Market Brief 30/09/2021

VIETNAM STOCK MARKET

1,342.06

1D 0.21%

YTD 22.06%

1,453.76

1D 0.22%

YTD 37.36%

357.33

1D 0.86%

YTD 81.29%

96.56

1D 0.65%

YTD 30.79%

-166.54

1D 0.00%

YTD 0.00%

18,779.94

1D -11.34%

YTD 9.48%

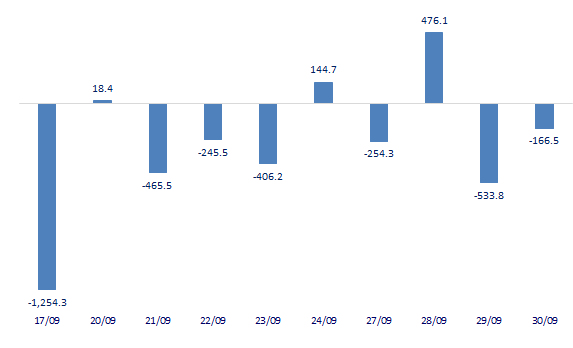

- Foreign investors' trade was still quite negative as this capital flow continued to be a net selling on HoSE and UPCoM, while only a slight net buying on HNX. For the whole market, foreign investors bought 27.6 million shares, worth 1,296 billion VND, while selling 34 million shares, worth 1,466 billion VND. Total net selling volume was at 6.56 million shares, equivalent to a net selling value of VND166 billion.

ETF & DERIVATIVES

24,550

1D 0.61%

YTD 30.59%

17,140

1D 0.23%

YTD 36.79%

18,490

1D 3.82%

YTD 39.02%

21,300

1D -0.93%

YTD 34.81%

20,300

1D 0.20%

YTD 48.72%

26,250

1D 1.47%

YTD 52.62%

18,350

1D 0.88%

YTD 31.54%

1,445

1D 0.01%

YTD 0.00%

1,448

1D 0.19%

YTD 0.00%

1,451

1D 0.28%

YTD 0.00%

1,452

1D 0.19%

YTD 0.00%

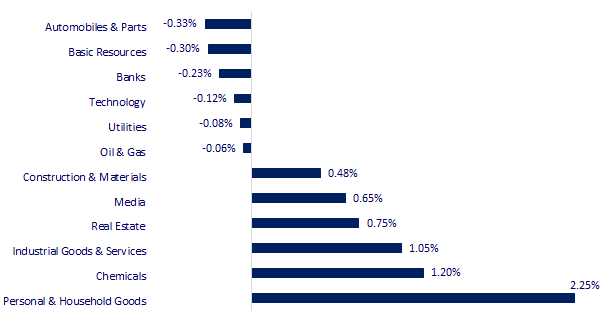

CHANGE IN PRICE BY SECTOR

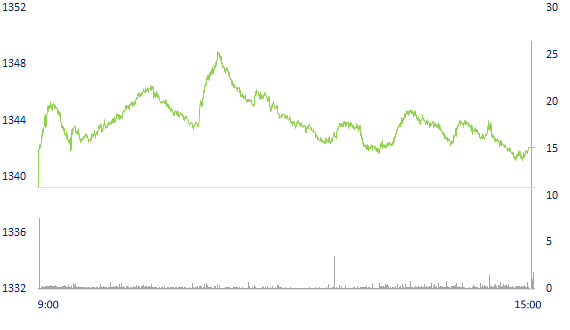

INTRADAY VNINDEX

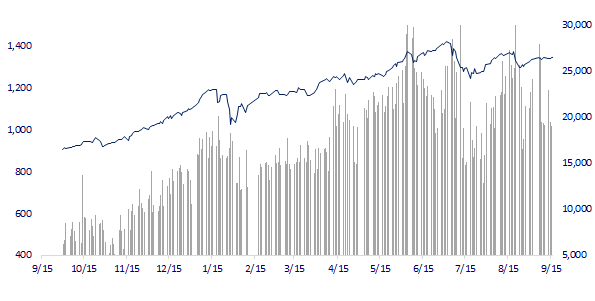

VNINDEX (12M)

GLOBAL MARKET

29,452.66

1D 0.19%

YTD 7.32%

3,568.17

1D 0.90%

YTD 4.50%

3,068.82

1D 0.28%

YTD 6.80%

24,575.64

1D 0.92%

YTD -9.47%

3,086.70

1D 0.40%

YTD 7.58%

1,605.68

1D -0.70%

YTD 10.79%

74.64

1D -0.21%

YTD 54.53%

1,724.25

1D -0.33%

YTD -9.42%

- China announced September PMI, Asian stocks mostly rose. In Japan, the Nikkei 225 fell 0.19%. The Chinese market rose with Shanghai Composite up 0.9%, Shenzhen Component up 1.634%. Hong Kong's Hang Seng increased by 092%. South Korea's Kospi index rose 0.28%.

VIETNAM ECONOMY

0.67%

1D (bps) -1

YTD (bps) 54

5.60%

YTD (bps) -20

0.99%

1D (bps) -20

YTD (bps) -23

1.90%

1D (bps) -2

YTD (bps) -13

22,860

1D (%) 0.02%

YTD (%) -1.37%

26,977

1D (%) -0.18%

YTD (%) -7.31%

3,591

1D (%) 0.14%

YTD (%) 0.50%

- According to the report of the People's Committee of Da Nang City, the local public investment capital plan in 2021 assigned by the National Assembly and the Prime Minister is VND 6,935.11 billion and VND 9,530,036 billion assigned by the City Council. The total disbursement value of public investment capital in 2021 adjusted to September 30, 2021 is estimated at 3,500 billion VND, reaching 50.5% of the plan assigned by the Central Government.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The State Bank began to worry about inflation risks

- Da Nang proposes to transfer more than 268 billion of public investment capital to 2022

- Deputy Governor: The ratio of on-balance sheet and potential bad debt may increase to approximately 8% by the end of this year

- The Korean government considers the possibility of joining the CPTPP

- The US House of Representatives passed a suspension of the debt ceiling, preventing the US government from defaulting on its debt

- Fed Chairman: Inflation expected to persist into 2022

VN30

BANK

97,200

1D -1.32%

5D -2.31%

Buy Vol. 2,028,000

Sell Vol. 2,030,400

39,450

1D -1.13%

5D 0.00%

Buy Vol. 2,307,400

Sell Vol. 2,636,900

30,400

1D 0.00%

5D -3.80%

Buy Vol. 12,225,400

Sell Vol. 12,224,800

49,600

1D 0.40%

5D -1.20%

Buy Vol. 9,954,000

Sell Vol. 11,527,600

65,900

1D -0.15%

5D -1.64%

Buy Vol. 9,392,800

Sell Vol. 11,198,100

27,850

1D 0.18%

5D -0.18%

Buy Vol. 12,214,000

Sell Vol. 15,811,200

25,400

1D 0.00%

5D 0.00%

Buy Vol. 4,112,500

Sell Vol. 3,922,100

41,600

1D 0.48%

5D 0.12%

Buy Vol. 9,737,200

Sell Vol. 12,800,200

25,700

1D -0.39%

5D -3.38%

Buy Vol. 16,694,200

Sell Vol. 17,932,800

31,550

1D 0.64%

5D -0.16%

Buy Vol. 8,513,900

Sell Vol. 7,302,400

- Up to now, the Vietnam stock market has recorded 5 enterprises with charter capital of over 40,000 billion dong, corresponding to the number of listed shares of over 4 billion units. In which, CTG leads the stock market with charter capital of over 48,058 billion dong. Next is HPG with 44,729 billion dong. In third place is VHM with VND 43,543 billion. BID and GVR have chartered capital of VND 40,220 billion and VND 40,000 billion respectively.

REAL ESTATE

102,000

1D 0.00%

5D -0.97%

Buy Vol. 1,223,900

Sell Vol. 1,922,600

41,600

1D 0.00%

5D -0.95%

Buy Vol. 1,643,500

Sell Vol. 2,800,100

81,800

1D 0.74%

5D 1.49%

Buy Vol. 3,768,100

Sell Vol. 3,377,100

- NVL: just approved the capital contribution to Khanh An Real Estate. NVL will contribute VND 1,000 billion, after completing capital contribution, NVL will own 57.88% of the capital.

OIL & GAS

97,000

1D 0.21%

5D 7.06%

Buy Vol. 2,189,800

Sell Vol. 2,419,300

11,950

1D -0.42%

5D 3.40%

Buy Vol. 19,035,700

Sell Vol. 31,849,200

51,600

1D -0.77%

5D 2.79%

Buy Vol. 1,822,500

Sell Vol. 2,843,000

- Oil prices fell on Wednesday (September 29) after crude inventories in the USA rose more than expected, even as OPEC plans to take a deliberate approach to replenish the market.

VINGROUP

88,000

1D 1.50%

5D 1.03%

Buy Vol. 4,951,800

Sell Vol. 7,275,300

78,300

1D 0.13%

5D -1.26%

Buy Vol. 7,337,900

Sell Vol. 6,808,500

29,100

1D 2.83%

5D 0.69%

Buy Vol. 8,974,600

Sell Vol. 8,902,900

- VIC: Vinpearl has successfully offered USD 425 million of sustainable bonds with the option to receive VIC shares

FOOD & BEVERAGE

89,600

1D 0.00%

5D -1.32%

Buy Vol. 4,936,600

Sell Vol. 6,232,100

142,600

1D 1.13%

5D -1.66%

Buy Vol. 1,483,100

Sell Vol. 1,702,300

156,400

1D -0.26%

5D -1.14%

Buy Vol. 206,500

Sell Vol. 177,300

- VNM continued to be the strongest net buying by foreign investors in today's session with a value of 82 billion dong.

OTHERS

127,900

1D -0.47%

5D 3.40%

Buy Vol. 873,200

Sell Vol. 985,800

127,900

1D -0.47%

5D 3.40%

Buy Vol. 873,200

Sell Vol. 985,800

93,000

1D -0.21%

5D -0.11%

Buy Vol. 2,222,300

Sell Vol. 2,917,000

127,800

1D 0.00%

5D -3.18%

Buy Vol. 1,855,100

Sell Vol. 2,455,300

98,700

1D 5.79%

5D 7.05%

Buy Vol. 2,932,900

Sell Vol. 2,617,300

35,900

1D -0.28%

5D -3.49%

Buy Vol. 3,023,500

Sell Vol. 3,898,300

40,650

1D 1.37%

5D -2.98%

Buy Vol. 7,870,600

Sell Vol. 8,081,600

52,900

1D -0.75%

5D 3.73%

Buy Vol. 39,186,100

Sell Vol. 49,953,600

- MWG: August became MWG's lowest business month since the beginning of 2021 with revenue of more than VND 6,500 billion and profit after tax of VND 222 billion, down 25% and 32% respectively over the same period. In 8 months, MWG achieved 78,495 billion dong in revenue and 3,006 billion dong in profit after tax, still increasing by 8% and 12% respectively, thereby achieving 63% of the year target.

Market by numbers

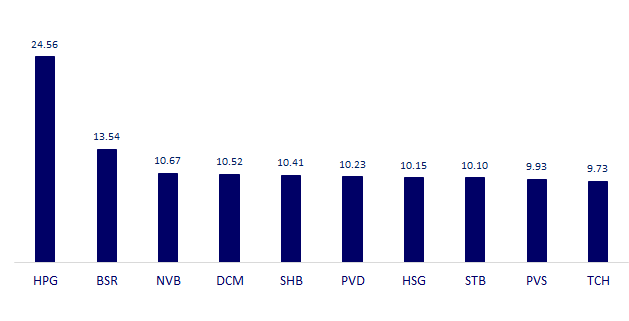

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

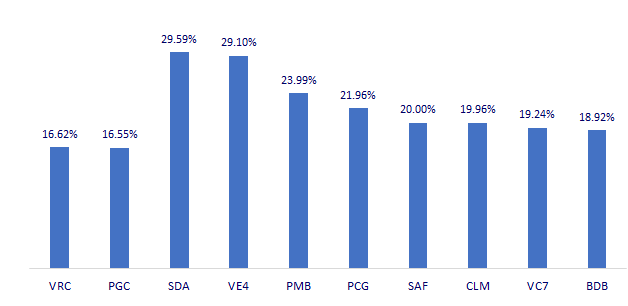

TOP INCREASES 3 CONSECUTIVE SESSIONS

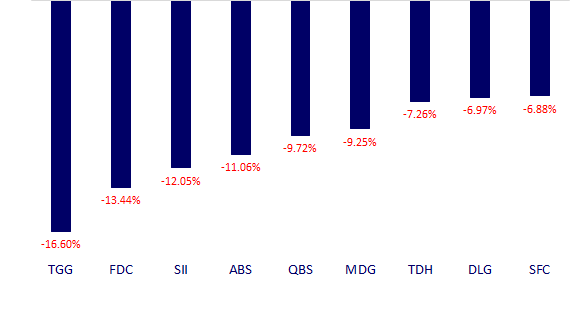

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.