- Getting started

Register new account

Document to submit

Fee policy

Update information

Account Verification

- Investing

Stock

Investing with cash advance

Investing with margin

Conditional Orders (Underlying Securities)

Derivatives

- Contract Specification and Trading Rules

- Derivatives Trading Process at Pinetree

- Derivatives Product Policy at Pinetree

- User Guide for Derivatives Conditional Orders - WebTrading

- User Guide for Derivatives Conditional Orders - AlphaTrading

- FAQ Derivatives Conditional Orders

- T&C - Conditional Orders in Derivatives Trading

Guidance on trading Private Corporate Bond

Guidance on trading debt instruments

- Cash transaction

Deposit Money to Securities Account

Withdraw Money from Securities Account

Amendment

- User guide

How to use AlphaTrading

How to use PineX

How to use Stock123

How to use WebTrading

Webview

- Deposit stock

Deposit/ Withdraw securities

Rights buy – Rights buy transfer

Stock transfer

Securities Ownership Transfer

Security Inheritance

- PineB Trading Policy

- Guidance on disclosing information

Disclosing information of majority shareholders, group of affiliated persons holding 5% and more of the voting shares

Disclosing information by internal actors and their affiliated persons

- FAQ

Closing/Open Account

Money Transaction

Financial Service - Margin

Bond

Pinefolio

Derivative

KRX and Derivative Trading

Sercurities services

Customer’s Information & Authentication

- Policy on personal data processing

- Professional Investor Status Confirmation

- Customer Development Program

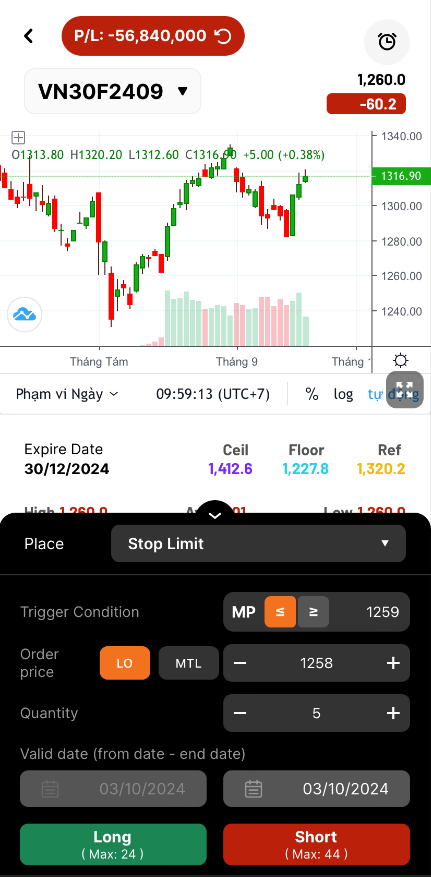

- Trigger condition is that the MP is less than or equal to 1260 which is set in this order at 1259;

- The Order price is 1258;

- Trading Quantity is 5 (less than or equal to the purchasing power of the account);

- Valid date is within 3/10/2024 (The system sets the beginning date as the placing order date as default. Customers set the end date by themselves).

- Customer can place Stop Limit orders 24/7. The conditional order is valid from the time the Customer places the order until the expiry date selected by the Customer but not beyond the maturity date of the derivative securities.

- Market price is the latest matched price in the continuous session.

- The order can only be triggered in the continuous session. Within the ATO session, within and after the ATC session, the order can not be triggered.

- The order will be triggered one time only.

- The order waiting for the trigger can be canceled or modified.

- If the normal order generated from the conditional order is sent to the exchange but not fully matched, the Customers are allowed to cancel and modify the placed order.

- If the conditional order has been triggered but not fully matched, it will be canceled at the end of the day and will not be carried over to the next day.

- Cases where the conditional order is rejected:

- The order price is lower than the floor price or higher than the ceiling price during the trading session when the conditional order is triggered.

- The number of contracts placed by the Customer may result in the total number of open contracts exceeding the position limit as regulated.

- The Customer’s account does not have sufficient buying/selling power at the time the conditional order is triggered.

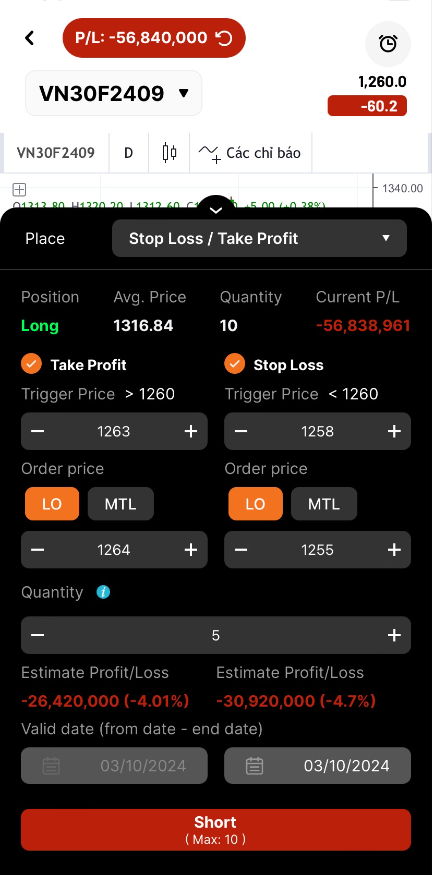

- Trading Quantity is 7 position (less than or equal to the purchasing power of the account)

- Valid date is within 3/10/2024 (The system sets the beginning date as the placing order date as default. Customers set the end date by themselves)

- Take Profit order:

- Trigger Condition is set to be bigger than MP which is 1263

- Order Price is 1264

- Stop Loss order:

- Trigger Condition is set to be less than MP which is 1258

- Order Price is 1255

- Customer can place Stop Limit orders 24/7. The conditional order is valid from the time the Customer places the order until the expiry date selected by the Customer but not beyond the maturity date of the derivative securities.

- Market price is the latest matched price in the continuous session.

- The order can only be triggered in the continuous session. Within the ATO session, within and after the ATC session, the order can not be triggered.

- The order will be triggered one time only.

- The order waiting for the trigger can be canceled or modified.

- If both take-profit and stop-loss orders are placed simultaneously, and one of the two orders is activated and the resulting child order sent to the exchange is fully matched, the remaining order will be canceled.

- If both take-profit and stop-loss orders are placed simultaneously, and one of the two orders is canceled or rejected, the remaining order will also be canceled.

- If the normal order generated from the conditional order is sent to the exchange but not fully matched, the Customers are allowed to cancel and modify the placed order.

- If the conditional order has been triggered but not fully matched, it will be canceled at the end of the day and will not be carried over to the next day.

- Cases where the conditional order is rejected:

- The order price is lower than the floor price or higher than the ceiling price during the trading session when the conditional order is triggered.

- The number of contracts placed by the Customer may result in the total number of open contracts exceeding the position limit as regulated.

- The Customer’s account does not have sufficient buying/selling power at the time the conditional order is triggered.

DerivativesUser Guide for Derivatives Conditional Orders – AlphaTrading

Stop Limit Orders

Stop Limit conditional orders allow Customers to buy/sell at an order price with a predetermined trigger price without monitoring the market continuously.

1. How to place order

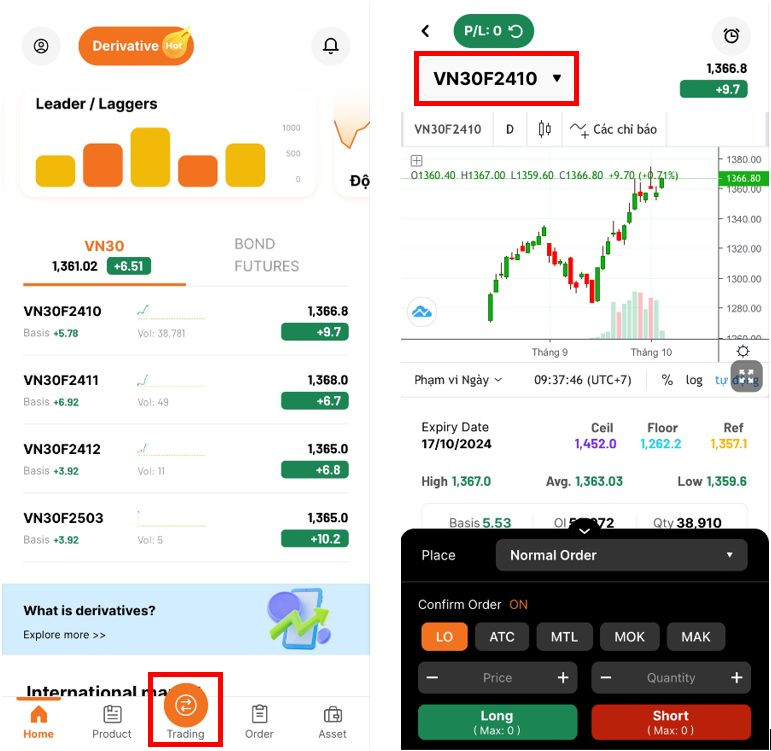

Step 1: Choose tab “Trading” at the bottom of the screen then choose the desired Contract code to trade.

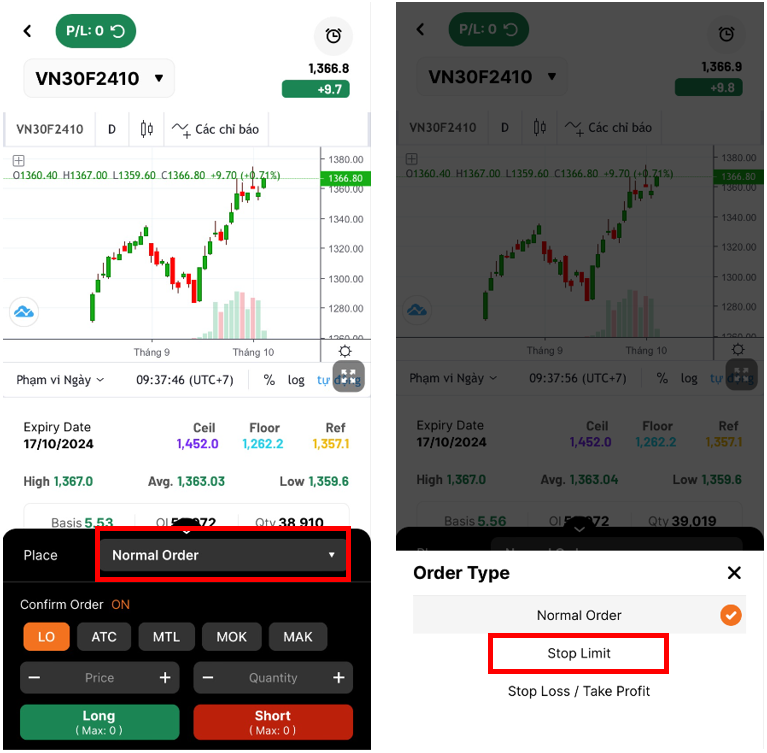

Step 2: On the order placing screen, choose the order type by clicking the order type list. Select “Stop Limit“

Step 3: Insert order information

Example: The market price (MP) of the VN30F2409 contract is now 1260

Therefore, on 3/10/2024, when the MP reaches 1259, the order will be triggered with an OP of 1258 and a quantity of 5 positions.

Step 4: Choose Long or Short

2. Stop Limit order features

Stop Loss/ Take Profit Orders

The order helps the Customer take profit/stop loss on futures contracts at a specific profit/loss level set by the Customer applied to the existing position held by the client.

1. How to place order

Option 1: Place order at “Trading” screen

Step 1: Choose tab “Trading” at the bottom of the screen then choose the desired Contract code to trade. (Note: select the contract with open positions)

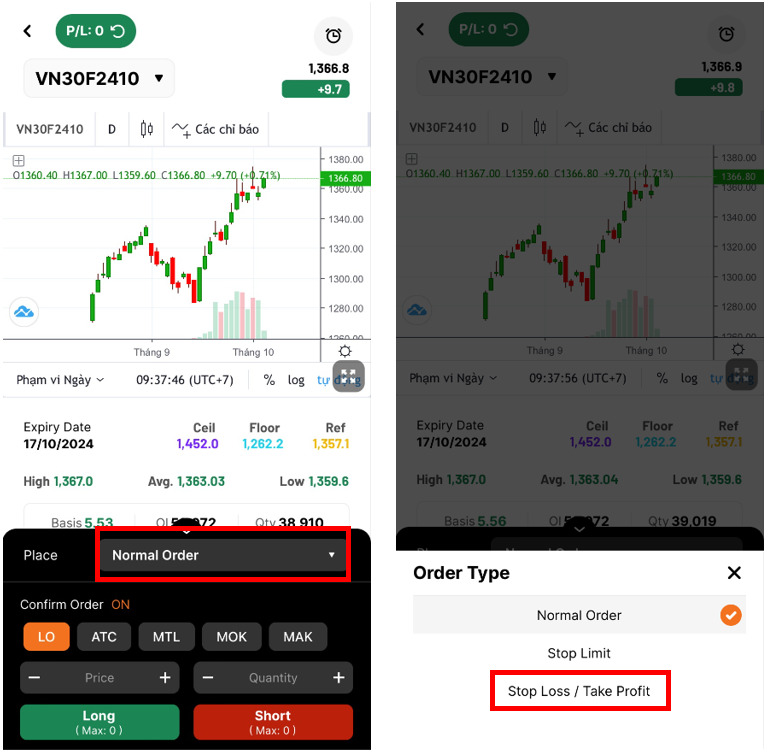

Step 2: On the order placing screen, choose the order type by clicking the order type list. Select “Stop Loss/Take Profit“

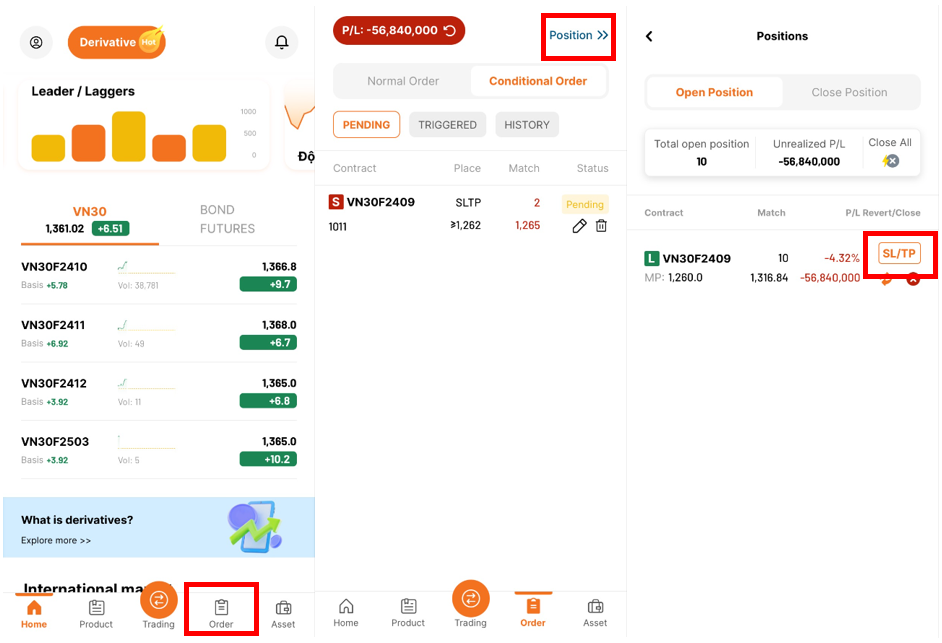

Option 2: Place order at “Open Position” screen

Step 1: Choose the tab “Orders” on the main screen, then choose “Position“.

Step 2: On the Open Position screen, choose the “SL/TP” button to place order.

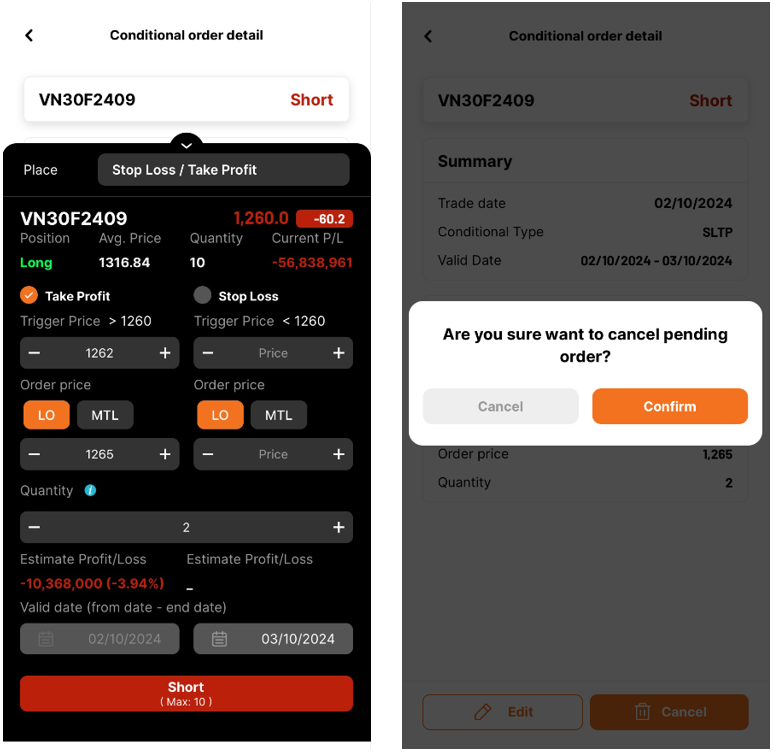

Step 3: Insert order information

Example: Customer has 10 open positions in the VN30F2409 contract with the MP of 1330. The Customer wants to order both Stop Loss and Take Price orders:

Therefore, within 3/10/2024, when the MP rises to 1263 or falls to 1258, the order will trigger the corresponding price. In the case where the Take Profit order is partially filled (for example, 3 positions) and the Stop Loss order is waiting to be triggered, if the price reverses and hits the activation level of the Stop Loss order, the system will retain the unfilled quantity (2 positions) and adjust the Take Profit order price from 1264 to the Stop Loss order price of 1255.

Step 4: Choose Short

2. Stop Loss/Take Profit order features

Conditional order management

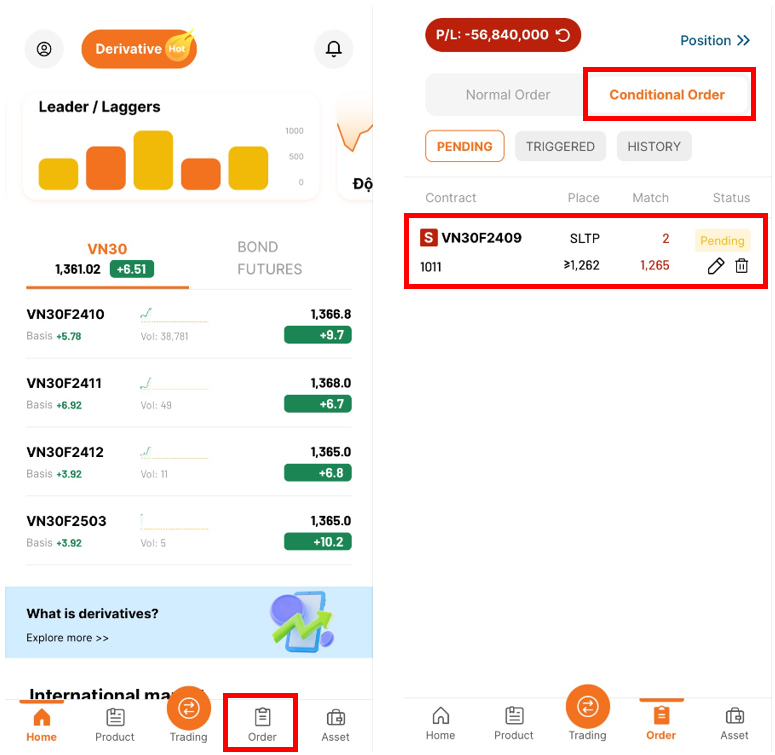

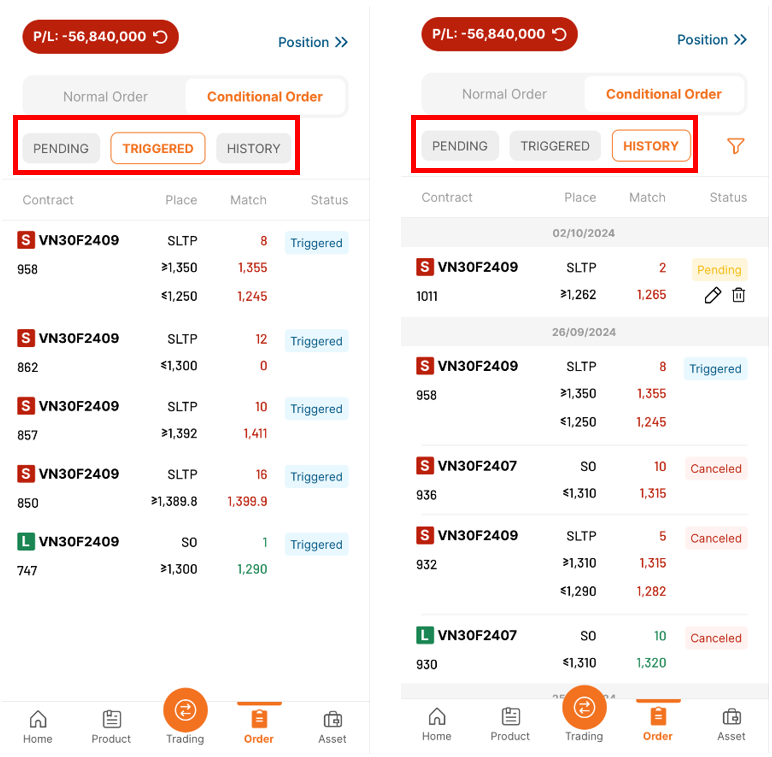

1. View/Modify/Cancel conditional orders in Order List

Step 1: Choose tab “Order” on the main screen then choose “Conditional Order” book.

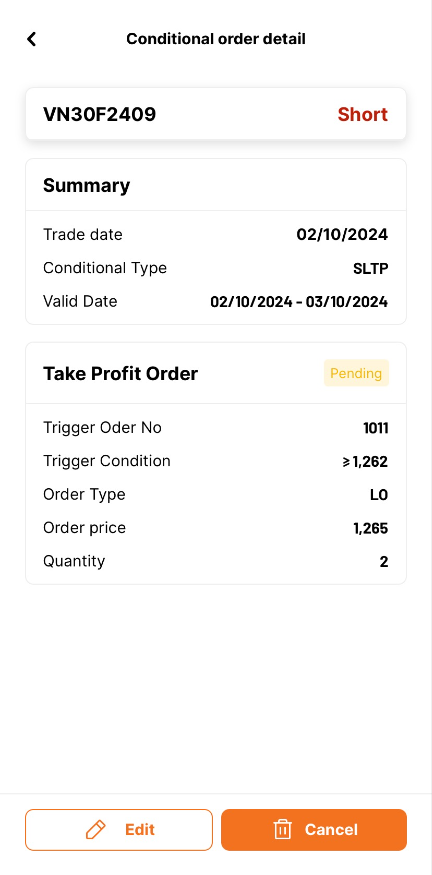

The Stop Limit order is shown as SO and the Stop Loss/Take Profit order is shown as SLTP.

Step 2: Choose the order to modify/cancel when the conditional order status is “Pending“

Modify order: Select the ‘Edit‘ button either from the Order book screen or from the Conditional order details screen. The order placing screen will appear, allowing the customer to update the desired order information.

Cancel order: Select the ‘Cancel‘ button either from the Order book screen or from the Conditional order details screen, then choose ‘Confirm‘ on the popup screen to complete the cancellation.

Step 3: Customer can view the triggered orders and all order history on Conditional order screen.

2. Conditional Order Status

Status Meaning Action on Conditional Order List (Cancel/Modify) Waiting for trigger The newly placed order has not met the trigger conditions. Yes On trigger The system is working to trigger the order No Triggered The order has met the trigger conditions and has been sent to the exchange. No

Note: The child orders in the regular order book can be canceled or modified according to the rules of the HNX exchange.Canceled The client cancels the conditional order; or when the client places both stop-loss and take-profit orders simultaneously, if one of the two orders is canceled or fully matched, the remaining order will be canceled. No Expired The order has exprired No Rejected The order met the trigger price but could not be sent to the exchange (insufficient buying power, price outside the floor/ceiling range, exceeding position limits, etc.) No

Copyright © 2022. Pinetree Securities Corporation| Tax Code: 0101294902Tạo phản hồi mớiTra cứu phản hồi