Market Brief 11/03/2021

VIETNAM STOCK MARKET

1,181.73

1D 1.00%

YTD 7.48%

1,188.71

1D 1.40%

YTD 12.31%

273.52

1D 2.40%

YTD 38.77%

80.34

1D 0.12%

YTD 8.82%

-285.98

1D 0.00%

YTD 0.00%

18,598.63

1D -12.25%

YTD 8.43%

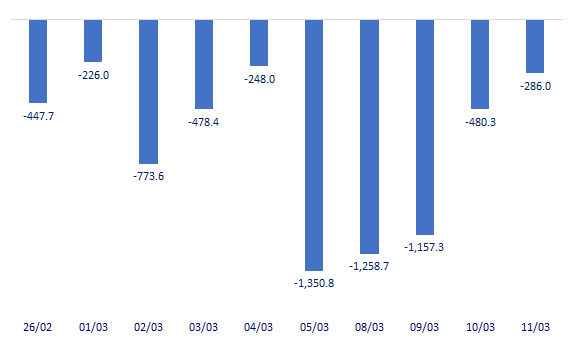

- Foreign investors continued to be net sellers on all 3 exchanges but their value dropped significantly to only 286 billion dong today. Selling force focused mainly on VNM, HPG, VCB …

ETF & DERIVATIVES

20,000

1D 1.42%

YTD 6.38%

13,860

1D -1.00%

YTD 10.61%

14,780

1D 0.89%

YTD 10.88%

17,300

1D 2.37%

YTD 9.49%

15,900

1D 2.45%

YTD 16.48%

19,870

1D 1.95%

YTD 15.52%

15,380

1D 1.99%

YTD 10.25%

1,191

1D 0.55%

YTD 0.00%

1,196

1D 1.07%

YTD 0.00%

1,193

1D 0.88%

YTD 0.00%

1,191

1D 1.05%

YTD 0.00%

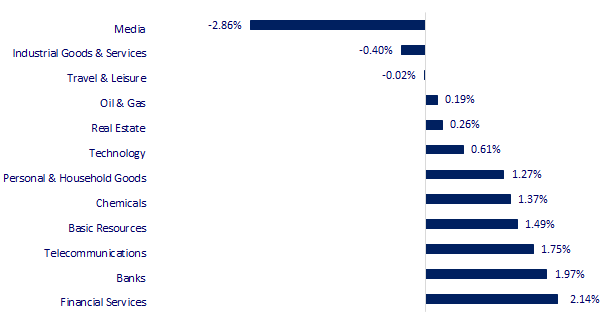

CHANGE IN PRICE BY SECTOR

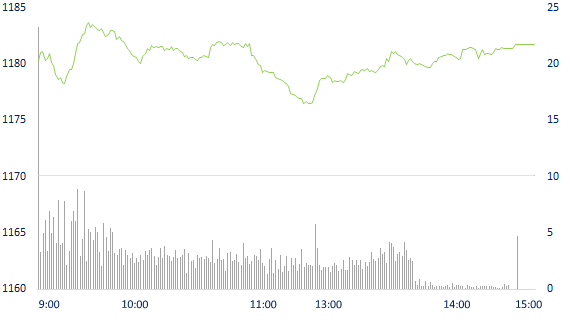

INTRADAY VNINDEX

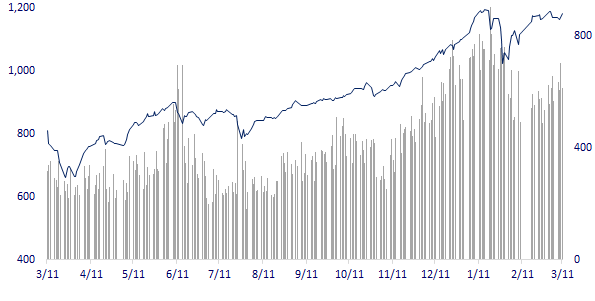

VNINDEX (12M)

GLOBAL MARKET

29,211.64

1D 0.34%

YTD 6.44%

3,436.83

1D 2.36%

YTD 0.66%

3,013.70

1D 1.88%

YTD 4.88%

29,385.61

1D 1.65%

YTD 8.25%

3,106.01

1D 0.85%

YTD 8.25%

1,575.13

1D 0.13%

YTD 8.68%

64.94

1D 0.05%

YTD 34.45%

1,733.85

1D 0.60%

YTD -8.92%

- Most Asian stocks rose, South Korea and China led the region. The MSCI Asia-Pacific Index excluding Japan rose 1.78%. In Japan, the Nikkei 225 increased by 0.34% while the Topix rose 0.27%. The Japanese market has often struggled to keep up the momentum until the end of the session. The Chinese market went up with the Shanghai Composite up 2.36% and Shenzhen Component up 2.23%. Hong Kong's Hang Seng increased by 1.65%.

VIETNAM ECONOMY

0.29%

YTD (bps) 16

5.80%

1.22%

1D (bps) 2

2.31%

1D (bps) 3

YTD (bps) 28

23,153

1D (%) 0.00%

YTD (%) -0.11%

28,287

1D (%) 0.34%

YTD (%) -2.80%

3,624

1D (%) 0.30%

YTD (%) 1.43%

- The Ministry of Finance announced that budget revenue in the first 2 months was estimated at nearly 287,000 billion VND, reaching 21.3% of the estimate and up 0.6% over the same period last year. In which, domestic revenue was estimated at more than 246,000 billion VND, equal to 21.8% of the estimate, up 2.8% over the same period last year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Foxconn will invest $700 million in Vietnam this year, increase 10,000 jobs, expected revenue of $10 billion

- Quang Binh wants to immediately upgrade Dong Hoi airport to an international airport

- The Ministry of Defense handed over 16 hectares of land to Tan Son Nhat T3 station, expected to commence at the end of October

- US - China officials are about to meet for the first time under Mr. Biden's term

- The House of Representatives approved a rescue package of 1.9 trillion USD, waiting for Mr. Biden's signature

- Thailand is expected to welcome two million international tourists this year

VN30

BANK

96,300

1D 0.84%

5D -1.03%

Buy Vol. 1,668,900

Sell Vol. 1,751,200

43,300

1D 3.10%

5D 1.29%

Buy Vol. 3,790,800

Sell Vol. 2,953,200

38,200

1D 1.73%

5D -0.26%

Buy Vol. 13,079,900

Sell Vol. 17,089,800

40,150

1D 2.16%

5D 2.82%

Buy Vol. 26,022,000

Sell Vol. 30,706,500

43,750

1D 4.17%

5D 5.42%

Buy Vol. 12,849,200

Sell Vol. 17,652,500

28,250

1D 1.07%

5D 4.05%

Buy Vol. 26,304,300

Sell Vol. 39,927,300

26,400

1D 1.15%

5D 0.76%

Buy Vol. 7,198,900

Sell Vol. 12,416,600

28,600

1D 0.53%

5D -0.17%

Buy Vol. 7,445,600

Sell Vol. 8,737,500

19,300

1D 3.21%

5D 5.18%

Buy Vol. 56,770,100

Sell Vol. 65,378,300

- BID: BIDV will submit to shareholders for approval of its business plan for 2021 and a plan to increase its charter capital by more than VND 8,300 billion through the issue of shares to pay dividends, to offer to the public or a private offering. Raising capital growth in accordance with capital use, balance with credit growth, is expected to be about 12-15%. The bank plans to spend VND 2,815 billion to pay stock dividends for 2020, equivalent to a rate of 7%.

REAL ESTATE

82,900

1D 0.48%

5D 2.85%

Buy Vol. 3,500,300

Sell Vol. 3,858,400

22,800

1D 0.44%

5D 4.59%

Buy Vol. 6,956,200

Sell Vol. 10,200,300

31,550

1D -0.47%

5D -1.25%

Buy Vol. 1,859,600

Sell Vol. 2,470,800

66,800

1D 3.89%

5D 6.37%

Buy Vol. 7,089,500

Sell Vol. 6,122,400

- NVL: Chairman Bui Thanh Nhon and his wife bought a total of nearly 22 million NVL shares, raising their holding rate to more than 27.55%.

OIL & GAS

92,700

1D 0.76%

5D 1.98%

Buy Vol. 580,600

Sell Vol. 822,300

13,800

1D 1.10%

5D 9.52%

Buy Vol. 22,789,400

Sell Vol. 30,355,700

55,600

1D -0.36%

5D -3.81%

Buy Vol. 5,769,000

Sell Vol. 4,623,000

- POW: PV Power recorded a 4% decrease in 2-month revenue, with an upcoming contribution from renewable electricity

VINGROUP

105,900

1D -0.09%

5D -0.94%

Buy Vol. 1,716,900

Sell Vol. 2,195,000

100,000

1D 0.10%

5D 0.00%

Buy Vol. 2,535,200

Sell Vol. 4,343,700

34,350

1D 0.59%

5D -0.58%

Buy Vol. 4,398,100

Sell Vol. 6,482,100

- VIC: For the first time, VinFast Fadil has become the best-selling car in the Vietnamese auto market, outstripping Toyota Vios at 7th place.

FOOD & BEVERAGE

102,800

1D 1.68%

5D -0.58%

Buy Vol. 4,472,700

Sell Vol. 4,743,200

87,300

1D 0.34%

5D -1.24%

Buy Vol. 1,592,300

Sell Vol. 1,563,100

22,700

1D 0.44%

5D 0.89%

Buy Vol. 6,751,900

Sell Vol. 9,280,600

OTHERS

136,100

1D 0.44%

5D -0.51%

Buy Vol. 874,100

Sell Vol. 767,400

136,100

1D 0.44%

5D -0.51%

Buy Vol. 874,100

Sell Vol. 767,400

76,700

1D 0.52%

5D 1.05%

Buy Vol. 2,085,800

Sell Vol. 3,394,100

132,500

1D 1.53%

5D -0.23%

Buy Vol. 864,900

Sell Vol. 1,075,100

84,000

1D 0.48%

5D 0.24%

Buy Vol. 352,000

Sell Vol. 1,079,700

55,500

1D 1.09%

5D 0.00%

Buy Vol. 1,228,000

Sell Vol. 1,168,000

33,950

1D 2.57%

5D 1.49%

Buy Vol. 20,197,100

Sell Vol. 22,201,300

46,400

1D 1.75%

5D 1.09%

Buy Vol. 31,731,500

Sell Vol. 32,525,100

- HPG: On March 9, investment fund PENM III Germany GmbH & Co. KG reported on the successful sale of 7.09 million shares of Hoa Phat Group JSC (HOSE: HPG). These are also all HPG shares that the Fund owns.

Market by numbers

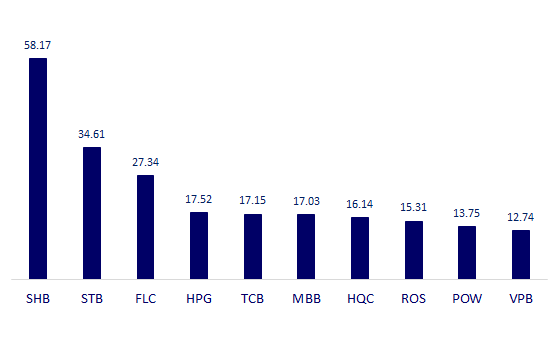

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

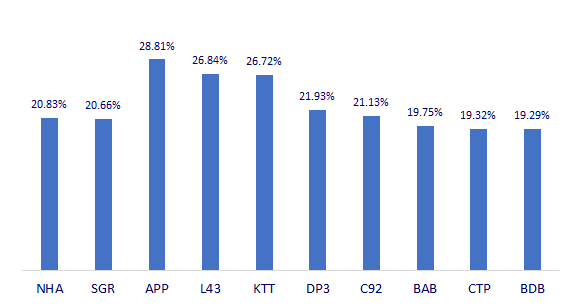

TOP INCREASES 3 CONSECUTIVE SESSIONS

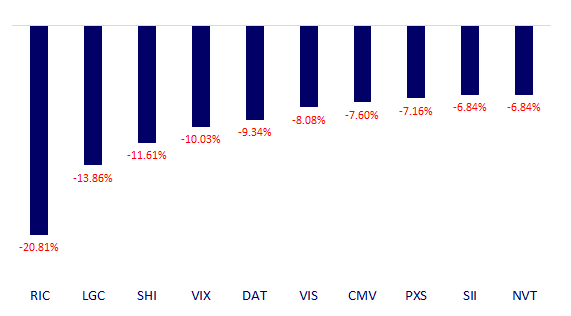

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.