- Getting started

Register new account

Document to submit

Fee policy

Update information

Account Verification

- Investing

Stock

Investing with cash advance

Investing with margin

Conditional Orders (Underlying Securities)

Derivatives

- Contract Specification and Trading Rules

- Derivatives Trading Process at Pinetree

- Derivatives Product Policy at Pinetree

- User Guide for Derivatives Conditional Orders - WebTrading

- User Guide for Derivatives Conditional Orders - AlphaTrading

- FAQ Derivatives Conditional Orders

- T&C - Conditional Orders in Derivatives Trading

Guidance on trading Private Corporate Bond

Guidance on trading debt instruments

- Cash transaction

Deposit Money to Securities Account

Withdraw Money from Securities Account

Amendment

- User guide

How to use AlphaTrading

How to use PineX

How to use Stock123

How to use WebTrading

Webview

- Deposit stock

Deposit/ Withdraw securities

Rights buy – Rights buy transfer

Stock transfer

Securities Ownership Transfer

Security Inheritance

- PineB Trading Policy

- Guidance on disclosing information

Disclosing information of majority shareholders, group of affiliated persons holding 5% and more of the voting shares

Disclosing information by internal actors and their affiliated persons

- FAQ

Closing/Open Account

Money Transaction

Financial Service - Margin

Bond

Pinefolio

Derivative

KRX and Derivative Trading

Sercurities services

Customer’s Information & Authentication

- Policy on personal data processing

- Professional Investor Status Confirmation

- Customer Development Program

- Order placement method: Buy and sell transactions on the exchange. Customers place sell orders for odd lots on the Alpha Trading app or Web Trading.

- Settlement time: Odd-lot transactions, once matched, are also settled and cleared like normal transactions.

- Order placement method: Buy and sell transactions on the exchange. Customers place sell orders for odd lots on the Alpha – Trading app or Web Trading.

- General trading regulations:

StockOdd Lot Trading

1. For the HNX and Upcom exchanges

2. For the HOSE exchange

Features Detail Applicable securities Stocks, closed-end fund certificates, ETF certificates, and warrants Trading volume From 01 to 99 securities Trading method Continuous matching transactions and put-through transactions Trading Time – Odd lot matching: 9:00 – 11:30 and 13:00 – 14:45 (periodic matching and continuous matching)

– Odd-lot put-through: 9:00 – 11:30 and 13:00 – 15:00Applicable order type Limit Order (LO) Price step

Price quotation unit

Price fluctuation range

Settlement time

Order modification and cancellationRegulations are similar to round-lot trading Others 1. Odd-lot transactions for newly listed stocks, fund certificates, and covered warrants, or those resuming trading after being suspended or halted for 25 consecutive trading days or more, cannot be entered into the trading system until a closing price is established.

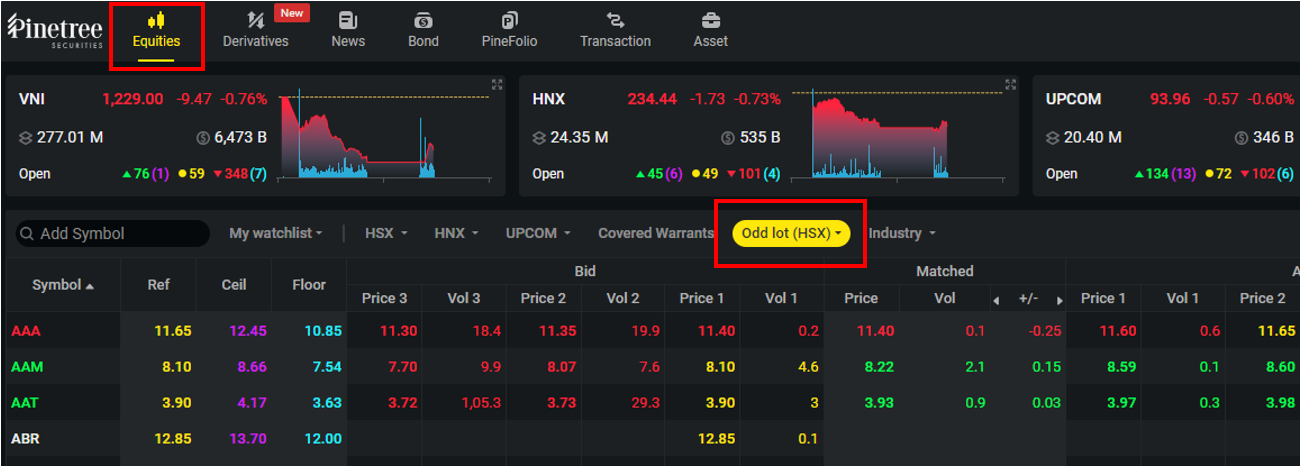

2. Odd-lot securities orders can only be matched with other odd-lot orders and cannot be matched with round-lot securities orders.To view the odd-lot price board on HOSE, please log in, select Price Board and then choose Odd Lot (HSX) as shown in the image below:

To place an odd-lot order, please follow these steps:

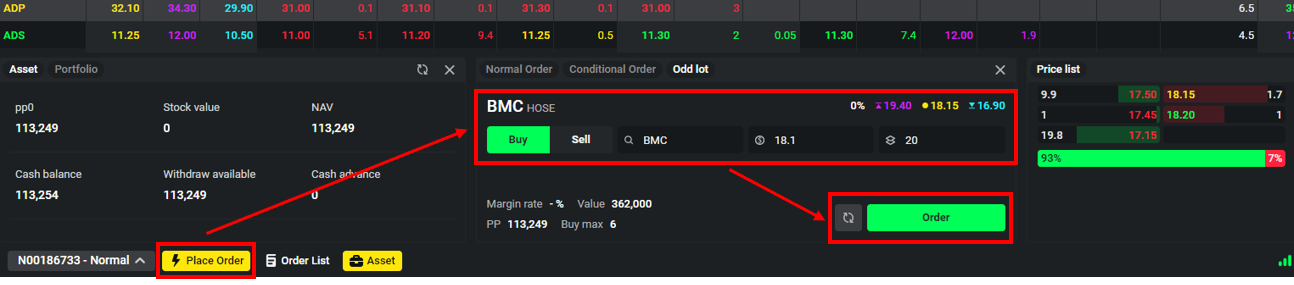

Step 1: Select the yellow “Place Order” button located at the bottom left corner of the screen.

Step 2: Enter the order information, including order type (Buy/Sell), symbol, order price, and volume (odd lot volume from 1-99).

Step 3: Click the green “Order” button, then confirm the order.

Copyright © 2022. Pinetree Securities Corporation| Tax Code: 0101294902Tạo phản hồi mớiTra cứu phản hồi