Margin call/Force sell

Margin calls are also known as margin calls. Margin call occurs when the margin of investor decreases to 35%. Investors will need to sell stocks or deposit money into their accounts to meet the maintenance margin ratio of 40%.

Force-sell happens when investor’s margin rate drops to 30%. Investors will need to sell stocks or deposit money into their accounts to meet a safe margin ratio of 50%.

When the account is called by a margin call, Pinetree will contact the customer to have an active treatment plan to raise the margin rate to the respective specified rate. If the investor does not process within 3 trading days, Pinetree will have to sell the client’s stock to bring the rate to the prescribed rate.

In case the client’s margin rate falls below the force-sell level, Pinetree will sell the client’s stock to bring the rate to the specified level in the next trading session if the client has not actively processed.

Example:

You buy 5000 stock X at the price of 40,000 VND, in which the purchase is equal to 100 million VND of equity capital and 100 million VND of a margin loan from Pinetree. Stock X price drops to 30,000 VND, so the value of shares on your account is only 150 million VND. Margin loan from Pinetree is still 100 million VND, so your equity is only 50 million VND.

The margin rate on your account then equal to

At that time, your account was called by margin call.

In order for the account to be no longer by margin calls, you need to raise the margin rate to the maintenance rate, then there are 2 ways to deposit more money into the account or sell stocks.

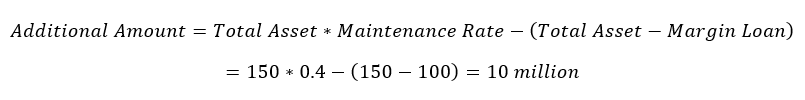

In case of additional money to the account, the additional amount is 10 million:

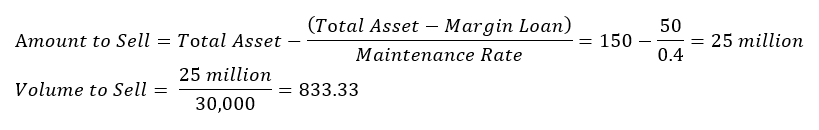

In case of selling stocks: the minimum volume to be sold at the price of 30,000 VND is 833.33 stocks:

So to avoid margin calls from your account, you need to deposit money into your account with 10 million VND or sell 833.33 stock X

Did you find this content helpful?