Up Viet Nam

We are very fortunate to be living and working in Viet Nam – one of the fastest growing economies in the world. This gives investors a huge advantage in understanding and capitalizing on investment opportunities. By choosing stocks that play an important role in the development of the economy, we can complete our accumulation plans and achieve attractive profits in the future.

Viet Nam’s economy has many sound bases for robust growth:

Firstly, Viet Nam is currently in the “golden population” period, which is a special time that occurs only once in the process of economic development. Many countries have used this advantage to create breakthroughs in economic development. With an abundant labor force (more than 50% of the population aged 15-60), Viet Nam has many advantages from labor supply. This is also the age group with the highest consumption demand, creating a growth momentum for the development of a dynamic economy.

Secondly, Viet Nam has many advantages to attract foreign investor, such as geographical position, human resources, stable political environment and opened policies of the Government,….

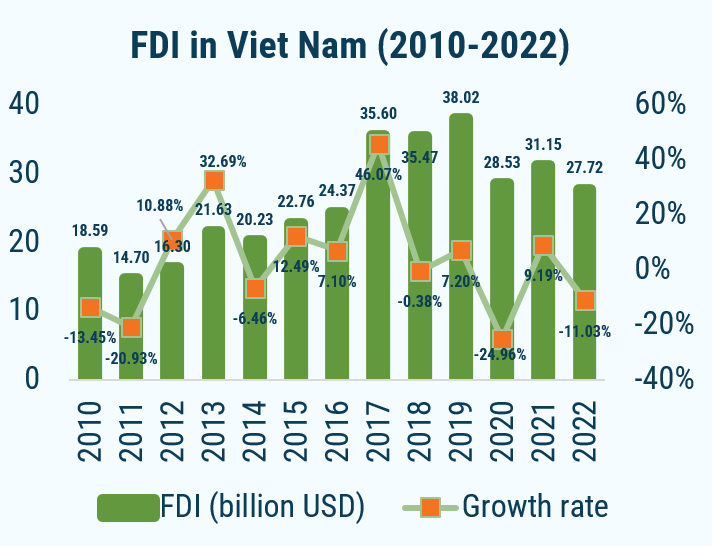

Besides, there are more opportunities to attract FDI in the upcoming period due to: (1) Viet Nam continuously signed new generation FTAs; (2) FDI is moving out of China due to changes in development policies of the Chinese Government, impacts from the Covid-19 pandemic and the trade war; (3) Viet Nam is assessed by foreign investors as having a strategic position in ensuring the global supply chain, as a safe and attractive investment destination. Viet Nam is among the top attracting FDI in Southeast Asia, and used to be in the top 20 of the world.

How to take advantage from this opportunity?

To accompany this trend, investors can choose from one of the portfolios constructed by Pinetree’s experienced staff.

The stocks included in the theme are those listed on the HSX (the stock exchange with the highest listing standards currently in Viet Nam) and such stocks must meet the following criteria:

These must be shares of enterprises whose main business lines are related to the development of the country: operating in industries that are spearheads of the country (e.g. textiles, high technology, agricultural specific products,…), or operating in a group of industries that make important contributions to the development process of the economy (for example, infrastructure construction, logistics, energy,…), or companies in the field which is benefit from the development of the country, from the growth of the consumer market.

After identifying groups of companies that satisfy the conditions of potential in the business field, we evaluate the effectiveness in governance, key profitable activities before making conclusions about profitability of the enterprise. The group of businesses with the most potential of making profit according to the above criteria will be included in the list of theme. During the monitoring of our portfolio, we will always try to update with new stocks that are relevant to the topic and weed out those that are either no longer relevant, or have no longer earning potential.

Investments Risks

Capital at Risk: No assurance can be given that the value of investments and the income from theme can rise as well as fall. Investors can lose some or all of the amount originally invested. Our theme are subject to risks including counterparty risk, credit risk, geopolitical risk, liquidity risk, market risk and other risk of economy.

The figures shown relate to past performance. Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy.