Market Brief 31/01/2024

VIETNAM STOCK MARKET

1,164.31

1D -1.30%

YTD 2.88%

229.18

1D -0.64%

YTD -0.35%

1,166.33

1D -1.30%

YTD 3.07%

87.69

1D -0.18%

YTD 0.13%

1,372.34

1D 0.00%

YTD 0.00%

26,968.61

1D 71.49%

YTD 42.72%

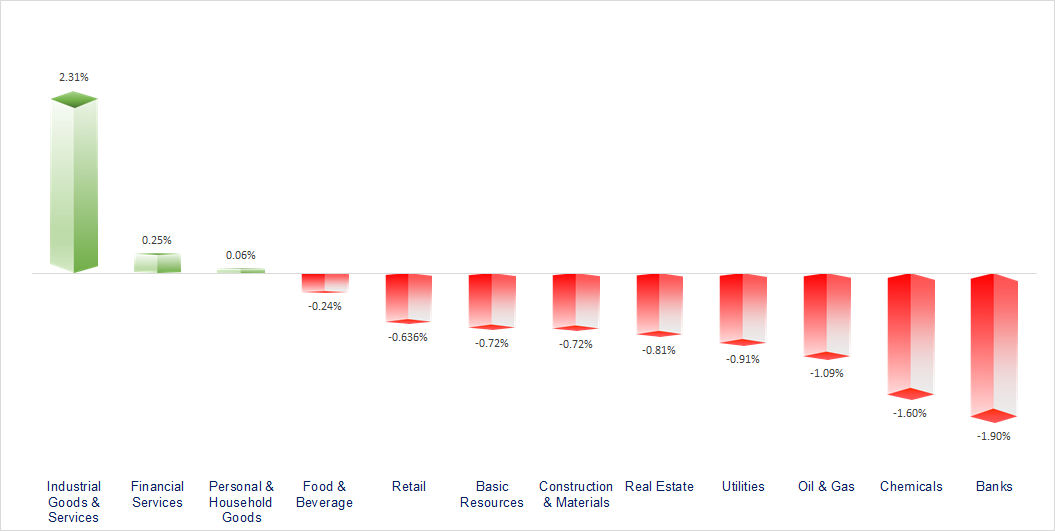

Most industries dropped in today's session, especially securities and industrial services were the rare industries that closed in the green. Notable gaining stocks include FTS +5.6%, MBS +3.2%, DHC +3.9%, MSH +1.6%.

ETF & DERIVATIVES

20,190

1D -0.98%

YTD 3.38%

13,870

1D -1.28%

YTD 3.12%

14,400

1D -1.17%

YTD 3.90%

17,100

1D -0.70%

YTD 0.71%

19,470

1D -1.67%

YTD 5.82%

27,140

1D -0.80%

YTD 4.26%

15,900

1D 0.13%

YTD 4.13%

1,171

1D -1.26%

YTD 0.00%

1,172

1D -1.18%

YTD 0.00%

1,168

1D -1.31%

YTD 0.00%

1,166

1D -1.33%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

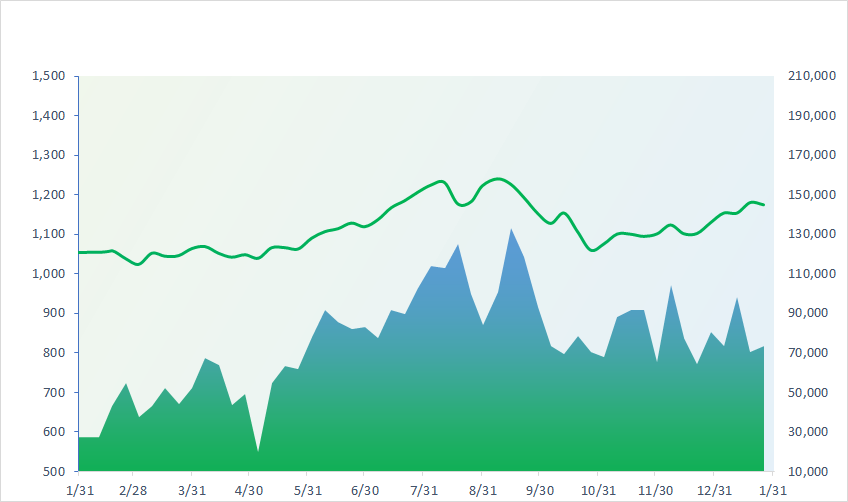

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

36,286.71

1D 0.61%

YTD 8.43%

2,788.54

1D -1.48%

YTD -5.87%

15,485.07

1D -1.39%

YTD -7.76%

2,497.09

1D -0.07%

YTD -6.47%

71,643.63

1D 0.71%

YTD -0.35%

3,154.62

1D 0.15%

YTD -2.33%

1,365.20

1D -0.58%

YTD -4.76%

82.20

1D -0.54%

YTD 4.26%

2,039.46

1D 0.15%

YTD -1.80%

Asian stocks were mixed as traders stayed on guard ahead of the Fed decision. In Japan, though, the Nikkei 225 ended the month with a more than 8% gain, its best January performance since 1998. A summary of opinions from the country's central bank's January meeting showed policymakers looking at the likelihood of a near-term exit from negative interest rates and possible scenarios for phasing out the bank's massive stimulus programme.

VIETNAM ECONOMY

1.06%

1D (bps) 94

YTD (bps) -254

4.70%

YTD (bps) -10

1.73%

YTD (bps) -15

2.17%

1D (bps) -20

YTD (bps) -1

24,605

1D (%) 0.14%

YTD (%) 0.39%

27,160

1D (%) -0.07%

YTD (%) -0.79%

3,474

1D (%) 0.14%

YTD (%) -0.06%

The dollar index has gained 2.1% against a basket of major currencies this month as markets dialled back expectations on the speed and scale of U.S. rate cuts in the face of strong economic data and pushback from central bankers. On the day, the dollar index was up 0.1% to 103.51, just below Monday's 103.82 which matched last week's seven-week high.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- In 2023, Vietnam's rice exports to the EU reached a record, exceeding the EVFTA quota;

- The Ministry of Transport said that construction procedures for 19 projects will be completed in 2024;

- Vietnam is ready to welcome a record high number of international visitors;

- Air freight rates increased sharply because of Red Sea tensions;

- Saudi Arabia's real gross domestic product (GDP) shrunk 3.7% in the fourth quarter of 2023;

- China’s C919 maker has sky-high ambitions to grab a piece of the aviation pie from Boeing, Airbus.

VN30

BANK

88,500

1D -2.75%

5D -2.85%

Buy Vol. 2,373,714

Sell Vol. 2,287,470

47,700

1D -1.55%

5D -2.45%

Buy Vol. 3,122,364

Sell Vol. 3,033,489

31,600

1D -1.86%

5D -1.25%

Buy Vol. 19,210,271

Sell Vol. 21,645,228

34,550

1D -1.85%

5D -1.99%

Buy Vol. 8,787,981

Sell Vol. 8,444,573

19,400

1D -1.52%

5D -1.27%

Buy Vol. 29,515,014

Sell Vol. 44,818,431

21,750

1D -1.58%

5D -0.68%

Buy Vol. 40,183,239

Sell Vol. 42,327,973

21,800

1D -0.23%

5D 3.07%

Buy Vol. 7,172,216

Sell Vol. 8,739,312

17,850

1D -2.46%

5D -2.46%

Buy Vol. 15,833,963

Sell Vol. 17,910,651

29,900

1D -2.61%

5D -2.76%

Buy Vol. 52,458,290

Sell Vol. 61,382,634

20,750

1D -0.72%

5D -0.48%

Buy Vol. 8,957,295

Sell Vol. 11,172,272

25,750

1D -0.77%

5D -0.19%

Buy Vol. 21,457,201

Sell Vol. 20,046,008

11,600

1D -5.69%

5D -4.92%

Buy Vol. 225,558,154

Sell Vol. 220,464,734

22,900

1D -0.43%

5D -0.87%

Buy Vol. 1,996,749

Sell Vol. 3,559,955

CTG: In the fourth quarter of 2023, Vietinbank's consolidated pre-tax profit reached VND7,699 billion, an increase of 43.4% compared to the fourth quarter of 2022. Total operating income reached VND18,475 billion, up 10.1% over the same period. Meanwhile, operating expenses increased only 0.8% to VND6,304 billion, provision expenses for credit losses decreased 13.3% to VND4,473 billion.

OIL & GAS

75,400

1D -1.31%

5D -0.44%

Buy Vol. 1,103,828

Sell Vol. 14,106,404

11,350

1D -1.30%

5D -0.14%

Buy Vol. 10,637,045

Sell Vol. 1,223,071

34,600

1D -0.43%

5D -1.51%

Buy Vol. 917,675

Sell Vol. 4,384,999

PLX: Today's session, foreign investors net bought PLX with a value of VND6.8 billion.

VINGROUP

42,500

1D -0.47%

5D -2.35%

Buy Vol. 4,080,226

Sell Vol. 12,113,520

41,500

1D -1.19%

5D -6.26%

Buy Vol. 9,467,026

Sell Vol. 33,544,211

22,450

1D -4.06%

5D -0.45%

Buy Vol. 26,703,266

Sell Vol. 8,246,681

VHM: Vinhomes' revenue exceeded the VND100,000 billion for the first time, profit reached more than VND33,000 billion, an increase of 14%.

FOOD & BEVERAGE

67,000

1D 0.15%

5D -2.72%

Buy Vol. 6,369,663

Sell Vol. 4,698,664

64,400

1D -2.57%

5D -6.63%

Buy Vol. 4,042,303

Sell Vol. 1,707,309

56,300

1D -1.57%

5D 5.32%

Buy Vol. 1,916,614

Sell Vol. 1,795,594

VNM: Export revenue in the fourth quarter of 2023 increased impressively by nearly 20%.

OTHERS

65,300

1D 0.00%

5D -0.49%

Buy Vol. 1,522,626

Sell Vol. 795,506

40,500

1D -1.22%

5D -0.49%

Buy Vol. 743,313

Sell Vol. 795,506

104,600

1D -0.95%

5D -0.10%

Buy Vol. 844,614

Sell Vol. 1,015,663

95,700

1D 0.10%

5D 0.74%

Buy Vol. 2,633,279

Sell Vol. 2,885,595

45,000

1D -0.88%

5D 1.35%

Buy Vol. 12,541,316

Sell Vol. 15,710,487

22,400

1D -2.40%

5D 7.18%

Buy Vol. 7,177,925

Sell Vol. 7,126,205

34,400

1D 0.73%

5D 1.18%

Buy Vol. 87,549,468

Sell Vol. 85,609,463

27,750

1D -0.89%

5D -1.77%

Buy Vol. 36,717,086

Sell Vol. 44,075,107

MWG: Mobile World said that revenue from mobile phones, laptops, washing machines and household appliances decreased by 10%-20%; TVs, tablets and watches decreased by 30%-50% over the same period. However, iPhone sales still recorded positive growth. Thereby, MWG's iPhone market share has increased from 25%-30% in the beginning of the year to about 50% by the end of 2023.

Market by numbers

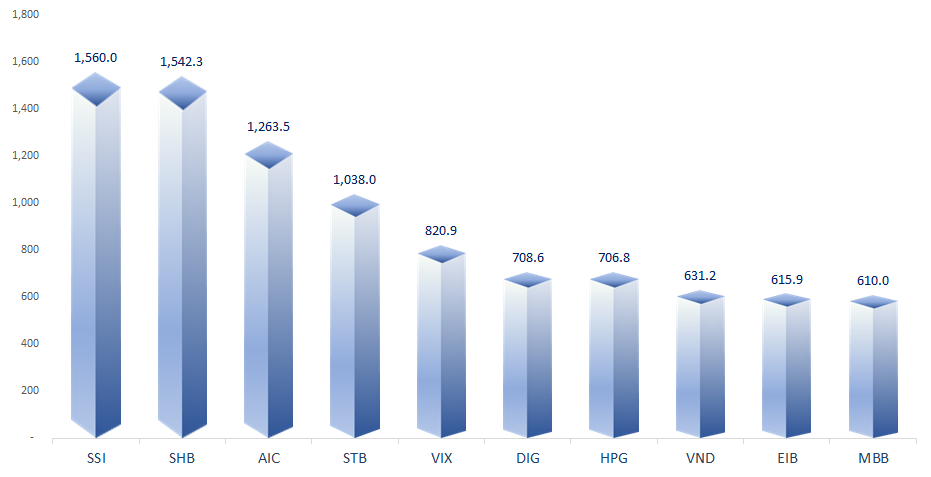

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

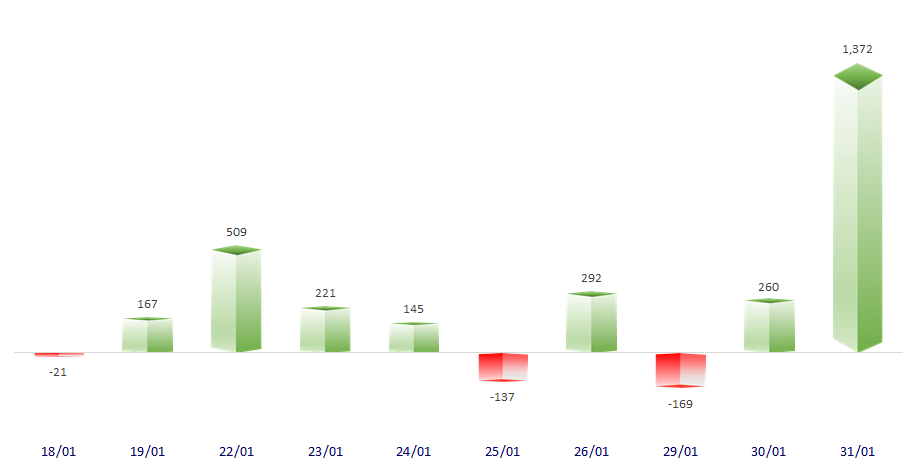

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

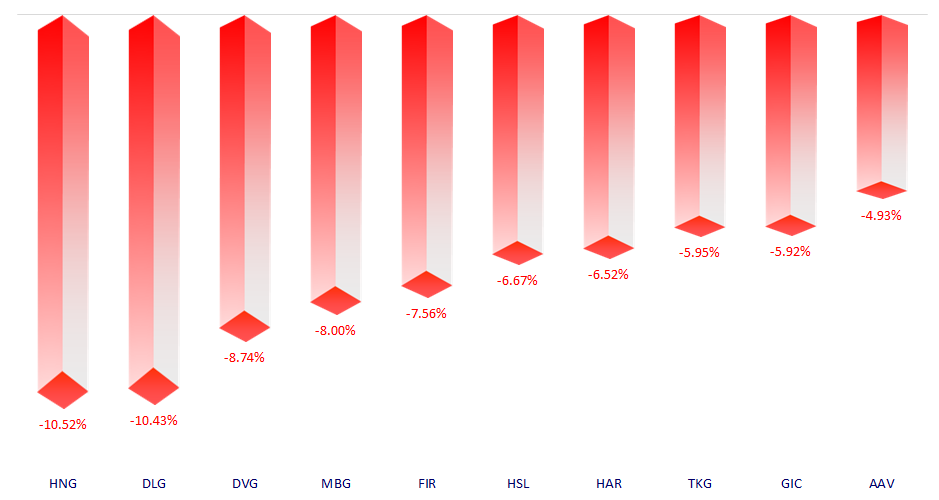

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.