- Getting started

Register new account

Document to submit

Update information

Account Verification

- Investing

Stock

Investing with cash advance

Investing with margin

Conditional Orders (Underlying Securities)

Derivatives

- Contract Specification and Trading Rules

- Derivatives Trading Process at Pinetree

- Derivatives Product Policy at Pinetree

- User Guide for Derivatives Conditional Orders - WebTrading

- User Guide for Derivatives Conditional Orders - AlphaTrading

- FAQ Derivatives Conditional Orders

- T&C - Conditional Orders in Derivatives Trading

Guidance on trading Private Corporate Bond

Guidance on trading debt instruments

- Cash transaction

Deposit Money to Securities Account

Withdraw Money from Securities Account

Amendment

- User guide

How to use AlphaTrading

How to use PineX

How to use Stock123

How to use WebTrading

Webview (Nam A Bank)

- Deposit stock

Deposit/ Withdraw securities

Rights buy – Rights buy transfer

Stock transfer

Odd Lot Trading

Securities Ownership Transfer

Security Inheritance

- Guidance on disclosing information

Disclosing information of majority shareholders, group of affiliated persons holding 5% and more of the voting shares

Disclosing information by internal actors and their affiliated persons

- FAQ

Fee policy

PineB Trading Policy

Contact Pinetree

Professional Investor Status Confirmation

Closing Account

Bond

Pinefolio

Derivative

- Policy on personal data processing

- Customer Development Program

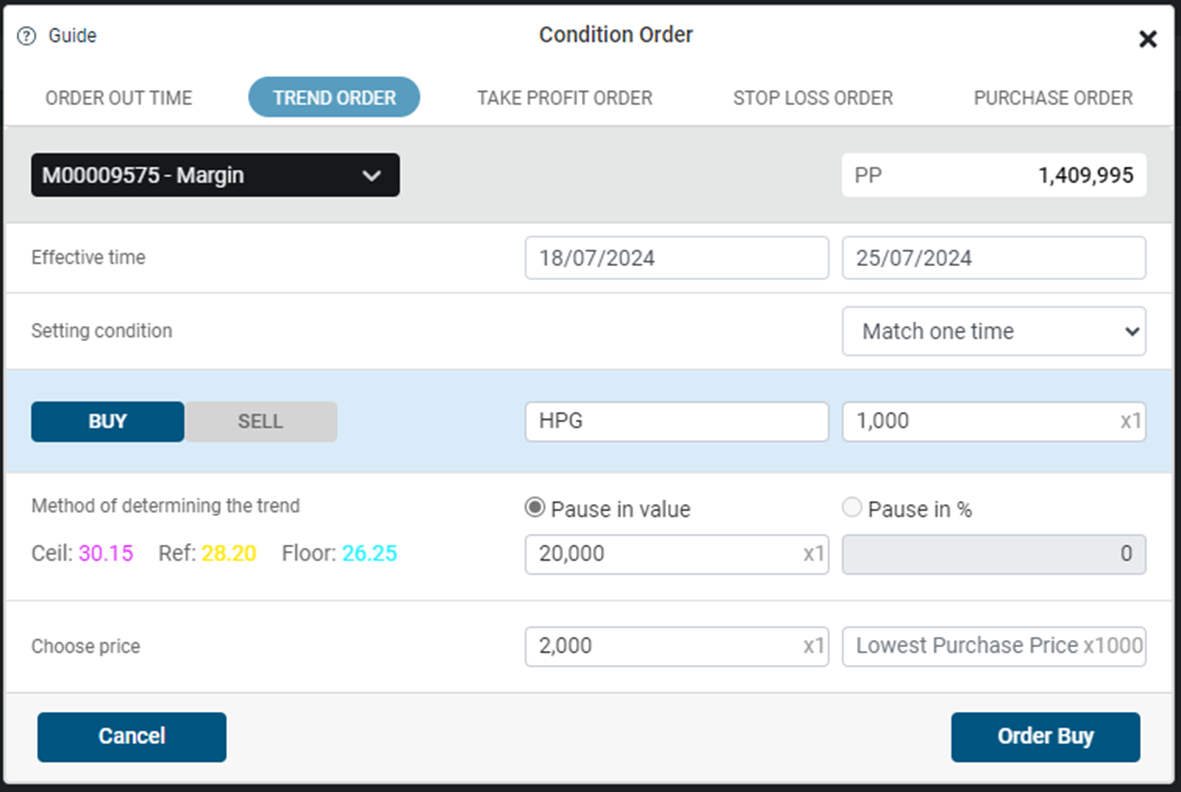

- Effective time: from …. to …. The pre-market order is valid no longer than 30 days from the placed time.

- Setting condition:

- Pause in value or Pause in % (at present, Pinetree only support customers on Pause in value): Customers set the condition on the buy/sell price to be higher or lower than the market price by a specific value.

- Choose Price:

- Market Price (MP): the final matching price. At the beginning of the day, when there is no most nearest matching price, the MP price will be determined as the reference price.

- Trigger Price (TP): the price used to compare with MP to determine if the price condition is met or not.

- Order Price (OP): the price of the order when the conditions of the order are met.

- Only suitable for Professional Investors

- Only can place Limit Order (LO)

- The conditional order can only be cancelled but cannot be adjusted.

- Order out time does not check the buying/selling power. The order will be activated and sent to the stock exchange if the conditions about price and volume are matched.

- For a trailing stop buy order (used to catch the bottom), if on the first day the opening price is higher than the reference price OR for a trailing stop sell order (used to predict the peak), if on the first day the opening price is lower than the reference price, the order will be activated immediately.

- In the case where a stock undergoes a rights issue leading to an adjusted MP that meets the activation conditions, the order will still be activated normally according to the adjusted market price.

Conditional ordersTrailing Stop Order

A trailing stop order is a conditional order that helps investors increase profit opportunities by selling at the optimal price at the peak when the market is trending up and buying at the optimal price at the bottom when the market is trending down. With the automatic activation principle, investors do not need to monitor market developments and can still buy at the bottom and sell at the top.

1. How to place a stop loss order on WebTrading

Step 1: Login to your account => “Trading” => “Conditional order” => “Order Condition”

Insert OTP code to confirm your account then on the condition order screen, choose “Trailing Stop Order” and sub-account to place the order.

Step 2: Insert information about Effective time, Setting condition, Buy or Sell, fill in the securities symbol and volume.

+ Match one time: the order would be matched one time only. On the effective day, if part of the order matches, the order status will be invalid at the end of that day.

+ Match order volume: within the valid time of the order, the system automatically activates when all the conditions are matched (price, volume, effective date…) until ensuring that all the placed volumes are matched.

+ TP Different Price: used to calculate the ordered price when activated to the exchange, to increase the matching probability.

+ Lowest buying/selling price: the desired buying/selling price of customers.

Type of Price in Trailing Stop Price:

Buy Order Price = Max (TP + TP and lowest buying price difference)

Sell Order Price = Min (TP – TP and highest selling price difference)

*** Note: At the time the order is activated

– If the order price is outside the ceiling range, the order activation will fail and it will not be sent to the exchange.

– In the case where the symbol undergoes a rights issue leading to an adjusted market price that meets the activation conditions, the order will still be activated normally according to the adjusted market price.

Step 3: Choose “Order Buy”/ “Order Sell” to finish placing order

2. Example

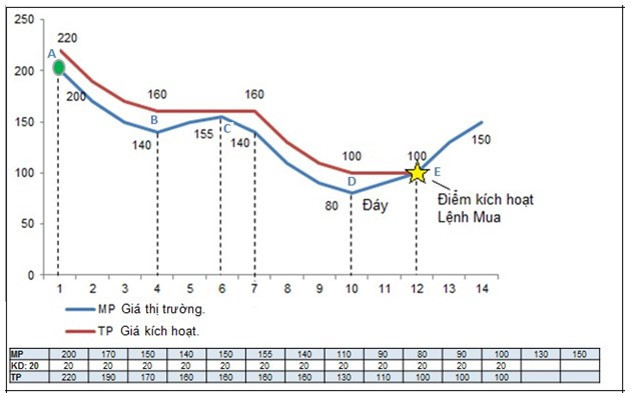

Trailing Stop Buy Order:

Currently, SAB shares are trading at 200,000 VND per share. Suppose that the investor predicts the market trend will decrease soon and wants to buy SAB shares at the lowest possible price without spending much time monitoring the market. The investor will place a trailing stop buy order with an absolute pause distance (the difference between the trigger price and the current market price) of 20,000 VND.

The chart representing the order will be as follows:

A: If MP = 200.000/share, TP = 220.000/share (=200.000 + 20.000)

B: Then, as the market continues to decline, the trigger price will slide down according to the new price levels. If SAB share price decrease to 170.000 VND; 150.000 VND; 140.000 VND per share, the TP will slice down to corresponding 190.000 VND; 170.000 VND and 160.000 VND.

C: After that, the market reverses, SAB’s MP rises to 155.000 VND per share, the TP will go on crossline with the price of 160.000 VND per share. At that time SAB’s MP increases but has not reached TP value so the order will not be activated.

D: Then, as the market declines further and the price of SAB shares continuously drops to new levels until it reaches 80,000 VND per share, the TP will continue to adjust and slide down accordingly to the new TP, down to 100,000 VND per share.

E: At this time, the market suddenly reverses and establishes an upward trend, and the MP of SAB increases accordingly. The most recent TP of 100,000 VND per share will be recorded by the system and will not change. When the MP of SAB shares rises to 100,000 VND per share, reaching the nearest TP and meeting the activation conditions of the trailing stop buy order (MP >= TP), the system will automatically send a buy order for SAB shares at 100,000 VND per share (LO order) to the exchange. If the MP is 110,000 VND per share, the system will automatically send a buy order for SAB shares at 110,000 VND per share (LO order) to the exchange.

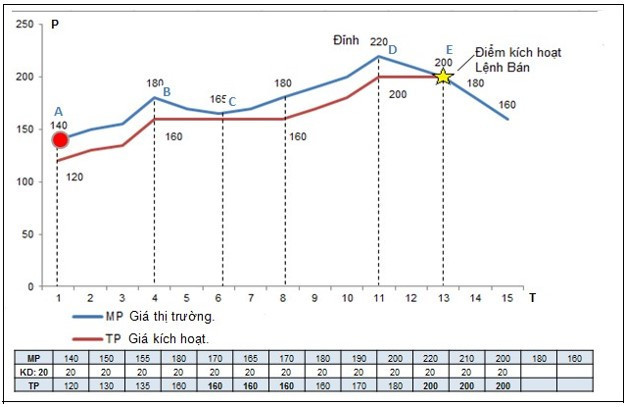

Trailing Stop Sell Order:

Currently, SAB shares are trading at 140,000 VND per share. Suppose that the investor predicts the market trend will increase soon and wants to take profit at the highest possible price without spending much time monitoring the market. The investor will place a trailing stop sell order with an absolute pause distance (the difference between the trigger price and the current market price) of 20,000 VND.

The chart representing the order will be as follows:

A: If MP = 140.000/share, TP = 120.000/share (=140.000 – 20.000)

B: Then, as the market continues to increase, the TP will slide up according to the new price levels. If SAB share price increase to 150.000 VND; 155.000 VND; 180.000 VND per share, the TP will slice up to corresponding 130.000 VND; 135.000 VND and 160.000 VND.

C: After that, the market reverses, SAB’s MP decreases to 165.000 VND per share, the TP will go on crossline with the price of 160.000 VND per share. At that time SAB’s MP decreases but has not reached TP value so the order will not be activated.

D: Then, as the market increases further and the price of SAB shares continuously goes up to new levels until it reaches 220,000 VND per share, the TP will continue to adjust and slide up to 200,000 VND per share.

E: At this time, the market suddenly reverses and establishes an downward trend, and the MP of SAB decreases accordingly. The most recent TP of 200,000 VND per share will be recorded by the system and will not change. When the MP of SAB shares decreases to 200,000 VND per share, reaching the nearest TP and meeting the activation conditions of the trailing stop sell order (MP <= TP), the system will automatically send a buy order for SAB shares at 200,000 VND per share (LO order) to the exchange. If the MP is 190,000 VND per share, the system will automatically send a buy order for SAB shares at 190,000 VND per share (LO order) to the exchange.

3. Trailing Stop Order’s Features:

Copyright © 2022. Pinetree Securities Corporation| Tax Code: 0101294902