Market brief 10/05/2022

VIETNAM STOCK MARKET

1,293.56

1D 1.89%

YTD -13.66%

1,345.46

1D 2.39%

YTD -12.39%

330.02

1D 2.05%

YTD -30.37%

99.06

1D 2.65%

YTD -12.09%

718.63

1D 0.00%

YTD 0.00%

19,955.67

1D -8.22%

YTD -35.78%

Foreign investors continued to net buy 718b dong in session 10/5. DGC was the strongest net bought by foreign investors on HoSE with a value of 105b dong. After that, STB was net bought 70b dong. HPG and NLG were net bought at 62b dong and 59b dong, respectively. On the other hand, fund certificates E1VFVN30 topped the list of net sellers with 38b dong. VRE and VNM were net sold 32b dong and 25b dong respectively.

ETF & DERIVATIVES

23,000

1D 4.55%

YTD -10.96%

15,740

1D 2.67%

YTD -12.99%

17,210

1D -3.37%

YTD -9.42%

19,400

1D 2.11%

YTD -15.28%

18,500

1D -2.63%

YTD -17.70%

26,610

1D 1.18%

YTD -5.13%

18,270

1D -0.71%

YTD -14.94%

1,333

1D 2.04%

YTD 0.00%

1,338

1D 2.67%

YTD 0.00%

1,332

1D 1.64%

YTD 0.00%

1,335

1D 2.06%

YTD 0.00%

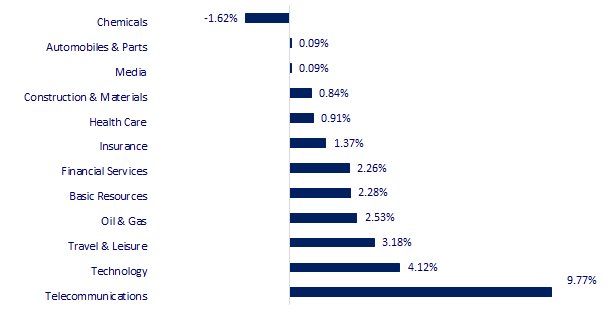

CHANGE IN PRICE BY SECTOR

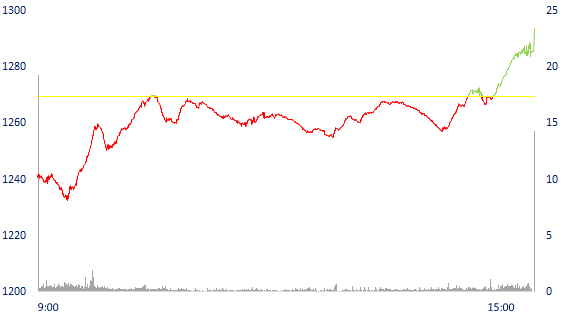

INTRADAY VNINDEX

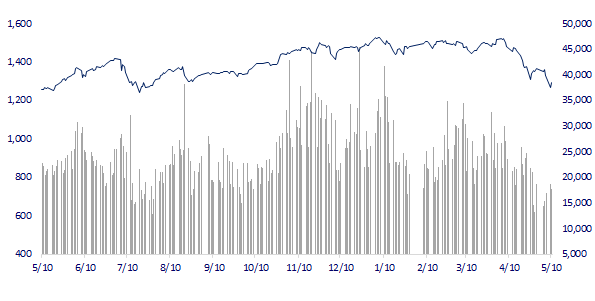

VNINDEX (12M)

GLOBAL MARKET

26,167.10

1D 0.84%

YTD -9.12%

3,035.84

1D 1.06%

YTD -16.59%

2,596.56

1D -0.55%

YTD -12.80%

19,633.69

1D 1.08%

YTD -16.09%

3,234.19

1D -1.25%

YTD 3.54%

1,622.78

1D 1.14%

YTD -2.10%

101.20

1D -0.08%

YTD 32.29%

1,859.55

1D 0.30%

YTD 2.13%

Asian stock markets mixed after the session on May 10 due to the psychological influence from the previous session in the US. South Korea's Kospi index fell 0.55%. In Japan, the Nikkei 225 index rose 0.84%. The Shanghai Composite Index rose 1.08%.

VIETNAM ECONOMY

1.78%

1D (bps) 8

YTD (bps) 97

5.60%

2.42%

1D (bps) 1

YTD (bps) 141

2.96%

1D (bps) -3

YTD (bps) 96

23,165

1D (%) 0.32%

YTD (%) 0.98%

24,654

1D (%) -1.27%

YTD (%) -6.85%

3,482

1D (%) 0.14%

YTD (%) -4.81%

According to recently released data of the General Department of Customs, the trade balance had a surplus of $850 million in April and a surplus of $2.53 billion after four months. In which, export turnover in April reached 33.32 billion USD, down 4% compared to the previous month. Meanwhile, accumulated in 4 months, export turnover reached 122.48 billion USD, up nearly 17% over the same period last year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Export turnover in April decreased by 4%

- Vietnam's new position when attending the ASEAN-US Special Conference

- Collect more than 4,500 billion VND of tax every day

- USD appreciation impacts emerging economies

- PBOC pledges to strengthen policy support for slowing economy

- EU considers additional funding for Eastern European countries to push for Russian oil ban

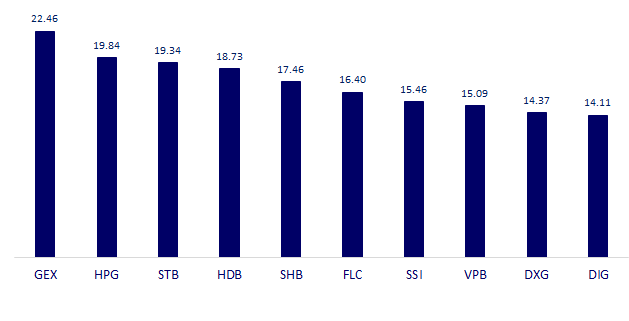

VN30

BANK

80,000

1D 2.70%

5D -1.11%

Buy Vol. 1,807,800

Sell Vol. 1,383,600

35,800

1D 3.92%

5D -3.89%

Buy Vol. 3,471,300

Sell Vol. 2,583,500

25,200

1D 0.20%

5D -9.19%

Buy Vol. 12,496,100

Sell Vol. 10,104,000

38,700

1D 0.26%

5D -12.05%

Buy Vol. 16,399,200

Sell Vol. 14,375,000

33,300

1D 4.72%

5D -9.26%

Buy Vol. 25,137,300

Sell Vol. 22,783,800

27,050

1D 3.24%

5D -9.23%

Buy Vol. 21,113,100

Sell Vol. 15,319,100

24,050

1D 4.57%

5D -4.94%

Buy Vol. 6,069,200

Sell Vol. 4,870,200

33,300

1D 5.38%

5D -0.89%

Buy Vol. 7,923,100

Sell Vol. 9,459,100

23,900

1D 0.63%

5D -13.72%

Buy Vol. 29,403,900

Sell Vol. 27,760,900

30,800

1D 0.65%

5D -5.81%

Buy Vol. 5,622,100

Sell Vol. 6,150,100

The results of the business trend survey in the second quarter of 2022 by the Department of Forecasting and Statistics, the State Bank showed that the lending and deposit interest rates are expected to remain unchanged by credit institutions or only a very slight increase of 0.03-0.06 percentage points in the second quarter of 2022 and 0.13-0.18 percentage points in the whole of 2022, mainly due to the expected increase in deposit rates.

REAL ESTATE

79,000

1D 0.64%

5D -3.66%

Buy Vol. 4,293,500

Sell Vol. 4,449,800

43,400

1D 1.17%

5D -9.39%

Buy Vol. 1,938,200

Sell Vol. 1,769,700

61,900

1D 4.38%

5D -0.32%

Buy Vol. 3,475,700

Sell Vol. 3,070,300

PDR: Additional transaction of nearly 179 million shares due to the issue of dividend payment to existing shareholders. Official transaction day: 05/17/2022

OIL & GAS

108,000

1D 2.96%

5D 1.89%

Buy Vol. 1,214,000

Sell Vol. 1,311,200

13,300

1D 2.70%

5D 1.14%

Buy Vol. 23,954,500

Sell Vol. 22,782,200

42,700

1D 0.23%

5D -11.04%

Buy Vol. 3,272,600

Sell Vol. 1,820,500

GAS: 4T2022, GAS supplied 2.7b m3 of dry gas (88% of the plan); producing and supplying 41 thousand tons of condensate (180% of the plan); producing and trading 760 thousand tons of LPG.

VINGROUP

80,400

1D 1.64%

5D 0.50%

Buy Vol. 3,601,700

Sell Vol. 3,875,300

69,900

1D 2.79%

5D 7.54%

Buy Vol. 6,531,700

Sell Vol. 6,488,400

28,100

1D -0.35%

5D -9.06%

Buy Vol. 6,456,900

Sell Vol. 6,354,700

VRE: in 2022, VRE will expand 3 million m of retail space, no dividend plan yet because it needs to retain cash flow

FOOD & BEVERAGE

70,600

1D 0.86%

5D -4.85%

Buy Vol. 4,383,900

Sell Vol. 5,171,900

116,100

1D 1.04%

5D 0.09%

Buy Vol. 1,588,500

Sell Vol. 1,755,500

164,900

1D 3.00%

5D 1.73%

Buy Vol. 333,900

Sell Vol. 426,100

VNM: The modern channel continues to accelerate with a growth rate of over 30% QoQ. This distribution channel is expected to continue to be a growth engine for the domestic market.

OTHERS

129,100

1D 4.11%

5D -0.62%

Buy Vol. 849,800

Sell Vol. 776,400

129,100

1D 4.11%

5D -0.62%

Buy Vol. 849,800

Sell Vol. 776,400

98,400

1D 4.68%

5D -6.29%

Buy Vol. 5,297,100

Sell Vol. 4,200,500

140,100

1D 2.71%

5D -6.10%

Buy Vol. 3,306,700

Sell Vol. 2,378,400

103,000

1D 3.94%

5D -4.63%

Buy Vol. 1,566,800

Sell Vol. 928,400

24,750

1D -0.80%

5D -14.21%

Buy Vol. 3,002,800

Sell Vol. 3,048,100

27,900

1D 3.91%

5D -16.84%

Buy Vol. 37,673,700

Sell Vol. 22,531,300

41,100

1D 2.88%

5D -5.08%

Buy Vol. 37,491,000

Sell Vol. 27,241,900

HPG: announced April production output reached 737,000 tons of crude steel, up slightly over the same period. Sales volume of steel products including construction steel, hot rolled coil, billet reached nearly 600,000 tons, down 31% over the same period last year and down 28% from the previous month.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

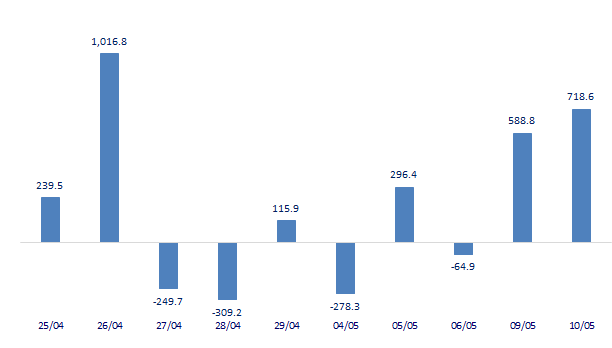

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

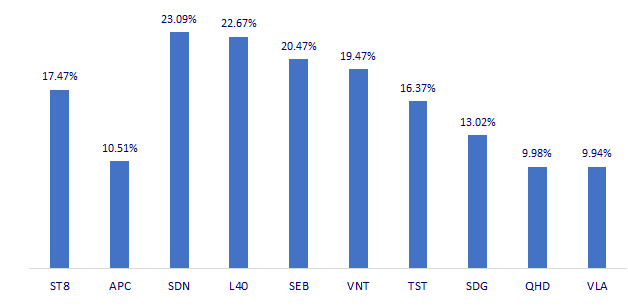

TOP INCREASES 3 CONSECUTIVE SESSIONS

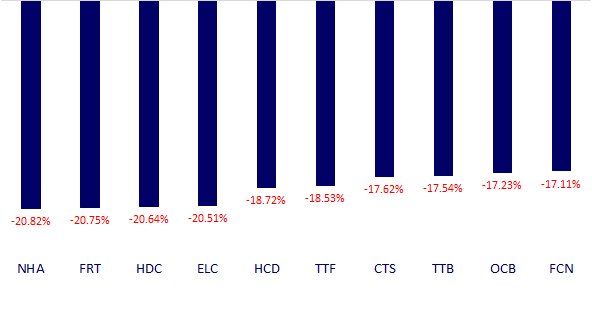

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.