Market brief 17/01/2023

VIETNAM STOCK MARKET

1,088.29

1D 2.03%

YTD 8.06%

1,103.73

1D 2.60%

YTD 9.80%

215.15

1D 2.02%

YTD 4.79%

72.97

1D 1.04%

YTD 1.84%

818.51

1D 0.00%

YTD 0.00%

13,194.59

1D 26.50%

YTD 53.14%

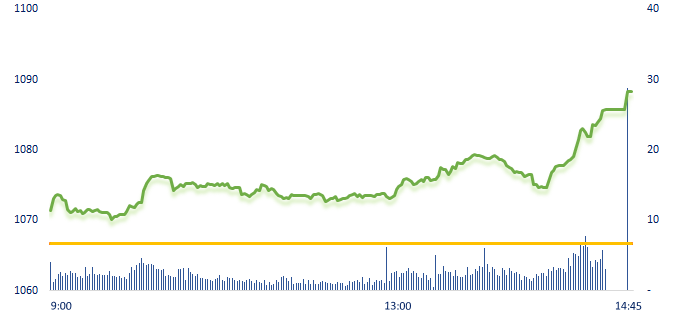

After 8 consecutive sideways trading sessions, VN-Index had an explosive session right before the Lunar New Year holiday. Banking and steel stocks, along with strong cash flow from foreign investors, were the most contributing factors that helped VN-Index gain strongly today.

ETF & DERIVATIVES

18,780

1D 2.90%

YTD 8.37%

13,000

1D 2.52%

YTD 9.06%

13,520

1D 1.96%

YTD 8.33%

15,330

1D 2.13%

YTD 9.11%

15,900

1D 2.71%

YTD 10.80%

23,530

1D 1.07%

YTD 5.04%

14,010

1D 0.72%

YTD 8.19%

1,084

1D 2.99%

YTD 0.00%

1,099

1D 3.39%

YTD 0.00%

1,115

1D 4.04%

YTD 0.00%

1,107

1D 2.96%

YTD 0.00%

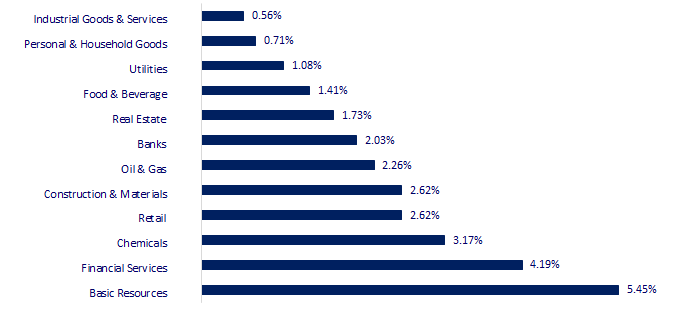

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

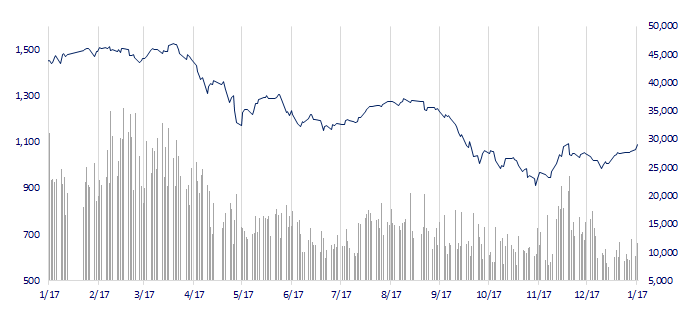

VNINDEX (12M)

GLOBAL MARKET

26,138.68

1D 1.23%

YTD 0.17%

3,224.24

1D -0.10%

YTD 4.37%

2,379.39

1D -0.85%

YTD 6.39%

21,577.64

1D -0.78%

YTD 9.08%

3,280.51

1D -0.09%

YTD 0.90%

1,681.11

1D -0.22%

YTD 0.64%

84.70

1D 0.55%

YTD -1.41%

1,908.55

1D -0.55%

YTD 4.51%

At the end of the session, Asian markets mostly dropped. The Chinese market decreased slightly as GDP growth was only 3%, lower than the expectation of 5.5%. In contrast, the Nikkei 225 gained quite strongly in today's session as the confidence that global inflation was under control and the opening of China erased worries about the BOJ's economic tightening in the future.

VIETNAM ECONOMY

6.28%

1D (bps) -20

YTD (bps) 131

7.40%

4.57%

1D (bps) -1

YTD (bps) -22

4.61%

1D (bps) -2

YTD (bps) -30

23,592

1D (%) 0.03%

YTD (%) -0.71%

26,081

1D (%) 0.01%

YTD (%) 1.64%

3,528

1D (%) -0.59%

YTD (%) 1.23%

Responding to voters' petitions to support lending interest rates in USD for enterprises engaged in import and export activities, the SBV considered that supporting foreign currency lending interest rates would increasing the demand for foreign currency, especially in the context of complicated international market movements causing pressure on the domestic exchange rate.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Construction of North-South Expressway through Tet;

- The Ministry of Finance proposes many policies to support businesses in 2023;

- Warn the risk of credit flowing into bond rolling;

- China's GDP growth of 3% in 2022;

- IMF: Economic fragmentation could reduce global GDP by 7%;

- China's population fell for the first time in more than 60 years.

VN30

BANK

89,400

1D 2.41%

5D 2.41%

Buy Vol. 1,254,131

Sell Vol. 1,184,238

44,950

1D 0.56%

5D 8.84%

Buy Vol. 2,362,488

Sell Vol. 3,057,905

30,600

1D 2.00%

5D 7.18%

Buy Vol. 5,728,740

Sell Vol. 6,600,431

29,000

1D 3.20%

5D 5.65%

Buy Vol. 10,673,678

Sell Vol. 14,847,192

19,600

1D 1.03%

5D 4.81%

Buy Vol. 48,804,320

Sell Vol. 49,993,381

19,400

1D 4.86%

5D 6.59%

Buy Vol. 34,875,201

Sell Vol. 29,877,270

17,250

1D 2.07%

5D 2.99%

Buy Vol. 3,527,746

Sell Vol. 3,681,558

23,000

1D 4.55%

5D 2.22%

Buy Vol. 25,249,336

Sell Vol. 18,294,187

26,550

1D 4.12%

5D 6.41%

Buy Vol. 39,876,605

Sell Vol. 24,805,436

22,900

1D 2.69%

5D 8.27%

Buy Vol. 6,815,570

Sell Vol. 5,955,638

25,300

1D 1.20%

5D 7.89%

Buy Vol. 8,118,690

Sell Vol. 7,327,682

VCB: In 2022, Vietcombank business targets have all met and exceeded the assigned plan. Specifically, the bank's capital mobilization in Market I reached VND1.26 million billion, up 9.1% compared to 2021, reaching 100% of the 2022 plan. The CASA reached 34%, an increase of 1.8% compared to 2021. Wholesale capital mobilization increased by 10.4%. Retail deposit mobilization grew at 8.0% compared to 2021.

REAL ESTATE

14,000

1D 2.56%

5D 0.36%

Buy Vol. 20,967,058

Sell Vol. 17,927,292

26,800

1D 1.71%

5D -3.94%

Buy Vol. 1,845,905

Sell Vol. 1,220,829

14,100

1D 2.92%

5D -1.05%

Buy Vol. 11,567,345

Sell Vol. 9,601,950

KDH: KDH was officially removed from the VN30 list and replaced by BCM from 6/2/2023.

OIL & GAS

104,200

1D 1.17%

5D -0.38%

Buy Vol. 542,960

Sell Vol. 522,580

12,150

1D 2.53%

5D 3.85%

Buy Vol. 24,345,752

Sell Vol. 21,940,690

37,350

1D 1.49%

5D 1.36%

Buy Vol. 1,898,779

Sell Vol. 1,256,534

GAS: On January 16, 2023, PV GAS appointed the Director of Khi Vung Tau and Deputy Head of Construction Investment Department of PV Gas.

VINGROUP

55,200

1D 0.73%

5D 1.28%

Buy Vol. 2,394,289

Sell Vol. 2,323,107

52,000

1D 1.36%

5D 4.52%

Buy Vol. 2,285,591

Sell Vol. 2,439,557

29,850

1D 4.74%

5D 1.53%

Buy Vol. 3,193,715

Sell Vol. 3,453,776

VIC: In December 2022, VF handed over 2,730 VF8 units to domestic consumers. With this sales level, VinFast VF8 ranks 3rd in the top 10 best-selling cars of the month.

FOOD & BEVERAGE

80,900

1D 1.89%

5D -0.12%

Buy Vol. 2,240,397

Sell Vol. 2,999,566

97,500

1D 2.74%

5D 2.20%

Buy Vol. 1,067,486

Sell Vol. 1,112,427

187,000

1D -0.80%

5D 6.19%

Buy Vol. 218,808

Sell Vol. 126,845

VNM: Optimum Gold of Vinamilk is the first baby formula product in Asia to win the Purity Award - the US award for purity, safety and transparency for consumers.

OTHERS

48,600

1D 0.93%

5D 1.25%

Buy Vol. 914,186

Sell Vol. 918,862

110,600

1D 3.08%

5D 1.37%

Buy Vol. 679,708

Sell Vol. 617,894

82,000

1D 1.49%

5D 1.99%

Buy Vol. 1,770,569

Sell Vol. 1,548,532

43,050

1D 2.74%

5D 2.01%

Buy Vol. 4,473,052

Sell Vol. 5,408,181

15,750

1D 3.62%

5D 9.38%

Buy Vol. 5,870,688

Sell Vol. 6,491,637

20,400

1D 5.15%

5D 7.94%

Buy Vol. 39,627,100

Sell Vol. 36,262,074

21,650

1D 6.91%

5D 9.34%

Buy Vol. 87,334,549

Sell Vol. 56,098,833

FPT: By the end of 2022, FPT's revenue reached more than VND44 trillion, an increase of over 23% compared to the previous year, reaching 104% of the year plan. Pre-tax income reached more than VND7.6 trillion, up 21% over the previous year, reaching 100% of the year plan. FPT recorded a net profit of nearly VND5.3 trillion, up 22% over the same period in 2021.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

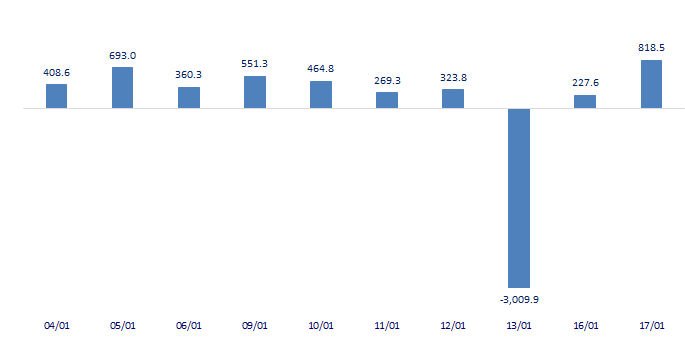

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

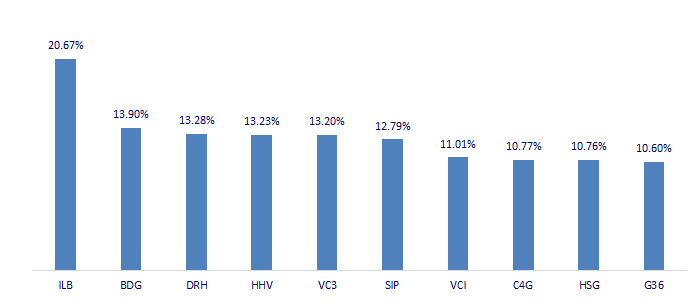

TOP INCREASES 3 CONSECUTIVE SESSIONS

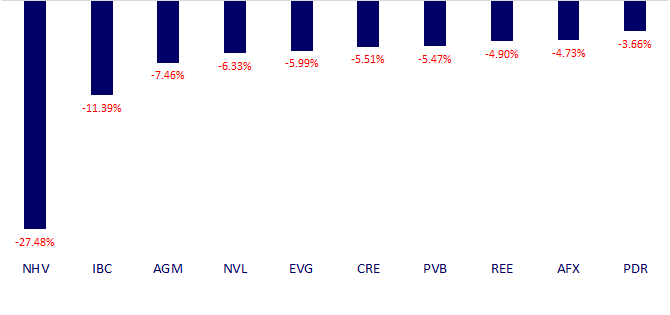

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.