- Getting started

Register new account

Document to submit

Update information

Account Verification

- Investing

Stock

Investing with cash advance

Investing with margin

Conditional Orders (Underlying Securities)

Derivatives

- Contract Specification and Trading Rules

- Derivatives Trading Process at Pinetree

- Derivatives Product Policy at Pinetree

- User Guide for Derivatives Conditional Orders - WebTrading

- User Guide for Derivatives Conditional Orders - AlphaTrading

- FAQ Derivatives Conditional Orders

- T&C - Conditional Orders in Derivatives Trading

Guidance on trading Private Corporate Bond

Guidance on trading debt instruments

- Cash transaction

Deposit Money to Securities Account

Withdraw Money from Securities Account

Amendment

- User guide

How to use AlphaTrading

How to use PineX

How to use Stock123

How to use WebTrading

Webview (Nam A Bank)

- Deposit stock

Deposit/ Withdraw securities

Rights buy – Rights buy transfer

Stock transfer

Odd Lot Trading

Securities Ownership Transfer

Security Inheritance

- Guidance on disclosing information

Disclosing information of majority shareholders, group of affiliated persons holding 5% and more of the voting shares

Disclosing information by internal actors and their affiliated persons

- FAQ

Fee policy

PineB Trading Policy

Contact Pinetree

Professional Investor Status Confirmation

Closing Account

Bond

Pinefolio

Derivative

- Policy on personal data processing

- Customer Development Program

- This is a capital support product that allows investors to borrow money from a securities company (Securities Company) to trade securities based on the customer’s collateral in the form of asset margin.

- Collateral assets are cash or securities within the list of the Securities Commission, which are allowed for margin trading by Pinetree at any given time. Pinetree’s margin list is diverse and adjusted according to market conditions.

- Customers must have a trading account at Pinetree and need to use the margin trading service.

- Customers need to sign a margin trading contract and verify their signature according to the instructions at: CUSTOMER VERIFICATION AT PINETREE.

- Internal transfer on WebTrading:

- Internal transfer on AlphaTrading: Here

- Internal securities transfer on WebTrading

- Internal securities transfer on AlphaTrading: Here

- Checking margin debt and proactively repaying on WebTrading:

- Checking margin debt and proactively repaying on AlphaTrading: Here

- The due date is not more than 15 days from the extension review date (Due Date – Review Date ≤ 15 days) (or another period according to the Company’s policy at the time).

- The margin ratio (RTT) of the account at the time of extension is > 50% (or another ratio according to the Company’s policy at the time).

- The stocks allocated with debt in the customer’s stock portfolio have not exceeded the lending limit or been removed from the lending list.

- The stocks allocated with debt in the customer’s stock portfolio have average or higher liquidity.

InvestingMargin Trading Guidelines

1. Service Introduction

2. Conditions of Application

3. Pinetree Regulation for Margin Trading

No. Criterion Regulations 1 Margin Loan Interest Rate 9.9% per year 2 Overdue Interest Rate 150% of the regular interest rate, equivalent to 14.85% per year 3 Loan Term 90 days 4 Loan Extension The loan can be extended by Pinetree if it meets the conditions set by Pinetree at each period.

Details on the conditions and instructions for loan extension can be found here.5 Loan Extension Fees • The first extension is free of charge.

• The fee for the second (02) extension is 0.2%; for subsequent extensions, the fee increases by 0.1% compared to the previous extension fee but does not exceed 0.5% of the total original margin loan value at the time of the request and extension by the customer.6 Initial Margin Rate 50% 7 Maintenance Margin Rate 40% 8 Margin Call Rate 35% 9 Force Sell Rate 30% 10 Handling of Collateral Assets 10.1 If the margin rate falls below the margin call rate for three consecutive working days but is still above the force sell rate Force sell on the third working day from the date the customer receives the first margin call notice. 10.2 If the margin rate falls below the force sell rate Sell on the working day immediately following the day the margin rate falls below the force sell rate (<30%). 11 Disbursement Date T+0 4. User Guidelines

To allow the system to automatically calculate the margin purchasing power on the customer’s securities account, the customer needs to transfer collateral assets (cash or securities allowed for margin trading according to Pinetree’s published list) from the regular account to the margin account. Detailed steps are as follows:

4.1. Instructions for internal transfer money to the margin account

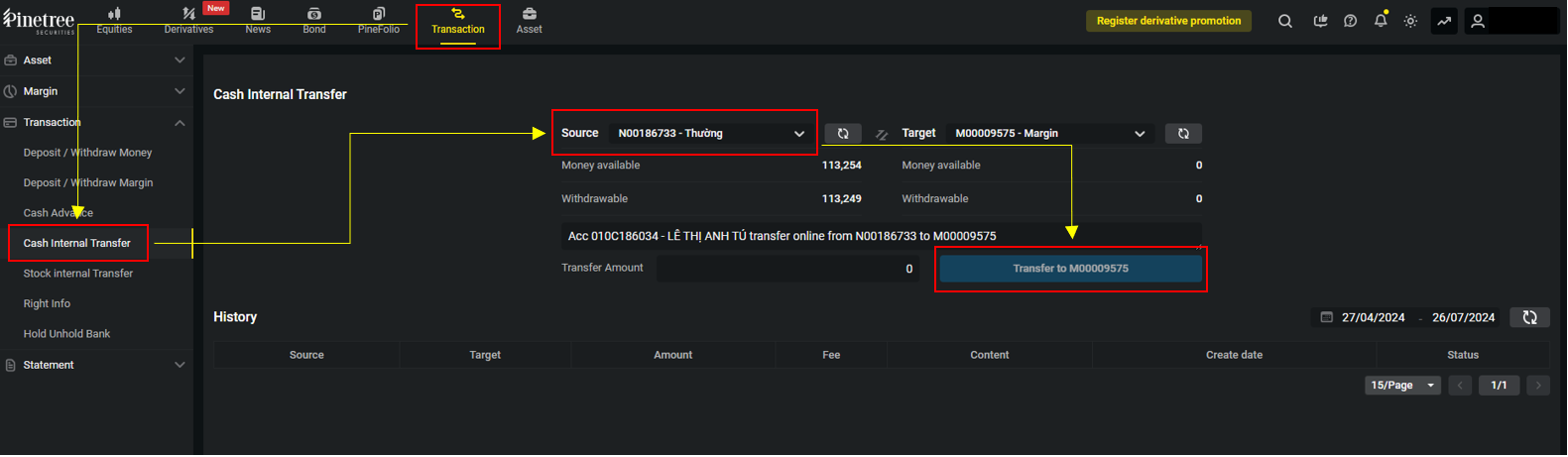

On the Transaction tab, choose Cash Internal Transfer feature, then choose the source and target account, insert the amount then click the blue “Transfer to ….” button

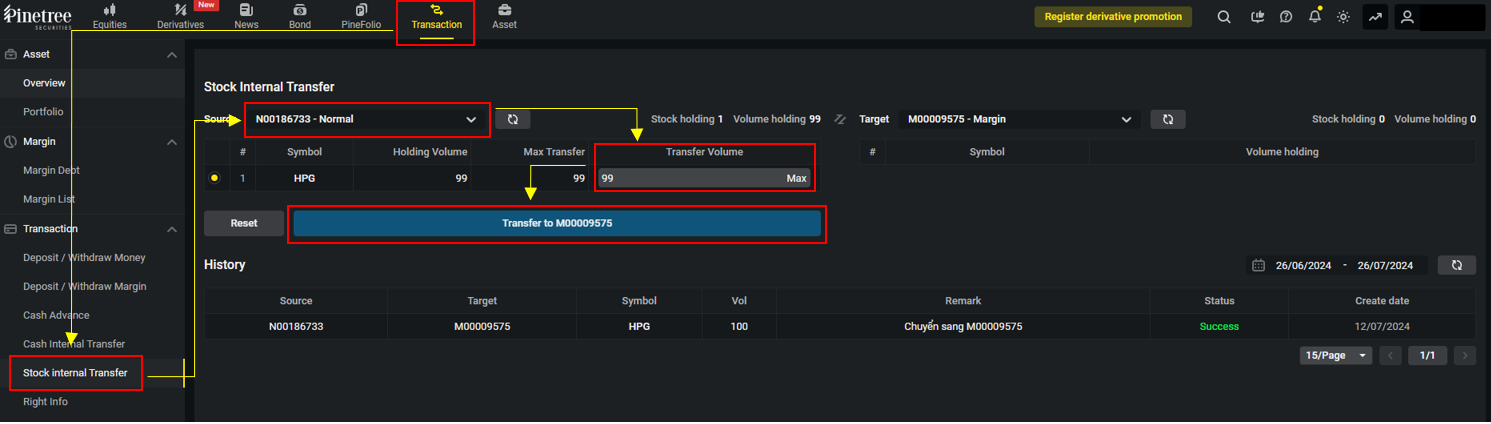

4.2. Instructions for transferring securities to the margin account

4.3. Checking Margin Debt and Proactively Repaying

Step 1: Login to WebTrading and selects “Assets” then selects “Margin Debt“.

Step 2: Select the margin sub-account.

Step 3: Check information and proactively repay by selecting the debt, insert the amount in the “Pay” column, and then click the “Pay” button.

4.4. Online Margin Loan Extension

Pinetree will consider extending the margin loan if it meets the following conditions:

Note: If one or more of the above conditions are not met, Pinetree will decide whether to agree to the customer’s loan extension based on market conditions and the customer’s account status.

Copyright © 2022. Pinetree Securities Corporation| Tax Code: 0101294902