Market brief 03/01/2023

VIETNAM STOCK MARKET

1,043.90

1D 3.66%

YTD 3.66%

1,047.25

1D 4.18%

YTD 4.18%

212.56

1D 3.53%

YTD 3.53%

72.40

1D 1.05%

YTD 1.05%

256.87

1D 0.00%

YTD 0.00%

10,536.62

1D 22.29%

YTD 22.29%

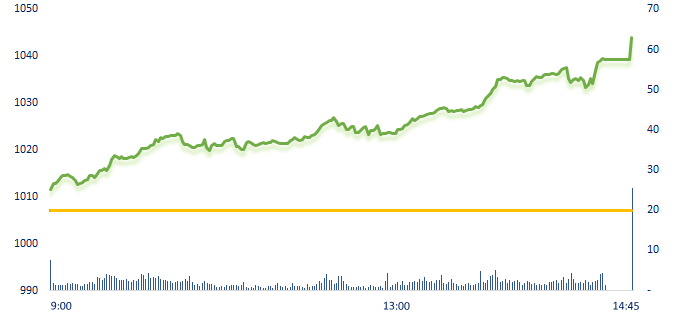

The first trading session of 2023, the VN-Index was filled with the rising green color most of the time. Most of the industry groups gained strongly such as real estate, banking, steel, securities, etc. In which, the most active stocks of the market were bluechips such as HPG, PDR, SSI, VRE and bank stocks.

ETF & DERIVATIVES

17,700

1D 2.14%

YTD 2.14%

12,340

1D 3.52%

YTD 3.52%

12,570

1D 0.72%

YTD 0.72%

14,110

1D 0.43%

YTD 0.43%

14,500

1D 1.05%

YTD 1.05%

22,820

1D 1.88%

YTD 1.88%

13,390

1D 3.40%

YTD 3.40%

1,015

1D 3.85%

YTD 0.00%

1,028

1D 3.84%

YTD 0.00%

1,044

1D 4.38%

YTD 0.00%

1,046

1D 4.08%

YTD 0.00%

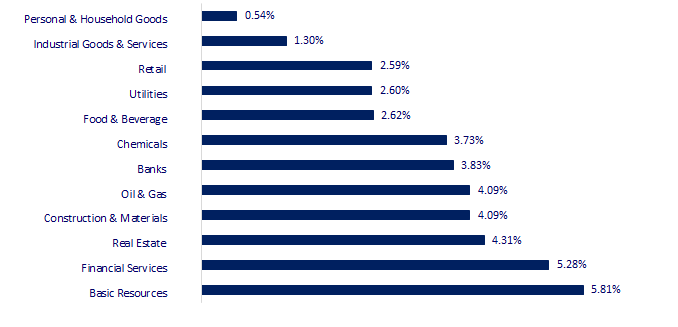

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

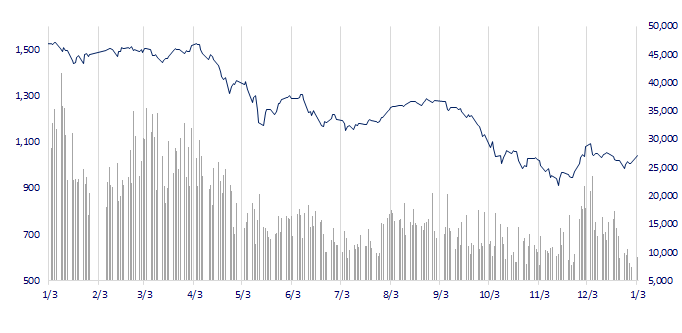

VNINDEX (12M)

GLOBAL MARKET

26,094.50

1D 0.00%

YTD 0.00%

3,116.51

1D 0.88%

YTD 0.88%

2,218.68

1D -0.31%

YTD -0.79%

20,145.29

1D 1.84%

YTD 1.84%

3,245.80

1D -0.17%

YTD -0.17%

1,678.97

1D 0.52%

YTD 0.52%

85.94

1D 1.05%

YTD 0.03%

1,844.65

1D 0.47%

YTD 1.01%

Asian markets were mixed in the first trading session of 2023. Shanghai Composite (China) and Hang Seng (Hong Kong) both increased strongly on the positive confidence of investors about easing policy Zero- Covid. In contrast, Kospi (Korea) eased slightly although the BOK has spoken out that it will try to ensure a soft landing for the economy in the face of uncertainties at home and abroad.

VIETNAM ECONOMY

5.00%

1D (bps) 3

YTD (bps) 3

7.40%

4.78%

1D (bps) -1

YTD (bps) -1

4.88%

1D (bps) -2

YTD (bps) -2

23,690

1D (%) -0.13%

YTD (%) -0.29%

25,545

1D (%) -1.24%

YTD (%) -0.44%

3,478

1D (%) -0.20%

YTD (%) -0.20%

On the morning of January 3, the Dollar index (DXY) increased 0.19% to 103.6884. On January 2, DXY gained 0.4% to 103.63, after falling to just 103.38 in the final week of 2022 – a 6-month low.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- PMI in December reached 46.4 points, the level of recession in the manufacturing industry increased by the end of 2022;

- In 2023, the Government decided to make the corporate bond, securities and real estate market healthy;

- Ensuring the progress of planning for airports;

- IMF: The world economy in 2023 will face many difficulties;

- The BOJ's policy turn sent the Japanese yen up sharply after months of selling;

- BOJ considers raising inflation forecast to near 2% target.

VN30

BANK

82,600

1D 3.25%

5D 4.42%

Buy Vol. 2,214,711

Sell Vol. 1,529,455

41,200

1D 6.74%

5D 3.00%

Buy Vol. 3,607,801

Sell Vol. 2,479,434

28,000

1D 2.75%

5D 5.26%

Buy Vol. 5,218,913

Sell Vol. 7,356,612

27,450

1D 6.19%

5D 4.37%

Buy Vol. 6,992,423

Sell Vol. 6,100,446

18,500

1D 3.35%

5D 3.35%

Buy Vol. 31,550,274

Sell Vol. 33,987,556

18,000

1D 5.26%

5D 4.35%

Buy Vol. 14,841,228

Sell Vol. 13,331,540

16,500

1D 3.45%

5D 0.92%

Buy Vol. 1,865,509

Sell Vol. 1,784,325

21,900

1D 4.04%

5D 4.04%

Buy Vol. 3,968,733

Sell Vol. 3,319,137

23,500

1D 4.44%

5D 4.44%

Buy Vol. 33,193,788

Sell Vol. 31,653,136

19,900

1D 4.74%

5D 4.74%

Buy Vol. 4,704,813

Sell Vol. 3,823,571

22,700

1D 3.65%

5D 2.71%

Buy Vol. 3,345,050

Sell Vol. 2,881,419

CTG: On December 30, 2022, the Board of Directors of VietinBank issued a Resolution to officially approve the financial plan targets for 2022. In which, separate profit before tax in 2022 of VietinBank is expected to reach VND19,451 billion, up 15% compared to 2021.

REAL ESTATE

14,650

1D 4.64%

5D 1.74%

Buy Vol. 24,605,414

Sell Vol. 24,590,650

28,000

1D 5.66%

5D 6.26%

Buy Vol. 2,575,933

Sell Vol. 2,688,587

14,550

1D 6.99%

5D 15.48%

Buy Vol. 31,264,083

Sell Vol. 20,193,446

According to the resolution of the Standing Committee of the National Assembly, the organization to collect people's opinions on the draft Land Law starts from 3/1 and 15/3/2023.

OIL & GAS

105,000

1D 3.45%

5D 1.84%

Buy Vol. 494,970

Sell Vol. 482,584

11,050

1D 3.76%

5D 3.76%

Buy Vol. 17,196,350

Sell Vol. 11,657,216

32,950

1D 3.94%

5D 7.68%

Buy Vol. 1,729,293

Sell Vol. 1,353,852

From 3pm on January 3, gasoline E5 RON 92 increased by 330 VND/liter, gasoline RON 95 increased by 350 VND/liter. Currently, the price of this item is at 21,300-22,200 VND/liter.

VINGROUP

56,800

1D 5.58%

5D 6.37%

Buy Vol. 3,673,258

Sell Vol. 3,155,620

49,400

1D 2.92%

5D 4.00%

Buy Vol. 2,493,431

Sell Vol. 2,983,057

28,100

1D 6.84%

5D 8.91%

Buy Vol. 5,337,869

Sell Vol. 4,762,868

VRE: Vincom Retail's stock increased to its full range in the first trading session of the year.

FOOD & BEVERAGE

78,500

1D 3.15%

5D 2.48%

Buy Vol. 2,816,157

Sell Vol. 2,635,843

96,000

1D 3.23%

5D 4.80%

Buy Vol. 1,073,025

Sell Vol. 1,152,399

169,000

1D 1.26%

5D -1.46%

Buy Vol. 228,410

Sell Vol. 193,885

VNM: Vinamilk plans to hold its Annual General Meeting of Shareholders online on April 25, 2023.

OTHERS

47,700

1D 2.36%

5D 2.58%

Buy Vol. 618,965

Sell Vol. 700,625

111,700

1D 2.01%

5D 3.43%

Buy Vol. 597,732

Sell Vol. 520,974

80,000

1D 4.03%

5D 4.58%

Buy Vol. 2,762,422

Sell Vol. 2,361,690

43,950

1D 2.45%

5D 0.34%

Buy Vol. 3,176,338

Sell Vol. 3,587,598

14,600

1D 5.80%

5D 2.46%

Buy Vol. 3,959,182

Sell Vol. 3,784,832

18,900

1D 6.78%

5D 3.85%

Buy Vol. 34,545,488

Sell Vol. 23,709,536

19,250

1D 6.94%

5D 5.48%

Buy Vol. 48,714,327

Sell Vol. 48,324,253

MWG: According to a report on the change in ownership ratio of major shareholders, 5 funds under Dragon Capital have sold 6.65 million shares of MWG, reducing the ownership ratio in MWG from 10.12% (more than 148 million shares) down to 9.67% (nearly 141.5 million shares).

Market by numbers

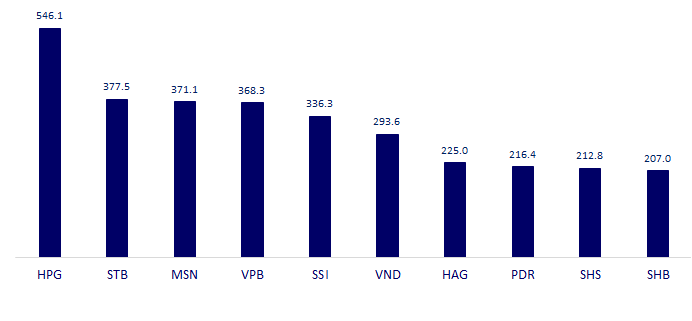

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

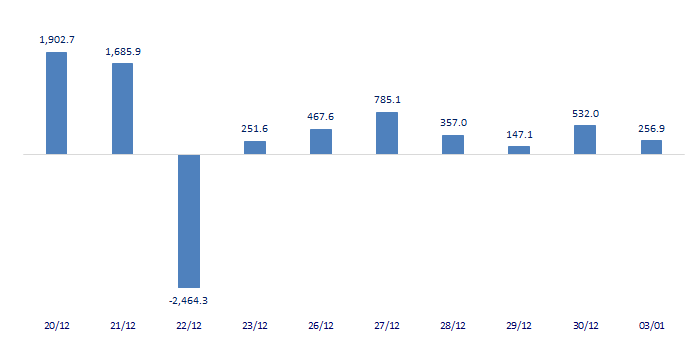

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

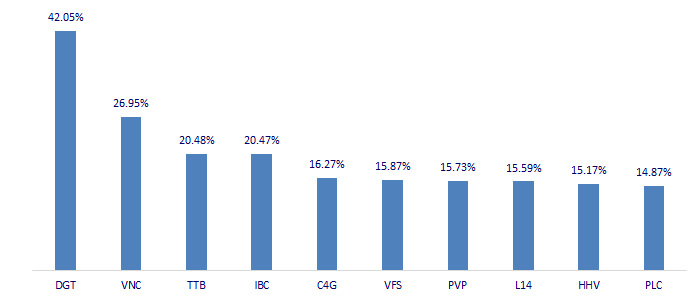

TOP INCREASES 3 CONSECUTIVE SESSIONS

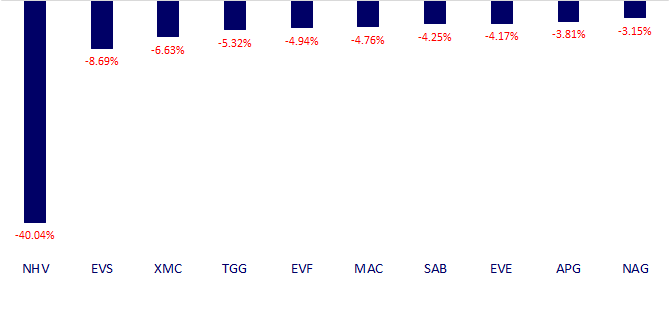

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.