Market Brief 21/11/2022

VIETNAM STOCK MARKET

960.65

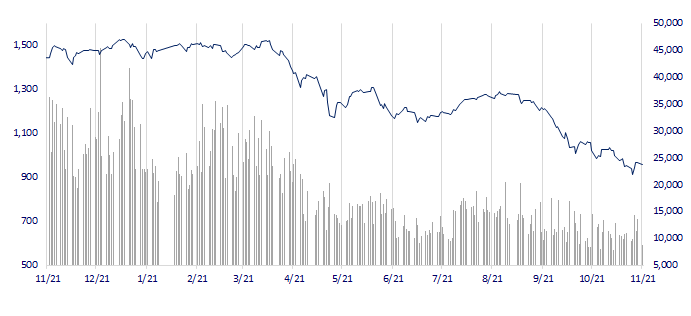

1D -0.90%

YTD -35.88%

956.89

1D -1.47%

YTD -37.69%

192.40

1D 0.80%

YTD -59.41%

67.64

1D 0.73%

YTD -39.97%

74.71

1D 0.00%

YTD 0.00%

9,960.33

1D -34.83%

YTD -67.94%

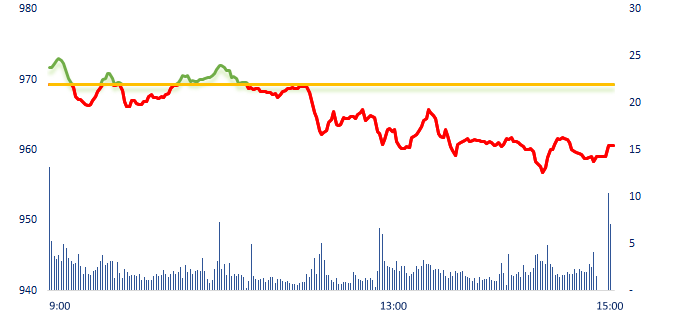

After an exciting trading week, the market at the beginning of the week was not very positive. After 3 sessions with trading volume reaching 20% higher than the average trading volume in the past 6 months, today's liquidity declined again. At the end of the session, VN-Index dropped but steel stocks still kept gaining momentum in some tickers like VGS, HSG, TLH,...

ETF & DERIVATIVES

16,290

1D -2.16%

YTD -36.93%

11,250

1D -1.49%

YTD -37.81%

11,770

1D 0.34%

YTD -38.05%

11,010

1D -4.34%

YTD -51.92%

12,340

1D 0.98%

YTD -45.11%

20,330

1D -3.42%

YTD -27.52%

11,880

1D -0.92%

YTD -44.69%

930

1D -2.49%

YTD 0.00%

937

1D -1.94%

YTD 0.00%

935

1D -2.58%

YTD 0.00%

938

1D -2.58%

YTD 0.00%

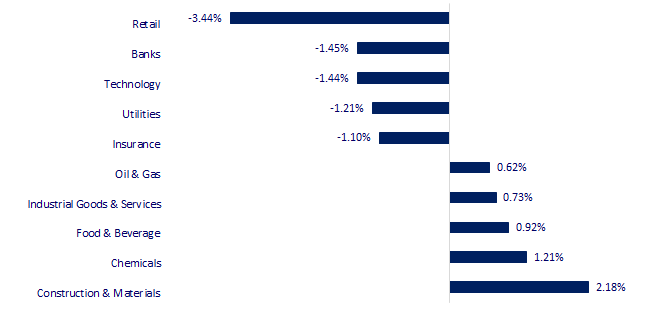

THAY ĐỔI GIÁ TẠI CÁC NGÀNH

INTRADAY VNINDEX

VNINDEX (12T)

GLOBAL MARKET

27,944.79

1D 0.16%

YTD -2.94%

3,085.04

1D -0.39%

YTD -15.24%

2,419.50

1D -1.02%

YTD -18.74%

17,655.91

1D -1.87%

YTD -24.54%

3,250.62

1D -0.66%

YTD 4.06%

1,618.86

1D 0.09%

YTD -2.34%

87.24

1D 0.48%

YTD 14.04%

1,742.05

1D -0.32%

YTD -4.33%

Asian stocks mostly fell today, especially the Hang Seng index dropped nearly 2%. China has stuck to its stringent zero-COVID approach, even as other nations have eased curbs. That has led to widespread public frustration and damage inflicted on the world's second-largest economy with lockdowns, some in key industrial areas.

VIETNAM ECONOMY

5.60%

1D (bps) 37

YTD (bps) 479

7.40%

YTD (bps) 180

4.88%

1D (bps) -2

YTD (bps) 387

4.91%

YTD (bps) 291

24,858

1D (%) 0.00%

YTD (%) 8.36%

25,872

1D (%) -1.72%

YTD (%) -2.25%

3,536

1D (%) -0.11%

YTD (%) -3.34%

In the session of November 18, SBV continued to issue nearly VND5,000 billion of bills with a term of 28 days, with an interest rate of 4.5% per year, while there were VND5,000 billion of bills due for payment. On the channel of pledging valuable papers (OMO), SBV net injected VND53 billion. In both channels, SBV continued to net withdraw VND4,947 billion on November 18.

EVENT CALENDAR

Không có sự kiện cho ngày này

Không có sự kiện cho ngày này

Không có sự kiện cho ngày này

Không có sự kiện cho ngày này

Không có sự kiện cho ngày này

Không có sự kiện cho ngày này

Không có sự kiện cho ngày này

SELECTED NEWS

- Proposing more than VND30,000 billion to "upgrade" Da Nang airport;

- Top 5 sectors attracting FDI equity inflow;

- Resolution on central budget allocation in 2023;

- Korean truckers to strike again in risk to global supply chains;

- Australia learns there’s no replacement for the Chinese consumer;

- China COVID cases rise, hard-hit Beijing districts shut schools.

VN30

Bank

75,000

1D -1.96%

5D -0.13%

Buy Vol. 1,371,347

Sell Vol. 2,175,995

35,500

1D -1.25%

5D -1.11%

Buy Vol. 2,078,784

Sell Vol. 2,779,336

24,100

1D -2.43%

5D 0.84%

Buy Vol. 10,323,430

Sell Vol. 11,109,375

22,250

1D -1.98%

5D 0.23%

Buy Vol. 7,325,939

Sell Vol. 9,299,066

15,500

1D 0.00%

5D -1.27%

Buy Vol. 19,209,039

Sell Vol. 21,483,072

15,700

1D 0.00%

5D 3.29%

Buy Vol. 22,163,316

Sell Vol. 20,160,765

14,800

1D -1.33%

5D 1.37%

Buy Vol. 2,779,770

Sell Vol. 4,087,730

20,600

1D 0.00%

5D 4.57%

Buy Vol. 6,669,652

Sell Vol. 5,988,673

16,700

1D -2.34%

5D 5.36%

Buy Vol. 37,929,048

Sell Vol. 29,648,795

18,500

1D 0.54%

5D 6.32%

Buy Vol. 4,014,163

Sell Vol. 4,595,464

20,600

1D -2.60%

5D 1.48%

Buy Vol. 4,352,033

Sell Vol. 4,392,249

Fitch Ratings has upgraded Joint Stock Commercial Bank For Foreign Trade of Vietnam's (Vietcombank) Long-Term Issuer Default Rating to 'BB' from 'BB-', on an upgrade of the Government Support Rating (GSR) to 'bb' from 'bb-'. The Outlook on the IDR is Positive, in line with Vietnam's sovereign rating of 'BB' with a Positive Outlook. Fitch has also upgraded Vietcombank's Viability Rating (VR) to 'bb-' from 'b+'.

Real Estate

27,250

1D -6.84%

5D -30.04%

Buy Vol. 632,902

Sell Vol. 83,720,001

22,400

1D 1.36%

5D 10.34%

Buy Vol. 5,596,380

Sell Vol. 3,841,781

17,100

1D -6.81%

5D -29.92%

Buy Vol. 173,139

Sell Vol. 193,268,857

PDR: General Director of Phat Dat Real Estate Development JSC, Mr. Bui Quang Anh Vu registered to buy 20 million shares of PDR from November 24 to December 23.

Oil & Gas

111,300

1D -2.62%

5D -2.20%

Buy Vol. 438,141

Sell Vol. 366,266

10,300

1D 1.98%

5D 0.00%

Buy Vol. 15,033,225

Sell Vol. 17,255,273

25,300

1D 0.80%

5D -4.53%

Buy Vol. 1,654,196

Sell Vol. 1,494,487

PLX: In the first 10 months of 2022, domestic outputs exceeded 14% compared to the plan and increased 22% over the same period.

VINGROUP

64,000

1D -2.44%

5D 16.36%

Buy Vol. 1,903,161

Sell Vol. 2,664,871

46,950

1D -2.19%

5D 6.70%

Buy Vol. 4,138,374

Sell Vol. 5,234,838

26,300

1D -4.71%

5D 3.75%

Buy Vol. 2,834,711

Sell Vol. 2,816,437

VHM: Vinhomes JSC agreed to acquire 99% stake in Cam Ranh Salt JSC.

Food & Beverage

77,900

1D 1.17%

5D -1.39%

Buy Vol. 2,762,975

Sell Vol. 3,315,971

95,100

1D -0.11%

5D 6.73%

Buy Vol. 885,621

Sell Vol. 912,419

182,600

1D 1.90%

5D -6.36%

Buy Vol. 155,507

Sell Vol. 185,728

MSN: Q3/2022, profit of MEATLife and MSR decreased and unrealized loss due to increased exchange rate volatility when revaluation of debt in USD led to a decrease in Masan's profit.

Other

47,700

1D -1.24%

5D 0.21%

Buy Vol. 1,151,130

Sell Vol. 1,066,871

100,600

1D -1.57%

5D -1.28%

Buy Vol. 260,855

Sell Vol. 220,973

70,100

1D -1.96%

5D -0.99%

Buy Vol. 1,578,493

Sell Vol. 1,656,997

40,650

1D -3.56%

5D 0.00%

Buy Vol. 3,202,999

Sell Vol. 3,559,273

13,000

1D 7.00%

5D 20.93%

Buy Vol. 6,367,936

Sell Vol. 3,405,326

16,100

1D -0.92%

5D 12.98%

Buy Vol. 25,311,878

Sell Vol. 27,313,109

14,950

1D -0.99%

5D 22.54%

Buy Vol. 65,525,331

Sell Vol. 55,575,606

FPT: Q3/2022, FPT Telecom (FOX) recorded revenue of VND3,731 billion, up 20% and EBT of VND723 billion, up 23%, contributing 33% of revenue and 36% of PBT of the corporation. FPT Telecom's subsidiary, FPT Online Services JSC (FOC), achieved revenue of VND214 billion, up 63% and EBT of VND84 billion, up 52% over the same period.

Market by numbers

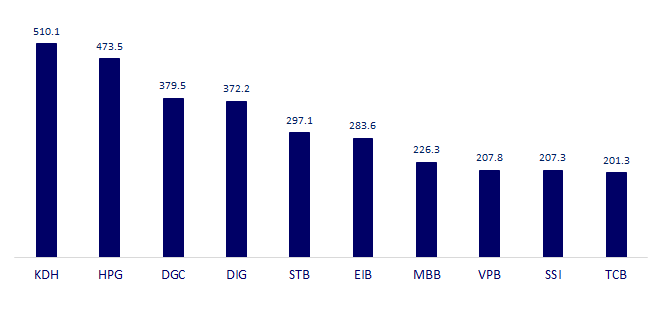

TOP CP GIAO DỊCH NHIỀU NHẤT (KHỐI LƯỢNG CP - TRIỆU CP)

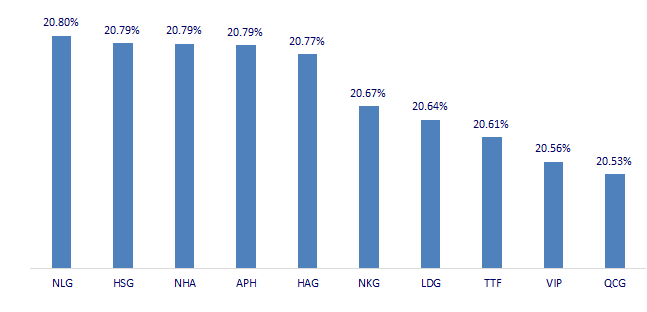

TOP CP TĂNG 3 PHIÊN LIÊN TIẾP

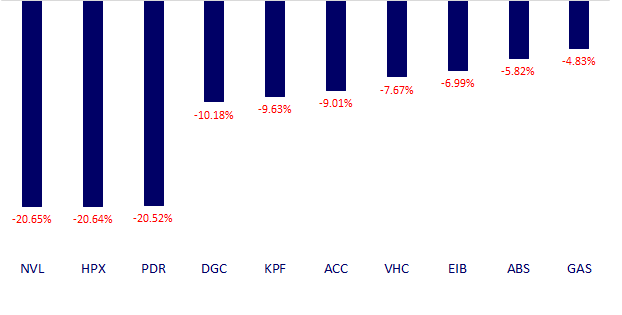

TOP CP GIẢM 3 PHIÊN LIÊN TIẾP

Công ty Cổ phần Chứng khoán Pinetree

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

Bài viết sử dụng hình ảnh của freepik và các trang web cho sử dụng hình ảnh miễn phí khác.