Market brief 01/08/2022

VIETNAM STOCK MARKET

1,231.35

1D 2.07%

YTD -17.82%

1,256.25

1D 1.97%

YTD -18.20%

294.62

1D 2.08%

YTD -37.84%

89.91

1D 0.33%

YTD -20.21%

651.24

1D 0.00%

YTD 0.00%

18,801.26

1D 10.26%

YTD -39.49%

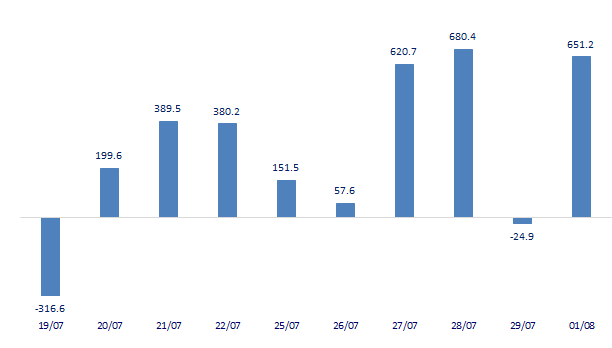

At the end of the trading session on August 1, foreign investors were active when buying 55.5 mil shares, worth 1,529 bil VND, while selling 32 mil shares, worth 878 bil VND. Total net buying volume reached 23.5 mil shares, equivalent to a net buying value of VND 651 bil. Foreign investors on HoSE were the strongest net buyers of SSI with 114 bil VND. STB and HPG were net bought 105 bil VND and 76 bil VND respectively.

ETF & DERIVATIVES

21,100

1D 0.72%

YTD -18.31%

14,790

1D 1.51%

YTD -18.24%

15,100

1D -15.22%

YTD -20.53%

17,990

1D 2.92%

YTD -21.44%

17,350

1D 2.97%

YTD -22.82%

26,350

1D -0.19%

YTD -6.06%

15,900

1D 0.06%

YTD -25.98%

1,239

1D 0.89%

YTD 0.00%

1,239

1D 0.83%

YTD 0.00%

1,240

1D 0.83%

YTD 0.00%

1,244

1D 1.11%

YTD 0.00%

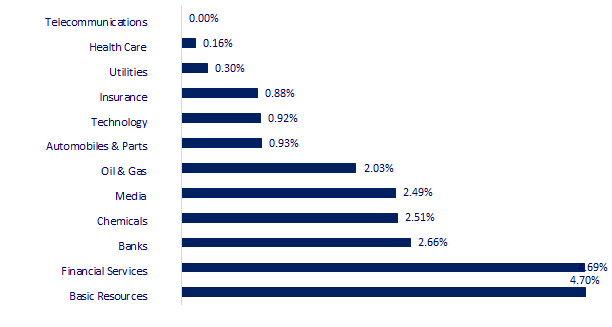

CHANGE IN PRICE BY SECTOR

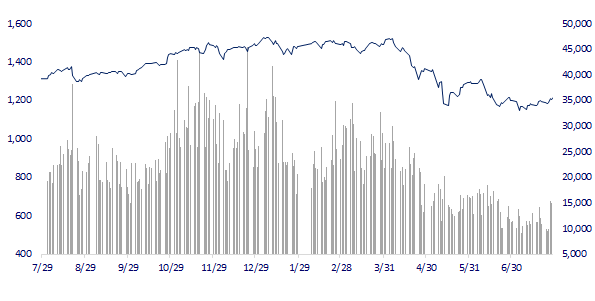

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,993.35

1D 0.53%

YTD -2.77%

3,259.96

1D 0.21%

YTD -10.44%

2,452.25

1D 0.03%

YTD -17.64%

20,165.84

1D 0.05%

YTD -13.81%

3,238.75

1D 0.85%

YTD 3.68%

1,593.24

1D 1.07%

YTD -3.88%

96.83

1D -0.63%

YTD 26.58%

1,789.25

1D 0.47%

YTD -1.73%

Asian stocks all rallied in the first trading session of August. In Japan, the Nikkei 225 gained 0.53% to 27,993.35 points, the Kospi index (Korea) gained 0.03%. to 2,452.25 points. In Hong Kong, the Hang Seng index recovered in afternoon trading, gaining 0.05% to 20,165.84 points. The Shanghai Composite Index rose 0.21% to 3,259.96.

VIETNAM ECONOMY

4.19%

1D (bps) -49

YTD (bps) 338

5.60%

3.13%

1D (bps) 8

YTD (bps) 212

3.62%

1D (bps) 5

YTD (bps) 162

23,499

1D (%) 0.10%

YTD (%) 2.44%

24,703

1D (%) 0.39%

YTD (%) -6.67%

3,529

1D (%) -0.03%

YTD (%) -3.53%

According to the latest forecast of the International Monetary Fund (IMF), Vietnam ranks 6th in GDP size among ASEAN countries with a GDP size of about 408.95 billion USD in 2022, while Indonesia and Thailand, respectively, lead the region with a GDP of VND 1,290 billion and VND 522 billion, respectively.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Quang Ninh: Q3/2022 Van Don Expressway - Newly put into operation

- July PMI reached over 51 points, manufacturing expanded for the 10th month in a row

- Prime Minister: Urgently find a solution to Thai Nguyen Iron and Steel Project

- Chinese banks may face a loss of 356 billion USD due to the real estate crisis

- Russia vowed to respond symmetrically to Sweden and Finland's accession to NATO

- Oil prices fell before OPEC+ meeting

VN30

BANK

77,000

1D 3.08%

5D 5.62%

Buy Vol. 2,523,100

Sell Vol. 2,695,300

39,000

1D 4.56%

5D 10.17%

Buy Vol. 5,433,000

Sell Vol. 5,471,400

28,700

1D 5.51%

5D 7.89%

Buy Vol. 15,053,600

Sell Vol. 15,442,900

38,600

1D 1.85%

5D 4.89%

Buy Vol. 11,684,700

Sell Vol. 11,748,700

29,100

1D 1.39%

5D 5.24%

Buy Vol. 20,516,500

Sell Vol. 22,029,700

26,500

1D 3.31%

5D 4.95%

Buy Vol. 20,814,400

Sell Vol. 18,706,600

24,700

1D 2.28%

5D 4.66%

Buy Vol. 6,054,200

Sell Vol. 4,030,800

27,250

1D 2.44%

5D -0.55%

Buy Vol. 3,624,800

Sell Vol. 3,376,100

25,200

1D 2.02%

5D 10.28%

Buy Vol. 31,011,600

Sell Vol. 30,754,300

26,650

1D 0.19%

5D 3.50%

Buy Vol. 4,520,800

Sell Vol. 3,218,200

VIB: At the end of the first 6 months, VIB recorded a pre-tax income of more than VND 5,000 bil, up 27% over the same period. Total operating income reached more than 8,700 bil VND, of which net interest income reached 7,200 bil VND, up 26% over the same period. Non-interest income reached more than 1,500 bil VND, contributing more than 18% to total operating income... By the end of the second quarter of 2022, VIB was in the top position in terms of market share of auto loans and life insurance in the world. Besides, VIB continues to be rated as one of the banks with the fastest credit card growth and highest card spending.

REAL ESTATE

25,000

1D 1.63%

5D 3.95%

Buy Vol. 7,261,400

Sell Vol. 6,984,000

74,700

1D 0.27%

5D 1.36%

Buy Vol. 3,157,500

Sell Vol. 3,602,800

38,500

1D 2.67%

5D 6.06%

Buy Vol. 1,679,900

Sell Vol. 1,154,300

OIL & GAS

53,600

1D 1.90%

5D 2.29%

Buy Vol. 2,287,800

Sell Vol. 1,934,300

107,900

1D 0.37%

5D 3.06%

Buy Vol. 699,600

Sell Vol. 1,104,400

13,500

1D 1.12%

5D 2.66%

Buy Vol. 26,511,300

Sell Vol. 24,768,800

VINGROUP

41,800

1D 1.70%

5D 1.70%

Buy Vol. 2,173,000

Sell Vol. 1,889,300

64,700

1D 1.09%

5D -3.86%

Buy Vol. 2,036,700

Sell Vol. 2,078,500

60,000

1D 0.17%

5D 1.87%

Buy Vol. 3,044,900

Sell Vol. 3,373,900

FOOD & BEVERAGE

29,000

1D 3.57%

5D 10.27%

Buy Vol. 3,591,000

Sell Vol. 4,166,500

73,500

1D 0.96%

5D 0.82%

Buy Vol. 3,994,000

Sell Vol. 3,592,500

109,400

1D 3.11%

5D 0.74%

Buy Vol. 1,156,400

Sell Vol. 1,279,400

OTHERS

183,000

1D 1.67%

5D 10.91%

Buy Vol. 319,700

Sell Vol. 474,100

127,100

1D 1.11%

5D 1.03%

Buy Vol. 585,600

Sell Vol. 531,700

127,100

1D 1.11%

5D 1.03%

Buy Vol. 585,600

Sell Vol. 531,700

84,000

1D 0.60%

5D -1.64%

Buy Vol. 3,207,500

Sell Vol. 3,028,000

61,300

1D 0.49%

5D -3.16%

Buy Vol. 6,088,300

Sell Vol. 5,195,700

24,700

1D 3.35%

5D 8.33%

Buy Vol. 5,132,800

Sell Vol. 4,776,300

22,800

1D 6.79%

5D 11.49%

Buy Vol. 72,747,700

Sell Vol. 40,679,700

22,800

1D 6.05%

5D 4.11%

Buy Vol. 77,540,200

Sell Vol. 58,523,600

Market by numbers

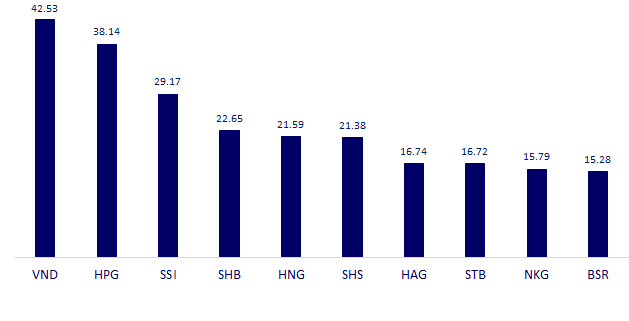

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

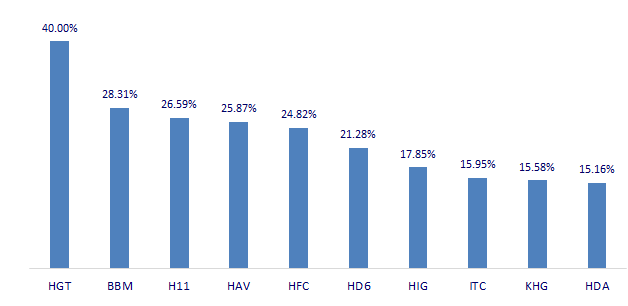

TOP INCREASES 3 CONSECUTIVE SESSIONS

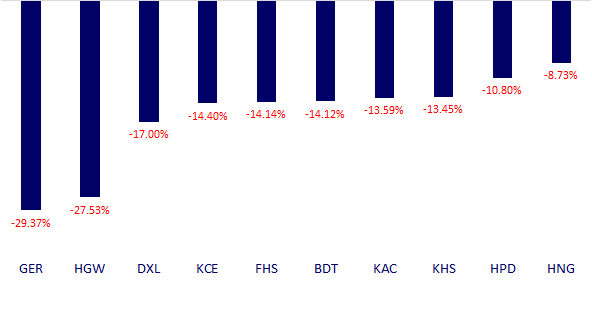

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.