Market brief 11/05/2022

VIETNAM STOCK MARKET

1,301.53

1D 0.62%

YTD -13.13%

1,349.82

1D 0.32%

YTD -12.10%

333.04

1D 0.92%

YTD -29.74%

98.79

1D -0.27%

YTD -12.33%

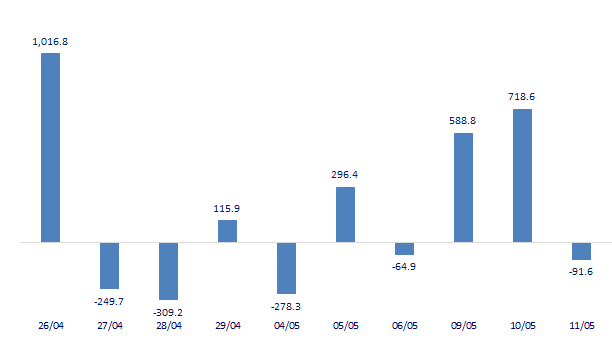

-91.62

1D 0.00%

YTD 0.00%

13,033.88

1D -34.69%

YTD -58.05%

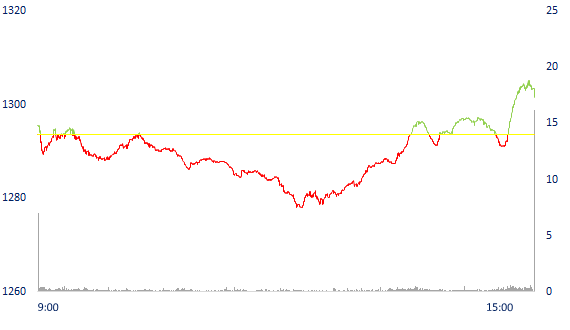

Real estate stocks broke out, VN-Index increased by nearly 8 points. Market liquidity dropped sharply compared to the previous session. The total matched value reached 11,495 billion dong, down 35% compared to the previous session, of which, the matched value on HoSE alone decreased by 36% to 10,294 billion dong. Foreign investors net sold again 91 billion dong on HoSE in this session.

ETF & DERIVATIVES

22,800

1D -0.87%

YTD -11.73%

15,930

1D 1.21%

YTD -11.94%

16,950

1D -4.83%

YTD -10.79%

19,300

1D -0.52%

YTD -15.72%

19,000

1D 2.70%

YTD -15.48%

27,650

1D 3.91%

YTD -1.43%

18,330

1D 0.33%

YTD -14.66%

1,338

1D 0.37%

YTD 0.00%

1,337

1D -0.10%

YTD 0.00%

1,339

1D 0.55%

YTD 0.00%

1,337

1D 0.15%

YTD 0.00%

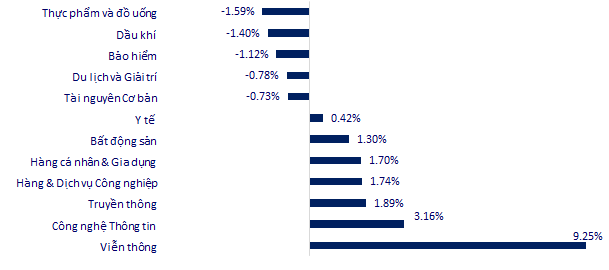

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

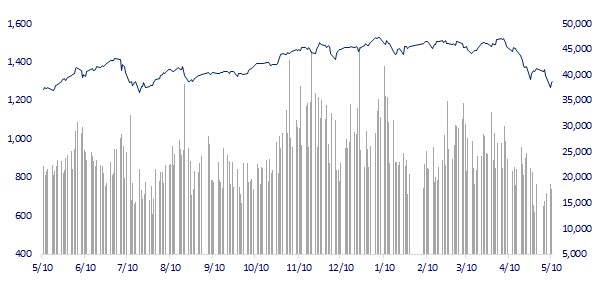

VNINDEX (12M)

GLOBAL MARKET

26,213.64

1D 0.13%

YTD -8.95%

3,058.70

1D 0.75%

YTD -15.96%

2,592.27

1D -0.17%

YTD -12.94%

19,824.57

1D 0.94%

YTD -15.27%

3,226.07

1D -0.25%

YTD 3.28%

1,613.34

1D -0.58%

YTD -2.67%

103.36

1D 2.57%

YTD 35.11%

1,852.97

1D 0.96%

YTD 1.77%

Asian stocks mixed, inflation in China and the US was the focus. In Japan, the Nikkei 225 index rose 0.13%. The Shanghai Composite Index rose 0.75%. South Korea's Kospi index fell 0.17%.

VIETNAM ECONOMY

1.91%

1D (bps) 13

YTD (bps) 110

5.60%

2.46%

1D (bps) 4

YTD (bps) 145

3.04%

1D (bps) 8

YTD (bps) 104

23,270

1D (%) 0.79%

YTD (%) 1.44%

24,772

1D (%) -0.49%

YTD (%) -6.41%

3,499

1D (%) 0.46%

YTD (%) -4.35%

Vietnam's seafood export value in April was estimated at 1.05 billion USD, bringing the export value of seafood in the first 4 months of this year to 3.57 billion USD, up 43.7% over the same period last year 2021. The US, Japan and China are the top 3 seafood import markets of Vietnam. Among them, the market with the strongest increase in value is China.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Revealing Vietnam's billion-dollar imported goods group

- More than 783 trillion of the bank is in real estate projects

- Seafood exports increased by nearly 44%

- EU hopes to reach agreement on oil embargo from Russia

- The Fed insists it will quickly raise interest rates to cool down inflation

- Southeast Asia needs to be ready to face rising inflation

VN30

BANK

80,000

1D 0.00%

5D 0.13%

Buy Vol. 1,297,400

Sell Vol. 1,618,800

36,100

1D 0.84%

5D -3.09%

Buy Vol. 1,691,200

Sell Vol. 1,691,900

26,700

1D 5.95%

5D -1.11%

Buy Vol. 10,907,000

Sell Vol. 9,425,000

39,000

1D 0.78%

5D -7.14%

Buy Vol. 6,183,100

Sell Vol. 6,923,700

33,400

1D 0.30%

5D -6.70%

Buy Vol. 11,427,600

Sell Vol. 14,079,900

27,500

1D 1.66%

5D -4.84%

Buy Vol. 10,351,100

Sell Vol. 9,145,100

24,250

1D 0.83%

5D -2.22%

Buy Vol. 2,369,300

Sell Vol. 2,840,500

33,450

1D 0.45%

5D 4.53%

Buy Vol. 5,116,100

Sell Vol. 5,127,800

23,550

1D -1.46%

5D -11.96%

Buy Vol. 19,124,200

Sell Vol. 22,268,200

31,600

1D 2.60%

5D -0.47%

Buy Vol. 3,596,800

Sell Vol. 3,605,900

At TPBank, the total bad debt as of the end of March 2022 increased by 48.1%, to 1,714 billion dong. In which, group 3 debt increased by 80% to 629 billion; Group 5 debt increased by 50% to 447 billion. However, TPBank still maintains a relatively low bad debt ratio, only 1.14%. Vietcombank also witnessed a sharp increase in the number of bad debts in the past period, with an increase of 36.8%, to VND 8,372 billion. This is also the bank with the highest increase in bad debt, in absolute terms (VND 2,251 billion). However, like TPBank, Vietcombank's bad debt ratio is still low at 0.81%.

REAL ESTATE

78,700

1D -0.38%

5D -2.24%

Buy Vol. 3,146,900

Sell Vol. 4,441,400

43,600

1D 0.46%

5D -6.24%

Buy Vol. 2,096,300

Sell Vol. 2,015,500

60,700

1D -1.94%

5D -1.30%

Buy Vol. 2,243,500

Sell Vol. 2,616,300

As of March 31, 2022, credit balance for investment projects to build urban areas and housing development projects reached VND188,105b, 24% of the total credit for real estate business.

OIL & GAS

108,900

1D 0.83%

5D 0.83%

Buy Vol. 640,500

Sell Vol. 866,100

13,200

1D -0.75%

5D -6.05%

Buy Vol. 15,804,600

Sell Vol. 17,281,500

41,500

1D -2.81%

5D -14.70%

Buy Vol. 2,103,800

Sell Vol. 1,940,000

POW: power output in April reached 1.4b kWh, 28% higher than the monthly plan; accumulated 5b kWh. In which, Nhon Trach 1 and 2, Hua Na, Dakdrinh all outperformed the monthly plan.

VINGROUP

80,500

1D 0.12%

5D 1.00%

Buy Vol. 2,977,600

Sell Vol. 3,547,000

70,500

1D 0.86%

5D 9.30%

Buy Vol. 4,897,500

Sell Vol. 6,068,000

28,900

1D 2.85%

5D -3.51%

Buy Vol. 7,431,000

Sell Vol. 6,553,500

VIC: Chairman Pham Nhat Vuong: 600,000 electric cars VinFast will export to the US by 2026, propose a series of incentives to invite chip manufacturers to open factories in Vietnam

FOOD & BEVERAGE

69,500

1D -1.56%

5D -4.14%

Buy Vol. 3,020,300

Sell Vol. 3,212,300

111,900

1D -3.62%

5D -1.06%

Buy Vol. 1,665,200

Sell Vol. 1,629,700

163,500

1D -0.85%

5D 0.00%

Buy Vol. 319,500

Sell Vol. 245,500

MSN: Q1/2022, EBITDA profit before interest and amortization (EBITDA) 164 billion dong, up 25% y/y in 2021. EBITDA margin improved from 1.8% to 2.2%.

OTHERS

126,500

1D -2.01%

5D -2.92%

Buy Vol. 695,900

Sell Vol. 734,200

126,500

1D -2.01%

5D -2.92%

Buy Vol. 695,900

Sell Vol. 734,200

101,900

1D 3.56%

5D -2.49%

Buy Vol. 2,866,100

Sell Vol. 2,855,300

141,000

1D 0.64%

5D -5.69%

Buy Vol. 2,068,800

Sell Vol. 1,663,400

107,000

1D 3.88%

5D -1.20%

Buy Vol. 1,140,000

Sell Vol. 1,114,600

24,600

1D -0.61%

5D -12.30%

Buy Vol. 1,993,900

Sell Vol. 2,071,900

27,700

1D -0.72%

5D -13.44%

Buy Vol. 10,713,700

Sell Vol. 10,902,500

40,650

1D -1.09%

5D -3.21%

Buy Vol. 15,613,600

Sell Vol. 15,602,800

VJC: At the end of Q1.2022, VJC continued to achieve quarterly consolidated revenue of VND4,522b, profit after tax of VND244b, up 12% and 98% respectively over the same period in 2021. In the air transportation segment alone, in the first 3 months of 2022, Vietjet achieved a revenue of VND 3,340b, up 17% QoQ. Total transportation revenue accounted for 65% of total revenue in the first quarter, while the same period in the same period in 2021.

Market by numbers

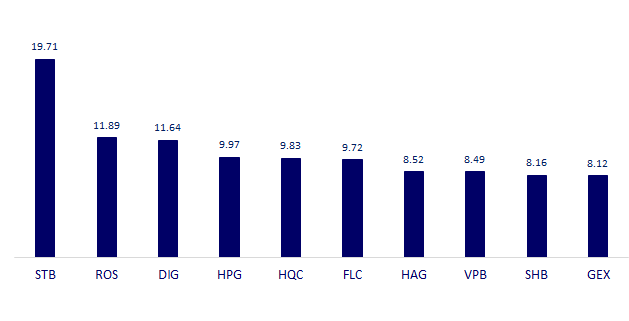

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

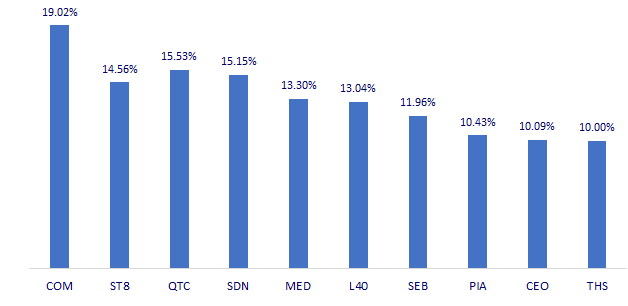

TOP INCREASES 3 CONSECUTIVE SESSIONS

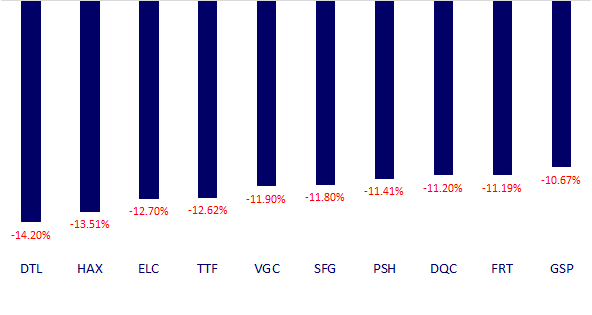

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.