- Knowledge for investors

Overview knowledge

Investment strategy

- Trading instructions

Opening Derivative An Account

How to place order on WTS/MTS

Trading regulations

- Account management parameters

- High leverage ratio: due to high leverage, in case the market fluctuates unexpectedly, investors will suffer large losses and the possibility of losing capital is also higher.

- Fluctuations of futures contracts do not follow the underlying market: in theory the price of futures contracts is based on the price fluctuations of the underlying asset, however in reality the price movements of futures contracts may not follow the price fluctuations of the index at certain times..

- Liquidity risk: currently long-term contracts have quite low liquidity, so when needing to trade large volumes, investors may have to trade at unfavorable prices compared to the market price.

- Investors analyze the macroeconomic situation and identify index trends

- Investors fundamentally analyze codes that have a great influence on the index based on underlying stock analysis & valuation reports; At the same time, evaluate future events affecting the composition and proportion of VN30

- From there, determine the expectation of the upcoming trend of the VN30 index

- Long with the expectation that the VN30 index will go up.

- Short with the expectation that the VN30 index will go down

- VN30 > futures price: BUY position (Long) brings more advantages than sell position

- Futures contract price > VN30: SELL position (Short) brings more advantages than buying position

- Please refer to detailed instructions for AlphaTrading here

- Please refer to detailed instructions for WebTrading here.

Speculation Strategy

When investors want to buy and sell futures contracts with the purpose of making a profit based on the price difference. Risks when speculating on futures contracts include:

a) Long-term contract investment strategy

Method of investing in long-term futures contracts over 3 months, using fundamental analysis based on macro analysis and analysis of the VN30 stock basket:

Step 1: Fundamental analysis, determine the trend of VN30 index

Step 2: Long/Short long term contract VN30F1Q or VN30F2Q

Step 3: Monitor investment results, take profits when reaching the expected profit target or cut losses when the performance of the VN30 index goes against investors’ expectations.

b) Short-term contract investment strategy

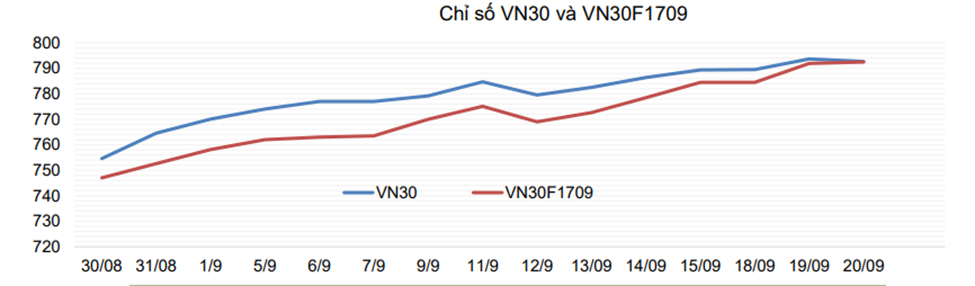

Investment method based on short-term fluctuations of the VN30 index and futures price. In the medium and long term, especially when approaching the futures contract expiration date, the futures contract price tends to approach the VN30 index. Investors execute Long/Short futures contracts VN30F1M and VN30F2M.

For example: On August 30 VN30F1709: 747 < VN30 INDEX: 757 → Open a BUY position (LONG)

c) Intraday trading

Intraday investment method based on technical analysis. Investors use technical analysis on the price chart of the VN30 index to determine buying and selling points to exploit price differences.