Market brief 25/05/2023

VIETNAM STOCK MARKET

1,064.63

1D 0.27%

YTD 5.71%

1,062.15

1D 0.06%

YTD 5.67%

216.78

1D 0.38%

YTD 5.59%

80.71

1D -0.27%

YTD 12.64%

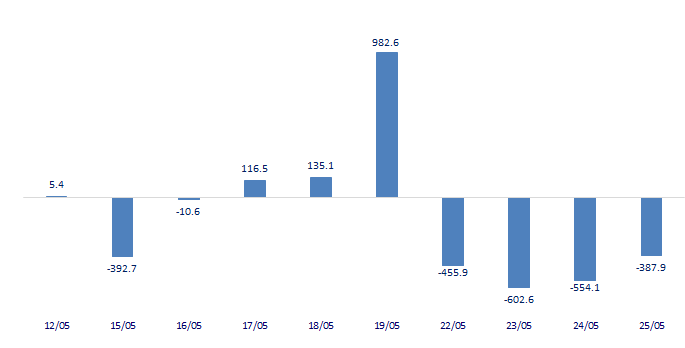

-387.87

1D 0.00%

YTD 0.00%

14,047.73

1D -11.27%

YTD 63.04%

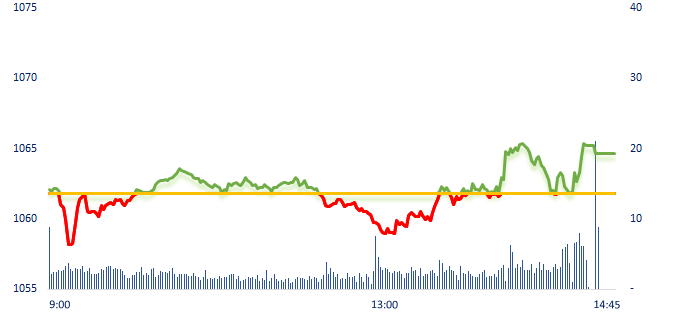

Today, the stock market struggled. At the end of the session, VNIndex kept the green color. Foreign investors had the fourth consecutive net selling session with a value of nearly VND388 billion, the total accumulated net selling value since the beginning of the month of foreign investors has reached nearly VND2,700 billion.

ETF & DERIVATIVES

18,090

1D -0.17%

YTD 4.39%

12,540

1D 0.32%

YTD 5.20%

13,010

1D 0.08%

YTD 4.25%

16,090

1D -0.62%

YTD 14.52%

16,150

1D -0.55%

YTD 12.54%

22,190

1D -0.36%

YTD -0.94%

13,540

1D 0.45%

YTD 4.56%

1,049

1D 0.09%

YTD 0.00%

1,053

1D 0.14%

YTD 0.00%

1,055

1D 0.23%

YTD 0.00%

1,057

1D 0.09%

YTD 0.00%

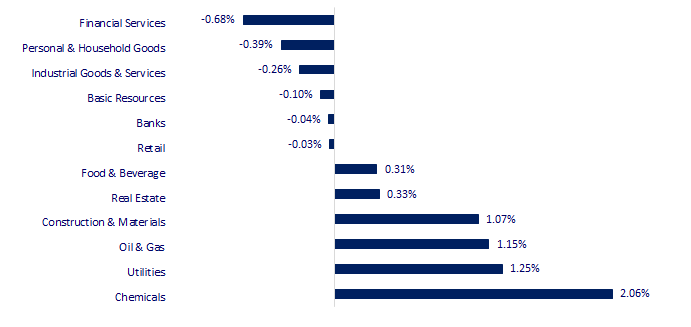

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

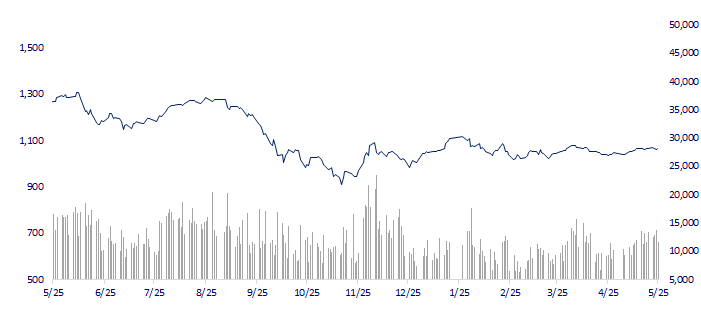

VNINDEX (12M)

GLOBAL MARKET

30,801.13

1D 0.35%

YTD 18.04%

3,201.26

1D -0.11%

YTD 3.63%

2,554.69

1D -0.50%

YTD 14.23%

18,746.92

1D -1.73%

YTD -5.23%

3,207.72

1D -0.20%

YTD -1.34%

1,535.42

1D -0.07%

YTD -8.08%

73.09

1D -6.53%

YTD -14.92%

1,962.24

1D 0.28%

YTD 7.45%

Asian stocks fell to a two-month low in the afternoon of May 25, as investors' fears increased as negotiations to raise the US debt ceiling remained deadlocked.

VIETNAM ECONOMY

4.18%

1D (bps) -16

YTD (bps) -79

7.20%

YTD (bps) -20

2.77%

1D (bps) -3

YTD (bps) -202

3.02%

YTD (bps) -188

23,685

1D (%) 0.19%

YTD (%) -0.32%

25,626

1D (%) -1.27%

YTD (%) -0.13%

3,391

1D (%) -0.09%

YTD (%) -2.70%

The Governor requested the organizations of the State Bank and credit institutions to proactively implement the policy of restructuring the repayment term and keeping the debt group unchanged according to Circular 02 in a synchronous and unified manner from the central to localities, from the State Bank to credit institutions.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Disbursement of public investment skyrocketed, but Ho Chi Minh City still has many worries;

- Directive of the Prime Minister on improving the efficiency of foreign investment;

- The Bank committed to further reduce interest rates;

- Russian ships were attacked while patrolling gas pipelines in the Black Sea;

- Europe's largest economy fell into recession;

- Unemployment of young people, the pain of China's economy.

VN30

BANK

93,200

1D 0.65%

5D -1.89%

Buy Vol. 1,067,814

Sell Vol. 996,823

43,750

1D 0.57%

5D -2.02%

Buy Vol. 1,617,254

Sell Vol. 1,104,156

27,600

1D -0.54%

5D -0.54%

Buy Vol. 5,554,736

Sell Vol. 5,460,653

29,800

1D 0.00%

5D 0.85%

Buy Vol. 5,021,202

Sell Vol. 5,037,040

19,200

1D -1.03%

5D -0.26%

Buy Vol. 14,426,372

Sell Vol. 17,336,470

18,450

1D -0.81%

5D -0.81%

Buy Vol. 9,123,948

Sell Vol. 11,304,544

19,500

1D 0.00%

5D 0.52%

Buy Vol. 2,761,022

Sell Vol. 2,926,542

23,400

1D -0.43%

5D 0.00%

Buy Vol. 2,510,333

Sell Vol. 1,969,640

27,000

1D -1.46%

5D -0.74%

Buy Vol. 58,973,092

Sell Vol. 49,386,981

20,900

1D -0.48%

5D -2.56%

Buy Vol. 7,908,493

Sell Vol. 5,611,919

25,100

1D -0.20%

5D 0.40%

Buy Vol. 12,931,193

Sell Vol. 13,209,834

Surveying the interest rates listed at 34 domestic banks at 9:30 a.m., up to 28 banks have changed their interest rates. In which, most of them decreased by 0.5 percentage points for terms from 1 month to less than 6 months to the ceiling of 5%/year and kept the long terms unchanged. Many banks even reduced the highest interest rates for terms from 1 to less than 6 months to 4.5 - 4.8 percentage points such as Viet Capital Bank, SeABank, LPBank, TPBank.

REAL ESTATE

13,200

1D -0.38%

5D -0.75%

Buy Vol. 16,116,824

Sell Vol. 21,073,310

77,400

1D 0.52%

5D -1.40%

Buy Vol. 75,771

Sell Vol. 143,459

13,550

1D -0.73%

5D 2.65%

Buy Vol. 12,551,713

Sell Vol. 14,843,104

NVL: At the end of Q1/2023, NVL recorded an inventory of VND136,905 billion, up 1% compared to the beginning of the year. In which, 91% are real estate projects under construction.

OIL & GAS

94,700

1D 2.38%

5D 1.83%

Buy Vol. 1,234,764

Sell Vol. 1,002,208

13,450

1D -0.37%

5D 0.37%

Buy Vol. 13,652,576

Sell Vol. 13,867,266

37,350

1D 0.13%

5D -0.27%

Buy Vol. 871,054

Sell Vol. 958,704

GAS: GAS sets a revenue target for 2023 of only VND76.4 trillion, (-24% YoY), profit after tax is just over VND6.5 trillion, (-57% YoY), on the basis of oil price reaching 70USD/barrel.

VINGROUP

52,600

1D 0.00%

5D -1.13%

Buy Vol. 2,314,708

Sell Vol. 3,231,937

55,000

1D 0.92%

5D 0.00%

Buy Vol. 2,382,079

Sell Vol. 3,385,434

27,700

1D 0.18%

5D -1.42%

Buy Vol. 2,525,371

Sell Vol. 3,079,385

VHM: As of March 31, 2023, VHM has VND377.622 billion in total assets, up 4%; in which, VND60,947 billion is inventory, down 5% from the beginning of the year, accounting for 16% of total assets.

FOOD & BEVERAGE

67,100

1D 1.21%

5D -3.03%

Buy Vol. 3,055,670

Sell Vol. 2,475,550

72,000

1D 0.28%

5D -1.64%

Buy Vol. 1,335,068

Sell Vol. 1,296,602

158,000

1D -0.32%

5D -2.65%

Buy Vol. 181,604

Sell Vol. 295,754

MSN: In the first quarter of 2023, WinCommerce opened 55 more WinMart+ and 1 WinMart, a total of 3,442 locations nationwide for both minimarts and supermarkets.

OTHERS

44,100

1D -0.79%

5D -1.56%

Buy Vol. 769,448

Sell Vol. 1,077,965

98,000

1D -0.41%

5D -1.41%

Buy Vol. 1,125,283

Sell Vol. 1,218,412

83,200

1D 2.34%

5D 0.36%

Buy Vol. 3,567,479

Sell Vol. 2,069,402

38,000

1D 0.13%

5D -0.26%

Buy Vol. 3,063,066

Sell Vol. 2,918,414

16,750

1D 4.04%

5D 5.68%

Buy Vol. 19,439,639

Sell Vol. 10,723,575

22,500

1D -0.88%

5D -1.32%

Buy Vol. 31,195,723

Sell Vol. 31,140,602

21,200

1D -0.47%

5D -3.42%

Buy Vol. 24,129,275

Sell Vol. 26,114,345

FPT: FPT said that the IT Services segment in the foreign market continued its impressive growth, reaching VND7,315 billion in revenue in Q1/2023, equivalent to an increase of 32%, led by growth coming from the Japanese market (up 36.4%) and APAC (up 64%).

Market by numbers

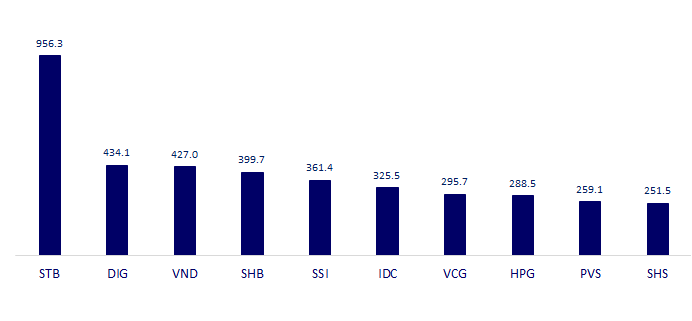

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

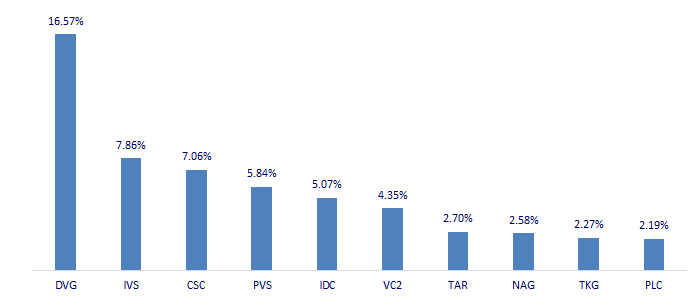

TOP INCREASES 3 CONSECUTIVE SESSIONS

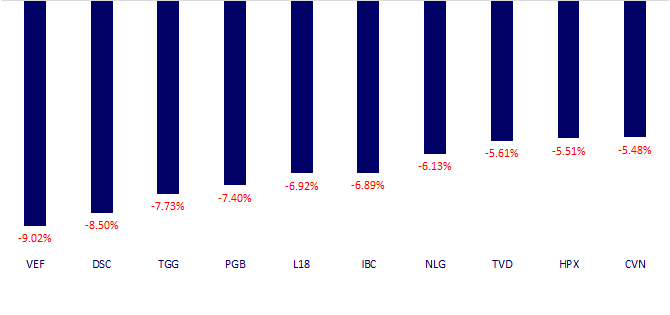

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.