- Getting started

Register new account

Document to submit

Fee policy

Update information

Account Verification

- Investing

Stock

Investing with cash advance

Investing with margin

Conditional Orders (Underlying Securities)

Derivatives

- Contract Specification and Trading Rules

- Derivatives Trading Process at Pinetree

- Derivatives Product Policy at Pinetree

- User Guide for Derivatives Conditional Orders - WebTrading

- User Guide for Derivatives Conditional Orders - AlphaTrading

- FAQ Derivatives Conditional Orders

- T&C - Conditional Orders in Derivatives Trading

Guidance on trading Private Corporate Bond

Guidance on trading debt instruments

- Cash transaction

Deposit Money to Securities Account

Withdraw Money from Securities Account

Amendment

- User guide

How to use AlphaTrading

How to use PineX

How to use Stock123

How to use WebTrading

Webview

- Deposit stock

Deposit/ Withdraw securities

Rights buy – Rights buy transfer

Stock transfer

Securities Ownership Transfer

Security Inheritance

- PineB Trading Policy

- Guidance on disclosing information

Disclosing information of majority shareholders, group of affiliated persons holding 5% and more of the voting shares

Disclosing information by internal actors and their affiliated persons

- FAQ

Closing/Open Account

Money Transaction

Financial Service - Margin

Bond

Pinefolio

Derivative

KRX and Derivative Trading

Sercurities services

Customer’s Information & Authentication

- Policy on personal data processing

- Professional Investor Status Confirmation

- Customer Development Program

- Trigger Price: TP

- Order Price: OP

- Stop Limit Order: SO

- Stop Loss/Take Profit Order: SL/TP

- Customer can place Stop Limit orders 24/7. The conditional order is valid from the time the Customer places the order until the expiry date selected by the Customer but not beyond the maturity date of the derivative securities.

- Market price is the latest matched price in the continuous session.

- The order can only be triggered in the continuous session. Within the ATO session, within and after the ATC session, the order can not be triggered.

- The order will be triggered one time only.

- The order waiting for the trigger can be canceled or modified.

- If the normal order generated from the conditional order is sent to the exchange but not fully matched, the Customers are allowed to cancel and modify the placed order.

- If the conditional order has been triggered but not fully matched, it will be canceled at the end of the day and will not be carried over to the next day.

- Cases where the conditional order is rejected:

- The order price is lower than the floor price or higher than the ceiling price during the trading session when the conditional order is triggered.

- The number of contracts placed by the Customer may result in the total number of open contracts exceeding the position limit as regulated.

- The Customer’s account does not have sufficient buying/selling power at the time the conditional order is triggered.

- Take-Profit Order: The trigger price is 1,350 points, and the order price is 1,355 points.

- Stop-Loss Order: The trigger price is 1,250 points, and the order price is 1,245 points.

- Customer can place Stop Limit orders 24/7. The conditional order is valid from the time the Customer places the order until the expiry date selected by the Customer but not beyond the maturity date of the derivative securities.

- Market price is the latest matched price in the continuous session.

- The order can only be triggered in the continuous session. Within the ATO session, within and after the ATC session, the order can not be triggered.

- The order will be triggered one time only.

- The order waiting for the trigger can be canceled or modified.

- If both take-profit and stop-loss orders are placed simultaneously, and one of the two orders is activated and the resulting child order sent to the exchange is fully matched, the remaining order will be canceled.

- If both take-profit and stop-loss orders are placed simultaneously, and one of the two orders is canceled or rejected, the remaining order will also be canceled.

- If the normal order generated from the conditional order is sent to the exchange but not fully matched, the Customers are allowed to cancel and modify the placed order.

- If the conditional order has been triggered but not fully matched, it will be canceled at the end of the day and will not be carried over to the next day.

- Cases where the conditional order is rejected:

- The order price is lower than the floor price or higher than the ceiling price during the trading session when the conditional order is triggered.

- The number of contracts placed by the Customer may result in the total number of open contracts exceeding the position limit as regulated.

- The Customer’s account does not have sufficient buying/selling power at the time the conditional order is triggered.

- Contract code

- Time duration

- Order type (Long or Short)

- Conditional order type (Stop Limit or SL/TP)

- Status

DerivativesUser Guide for Derivatives Conditional Orders

Terms and abbreviations used for conditional orders:

Stop Limit Orders

Stop Limit conditional orders allow Customers to buy/sell at an order price with a predetermined trigger price without monitoring the market continuously.

1. How to place orders

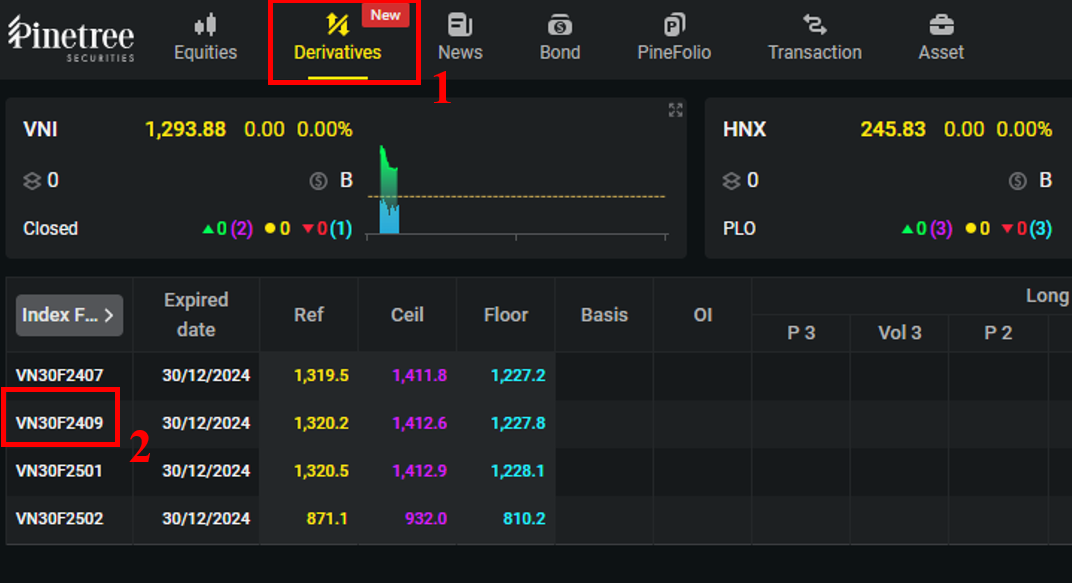

Step 1. After logging into the account, Customers choose Derivatives tab then select the contract code that you want to trade to go to the detail screen.

Or choose the Place Order button at the left bottom of the screen then select the contract code that you want to trade.

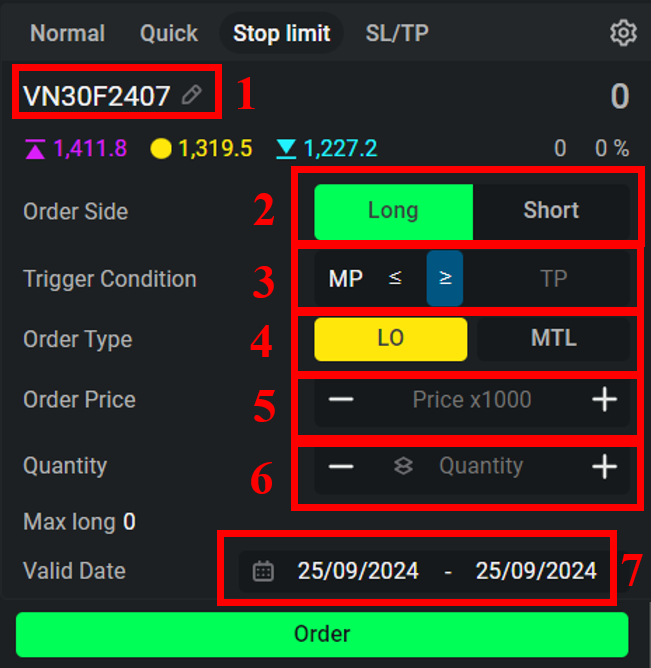

Step 2. At the Place Order screen, choose Stop Limit to insert order information.

(1) Choose Contract Code

(2) Choose Order Side: Long or Short

(3) Set Trigger Condition: Insert trigger price compared with market price.

(4) Set Order Type while the conditional order is triggered: LO/MTL

(5) Order Price: Insert order price if the order type is LO.

Note: If the order price is outside the ceil-floor area at the trading session when the order is triggered, the order will be rejected and not sent to the exchange.

(6) Quantity: Insert the quantity that is smaller or equal to the Max Long/Short of the account.

(7) Valid Date: The system sets the start date is the placing date by default. Customers select the end date by themselves.

Step 3. Choose Order button to finish placing conditional order

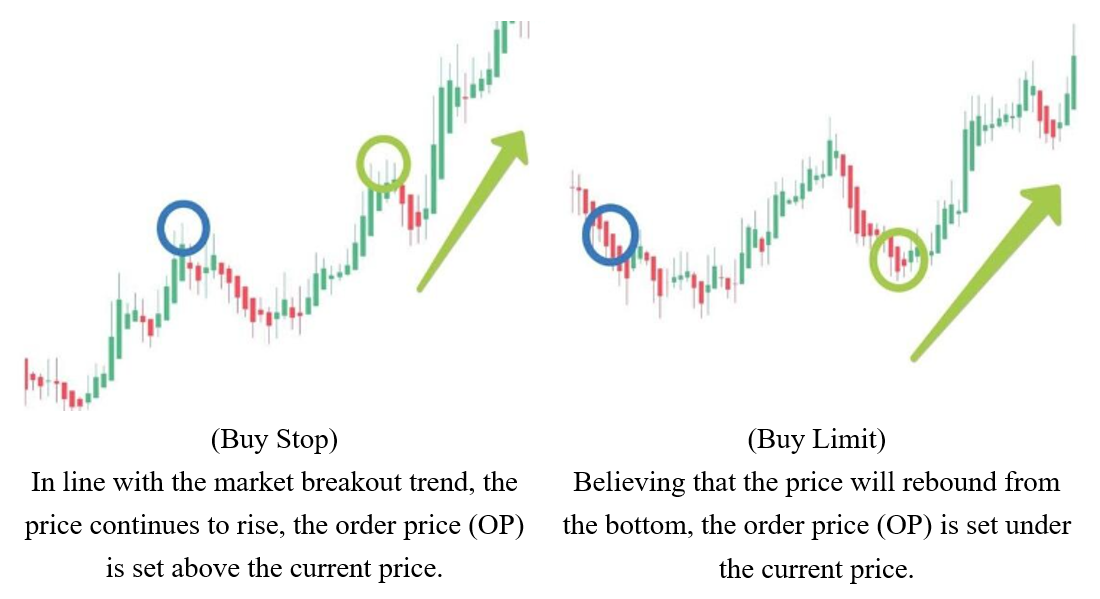

2. Stop Limit order example

Customer chooses order side Long (Stop Limit Buy) with the contract VN30F2409, the current market price is 1.300. The trigger condition is the market price higher or equal to the trigger price which is 1.350. The order price is 1.335. Therefore, when the market price reaches 1.350, the system will trigger to place an order with the order price Customer set at 1.355.

Note: If the Customer chooses the trigger condition that MP >= TP, depending on his strategy, he can choose OP > TP or OP < TP.

3. Stop Limit Order features

Stop Loss/ Take Profit Order

The order helps the Customer take profit/stop loss on futures contracts at a specific profit/loss level set by the Customer applied to the existing position held by the client.

1. How to place orders

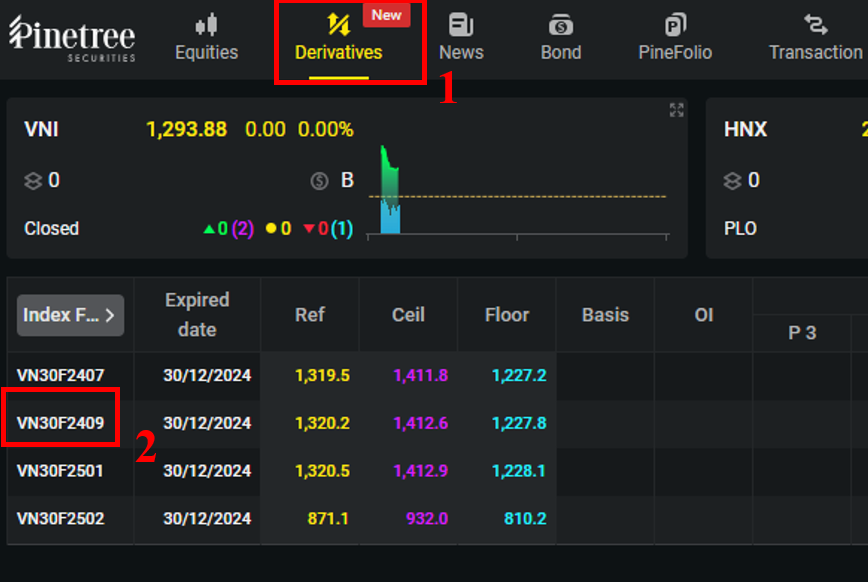

Step 1. After logging into the account, Customers choose Derivatives tab then select the contract code that you want to trade to go to the detail screen.

Or choose the Place Order button at the left bottom of the screen then select the contract code that you want to trade.

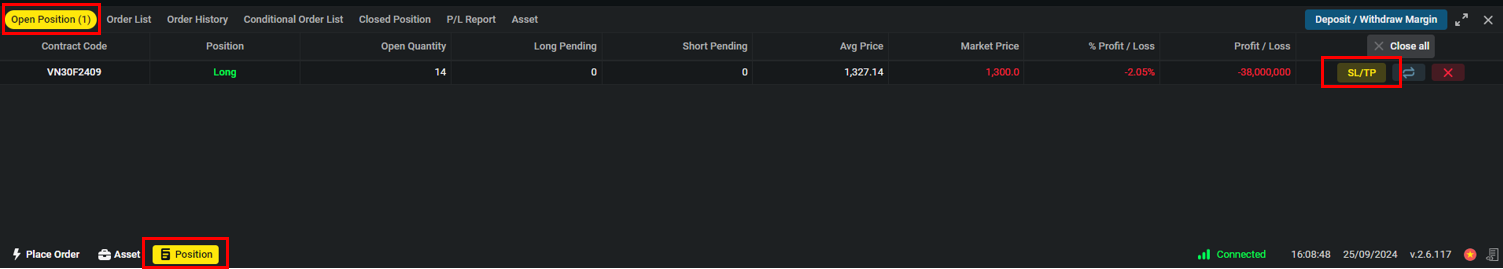

Choose SL/PL at the Opening Position tab to place order

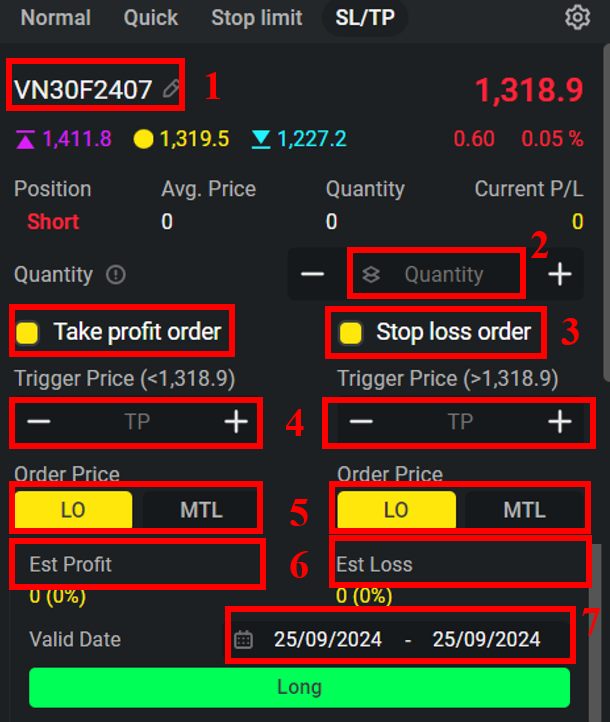

Step 2. At the Place Order, choose ST/TP to insert the order information.

(1) Choose Contract Code

(2) Contract Quantity: The order quantity must smaller or equal to the number of positions currently held.

(3) Set Order Type: Take profit order or Stop loss order or both

(4) Insert Trigger Price compared with market price. Trigger Condition:

+ If the position held is a sell position (Short), the take-profit order will be a buy order (Long) with a trigger price that must be lower than the market price, and the stop-loss order will be a buy order (Long) with a trigger price that must be higher than the market price.

+ If the position held is a long position (Long), the take-profit order will be a sell order (Short) with a trigger price that must be higher than the market price, and the stop-loss order will be a sell order (Short) with a trigger price that must be lower than the market price.

Note: At the time of order activation, if the number of positions in the account changes compared to when the conditional order was set, the system will still send the order to the exchange with the volume of the originally placed conditional order.

(5) Set Order Type while the conditional order is triggered: LO/MTL

(6) Order Price: Insert order price if the order type is LO.

Note: If the order price is outside the ceil-floor area at the trading session when the order is triggered, the order will be rejected and not sent to the exchange.

(7) Valid Date: The system sets the start date is the placing date by default. Customers select the end date by themselves.

Step 3. Choose Long/Short button to finish placing conditional order.

2. Stop Loss/Take Profit order example

A client holds 10 long positions, and the market price is 1,300 points. The client sets up conditional orders for both take-profit and stop-loss scenarios.

If the market price reaches 1,350 or drops to 1,250, the corresponding order will be activated. In the case where the take-profit order is partially executed (e.g., 5 positions), and the stop-loss order is waiting to be triggered, if the market reverses and hits the stop-loss trigger level, the system will retain the unmatched volume (5 positions) and adjust the order price of the take-profit order from 1,355 to the stop-loss order price of 1,245.

3. Stop Loss/Take Profit order features

Conditional Order Management

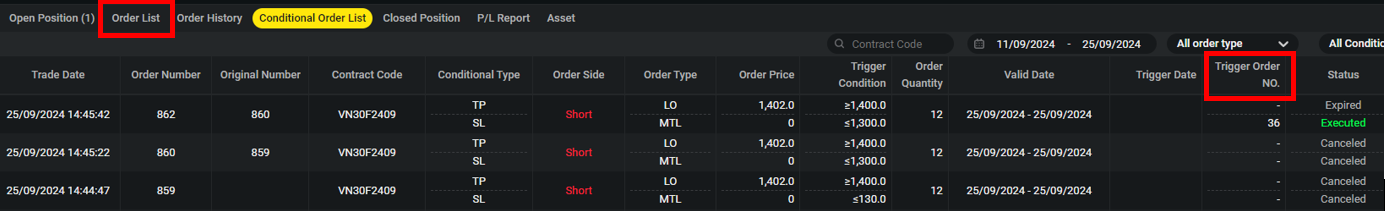

1. View/Modify/Cancel conditional orders in Order List

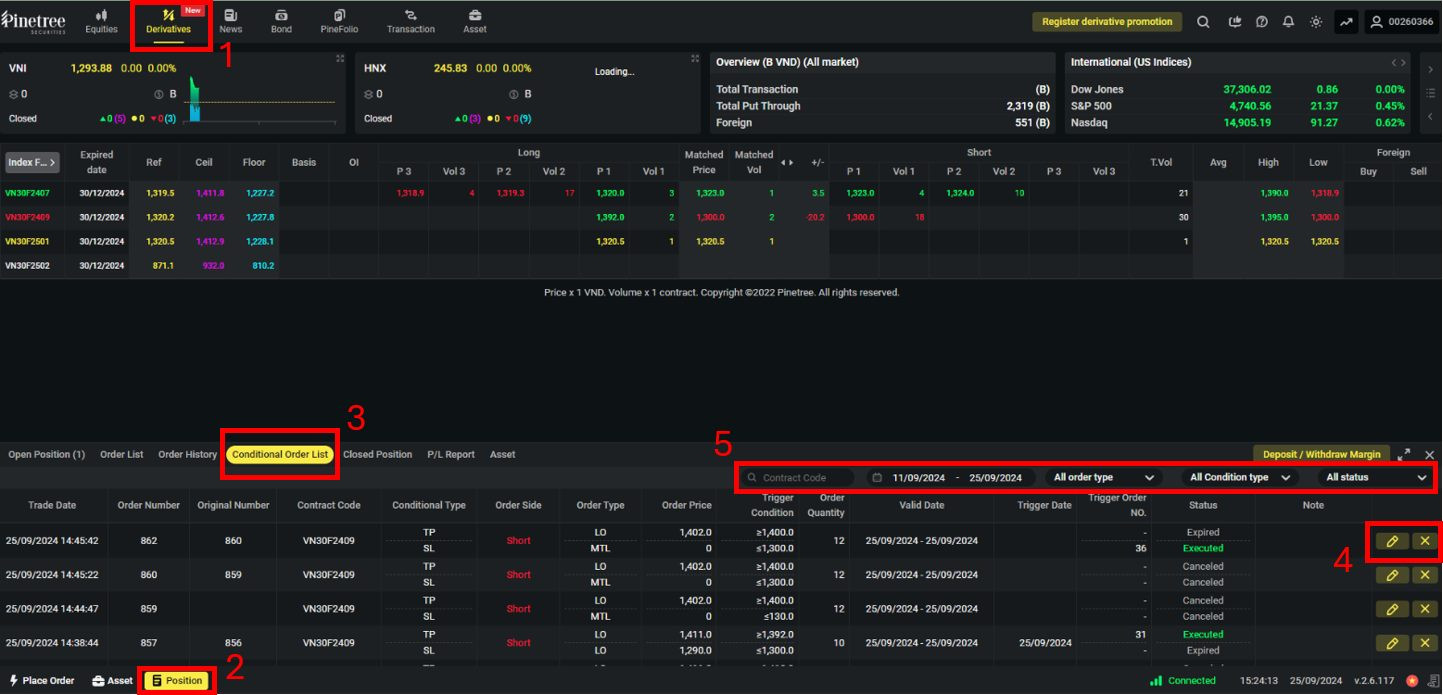

Step 1. After logging in the account, choose Derivatives tab then choose Positions and Conditional Order List tab.

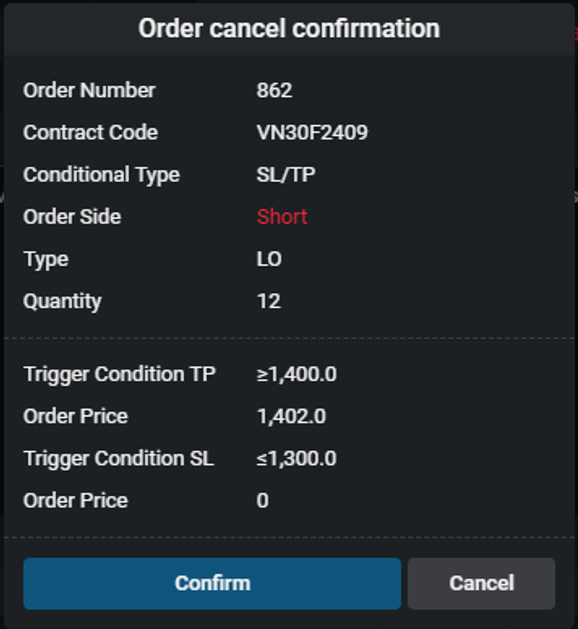

At the Waiting for Trigger status, if customer wants to cancel the order, choose the right icon or to modify the order, choose the left icon.

Step 2. Enter OTP code and confirm to cancel/modify the order

Step 3. Check the statement and filter the order list by:

Note: For the triggered orders, Customer can compare the activated conditional order number in the Conditional Order List with the order number in the normal Order List.

Customers can also monitor the movements of TP in Stop Loss/Take Profit conditional orders on the chart. 2. Conditional Order Status

Status Meaning Action on Conditional Order List (Cancel/Modify) Waiting for trigger The newly placed order has not met the trigger conditions. Yes On trigger The system is working to trigger the order No Triggered The order has met the trigger conditions and has been sent to the exchange. No

Note: The child orders in the regular order book can be canceled or modified according to the rules of the HNX exchange.Canceled The client cancels the conditional order; or when the client places both stop-loss and take-profit orders simultaneously, if one of the two orders is canceled or fully matched, the remaining order will be canceled. No Expired The order has exprired No Rejected The order met the trigger price but could not be sent to the exchange (insufficient buying power, price outside the floor/ceiling range, exceeding position limits, etc.) No

Copyright © 2022. Pinetree Securities Corporation| Tax Code: 0101294902Tạo phản hồi mớiTra cứu phản hồi