Market brief 14/10/2022

VIETNAM STOCK MARKET

1,061.85

1D 1.03%

YTD -29.13%

1,061.39

1D 0.97%

YTD -30.89%

227.89

1D 1.40%

YTD -51.92%

80.16

1D 1.51%

YTD -28.86%

264.18

1D 0.00%

YTD 0.00%

16,104.64

1D 63.53%

YTD -48.17%

The stock market ended October 14 with a strong bounce after ATC. VN-Index closed the day with an increase of 10.89 points to 1,061.85 points. HNX-Index increased more than 227.89 points.

ETF & DERIVATIVES

18,000

1D 1.69%

YTD -30.31%

12,650

1D 2.93%

YTD -30.07%

13,210

1D 4.59%

YTD -30.47%

16,000

1D -4.71%

YTD -30.13%

13,390

1D 4.20%

YTD -40.44%

22,700

1D 1.89%

YTD -19.07%

13,500

1D 2.20%

YTD -37.15%

1,045

1D 1.90%

YTD 0.00%

1,046

1D 1.98%

YTD 0.00%

1,044

1D 1.36%

YTD 0.00%

1,048

1D 0.81%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

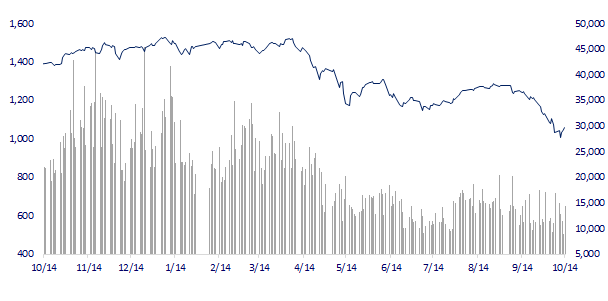

VNINDEX (12M)

GLOBAL MARKET

27,090.76

1D 0.50%

YTD -5.91%

3,071.99

1D 1.84%

YTD -15.60%

2,212.55

1D 0.27%

YTD -25.69%

16,587.69

1D 1.21%

YTD -29.11%

3,039.61

1D -0.03%

YTD -2.69%

1,560.78

1D 0.00%

YTD -5.84%

88.28

1D -0.76%

YTD 15.40%

1,661.80

1D -0.43%

YTD -8.73%

At the end of the session, Asian stocks mostly gained. Nikkei 225 (Japan) increased by 0.5%, reaching 27,090.76 points, Shanghai Composite (China) increased by 1.84%, reaching 3,071.99 points, Kospi (South Korea) increased by 0.27%, reaching 2,212.55 points, Hang Seng (Hong Kong) increased by 1.21% , reaching 16,587.69 points.

VIETNAM ECONOMY

5.48%

1D (bps) -103

YTD (bps) 467

6.60%

YTD (bps) 100

4.77%

1D (bps) 6

YTD (bps) 376

4.88%

1D (bps) 14

YTD (bps) 288

24,247

1D (%) 0.19%

YTD (%) 5.70%

23,974

1D (%) -1.38%

YTD (%) -9.42%

3,424

1D (%) -0.38%

YTD (%) -6.40%

The Government and the Ministry of Transport set a goal of "super" Long Thanh airport project (Dong Nai) to serve the first flight on September 2, 2025. Up to now, although some component projects are behind schedule of site clearance and construction, the Ministry of Transport is still confident that the project will finish on time.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Foreign media positively evaluates the investment and production environment in Vietnam;

- Not including 6,800 MW of coal-fired power in the draft Power Plan VIII;

- Da Nang ranks fourth in the country in terms of GRDP growth rate;

- Asian countries "burn" 50 billion USD in foreign exchange reserves in September only to protect their local currencies against the USD;

- China overtakes Germany to become the world's second largest auto exporter;

- Despite rising tensions, Russia and NATO will both conduct nuclear exercises.

VN30

BANK

68,100

1D 2.41%

5D 2.10%

Buy Vol. 2,387,240

Sell Vol. 2,621,002

33,000

1D 1.69%

5D 13.01%

Buy Vol. 2,928,985

Sell Vol. 3,649,438

22,700

1D 1.34%

5D 13.78%

Buy Vol. 8,597,949

Sell Vol. 10,378,075

25,700

1D 1.58%

5D -5.69%

Buy Vol. 11,118,389

Sell Vol. 11,408,674

16,150

1D 0.94%

5D 5.21%

Buy Vol. 15,061,329

Sell Vol. 20,268,326

17,800

1D 2.30%

5D 5.01%

Buy Vol. 21,660,837

Sell Vol. 21,846,605

17,000

1D 1.19%

5D -2.58%

Buy Vol. 2,923,476

Sell Vol. 2,371,280

20,600

1D 0.00%

5D -7.83%

Buy Vol. 3,524,840

Sell Vol. 4,334,101

17,650

1D 0.00%

5D 5.37%

Buy Vol. 49,525,007

Sell Vol. 36,892,226

20,200

1D 2.54%

5D 1.00%

Buy Vol. 5,963,239

Sell Vol. 5,534,484

20,850

1D 4.51%

5D 11.80%

Buy Vol. 6,456,611

Sell Vol. 5,111,397

VPB: Asia Risk Magazine has just honored Vietnam Prosperity Commercial Joint Stock Bank (VPBank) as "Top Excellent Bank in 2022 - Vietnam House of The Year 2022" in the field of Risk Management. This is the second time in a row that VPBank has been awarded this prestigious award. Accordingly, thanks to abundant capital, by June 2022, the capital adequacy ratio (CAR) according to Basel II standards of the consolidated bank reached 14.3%, far exceeding the requirement of the State Bank of 8% and access to leading banks in the region.

REAL ESTATE

76,000

1D 0.66%

5D -3.80%

Buy Vol. 3,137,818

Sell Vol. 3,386,545

26,500

1D 0.00%

5D 6.00%

Buy Vol. 3,216,614

Sell Vol. 5,014,180

48,950

1D 0.00%

5D -1.11%

Buy Vol. 2,345,462

Sell Vol. 2,713,948

Many projects on the coast and in prime locations of Da Nang have been slow to implement, the "golden land" has been abandoned for many years.

OIL & GAS

109,800

1D 1.67%

5D 7.65%

Buy Vol. 678,249

Sell Vol. 892,795

10,800

1D 1.89%

5D 1.41%

Buy Vol. 23,633,192

Sell Vol. 21,814,047

33,700

1D 0.00%

5D 5.97%

Buy Vol. 1,869,406

Sell Vol. 2,337,841

Prime Minister Pham Minh Chinh requested research to shorten the petrol price adjustment cycle.

VINGROUP

59,700

1D -1.16%

5D -0.83%

Buy Vol. 1,353,597

Sell Vol. 2,097,969

51,900

1D -1.70%

5D -3.53%

Buy Vol. 2,539,722

Sell Vol. 3,475,943

25,200

1D -1.56%

5D -3.08%

Buy Vol. 1,264,115

Sell Vol. 1,444,506

VIC: Vinfast and Petrolimex officially opened the electric vehicle charging service at the first 10 petrol stations.

FOOD & BEVERAGE

74,000

1D 0.27%

5D 6.02%

Buy Vol. 2,241,565

Sell Vol. 3,047,312

79,000

1D 0.38%

5D -3.07%

Buy Vol. 2,270,704

Sell Vol. 2,389,079

188,400

1D -0.84%

5D 0.75%

Buy Vol. 172,795

Sell Vol. 262,001

MSN: Masan group member continues to be recognized in Top 10 Strong Brands in Vietnam 2022.

OTHERS

50,700

1D 2.94%

5D 5.19%

Buy Vol. 1,778,575

Sell Vol. 2,278,928

109,000

1D 0.28%

5D -5.22%

Buy Vol. 523,953

Sell Vol. 433,496

74,000

1D 1.37%

5D 0.00%

Buy Vol. 1,784,944

Sell Vol. 2,079,093

59,900

1D 3.99%

5D 10.93%

Buy Vol. 5,434,684

Sell Vol. 6,561,724

16,450

1D 2.81%

5D 1.74%

Buy Vol. 3,665,968

Sell Vol. 3,397,660

17,900

1D 2.29%

5D 6.55%

Buy Vol. 34,305,306

Sell Vol. 41,601,799

19,450

1D -0.26%

5D 10.51%

Buy Vol. 38,389,134

Sell Vol. 42,168,424

HPG: Within a week, Hoa Phat brand had 3 reductions in construction steel prices, down to about 14.5 - 14.6 million VND/ton. The company said that in September construction steel consumption reached 318,000 tons, down 3% compared to the same period in 2021. Hoa Phat's construction steel sales this month fell to the lowest level since April.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS