVERAGE

89,300

1D 0.56%

5D 0.56%

Buy Vol. 6,279,900

Sell Vol. 6,024,600

136,000

1D 0.74%

5D -5.23%

Buy Vol. 2,115,100

Sell Vol. 1,942,200

157,100

1D -1.19%

5D -0.57%

Buy Vol. 218,100

Sell Vol. 207,800

- VNM: one of the top stocks that were bought the most by foreign investors in today's trading session with a value of more than 87 billion dong.

OTHERS

129,000

1D 0.00%

5D 4.45%

Buy Vol. 1,020,200

Sell Vol. 1,074,100

129,000

1D 0.00%

5D 4.45%

Buy Vol. 1,020,200

Sell Vol. 1,074,100

93,000

1D 0.98%

5D -0.53%

Buy Vol. 3,301,500

Sell Vol. 2,327,100

126,700

1D 0.56%

5D 2.34%

Buy Vol. 2,424,200

Sell Vol. 2,700,600

93,000

1D 2.20%

5D 3.22%

Buy Vol. 1,298,000

Sell Vol. 1,123,200

35,800

1D 0.56%

5D -1.65%

Buy Vol. 7,752,000

Sell Vol. 6,780,000

40,600

1D 1.50%

5D -3.56%

Buy Vol. 12,931,700

Sell Vol. 11,740,800

52,600

1D 3.54%

5D 3.54%

Buy Vol. 60,895,600

Sell Vol. 54,733,100

- HPG: Construction steel and hot-rolled steel (HRC) prices increased by 57% and 132% respectively, while raw material prices increased at a slower pace, causing gross profit margin of Hoa Phat Group (HPG) to increase. from 18.1% in the first 6 months of 2020 to 32.7% in the first half of 2021.

Market by numbers

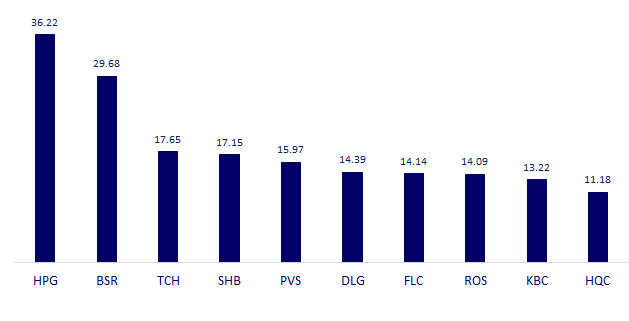

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

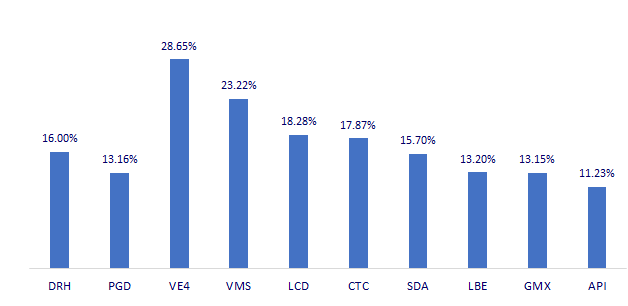

TOP INCREASES 3 CONSECUTIVE SESSIONS

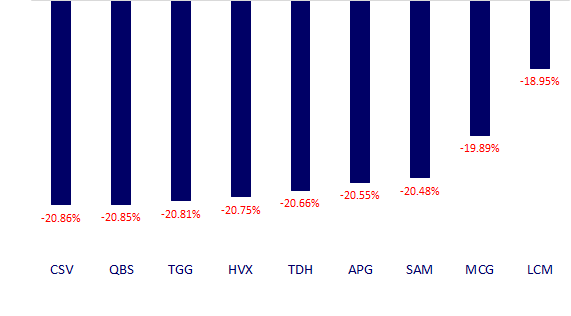

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.